Ind AS 117 And The Future Of Insurance In India: Opportunities And Challenges

Table of Contents

Understanding Ind AS 117 and its Impact on Indian Insurers

Ind AS 117, issued by the International Accounting Standards Board (IASB), dictates the accounting treatment of insurance contracts. Its core principles revolve around a more accurate reflection of an insurer's financial position and performance by focusing on the promises made to policyholders. This represents a departure from previous accounting standards in India, impacting various aspects of financial reporting.

Key differences from older standards include:

- Changes in revenue recognition: Revenue is now recognized over the period the insurer provides insurance coverage, rather than solely at the time of premium receipt. This necessitates a more nuanced approach to revenue allocation and tracking.

- Impact on contract valuation and liabilities: Ind AS 117 requires insurers to accurately value their insurance liabilities, considering factors like future claims, discounting rates, and risk margins. This leads to a more complex and potentially higher reported liability figure.

- Increased complexity in financial reporting: The standard introduces significant complexities in financial reporting processes, demanding sophisticated systems and expertise to manage the intricate calculations involved.

- Requirement for enhanced risk management capabilities: Accurate application of Ind AS 117 necessitates robust risk management systems to accurately assess and quantify future obligations and potential financial impacts.

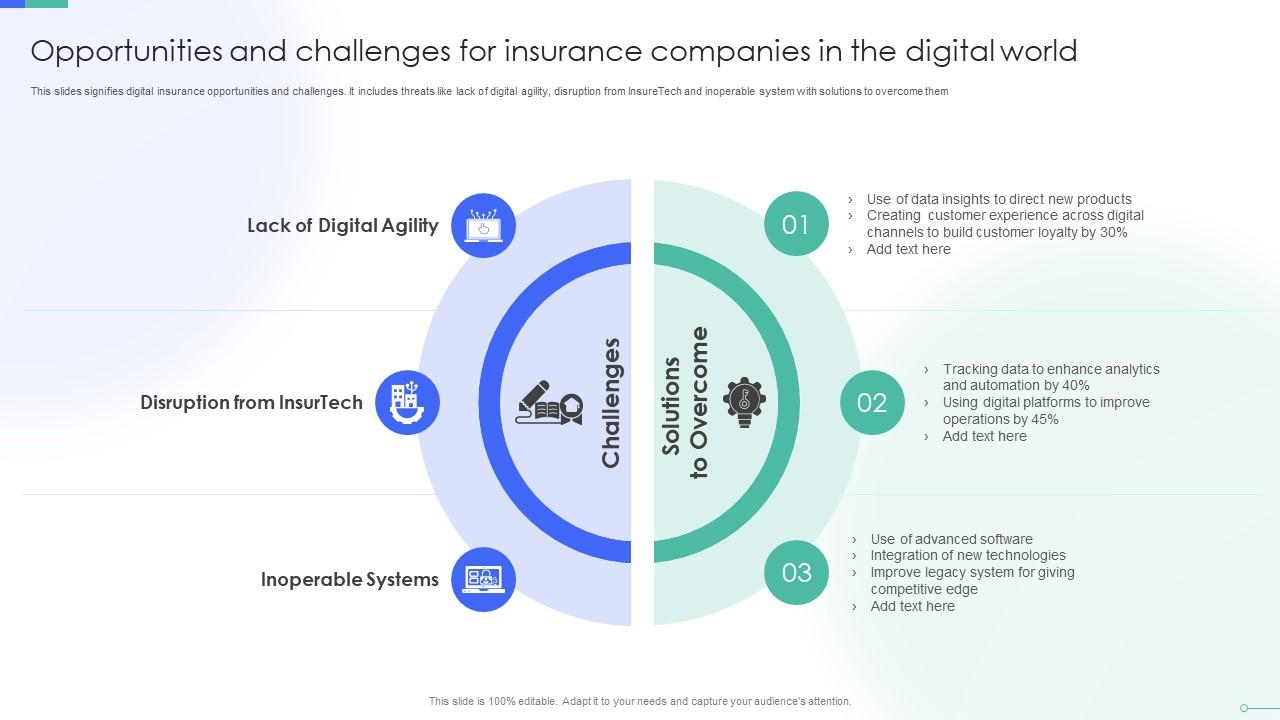

Opportunities Presented by Ind AS 117

Despite the challenges, Ind AS 117 opens doors to several significant opportunities for Indian insurers:

- Improved transparency and investor confidence: The enhanced transparency provided by the standard boosts investor confidence by presenting a clearer and more reliable picture of an insurer's financial health. This facilitates easier access to capital markets.

- Better risk management and capital allocation: The rigorous valuation requirements of Ind AS 117 necessitate a more thorough risk assessment process. This, in turn, leads to more effective capital allocation and improved risk management strategies.

Specific benefits include:

- Attracting foreign investment: Alignment with global accounting standards makes Indian insurers more attractive to foreign investors seeking reliable and comparable financial information.

- Enhanced credibility with international stakeholders: Meeting international accounting standards enhances the credibility and reputation of Indian insurers on the global stage.

- Improved corporate governance: The increased focus on transparency and accountability mandated by Ind AS 117 contributes to improved corporate governance practices.

- Facilitating mergers and acquisitions: Standardized financial reporting simplifies the valuation and due diligence processes associated with mergers and acquisitions, boosting M&A activity within the sector.

