Understanding The Recent Fluctuations In The Canadian Dollar

Table of Contents

H2: Key Factors Influencing the Canadian Dollar's Value

The Canadian dollar's value is a complex interplay of various economic and geopolitical factors. Understanding these influences is key to predicting future trends and mitigating potential risks associated with CAD fluctuations. Let's explore some of the most important drivers:

H3: Commodity Prices and Their Impact

Canada is a significant exporter of commodities, particularly oil, natural gas, and lumber. The CAD is often referred to as a "commodity currency" due to its strong correlation with commodity prices. When global demand for these commodities rises, so does the demand for the Canadian dollar, leading to an appreciation in its value (a stronger CAD). Conversely, a decline in commodity prices weakens the CAD.

- Global Demand: Increased global demand, driven by factors such as economic growth in major economies (e.g., China), boosts commodity prices and strengthens the CAD.

- Supply Chain Issues: Disruptions to global supply chains, as seen during recent years, can lead to commodity shortages and price spikes, positively impacting the CAD.

- OPEC Decisions: Decisions by the Organization of the Petroleum Exporting Countries (OPEC) regarding oil production quotas significantly influence oil prices and, consequently, the CAD. For example, production cuts can lead to higher oil prices and a stronger CAD.

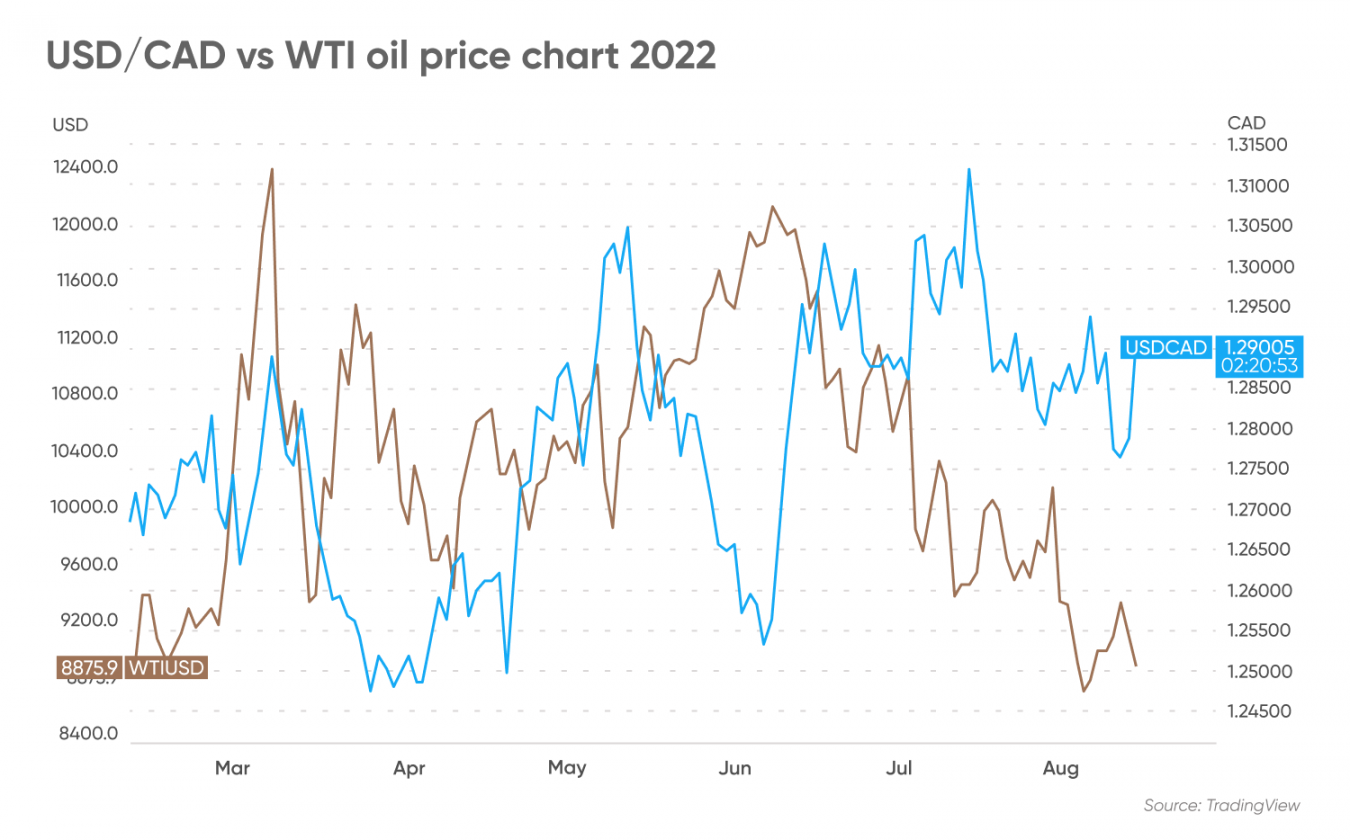

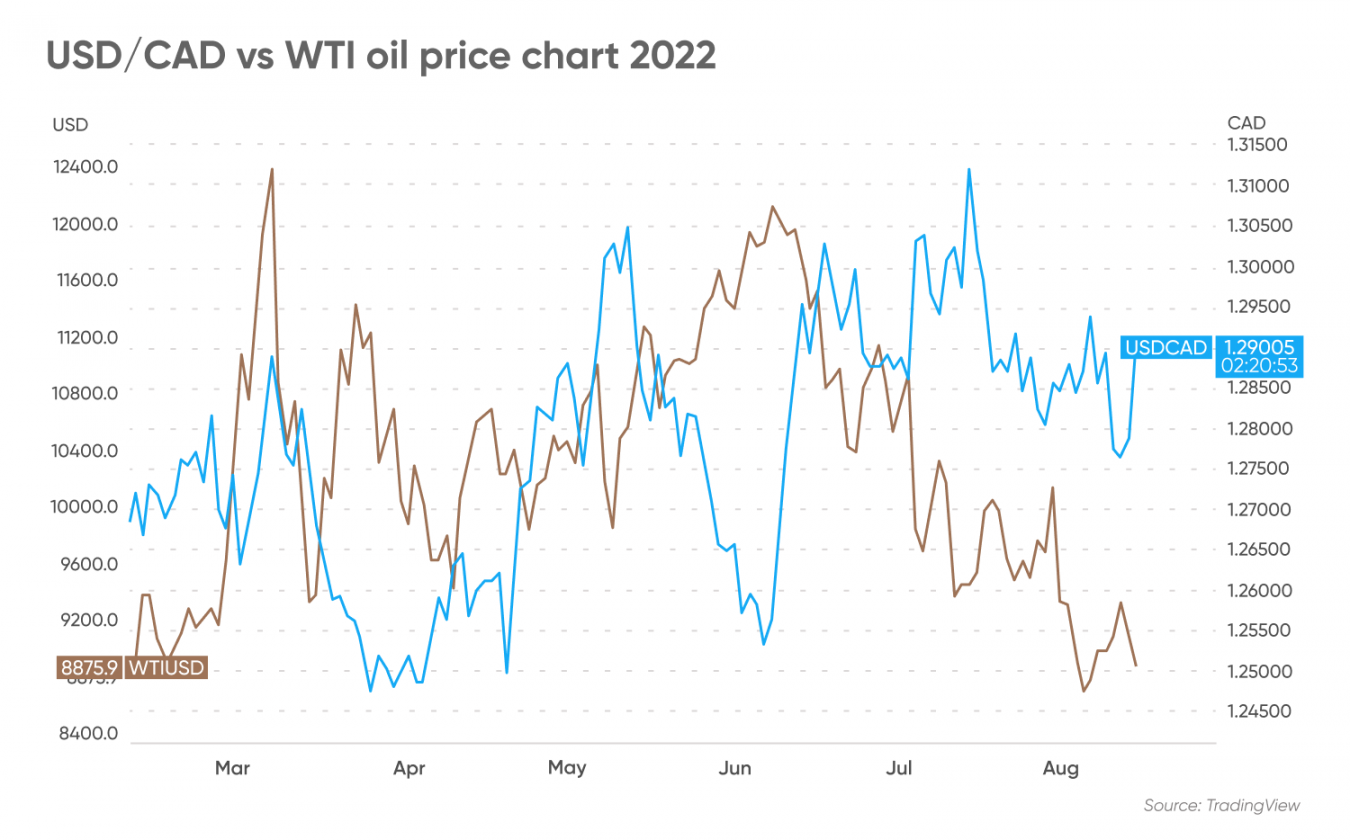

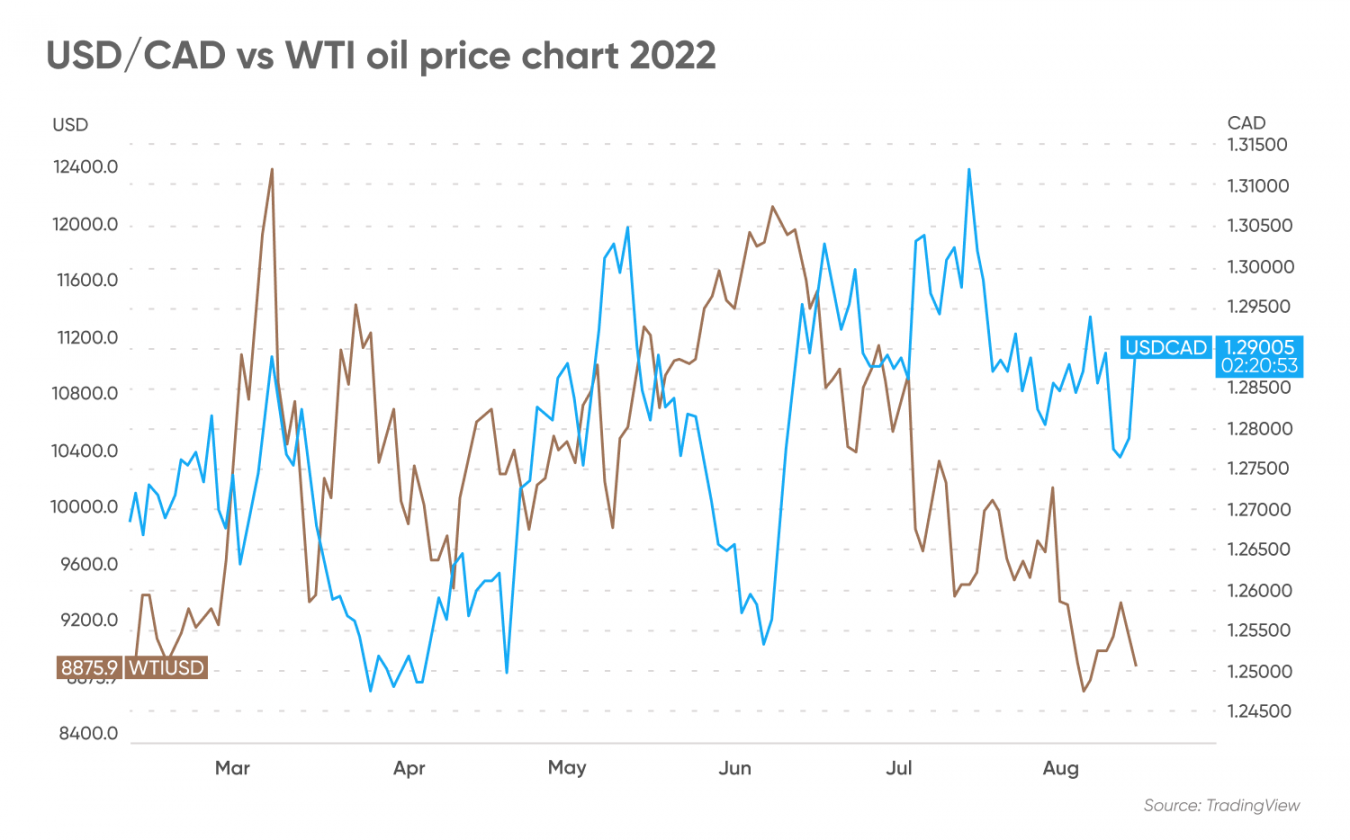

- Recent Examples: The surge in oil prices in 2022, driven by geopolitical instability and increased global demand, significantly boosted the CAD. Conversely, periods of low oil prices have historically weakened the Canadian dollar.

Changes in commodity prices directly impact the Canadian dollar because increased exports generate higher foreign currency inflows, increasing demand for the CAD in the forex market.

H3: Interest Rate Differentials

Interest rate decisions made by the Bank of Canada (BoC) play a crucial role in influencing the CAD's value. The BoC's monetary policy decisions are often compared to those of other major central banks, particularly the US Federal Reserve.

- Attracting Foreign Investment: Higher interest rates in Canada relative to other countries attract foreign investment, increasing demand for the CAD. This is because investors seek higher returns on their investments.

- Interest Rate Hikes/Cuts: When the BoC raises interest rates, it generally strengthens the CAD, while interest rate cuts tend to weaken it. The current BoC stance and its projected path for interest rates are closely watched by forex traders.

- Interest Rate Parity: This theory suggests that the interest rate differential between two countries should be reflected in the exchange rate. However, this is not always the case in the short term due to other market forces.

The relationship between interest rates and currency values is a crucial aspect of understanding CAD fluctuations.

H3: Geopolitical Events and Global Economic Uncertainty

Global events can significantly impact investor sentiment and the CAD's value. Periods of geopolitical uncertainty or global economic slowdown often lead to a "risk-off" sentiment, where investors move away from riskier assets like the CAD and towards safer havens like the US dollar.

- Specific Examples: The war in Ukraine, trade tensions between major economies, and political instability in various regions have all influenced investor sentiment and caused fluctuations in the CAD.

- Risk-Off/Risk-On Sentiment: During periods of "risk-off" sentiment, the CAD tends to weaken, while "risk-on" periods typically see the CAD strengthen.

- Safe-Haven Currencies: The US dollar is often considered a safe-haven currency, meaning investors flock to it during times of uncertainty, which can negatively impact the CAD.

