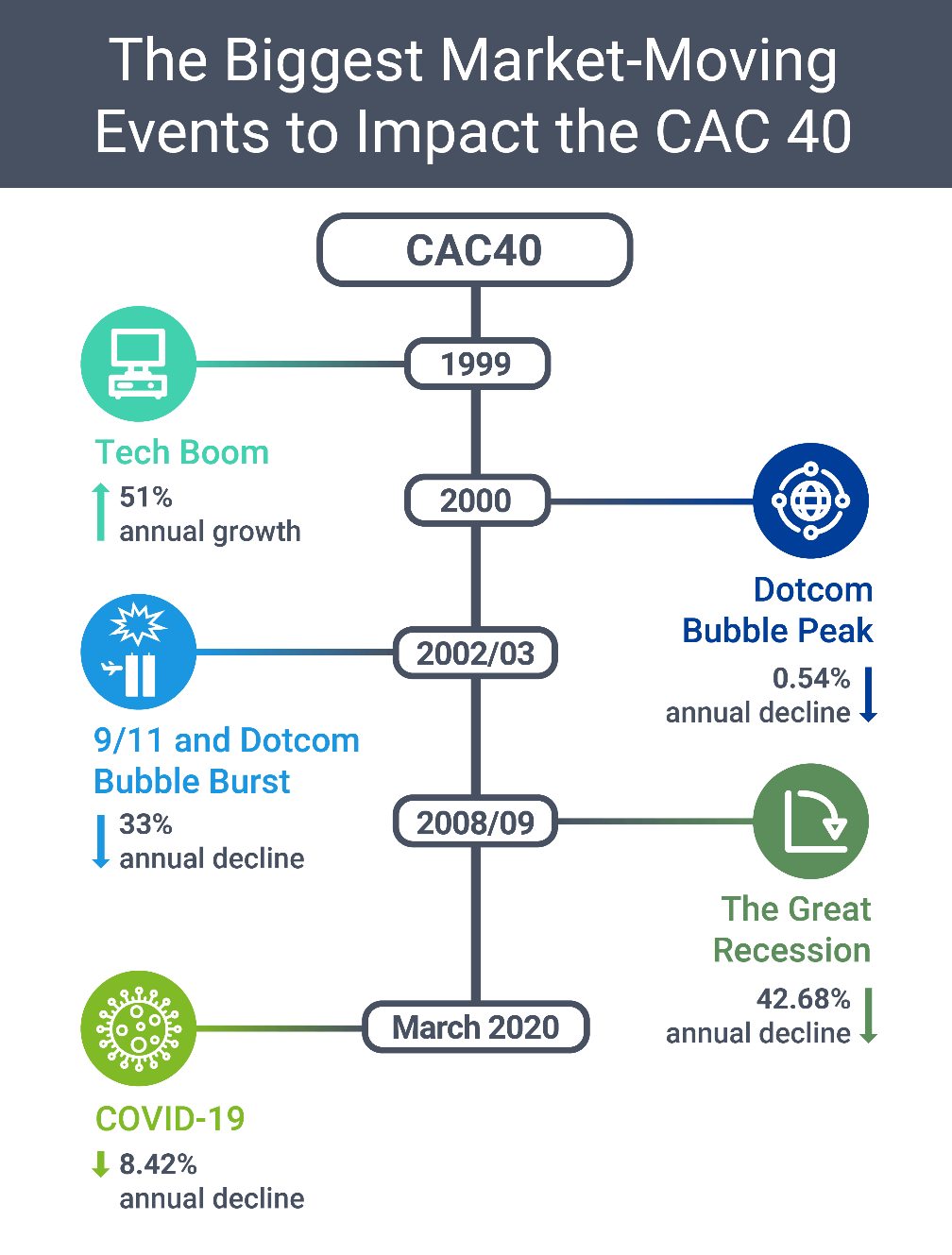

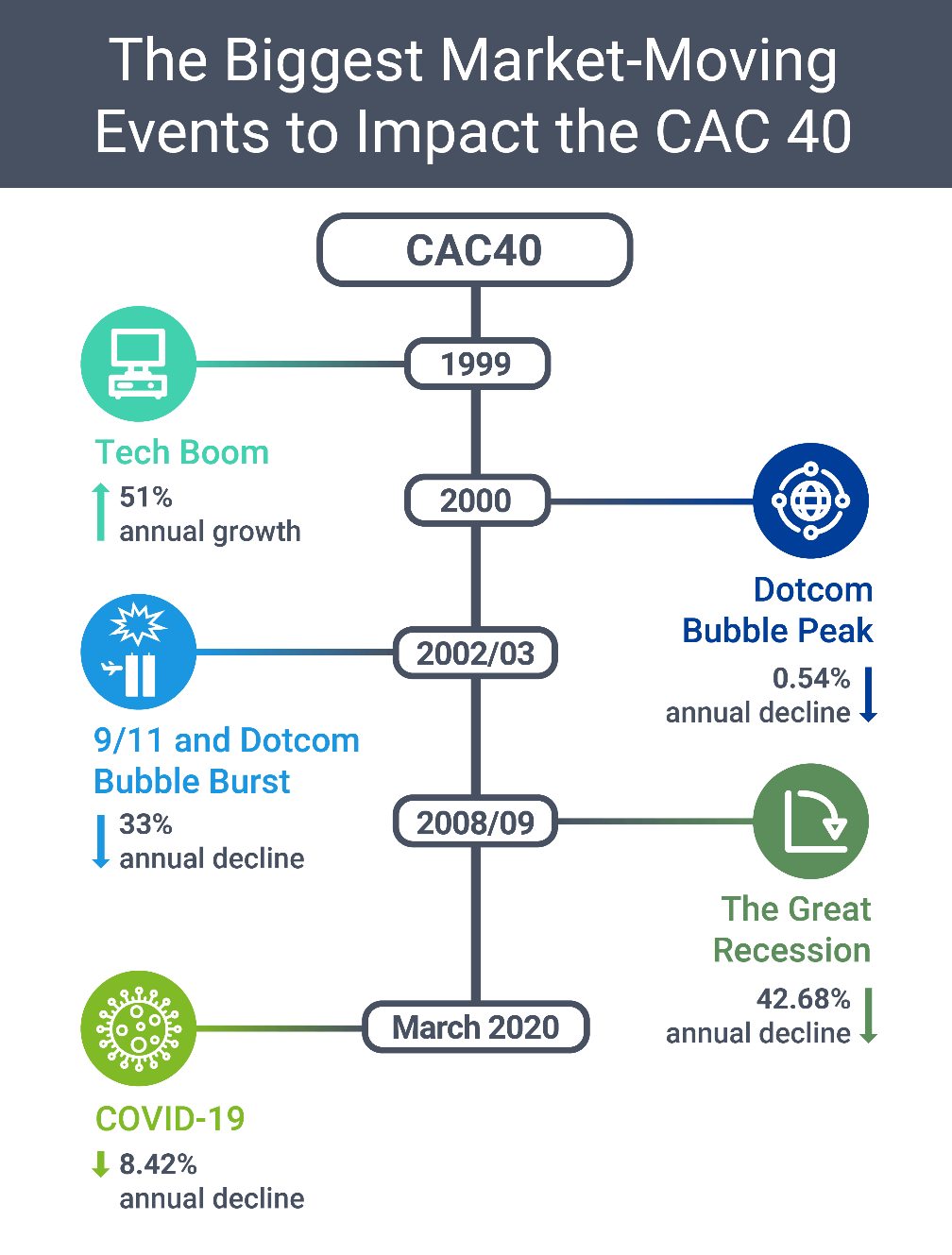

CAC 40 Ends Week Down, But Weekly Trend Shows Stability (March 7, 2025)

Table of Contents

Friday's Dip: Understanding the CAC 40's Weekly Decline

The CAC 40 experienced a noticeable dip on Friday, March 7th, 2025, closing down approximately 1.2%. Several factors contributed to this decline. Firstly, global market trends played a significant role. Concerns over rising inflation in the United States, coupled with uncertainty surrounding interest rate hikes, led to a general sell-off in European markets, impacting the CAC 40. Secondly, the performance of individual companies within the index exerted considerable influence.