Leveraging Technology for Ind AS 117 Compliance

Successfully implementing Ind AS 117 requires leveraging technology to its fullest. Specialized software and data analytics play a vital role in streamlining the compliance process:

- Automated data collection and processing: Automation minimizes manual effort and reduces the risk of errors in data entry and calculations.

- Real-time reporting and analysis: Real-time data access provides insurers with the capability to monitor their financial performance continuously and make informed decisions.

- Improved accuracy and efficiency: Technology drastically improves the accuracy and efficiency of financial reporting processes.

- Reduced compliance costs: While initial investment in technology is necessary, long-term cost savings are realized through increased efficiency and reduced manual workload.

Challenges in Implementing Ind AS 117 in India

Despite the opportunities, implementing Ind AS 117 in India presents several significant challenges:

- Complexities of adapting to new accounting standards: The transition from existing accounting practices to the complexities of Ind AS 117 necessitates a significant change management effort.

- Significant investment in IT infrastructure and skilled personnel: Meeting the requirements of Ind AS 117 requires substantial investment in new IT systems, data infrastructure, and training for skilled professionals.

Specific obstacles include:

- Data migration challenges: Migrating vast amounts of historical data to comply with the new standard can be a time-consuming and resource-intensive process.

- Lack of skilled professionals: A shortage of professionals with expertise in Ind AS 117 can hinder the smooth implementation of the standard.

- High implementation costs: The overall cost of implementing Ind AS 117, including IT upgrades, training, and consulting fees, can be substantial.

- Potential for operational disruptions: The transition can disrupt existing operational processes and workflows, potentially impacting efficiency in the short term.

Regulatory and Compliance Aspects of Ind AS 117

The regulatory landscape surrounding Ind AS 117 in India is crucial. The IRDAI (Insurance Regulatory and Development Authority of India) plays a pivotal role in enforcing the standard:

- IRDAI guidelines and interpretations: The IRDAI issues guidelines and interpretations to provide clarity and address specific implementation issues.

- Potential for audits and inspections: Insurers are subject to audits and inspections to ensure compliance with Ind AS 117.

- Consequences of non-compliance: Non-compliance with Ind AS 117 can result in penalties and reputational damage.

Conclusion

Ind AS 117 represents a pivotal moment for the Indian insurance sector. While the implementation involves considerable challenges, demanding investment in technology and skilled professionals, the potential benefits—improved transparency, better risk management, and increased foreign investment—are substantial. Successfully navigating this transition requires proactive planning, technological advancements, and robust regulatory support.

Call to Action: Understanding the intricacies of Ind AS 117 is paramount for the future success of insurance businesses in India. Proactive engagement with the standard, meticulous planning, and strategic use of technology will help insurers not only meet compliance requirements but also unlock new opportunities for sustainable growth under Ind AS 117. Embrace the changes, invest wisely, and position your organization for success in this new era of Indian insurance.

Featured Posts

-

College Van Omroepen Hoe Vertrouwen Binnen De Npo Te Herstellen

May 15, 2025

College Van Omroepen Hoe Vertrouwen Binnen De Npo Te Herstellen

May 15, 2025 -

Kypros Oyggaria Synergasia En Meso Kypriakoy Kai Ellinikis Proedrias Ee

May 15, 2025

Kypros Oyggaria Synergasia En Meso Kypriakoy Kai Ellinikis Proedrias Ee

May 15, 2025 -

Paytm Payments Bank Penalized R5 45 Crore By Fiu Ind For Money Laundering

May 15, 2025

Paytm Payments Bank Penalized R5 45 Crore By Fiu Ind For Money Laundering

May 15, 2025 -

Dijital Veri Tabani Isguecue Piyasasi Ledra Pal Da Carsamba Rehberi

May 15, 2025

Dijital Veri Tabani Isguecue Piyasasi Ledra Pal Da Carsamba Rehberi

May 15, 2025 -

Leeflangs Leiderschap Bij De Npo Klachten Over Angstcultuur Onder Medewerkers

May 15, 2025

Leeflangs Leiderschap Bij De Npo Klachten Over Angstcultuur Onder Medewerkers

May 15, 2025

Latest Posts

-

Aanhoudende Klachten Over Angstcultuur Bij De Npo Onder Leiding Van Leeflang

May 15, 2025

Aanhoudende Klachten Over Angstcultuur Bij De Npo Onder Leiding Van Leeflang

May 15, 2025 -

Npo Medewerkers Melden Angstcultuur Onderzoek Naar Leeflangs Management Gewenst

May 15, 2025

Npo Medewerkers Melden Angstcultuur Onderzoek Naar Leeflangs Management Gewenst

May 15, 2025 -

Leeflangs Leiderschap Bij De Npo Klachten Over Angstcultuur Onder Medewerkers

May 15, 2025

Leeflangs Leiderschap Bij De Npo Klachten Over Angstcultuur Onder Medewerkers

May 15, 2025 -

Angstcultuur Bij De Npo Medewerkers Spreken Zich Uit Over Leeflangs Leiderschap

May 15, 2025

Angstcultuur Bij De Npo Medewerkers Spreken Zich Uit Over Leeflangs Leiderschap

May 15, 2025 -

Nieuwe Stappen Tegen Grensoverschrijdend Gedrag Bij De Npo

May 15, 2025

Nieuwe Stappen Tegen Grensoverschrijdend Gedrag Bij De Npo

May 15, 2025