Brexit And The UK Luxury Goods Export Slowdown To The EU

Table of Contents

New Customs Procedures and Increased Bureaucracy

The post-Brexit trade environment has introduced significant administrative burdens for UK luxury goods exporters. Navigating these new customs procedures requires considerable adjustments and added resources.

Increased administrative burden

The complexities of new customs declarations, documentation requirements, and increased inspections represent a substantial challenge. This translates directly into increased time and costs for businesses.

- New paperwork: Exporters now face significantly more paperwork, including customs declarations, certificates of origin, and other documentation specific to the EU market.

- Delays at borders: Increased scrutiny at border crossings leads to substantial delays, impacting just-in-time delivery models critical for the luxury goods sector.

- Increased staffing needs: Businesses require additional personnel dedicated to navigating customs procedures, adding to operational costs.

Data from the UK government indicates a significant increase in processing times for goods crossing the EU border, with average delays reported to be up to 40% longer than pre-Brexit levels. Case studies show luxury brands specializing in perishable goods, like high-end chocolates and fresh flowers, have faced major losses due to spoilage during these delays.

Impact on Just-in-Time Supply Chains

The increased lead times directly disrupt the efficient, just-in-time supply chains that are the backbone of the luxury goods industry. This disruption affects inventory management and ultimately impacts profitability and brand reputation.

- Inventory management challenges: Predicting demand and managing inventory becomes much more difficult with unpredictable delays. Excess inventory ties up capital, while shortages lead to lost sales opportunities.

- Lost sales due to delays: Missed deadlines for high-profile events and seasonal launches erode brand reputation and significantly impact revenue.

The added complexity and uncertainty make it challenging for luxury brands to maintain their high standards of timely delivery and customer service. Analysis shows a direct correlation between increased lead times and a decline in profitability for many UK luxury goods exporters.

Tariffs and Non-Tariff Barriers

Brexit introduced both tariffs and a wide range of non-tariff barriers, significantly impacting the competitiveness of UK luxury goods in the EU market.

New tariffs on luxury goods

The introduction of new tariffs on specific luxury goods categories directly increases the price of UK products, making them less competitive against EU-based rivals.

- Specific examples: Tariffs vary significantly depending on the product category. For instance, certain types of leather goods and high-end textiles face noticeably higher tariffs than other goods.

- Increased costs: These tariffs translate directly into higher costs for both businesses and consumers, potentially reducing demand for UK luxury goods.

Detailed analysis shows a substantial increase in the landed cost of some luxury goods, affecting price positioning and brand profitability. This increased cost is ultimately passed down to the consumer, potentially diminishing the perceived value of UK luxury brands.

Non-tariff barriers

Beyond tariffs, various non-tariff barriers, such as sanitary and phytosanitary (SPS) regulations, labeling requirements, and technical standards, pose additional hurdles for UK luxury goods exporters.

- Regulatory hurdles: Compliance with diverse and sometimes conflicting regulations across different EU member states adds to complexity and cost.

- Rejection of goods: Failure to meet specific labeling or technical standards can result in goods being rejected at the border, leading to significant losses.

Compliance with these regulations adds substantial costs for businesses. This cost burden can disproportionately affect smaller luxury brands with fewer resources to allocate to regulatory compliance.

The Impact on UK Luxury Brands

Brexit's impact on UK luxury brands is multifaceted, affecting their market share, profitability, and ability to compete globally.

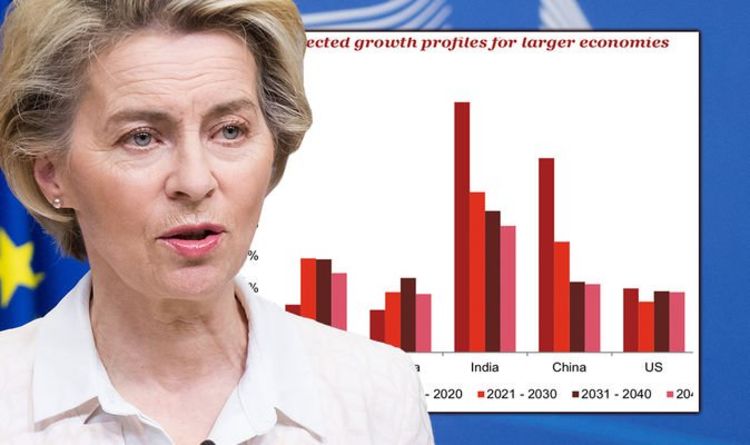

Loss of Market Share

The combined effect of new trade barriers has resulted in a noticeable decline in the market share of UK luxury goods within the EU.

