Broadcom's VMware Acquisition: A 1,050% Price Hike Concerns AT&T

Table of Contents

The Financial Impact of the VMware Acquisition on AT&T

The increased cost of VMware-related networking equipment following Broadcom's acquisition poses a substantial financial challenge for AT&T. This price hike directly impacts AT&T's infrastructure investments and overall profitability.

Increased Costs for Networking Infrastructure

The price increases are not uniform across the board; however, reports suggest some VMware-related networking products experienced price increases exceeding 1000%. This affects crucial components of AT&T's network.

- VMware vSphere: This virtualization platform, essential for AT&T's data centers, has seen a reported price increase of over 1050%, according to industry analysts. [Link to supporting news article or report if available].

- VMware NSX: This network virtualization platform, critical for AT&T's network segmentation and security, has also faced significant price increases, impacting their operational costs. [Link to supporting news article or report if available].

- VMware vRealize Operations: This management tool, crucial for network monitoring and optimization, also experienced substantial price hikes. [Link to supporting news article or report if available].

These price increases directly translate into a significantly larger operating budget for AT&T, potentially impacting profitability and shareholder returns. The exact financial impact remains to be seen, but initial assessments indicate a substantial burden on AT&T's financial resources.

Strategic Implications for AT&T's Network Upgrades and Expansion Plans

The steep price hike directly threatens AT&T's network modernization and expansion plans. The increased costs could force AT&T to:

- Delay upgrades: Essential network upgrades might be postponed, hindering the company's ability to compete effectively in a rapidly evolving technological landscape.

- Reduce investment: AT&T may be forced to reduce investments in new technologies and innovative services, impacting its long-term growth potential.

- Limit service offerings: The company might curtail the expansion of its service offerings or reduce the scope of existing services due to budget constraints.

AT&T may explore alternative solutions, including negotiating better terms with Broadcom or seeking alternative technologies to mitigate the impact of the price increase.

Competitor Analysis

The significant price hike puts AT&T at a competitive disadvantage. Competitors who have diversified their vendor base or adopted alternative technologies may enjoy lower costs and greater flexibility. This could lead to:

- Loss of market share: AT&T might lose market share to competitors offering similar services at lower costs due to their more diverse technological approach.

- Reduced competitiveness: The price hike hinders AT&T's ability to invest in innovative services and compete effectively in the market.

- Increased pressure to cut costs: The need to remain competitive will exert further pressure on AT&T to find more cost-effective alternatives and internal cost-cutting measures.

Antitrust Concerns and Regulatory Scrutiny

Broadcom's acquisition of VMware raises significant antitrust concerns, given the combined market power of the two companies in the networking equipment sector.

Potential for Monopolization

The merger significantly increases Broadcom's market share, raising concerns about the potential for monopolization or the creation of an oligopoly. This could lead to:

- Reduced competition: A lack of competition could stifle innovation and result in higher prices for telecom companies across the board.

- Limited consumer choice: Reduced competition could translate to fewer choices for consumers and potentially higher prices for telecom services.

- Ongoing investigations: Regulatory bodies are likely to scrutinize the deal, potentially leading to investigations and potential antitrust lawsuits.

Government Intervention and its Potential Effects on AT&T

Government intervention, such as blocking the acquisition or imposing price controls on Broadcom, could significantly impact AT&T. Possible outcomes include:

- Price reductions: Government intervention could lead to lower prices for VMware products, benefiting AT&T and other telecom providers.

- Delayed implementation: Regulatory hurdles could delay the full integration of VMware into Broadcom's operations, potentially postponing the price increases.

- Alternative solutions: Regulatory pressure could prompt Broadcom to offer more competitive pricing or alternative solutions to appease regulatory bodies.

AT&T's Response and Mitigation Strategies

Faced with the substantial price increase, AT&T will need to employ various strategies to mitigate the impact.

Cost-Cutting Measures

To offset the increased costs, AT&T is likely to explore various cost-cutting measures, including:

- Renegotiating contracts: AT&T may attempt to renegotiate contracts with Broadcom to secure more favorable pricing terms.

- Seeking alternative suppliers: The company might explore alternative suppliers for networking equipment to reduce its reliance on Broadcom.

- Optimizing network infrastructure: AT&T may optimize its network infrastructure to improve efficiency and reduce overall costs.

Technological Alternatives

AT&T might explore alternative technologies to reduce its reliance on VMware and Broadcom products:

- Open-source solutions: Adopting open-source alternatives could offer a cost-effective solution, albeit with potential challenges in implementation and support.

- Competing virtualization platforms: Switching to competing virtualization platforms could provide leverage in negotiations with Broadcom.

- Cloud-based solutions: Migrating workloads to cloud providers may offer more price-competitive alternatives.

Lobbying Efforts

AT&T will likely engage in lobbying efforts to influence regulatory decisions and potentially mitigate the price hike. This could include:

- Advocating for stronger antitrust regulations: AT&T might lobby for stronger regulations to prevent future monopolies in the networking equipment sector.

- Supporting regulatory investigations: AT&T could support ongoing regulatory investigations into Broadcom's pricing practices.

- Seeking government intervention: AT&T might advocate for government intervention to control prices or limit Broadcom's market power.

