BofA's View: Are High Stock Market Valuations A Cause For Concern?

Table of Contents

BofA's Current Market Assessment

BofA regularly publishes reports analyzing the health of the stock market and offering a detailed stock market assessment. Their analyses incorporate various metrics to gauge market valuation, providing a comprehensive overview. Let's look at some key aspects of their recent findings:

- Key Valuation Metrics: BofA utilizes several key metrics, including the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and other proprietary models to evaluate stock market valuations. These metrics provide a comparative analysis across different time periods and economic cycles.

- BofA's Stance on Current Valuation Levels: (Note: This section requires up-to-date information from BofA's recent publications. Replace the bracketed information with the actual findings from their reports. For example: "[Insert BofA's recent statement on whether the market is overvalued, fairly valued, or undervalued, citing the specific report and date]. This assessment is often nuanced, considering various economic factors and potential future growth.")

- Sector-Specific Analyses: BofA typically provides sector-specific analyses, highlighting sectors they deem particularly overvalued or undervalued. (Note: Again, replace this with specific examples from BofA's reports, e.g., "[According to BofA's [Report Name, Date], the technology sector shows signs of overvaluation, while the energy sector may be relatively undervalued.]").

Factors Contributing to High Stock Market Valuations

Several interconnected factors contribute to the current state of high stock market valuations. Understanding these forces is crucial for informed investment decisions.

- Low Interest Rates: Historically low interest rates have encouraged investors to seek higher returns in the stock market, driving up demand and prices. This reduces the attractiveness of bonds and other fixed-income instruments.

- Quantitative Easing (QE): Previous rounds of quantitative easing by central banks injected significant liquidity into the market, further inflating asset prices, including stocks.

- Corporate Earnings: Strong corporate earnings (or the expectation of strong earnings) support higher valuations. However, if earnings fail to meet expectations, it can lead to a market correction.

- Investor Sentiment: Increased investor confidence and risk appetite tend to push stock prices higher. Conversely, periods of uncertainty or fear can lead to market declines.

Potential Risks Associated with High Valuations

While high stock market valuations can indicate strong economic conditions, they also present significant risks:

- Market Corrections/Crashes: High valuations leave the market vulnerable to sharp corrections or even crashes if investor sentiment shifts or unexpected economic events occur.

- Lower Future Returns: Investing in a highly valued market typically suggests lower potential returns in the future compared to investing at lower valuation levels.

- Impact on Investment Strategies: High valuations disproportionately impact different investment strategies. Value investors might find fewer attractive opportunities, while growth investors might face higher risks.

- Inflationary Pressures: High inflation can erode the real returns from stock investments, especially if earnings growth fails to keep pace with inflation.

BofA's Recommendations for Investors

Navigating the complexities of a market with high stock market valuations requires a cautious and strategic approach. BofA typically offers guidance to help investors manage their portfolios effectively:

- Portfolio Diversification: BofA likely emphasizes the importance of diversification across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk.

- Sector Rotation: Given their sector-specific analyses, BofA may recommend shifting allocations from overvalued sectors to potentially undervalued ones.

- Risk Management Strategies: Investors should carefully consider their risk tolerance and adjust their portfolios accordingly. This might involve hedging strategies or reducing overall exposure to equities.

- Long-Term Perspective: BofA usually encourages investors to maintain a long-term investment horizon and avoid making impulsive decisions based on short-term market fluctuations.

Conclusion

BofA's assessment of high stock market valuations (replace with BofA's actual assessment from their reports) highlights both the potential for continued growth and the inherent risks involved. Their recommendations emphasize the importance of diversification, careful risk management, and a long-term investment strategy. The key takeaway is that while high valuations present a challenge, they don't necessarily signal an imminent crash. However, investors should proceed with caution, conduct thorough research, and consider seeking professional financial advice. Understanding how to assess market valuations and manage high stock valuations is crucial for navigating the current market landscape. Consider reviewing BofA's latest reports and consulting with a financial advisor to create a robust investment plan that aligns with your risk tolerance and financial goals.

Featured Posts

-

Landlords Face Backlash Over Price Increases After La Fires

Apr 24, 2025

Landlords Face Backlash Over Price Increases After La Fires

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Finns Promise To Liam On April 23rd

