Buy-and-Hold: Facing The Challenges Of Long-Term Investing

Table of Contents

Understanding the Core Principles of Buy-and-Hold Investing

Defining Buy-and-Hold

Buy-and-hold is a passive investing approach characterized by minimal trading activity. Instead of attempting to time the market, buy-and-hold investors select assets aligned with their long-term financial goals and hold them for years, often decades, regardless of short-term market fluctuations. This long-term perspective allows for the power of compounding to work its magic, generating significant returns over time. This strategy is suitable for various asset classes, including stocks, bonds, and real estate.

- Minimize trading fees and taxes: Reduced trading means lower commissions and capital gains taxes.

- Benefit from compounding returns over time: Reinvested earnings generate further earnings, accelerating growth exponentially.

- Requires patience and discipline: Resisting the urge to react to short-term market volatility is crucial.

- Suitable for various asset classes: Buy-and-hold can be applied to diversified portfolios across stocks, bonds, real estate, and other asset classes.

Confronting Market Volatility and Economic Downturns

The Psychological Impact of Market Fluctuations

Market corrections and bear markets are inevitable. The psychological impact on investors can be significant, leading to impulsive decisions that undermine long-term goals.

- Fear of missing out (FOMO) and panic selling: These emotional responses often result in selling low and buying high, precisely the opposite of what a successful long-term investor should do.

- Importance of a well-defined investment plan: A detailed plan outlining your goals, risk tolerance, and asset allocation serves as a roadmap during turbulent periods.

- Strategies for managing emotional responses: Regular portfolio reviews, coupled with realistic expectations, can help maintain perspective and avoid impulsive actions.

- The role of diversification in mitigating risk: A diversified portfolio reduces the impact of any single asset's underperformance.

Historical Data and Long-Term Market Trends

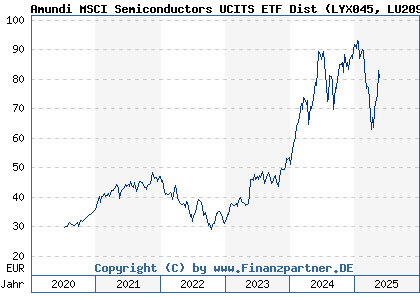

Despite short-term volatility, historical data consistently demonstrates the long-term upward trend of the market.

- Examples of past market crashes and subsequent recoveries: The 1987 Black Monday, the dot-com bubble burst, and the 2008 financial crisis all illustrate the market's resilience.

- Illustrative charts and graphs demonstrating long-term growth: Visual representations effectively highlight the power of compounding over time.

- Highlighting the importance of staying invested during downturns: This is arguably the most crucial aspect of successful buy-and-hold investing.

Diversification and Risk Management in a Buy-and-Hold Portfolio

Asset Allocation Strategies

Diversification is fundamental to mitigating risk in a buy-and-hold portfolio.

- The importance of diversification across different asset classes: Spreading investments across stocks, bonds, real estate, and potentially commodities helps reduce overall portfolio volatility.

- Adjusting asset allocation based on risk tolerance and investment goals: Risk tolerance influences the proportion of each asset class in your portfolio.

- Using ETFs or mutual funds for diversification: These investment vehicles provide convenient access to a diversified range of assets.

Regular Portfolio Rebalancing

Periodic rebalancing helps maintain your desired asset allocation.

- How to identify when rebalancing is necessary: Rebalancing typically occurs when the proportion of any asset class deviates significantly from your target allocation.

- The benefits of rebalancing for risk management and return optimization: It helps prevent overexposure to any single asset class and capitalizes on market fluctuations.

- Practical steps for rebalancing a buy-and-hold portfolio: This involves selling some assets that have outperformed and buying others that have underperformed to restore the target allocation.

The Role of Inflation and Taxes in Long-Term Investing

Inflation's Impact on Investment Returns

Inflation erodes the purchasing power of your investments over time.

- Investing in inflation-hedged assets: Real estate and commodities often perform well during inflationary periods.

