BSE Market Update: Sensex Up, Top Performing Stocks

Table of Contents

Sensex Performance and Key Market Indicators

The BSE Sensex closed at X points today, marking a significant X% increase compared to yesterday's closing value. This positive movement reflects a strong investor sentiment and reflects positive market trends. The trading volume was exceptionally high at Y shares traded, indicating robust market activity. Several factors contributed to this positive performance, including positive global market trends and encouraging domestic economic data.

Here's a summary of the key market indicators:

- Opening Value: Z points

- Closing Value: X points

- High Value: A points

- Low Value: B points

- Trading Volume: Y shares

- Market Breadth (Advance-Decline Ratio): Positive, indicating more advancing stocks than declining stocks.

- Volatility Index (VIX): [Insert VIX value and interpretation - e.g., decreased, indicating reduced market volatility].

Top Performing Stocks in the BSE Today

Several stocks significantly contributed to the Sensex's impressive gains. Below are the top 10 performers, showcasing remarkable growth and highlighting opportunities for investors analyzing return on investment (ROI) and market capitalization:

| Stock Symbol | Sector | Percentage Gain | Brief Reason for Growth |

|---|---|---|---|

| RELIANCE | Energy | 5.2% | Strong Q3 earnings and positive outlook for the sector |

| TCS | IT | 4.8% | Robust deal wins and positive global IT market sentiment |

| HDFCBANK | Banking | 4.5% | Increased loan disbursements and positive credit growth |

| INFOSYS | IT | 4.2% | Strong client demand and positive guidance |

| ICICIBANK | Banking | 4.0% | Positive economic indicators and increased credit demand |

| HUL | FMCG | 3.8% | Strong sales growth and market share gains |

| TATASTEEL | Metals | 3.5% | Positive global steel demand and higher steel prices |

| SBIN | Banking | 3.2% | Improved asset quality and increased profitability |

| ITC | FMCG | 3.0% | Increased cigarette sales and strong rural demand |

| BHARTIARTL | Telecom | 2.8% | Subscriber growth and tariff hikes |

These stock price increases reflect a variety of factors, including strong earnings reports, positive industry outlooks, and overall market optimism. Analyzing sector performance and market capitalization alongside stock price movements is crucial for effective investment strategies.

Sector-wise Performance Analysis

The BSE witnessed varied sectoral performances today. The IT and Banking sectors were clear leaders, significantly contributing to the overall market gains. The strong performance of these sectors can be attributed to positive global and domestic economic data and investor confidence in these sectors.

- Top Performing Sectors: IT, Banking, Energy, and FMCG showed the most significant gains.

- Underperforming Sectors: [Mention underperforming sectors and reasons, e.g., Pharma, Auto – potential reasons such as regulatory concerns or global supply chain issues].

- Reasons for Sector-Specific Performance: [Elaborate on the reasons behind the performance of the top and underperforming sectors using market leadership and sectoral indices as keywords]

Factors Influencing BSE Market Movement

Several global and domestic factors influenced today's BSE market movement. These include:

- Global Economic Trends: Positive global economic data and easing inflation concerns boosted investor sentiment.

- Geopolitical Events: [Mention any significant geopolitical events and their impact, if any].

- Government Policies: [Mention any recent government policies or announcements impacting the market].

- Crude Oil Prices: [Discuss the impact of crude oil price fluctuations on the market].

- Inflation Rates: [Discuss how inflation rates affect investor sentiment and market performance].

Understanding these economic indicators and risk assessment is crucial for navigating market volatility effectively.

Conclusion: Stay Updated on BSE Market Movements and Top Performing Stocks

Today's BSE market update reveals a positive market trend, with the Sensex demonstrating significant gains driven by strong performances in key sectors and individual stocks. The top-performing stocks highlighted above provide valuable insights into current market opportunities. Staying informed about BSE market analysis and understanding the factors influencing market volatility is crucial for making informed investment decisions. Check back tomorrow for more BSE updates and in-depth analysis of top BSE stocks and the latest BSE stock market trends. Subscribe to our newsletter for daily BSE market analysis and top stock picks!