Apr 24, 2025

The Bold And The Beautiful Spoilers Finns Promise To Liam On April 23rd

Apr 24, 2025 -

Celebrities Who Lost Homes In The La Palisades Fires A Complete List

Apr 24, 2025

Celebrities Who Lost Homes In The La Palisades Fires A Complete List

Apr 24, 2025 -

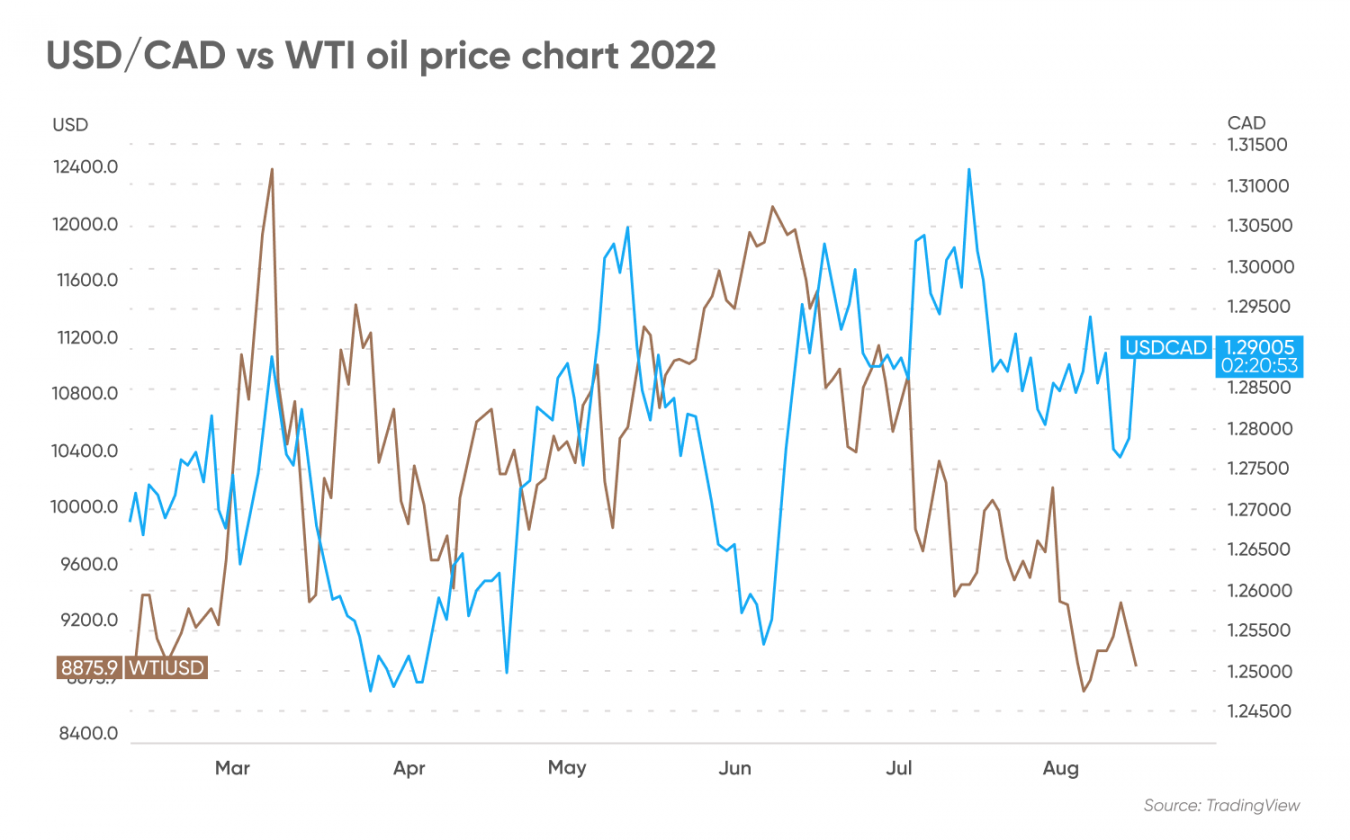

Understanding The Recent Fluctuations In The Canadian Dollar

Apr 24, 2025

Understanding The Recent Fluctuations In The Canadian Dollar

Apr 24, 2025 -

Latest Oil Market News And Price Analysis April 23

Apr 24, 2025

Latest Oil Market News And Price Analysis April 23

Apr 24, 2025

Latest Posts

-

Jessica Simpson Allegedly Hints At Eric Johnson Cheating In New Music

May 12, 2025

Jessica Simpson Allegedly Hints At Eric Johnson Cheating In New Music

May 12, 2025 -

Jessica Simpsons New Song Hints At Eric Johnson Infidelity

May 12, 2025

Jessica Simpsons New Song Hints At Eric Johnson Infidelity

May 12, 2025 -

Jessica Simpson Walmart Kimono Cardigan Shop The 29 Bestseller

May 12, 2025

Jessica Simpson Walmart Kimono Cardigan Shop The 29 Bestseller

May 12, 2025 -

Are Jessica Simpson And Eric Johnson Back Together A Look At Recent Sightings

May 12, 2025

Are Jessica Simpson And Eric Johnson Back Together A Look At Recent Sightings

May 12, 2025 -

Jessica Simpson And Birdie A Mother Daughter Day At The Beach In Yellow Swimsuits

May 12, 2025

Jessica Simpson And Birdie A Mother Daughter Day At The Beach In Yellow Swimsuits

May 12, 2025