Buying A House With Student Loan Debt: Is It Possible?

Table of Contents

Assessing Your Financial Situation with Student Loan Debt

Before you even begin dreaming of open houses, it's crucial to understand your current financial standing, especially when dealing with student loan debt and mortgages. This involves a thorough assessment of your debt-to-income ratio, exploring different mortgage options, and creating a realistic budget.

Understanding Your Debt-to-Income Ratio (DTI)

Your debt-to-income ratio (DTI) is a crucial factor in determining your mortgage eligibility. It represents the percentage of your gross monthly income that goes towards debt repayment. Lenders use DTI to assess your ability to manage additional debt, like a mortgage. Student loan payments significantly impact your DTI, potentially making it harder to qualify for a loan.

- Factors influencing DTI: Student loan payments, credit card debt, car loans, alimony, and child support.

- Lowering your DTI: Reduce existing debt, increase your income, or explore ways to consolidate or refinance your student loans to lower monthly payments. You can use online DTI calculators to estimate your ratio. Many are available via a quick Google search for "DTI calculator."

Exploring Different Mortgage Options

Several mortgage options cater to various financial situations, including those with student loan debt. Understanding these options is key to finding the best fit.

-

Conventional Loans: These are offered by private lenders and usually require a higher credit score and a larger down payment.

-

FHA Loans: Backed by the Federal Housing Administration, these loans often require lower credit scores and down payments, making them more accessible to borrowers with student loan debt.

-

VA Loans: Guaranteed by the Department of Veterans Affairs, these loans are available to eligible veterans and active-duty military personnel, often requiring no down payment.

-

Requirements for each mortgage type: Credit score, debt-to-income ratio, down payment amount, and loan-to-value ratio vary.

-

Most favorable type for those with student loan debt: FHA loans often prove more attainable due to their more lenient requirements. However, your individual circumstances should be carefully evaluated.

Creating a Realistic Budget

Budgeting is crucial when juggling student loan payments and potential mortgage expenses. It's vital to create a detailed budget that accounts for all income and expenses, leaving room for unexpected costs.

- Example budget breakdown: Include student loan payments, estimated mortgage payment (principal, interest, taxes, insurance – PITI), utilities, groceries, transportation, entertainment, and savings.

- Tips for saving money: Track expenses, identify areas for reduction, consider cheaper alternatives, and automate savings. Budgeting apps and spreadsheets can assist in this process.

Strategies for Improving Your Chances of Homeownership

While student loan debt may seem like a hurdle, there are strategic steps you can take to improve your chances of homeownership.

Paying Down Student Loan Debt

Reducing your student loan debt before applying for a mortgage will significantly improve your DTI and increase your chances of approval.

- Accelerated repayment strategies: Explore refinancing options to potentially secure lower interest rates and reduce monthly payments. Income-driven repayment plans can adjust your monthly payments based on your income.

- Benefits of debt reduction: A lower DTI makes you a more attractive borrower, increasing your likelihood of approval for a mortgage.

- Pros and cons of different repayment plans: Research carefully to find the plan that aligns with your financial capabilities and long-term goals. Compare interest rates and total repayment amounts across different refinancing options.

Increasing Your Credit Score

A good credit score is essential for securing a favorable mortgage interest rate. Aim for a score above 700 to qualify for the best rates.

- Factors impacting credit score: Payment history, amounts owed, length of credit history, credit mix, and new credit.

- Improving your credit score: Pay bills on time, reduce credit utilization (keep balances low compared to credit limits), and avoid opening multiple new accounts within a short period. Monitor your credit report regularly using free services like AnnualCreditReport.com.

Saving for a Down Payment

Saving for a down payment is a significant step towards homeownership. Even a small down payment can improve your chances of approval.

- Tips for effective saving: Automate savings, set realistic goals, and track your progress. Explore high-yield savings accounts to maximize your returns.

- Down payment assistance programs: Research government and local programs offering assistance to first-time homebuyers. These programs can help you overcome the challenge of saving for a significant down payment.

Seeking Professional Advice

Navigating the complexities of buying a house with student loan debt can be overwhelming. Seeking expert advice can make the process smoother and more successful.

Consulting with a Financial Advisor

A financial advisor can provide personalized guidance on managing debt, creating a budget, and developing a comprehensive plan for achieving your homeownership goals. They can offer valuable insights into debt consolidation, refinancing options, and investment strategies.

Working with a Mortgage Lender

Pre-qualification and pre-approval are crucial steps in the mortgage process. Pre-qualification provides an estimate of how much you can borrow, while pre-approval gives you a firm commitment from a lender, making your offer stronger.

Shop around for the best mortgage rates and terms from multiple lenders. Compare interest rates, fees, and closing costs to ensure you secure the most favorable deal.

Conclusion

Buying a house with student loan debt is indeed possible, but it requires careful planning, strategic actions, and potentially, some professional guidance. By thoroughly assessing your financial situation, implementing strategies to improve your creditworthiness, and actively seeking expert advice, you can significantly increase your chances of achieving your homeownership dreams. Don't let student loan debt derail your dreams of homeownership – take control of your finances and start planning now! Ready to learn more about buying a house with student loan debt? Explore our resources and find the right path for you!