-

Impact of LVMH stock performance on the CAC 40: Luxury goods giant LVMH, a major component of the CAC 40, experienced a slight downturn following a less-than-stellar earnings report, contributing to the overall index decline.

-

Influence of global economic indicators: The release of weaker-than-expected manufacturing data from Germany, a key trading partner for France, negatively impacted investor sentiment and put downward pressure on the CAC 40.

-

Analysis of trading volume on Friday: Increased trading volume on Friday indicated heightened volatility and investor nervousness, exacerbating the downward pressure on the index. This surge in activity suggests a response to the unfolding global economic uncertainties.

Weekly Trend Analysis: Evidence of CAC 40 Stability

Despite Friday's drop, a broader weekly analysis reveals significant stability within the CAC 40. From Monday to Thursday, the index showed a modest increase of 0.8%, demonstrating resilience in the face of Friday's volatility. This underlying strength highlights the inherent stability of the French economy and the confidence of many investors in its long-term prospects. Certain sectors displayed notable resilience:

-

Performance comparison with other major European indices: While the DAX and FTSE 100 also experienced some decline on Friday, the CAC 40's overall weekly performance was comparatively stronger, suggesting a relatively better performance of French companies compared to their German and British counterparts.

-

Highlight sectors that showed growth or stability throughout the week: The technology and luxury goods sectors, despite some Friday volatility, displayed relatively strong performance throughout the week, buoyed by positive earnings reports and robust consumer demand.

-

Mention any significant positive news impacting investor confidence: The announcement of a significant new investment in French renewable energy infrastructure contributed to a positive sentiment among certain investors, offsetting some of the negative impact of global economic concerns.

Investor Sentiment and Future Outlook for the CAC 40

Analyzing investor sentiment requires a careful examination of market data and news reports. While Friday's dip reflects some apprehension, the overall weekly performance suggests a relatively positive outlook. Trading volume and volatility, while increased on Friday, remained within typical ranges for the majority of the week, indicating a degree of market stability.

-

Analysis of investor confidence based on trading volume and volatility: The relatively moderate trading volumes across the week, excluding Friday, suggest a level of confidence among investors, despite the global economic headwinds.

-

Discussion of upcoming economic releases that could impact the market: The upcoming release of French inflation figures and unemployment data will significantly influence investor sentiment and the direction of the CAC 40 in the coming weeks.

-

Predictions for the short-term and long-term outlook of the CAC 40: Analysts predict that the CAC 40 will remain relatively stable in the short-term, barring any major unforeseen geopolitical events or significant shifts in global economic conditions. The long-term outlook remains positive, driven by strong growth in key sectors of the French economy.

Conclusion

The CAC 40 experienced a Friday dip, but the overall weekly trend demonstrates notable stability. This resilience highlights the strength of the French market despite various market pressures. The analysis revealed the factors contributing to the Friday decline, alongside positive indicators supporting a stable underlying trend. Understanding these dynamics is crucial for making informed investment decisions.

Call to Action: Stay informed on the evolving dynamics of the CAC 40 index. Continue monitoring key economic indicators, market news, and company performance to make well-informed decisions regarding your investments in the French stock market. Regularly check back for further updates on the CAC 40 performance and analysis.

