Broadcom's VMware Acquisition: AT&T Faces A Staggering 1,050% Price Increase

Table of Contents

Understanding the Broadcom-VMware Merger and its Impact

Broadcom's $61 billion acquisition of VMware, finalized in late 2022, represents a significant consolidation of power in the enterprise software market. Broadcom, known for its semiconductor and infrastructure software, aims to expand its reach into the lucrative virtualization and cloud management sectors. This strategic move positions Broadcom to compete more effectively with industry giants like Microsoft and AWS.

- Broadcom's expansion into enterprise software: The VMware acquisition is a key component of Broadcom's strategy to diversify its revenue streams and become a dominant player in enterprise software solutions.

- Increased market consolidation: This merger significantly reduces competition in the virtualization and cloud infrastructure market, raising concerns about potential monopolies.

- Anticipated benefits for Broadcom: Broadcom anticipates significant synergies through combining VMware's software portfolio with its existing infrastructure solutions, leading to increased market share and profitability.

The 1050% Price Increase for AT&T: A Detailed Breakdown

Reports indicate AT&T is facing a phenomenal 1,050% increase in its VMware licensing fees. While the exact services affected haven't been publicly disclosed, the magnitude of the increase is undeniably significant. This drastic price hike translates to a substantial financial burden for AT&T, impacting its bottom line and potentially affecting its investment in other crucial technologies.

- Quantifying the financial burden: The exact cost increase remains undisclosed, but a 1,050% jump on existing VMware contracts represents millions, if not billions, of dollars in additional expenditure for AT&T.

- Potential cost-cutting measures: AT&T may be forced to explore cost-cutting measures across various departments to offset the unexpected increase in VMware licensing fees. This could involve staff reductions, project delays, or even reevaluating its technology stack.

- Impact on AT&T's profitability and investment strategies: The price hike significantly impacts AT&T's profitability and could force the company to reconsider its investment plans in other critical areas, potentially hindering innovation and long-term growth.

Potential Reasons Behind the Price Increase

Several factors could contribute to such a dramatic price increase for AT&T.

- Lack of competition post-merger: With Broadcom controlling VMware, the reduced competition allows them to leverage their market dominance and increase prices significantly.

- Leveraging market power: The merger allows Broadcom to exercise significant market power, potentially leading to less competitive pricing for its clients.

- Regulatory scrutiny and investigations: The steep price increase may attract regulatory scrutiny from antitrust authorities, who are likely to investigate potential anti-competitive practices.

Implications for the Telecom Industry and Other Businesses

The implications of this price increase extend far beyond AT&T. Other major telecom companies and businesses relying on VMware virtualization technologies could face similar, albeit perhaps less dramatic, price increases.

- Impact on smaller telecom companies: Smaller telecom companies may find it significantly more challenging to absorb such a substantial price increase, potentially forcing them to seek alternative, possibly less effective, solutions.

- Shift in technology vendor selection: This situation could incentivize businesses to re-evaluate their reliance on VMware and explore alternative virtualization and cloud management platforms. This could lead to a broader shift in the technology vendor landscape.

- Long-term effects on innovation and competition: The potential for increased prices across the board could stifle innovation and reduce competition within the telecom and broader IT sectors.

Regulatory Response and Future Outlook

The dramatic price increase and the Broadcom-VMware merger itself are likely to face intense regulatory scrutiny.

- Potential antitrust investigations: Antitrust authorities in various jurisdictions are likely to investigate the merger and the subsequent price hikes, potentially leading to legal challenges and fines.

- The role of regulatory bodies: Regulatory bodies play a crucial role in protecting consumers and businesses from anti-competitive practices and ensuring fair market competition.

- Long-term implications for the competitive landscape: The outcome of regulatory investigations and potential legal challenges will significantly shape the competitive landscape of the enterprise software market for years to come.

Conclusion

Broadcom's acquisition of VMware has resulted in a seismic shift in the enterprise software market, exemplified by the staggering 1,050% price increase imposed on AT&T. This action highlights the potential for significant market consolidation and raises concerns about anti-competitive practices. The implications extend beyond AT&T, affecting smaller telecom companies and businesses reliant on VMware technologies. Regulatory responses will be crucial in determining the long-term impact on competition and innovation. Stay informed about the unfolding developments surrounding the Broadcom VMware acquisition for updated information and analysis. Further research into the effects of this acquisition on other businesses is crucial to understanding the wider implications of this unprecedented price increase.