Featured Posts

-

112

May 17, 2025

112

May 17, 2025 -

Thibodeaus Frustration Boils Over After Knicks Game 2 Loss

May 17, 2025

Thibodeaus Frustration Boils Over After Knicks Game 2 Loss

May 17, 2025 -

New York Knicks Landry Shamet A Roster Conundrum

May 17, 2025

New York Knicks Landry Shamet A Roster Conundrum

May 17, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6th Claims At The Center Of Lawsuit

May 17, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Claims At The Center Of Lawsuit

May 17, 2025 -

Top Bitcoin And Crypto Casinos For 2025 A Comprehensive Review

May 17, 2025

Top Bitcoin And Crypto Casinos For 2025 A Comprehensive Review

May 17, 2025

Latest Posts

-

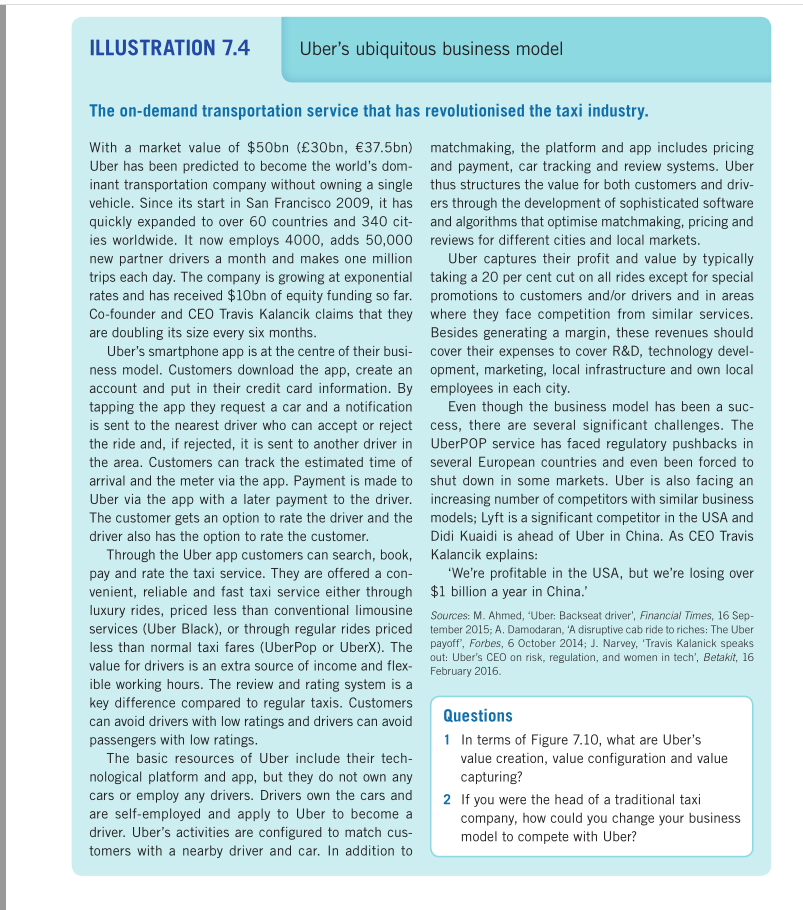

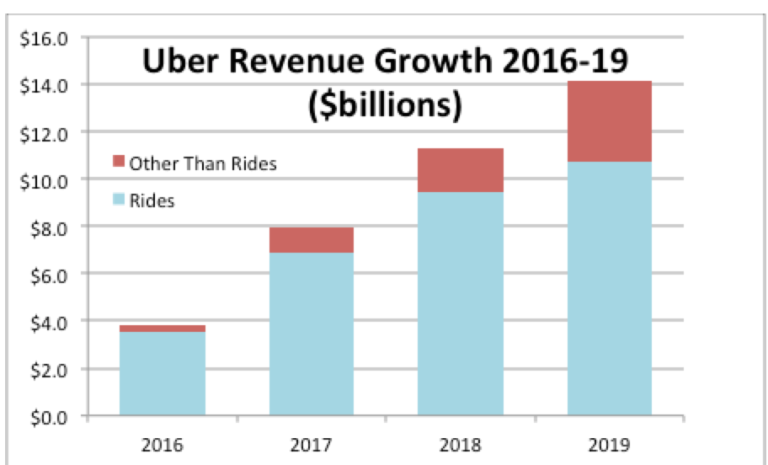

Analyzing Ubers Resilience In A Potential Recession

May 17, 2025

Analyzing Ubers Resilience In A Potential Recession

May 17, 2025 -

Taking Your Pet On Uber In Mumbai Complete Guide

May 17, 2025

Taking Your Pet On Uber In Mumbai Complete Guide

May 17, 2025 -

Ubers Stock Performance Defying Recessionary Trends

May 17, 2025

Ubers Stock Performance Defying Recessionary Trends

May 17, 2025 -

Why Uber Might Weather An Economic Downturn

May 17, 2025

Why Uber Might Weather An Economic Downturn

May 17, 2025 -

Uber Pet Policy Mumbai How To Transport Your Furry Friend

May 17, 2025

Uber Pet Policy Mumbai How To Transport Your Furry Friend

May 17, 2025