H2: Analyzing Recent Fluctuations in the USD/CAD Exchange Rate

Understanding the recent movements in the USD/CAD exchange rate is crucial for grasping current trends. [Insert chart showing recent USD/CAD exchange rate fluctuations here, clearly labelled and annotated].

H3: Chart Analysis (with visuals)

The chart illustrates [Describe observed trends in the chart, correlating them with the factors discussed above, for example: periods of rising oil prices coinciding with CAD appreciation, or periods of global uncertainty leading to CAD depreciation]. Clear annotations on the chart should highlight these correlations.

H3: Short-Term vs. Long-Term Outlook

Predicting future currency movements is inherently challenging, but analyzing current economic indicators and expert opinions provides a tentative outlook. [Provide cautious predictions for the short-term and long-term outlook of the CAD, based on current economic indicators and expert analysis]. Factors such as the BoC's monetary policy decisions, global economic growth, and commodity price trends will significantly influence the future direction of the CAD.

H2: Strategies for Navigating Canadian Dollar Fluctuations

Navigating the volatility of the Canadian dollar requires proactive strategies, varying depending on your role as a business, traveler, or investor.

H3: Hedging Strategies for Businesses

Businesses involved in international trade are particularly vulnerable to currency fluctuations. Several hedging strategies can mitigate currency risk:

- Forward Contracts: Locking in a specific exchange rate for a future transaction.

- Options: Providing the right, but not the obligation, to buy or sell currency at a specific rate.

- Swaps: Exchanging currencies at predetermined rates over a specific period.

H3: Tips for Travelers

Travelers can minimize currency exchange costs by following these tips:

- Favorable Exchange Rates: Use credit cards with low foreign transaction fees.

- Avoid Airport Exchanges: Airport currency exchange services often have unfavorable rates.

- Money Transfer Services: Utilize money transfer services that offer competitive exchange rates.

H3: Investment Strategies

Investors can adjust their portfolios to manage CAD fluctuations:

- Diversification: Spread investments across different currencies and asset classes to reduce risk.

- Hedging Techniques: Employ hedging strategies, such as currency futures or options, to protect against losses.

3. Conclusion

The Canadian dollar's recent fluctuations are a result of a complex interplay between commodity prices, interest rate differentials, and geopolitical events. Understanding these factors is vital for businesses, travelers, and investors. By monitoring economic news, consulting financial experts, and implementing appropriate strategies, individuals and businesses can effectively navigate the challenges posed by the fluctuating Canadian dollar. To stay informed, regularly research keywords like "Canadian dollar forecast," "CAD exchange rate prediction," and "managing Canadian dollar risk," and consult with financial advisors for personalized guidance on managing your exposure to Canadian dollar fluctuations.

Featured Posts

-

Seventh Straight Loss For Hornets As Warriors Triumph

Apr 24, 2025

Seventh Straight Loss For Hornets As Warriors Triumph

Apr 24, 2025 -

Instagram Launches Video Editing App To Poach Tik Tok Creators

Apr 24, 2025

Instagram Launches Video Editing App To Poach Tik Tok Creators

Apr 24, 2025 -

Bold And The Beautiful Spoilers Wednesday April 23 Finns Pledge To Liam

Apr 24, 2025

Bold And The Beautiful Spoilers Wednesday April 23 Finns Pledge To Liam

Apr 24, 2025 -

Understanding The Recent Fluctuations In The Canadian Dollar

Apr 24, 2025

Understanding The Recent Fluctuations In The Canadian Dollar

Apr 24, 2025 -

John Travolta Honors Late Son Jett On His Birthday With A Shared Photo

Apr 24, 2025

John Travolta Honors Late Son Jett On His Birthday With A Shared Photo

Apr 24, 2025

Latest Posts

-

Jessica Simpson Shares Raw Emotions Following Marriage End

May 12, 2025

Jessica Simpson Shares Raw Emotions Following Marriage End

May 12, 2025 -

Jessica Simpson Opens Up About Marriage Struggles And Emotional Pain

May 12, 2025

Jessica Simpson Opens Up About Marriage Struggles And Emotional Pain

May 12, 2025 -

Dzhessika Simpson I Ee Effektivnaya Metodika Pokhudeniya

May 12, 2025

Dzhessika Simpson I Ee Effektivnaya Metodika Pokhudeniya

May 12, 2025 -

Dance Track Review Neal Mc Clellands Ill House U With Andrea Love

May 12, 2025

Dance Track Review Neal Mc Clellands Ill House U With Andrea Love

May 12, 2025 -

Celebrity Airport Style Jessica Simpsons Bold Cheetah And Blue Fur Coat Outfit

May 12, 2025

Celebrity Airport Style Jessica Simpsons Bold Cheetah And Blue Fur Coat Outfit

May 12, 2025