Featured Posts

-

Hudsons Bay Leasehold Interest 65 Properties Attract Attention

Apr 24, 2025

Hudsons Bay Leasehold Interest 65 Properties Attract Attention

Apr 24, 2025 -

Ohio Train Derailment Lingering Toxic Chemicals In Buildings

Apr 24, 2025

Ohio Train Derailment Lingering Toxic Chemicals In Buildings

Apr 24, 2025 -

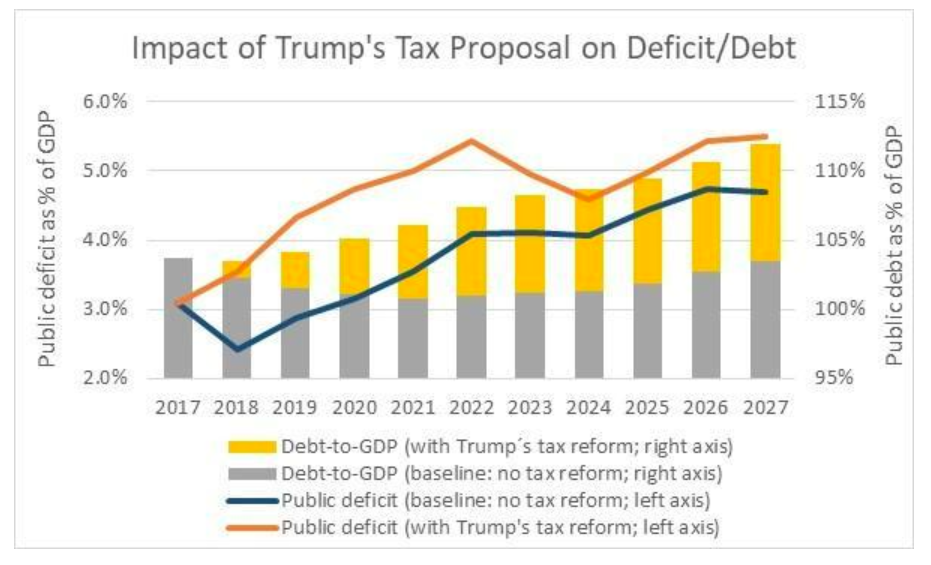

Btc Price Increase Analyzing The Impact Of Trump And The Federal Reserve

Apr 24, 2025

Btc Price Increase Analyzing The Impact Of Trump And The Federal Reserve

Apr 24, 2025 -

Google Fis New 35 Unlimited Plan Everything You Need To Know

Apr 24, 2025

Google Fis New 35 Unlimited Plan Everything You Need To Know

Apr 24, 2025 -

Sk Hynix Overtakes Samsung In Dram Market Ais Role

Apr 24, 2025

Sk Hynix Overtakes Samsung In Dram Market Ais Role

Apr 24, 2025

Latest Posts

-

Dzhessika Simpson I Ee Effektivnaya Metodika Pokhudeniya

May 12, 2025

Dzhessika Simpson I Ee Effektivnaya Metodika Pokhudeniya

May 12, 2025 -

Dance Track Review Neal Mc Clellands Ill House U With Andrea Love

May 12, 2025

Dance Track Review Neal Mc Clellands Ill House U With Andrea Love

May 12, 2025 -

Celebrity Airport Style Jessica Simpsons Bold Cheetah And Blue Fur Coat Outfit

May 12, 2025

Celebrity Airport Style Jessica Simpsons Bold Cheetah And Blue Fur Coat Outfit

May 12, 2025 -

Pokhudenie Dzhessiki Simpson Podrobnosti Ee Diety I Trenirovok

May 12, 2025

Pokhudenie Dzhessiki Simpson Podrobnosti Ee Diety I Trenirovok

May 12, 2025 -

Neal Mc Clellands Ill House U Ft Andrea Love House Musics Latest Hit

May 12, 2025

Neal Mc Clellands Ill House U Ft Andrea Love House Musics Latest Hit

May 12, 2025