Conclusion

Broadcom's VMware acquisition presents a significant challenge for AT&T, with the dramatic price hike on crucial networking equipment having profound financial and strategic implications. The potential for monopolization and the ensuing regulatory scrutiny add layers of uncertainty. AT&T’s response will likely involve a multifaceted approach encompassing cost-cutting measures, exploration of alternative technologies, and lobbying efforts. Staying updated on the latest developments in the Broadcom's VMware acquisition is crucial for understanding its ongoing impact on AT&T and the broader telecom industry. The long-term effects remain to be seen, but the situation underscores the importance of diversification and adaptability in the face of market consolidation and significant price fluctuations. Follow the ongoing impact of the Broadcom VMware acquisition on AT&T to stay informed about this evolving situation.

Featured Posts

-

Bed Antqalh Llahly Almsry Madha Qdm Markw Fyraty Me Alerby Alqtry

May 10, 2025

Bed Antqalh Llahly Almsry Madha Qdm Markw Fyraty Me Alerby Alqtry

May 10, 2025 -

Is Palantir Stock A Good Buy Before Its May 5th Earnings

May 10, 2025

Is Palantir Stock A Good Buy Before Its May 5th Earnings

May 10, 2025 -

Dijon 2026 Le Projet Ecologiste Pour Les Municipales

May 10, 2025

Dijon 2026 Le Projet Ecologiste Pour Les Municipales

May 10, 2025 -

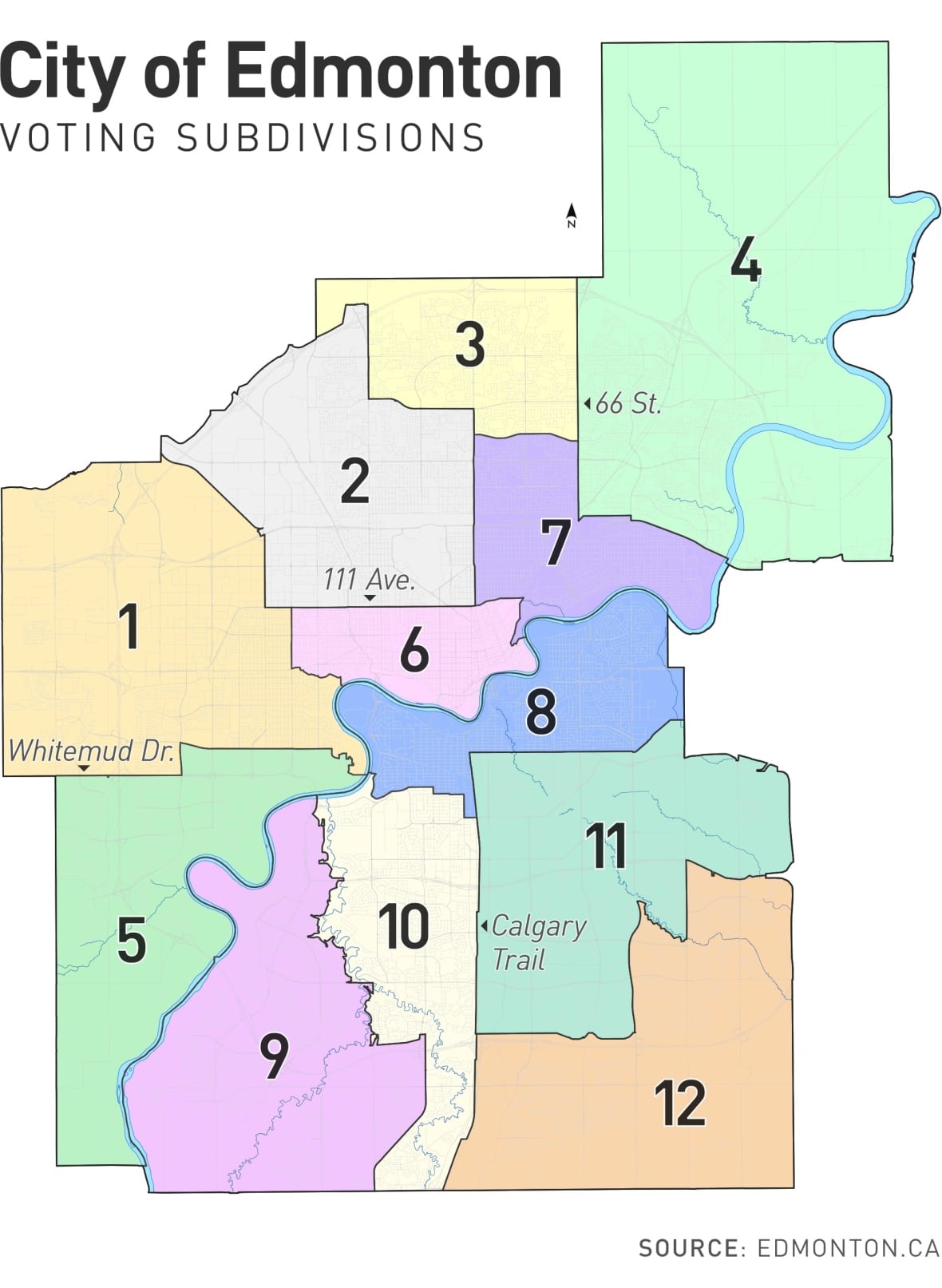

Edmonton Federal Riding Changes What Voters Need To Know

May 10, 2025

Edmonton Federal Riding Changes What Voters Need To Know

May 10, 2025 -

Palantir Stock Prediction 2 Potential Outperformers In The Next 3 Years

May 10, 2025

Palantir Stock Prediction 2 Potential Outperformers In The Next 3 Years

May 10, 2025