Featured Posts

-

Sensex Rises Stocks That Jumped Over 10 On Bse Today

May 15, 2025

Sensex Rises Stocks That Jumped Over 10 On Bse Today

May 15, 2025 -

Unlocking Potential The Value Of Middle Managers In The Modern Workplace

May 15, 2025

Unlocking Potential The Value Of Middle Managers In The Modern Workplace

May 15, 2025 -

Actie Tegen Npo Baas Frederieke Leeflang Wat Staat Er Op Het Spel

May 15, 2025

Actie Tegen Npo Baas Frederieke Leeflang Wat Staat Er Op Het Spel

May 15, 2025 -

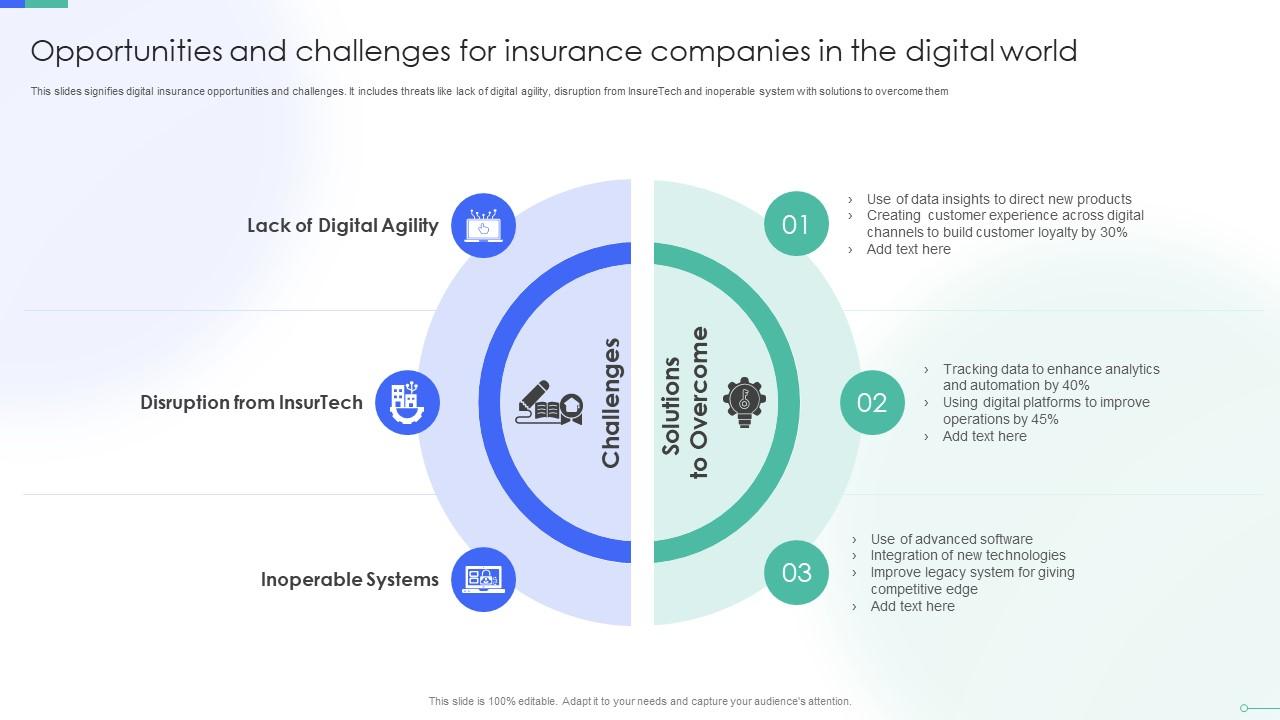

Ind As 117 And The Future Of Insurance In India Opportunities And Challenges

May 15, 2025

Ind As 117 And The Future Of Insurance In India Opportunities And Challenges

May 15, 2025 -

The King Of Davoss Reign Rise Rule And Ruin

May 15, 2025

The King Of Davoss Reign Rise Rule And Ruin

May 15, 2025

Latest Posts

-

The 2026 Bmw I X Best Case Electric Vehicle Or Overhyped

May 15, 2025

The 2026 Bmw I X Best Case Electric Vehicle Or Overhyped

May 15, 2025 -

Exploring Androids Updated Design Language

May 15, 2025

Exploring Androids Updated Design Language

May 15, 2025 -

2026 Bmw I X Evaluating The Best Case Scenario Electric Vehicle Claim

May 15, 2025

2026 Bmw I X Evaluating The Best Case Scenario Electric Vehicle Claim

May 15, 2025 -

Review The 2026 Bmw I X A Best Case Ev

May 15, 2025

Review The 2026 Bmw I X A Best Case Ev

May 15, 2025 -

The Reality Of Trumps Egg Price Claims

May 15, 2025

The Reality Of Trumps Egg Price Claims

May 15, 2025