- The importance of regular portfolio reviews in the context of inflation: Adjusting your strategy to account for inflation is crucial for maintaining purchasing power.

Tax Implications of Long-Term Investments

Tax implications are a significant consideration in long-term investing.

- Tax-advantaged investment accounts: Utilizing 401(k)s and IRAs can significantly reduce your tax burden.

- Tax-loss harvesting strategies: This technique can help offset capital gains taxes.

Conclusion

Buy-and-hold investing, while seemingly straightforward, requires careful planning and disciplined execution. Navigating market volatility, managing emotional responses, and considering the impact of inflation and taxes are critical for success. By implementing a well-diversified portfolio, regularly rebalancing your assets, and maintaining a long-term perspective, you can significantly increase your chances of achieving your financial goals. Start your journey towards successful buy-and-hold investing today! Learn more about creating a robust buy-and-hold strategy to secure your financial future.

Featured Posts

-

Dutch Stocks Slump Amidst Escalating Us Trade War

May 25, 2025

Dutch Stocks Slump Amidst Escalating Us Trade War

May 25, 2025 -

Chinas Zheng Qinwen Achieves Career Milestone Beats Sabalenka At Italian Open

May 25, 2025

Chinas Zheng Qinwen Achieves Career Milestone Beats Sabalenka At Italian Open

May 25, 2025 -

Amundi Djia Ucits Etf A Comprehensive Guide To Net Asset Value

May 25, 2025

Amundi Djia Ucits Etf A Comprehensive Guide To Net Asset Value

May 25, 2025 -

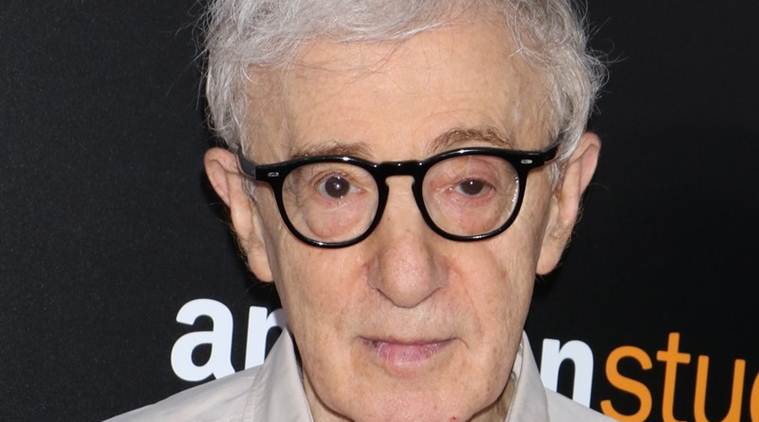

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025 -

Jejak Sejarah Porsche 356 Di Pabrik Zuffenhausen Jerman

May 25, 2025

Jejak Sejarah Porsche 356 Di Pabrik Zuffenhausen Jerman

May 25, 2025

Latest Posts

-

Naomi Kempbell 55 Let Luchshie Foto Supermodeli

May 25, 2025

Naomi Kempbell 55 Let Luchshie Foto Supermodeli

May 25, 2025 -

Naomi Kempbell 55 Rokiv Foto Z Zhittya Superzirki

May 25, 2025

Naomi Kempbell 55 Rokiv Foto Z Zhittya Superzirki

May 25, 2025 -

Supermodel Naomi Kempbell Otkrovennye Kadry V Novoy Fotosessii

May 25, 2025

Supermodel Naomi Kempbell Otkrovennye Kadry V Novoy Fotosessii

May 25, 2025 -

Glyantsevi Foto Naomi Kempbell U Yiyi 55 Rokiv

May 25, 2025

Glyantsevi Foto Naomi Kempbell U Yiyi 55 Rokiv

May 25, 2025 -

Yuviley Naomi Kempbell Fotografiyi Z Urochistostey

May 25, 2025

Yuviley Naomi Kempbell Fotografiyi Z Urochistostey

May 25, 2025