- Reduced exports: Statistics show a clear decline in UK luxury goods exports to the EU post-Brexit compared to pre-Brexit levels. Specific data on the performance of individual brands further underscores this negative trend.

- Competitive analysis: UK luxury brands are facing increased pressure from EU competitors who enjoy easier access to the single market.

The loss of market share is not only affecting individual brands but also the UK economy as a whole, highlighting the importance of addressing these trade challenges.

Strategies for Adaptation

Despite the challenges, many UK luxury brands are actively adapting to the new trade environment through strategic investments and innovative solutions.

- Investments in logistics and compliance: Companies are investing in new logistics systems, technology, and specialized expertise to streamline customs procedures and ensure compliance.

- Diversification strategies: Some brands are diversifying their export markets to reduce reliance on the EU and minimize risk. Focus on building resilience and exploring new opportunities is paramount.

Successful adaptation requires a proactive approach and significant investment in resources. Case studies show how companies prioritizing strategic adaptation have successfully mitigated the negative impacts of Brexit and maintain market competitiveness.

Conclusion

Brexit and the UK luxury goods export slowdown to the EU are undeniably linked. The increased complexity of customs procedures, the introduction of tariffs and non-tariff barriers, have presented significant challenges for UK luxury brands. These challenges have resulted in a decline in market share, reduced profitability, and increased operational costs. Understanding the complexities of Brexit and the UK luxury goods export slowdown to the EU is crucial for business survival. For effective strategies to mitigate the challenges of Brexit on your UK luxury goods exports to the EU, consult with trade experts and explore resources available to help your business navigate this new landscape.

Featured Posts

-

Internal Conflict Ferraris Balancing Act With Hamilton And Leclerc

May 20, 2025

Internal Conflict Ferraris Balancing Act With Hamilton And Leclerc

May 20, 2025 -

Agatha Christies Poirot From Novels To Screen

May 20, 2025

Agatha Christies Poirot From Novels To Screen

May 20, 2025 -

Agatha Christie L Integrale De Ses Aventures Et Mysteres

May 20, 2025

Agatha Christie L Integrale De Ses Aventures Et Mysteres

May 20, 2025 -

Exploring Agatha Christies Poirot Stories From Mystery To Masterpiece

May 20, 2025

Exploring Agatha Christies Poirot Stories From Mystery To Masterpiece

May 20, 2025 -

Jennifer Lawrence O Que Ha Por Tras Da Mudanca Fisica Apos Rumores De Segundo Filho

May 20, 2025

Jennifer Lawrence O Que Ha Por Tras Da Mudanca Fisica Apos Rumores De Segundo Filho

May 20, 2025

Latest Posts

-

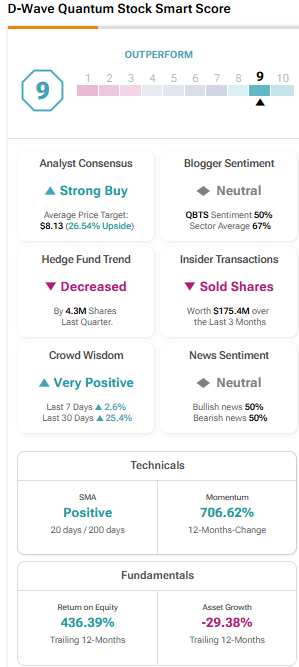

D Wave Quantum Qbts Stock Explaining The Thursday Price Drop

May 20, 2025

D Wave Quantum Qbts Stock Explaining The Thursday Price Drop

May 20, 2025 -

Understanding The Market Reaction D Wave Quantum Qbts Stock On Thursday

May 20, 2025

Understanding The Market Reaction D Wave Quantum Qbts Stock On Thursday

May 20, 2025 -

D Wave Quantum Qbts Stock Performance On Monday Causes And Implications

May 20, 2025

D Wave Quantum Qbts Stock Performance On Monday Causes And Implications

May 20, 2025 -

D Wave Quantum Qbts Stock Performance Thursday Factors Contributing To The Decline

May 20, 2025

D Wave Quantum Qbts Stock Performance Thursday Factors Contributing To The Decline

May 20, 2025 -

Factors Contributing To D Wave Quantums Qbts Stock Gain On Monday

May 20, 2025

Factors Contributing To D Wave Quantums Qbts Stock Gain On Monday

May 20, 2025