Featured Posts

-

Philips 2025 Annual General Meeting Of Shareholders Key Updates And Agenda

May 25, 2025

Philips 2025 Annual General Meeting Of Shareholders Key Updates And Agenda

May 25, 2025 -

Brazilian Banking Reshaped Brb And Banco Master Combine Forces

May 25, 2025

Brazilian Banking Reshaped Brb And Banco Master Combine Forces

May 25, 2025 -

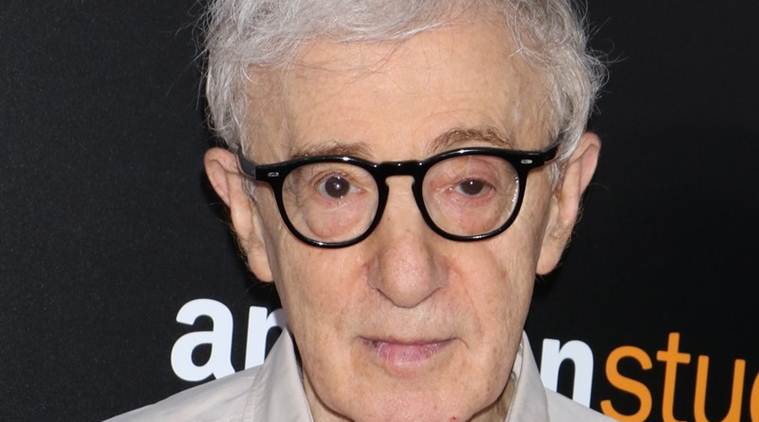

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025 -

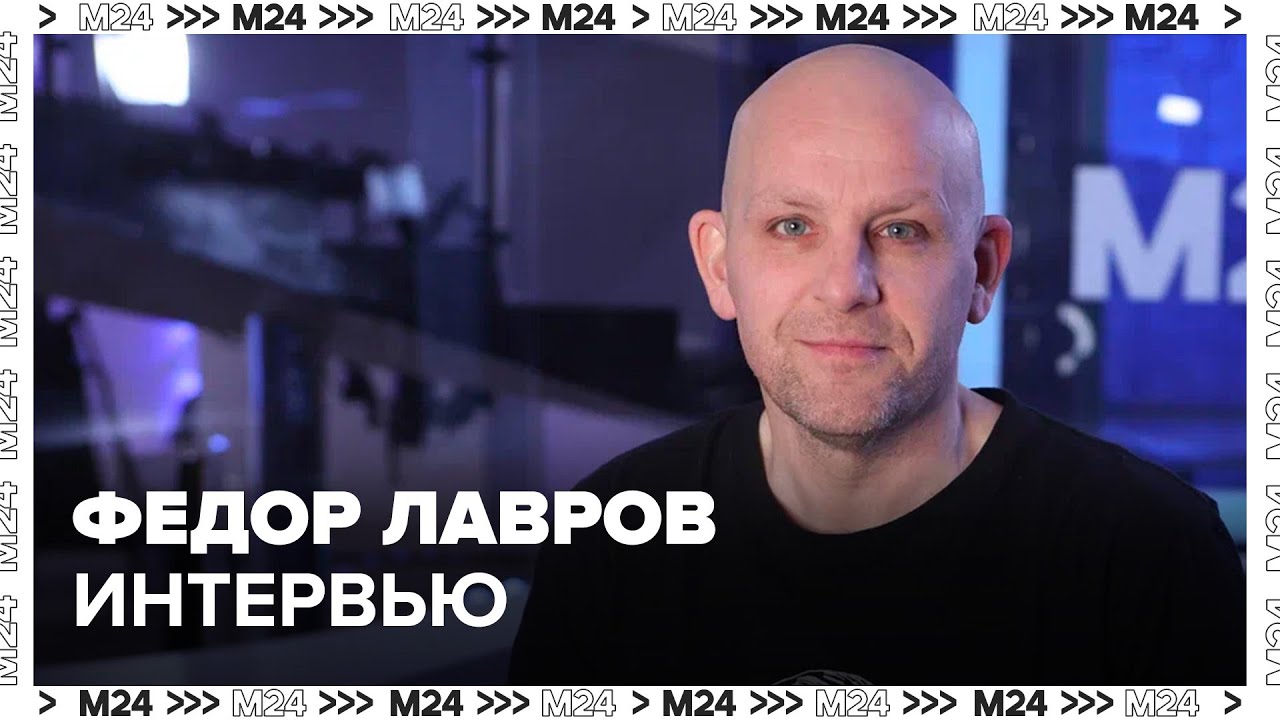

Lyudi Lyubyat Schekotat Nervy Fedor Lavrov O Pavle I Trillerakh I Refleksii

May 25, 2025

Lyudi Lyubyat Schekotat Nervy Fedor Lavrov O Pavle I Trillerakh I Refleksii

May 25, 2025 -

Finding A Dream Home In The Countryside Budget Friendly Options Under 1m

May 25, 2025

Finding A Dream Home In The Countryside Budget Friendly Options Under 1m

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025 -

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025 -

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025