California Revenue At Risk: The Impact Of Trump's Tariffs

Table of Contents

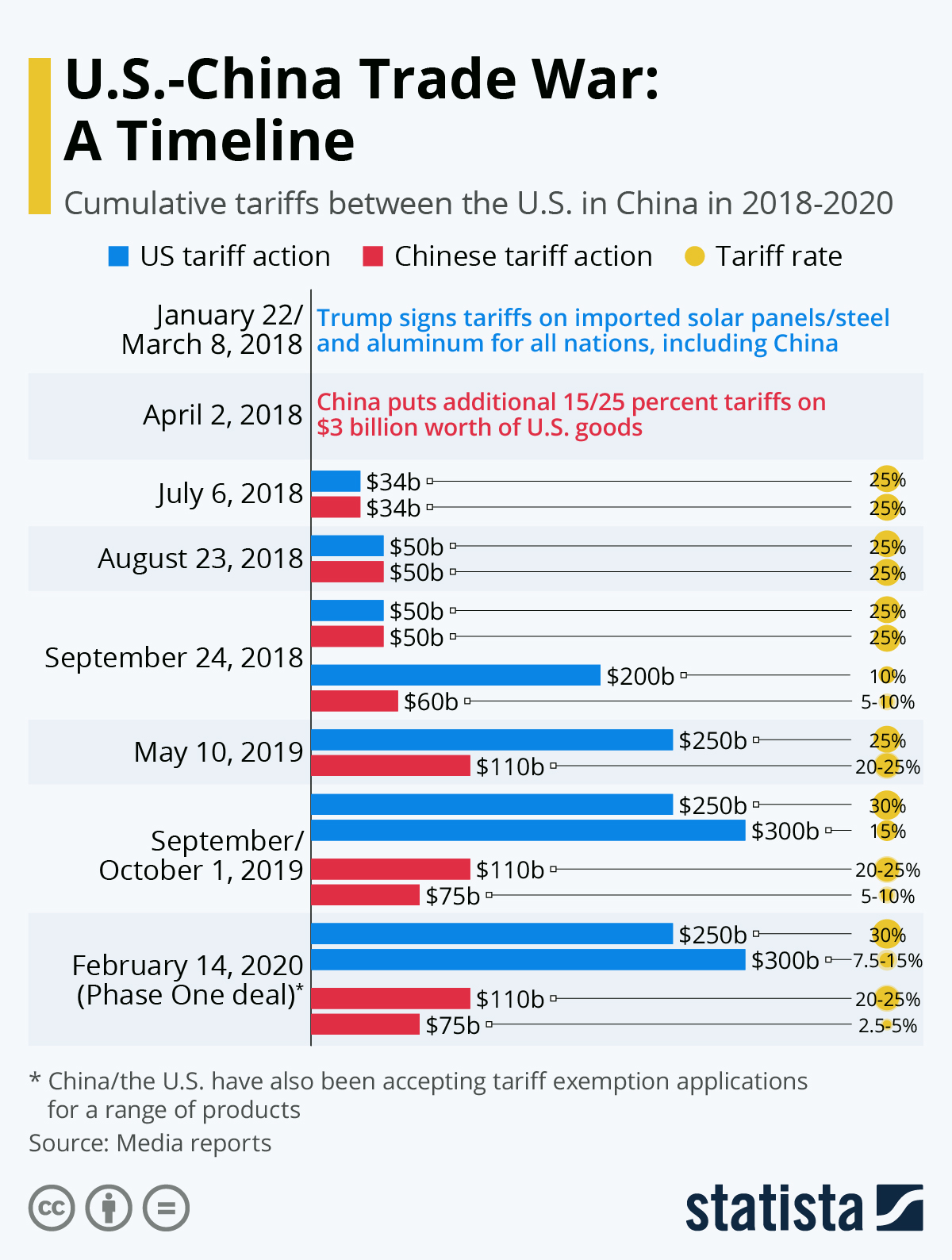

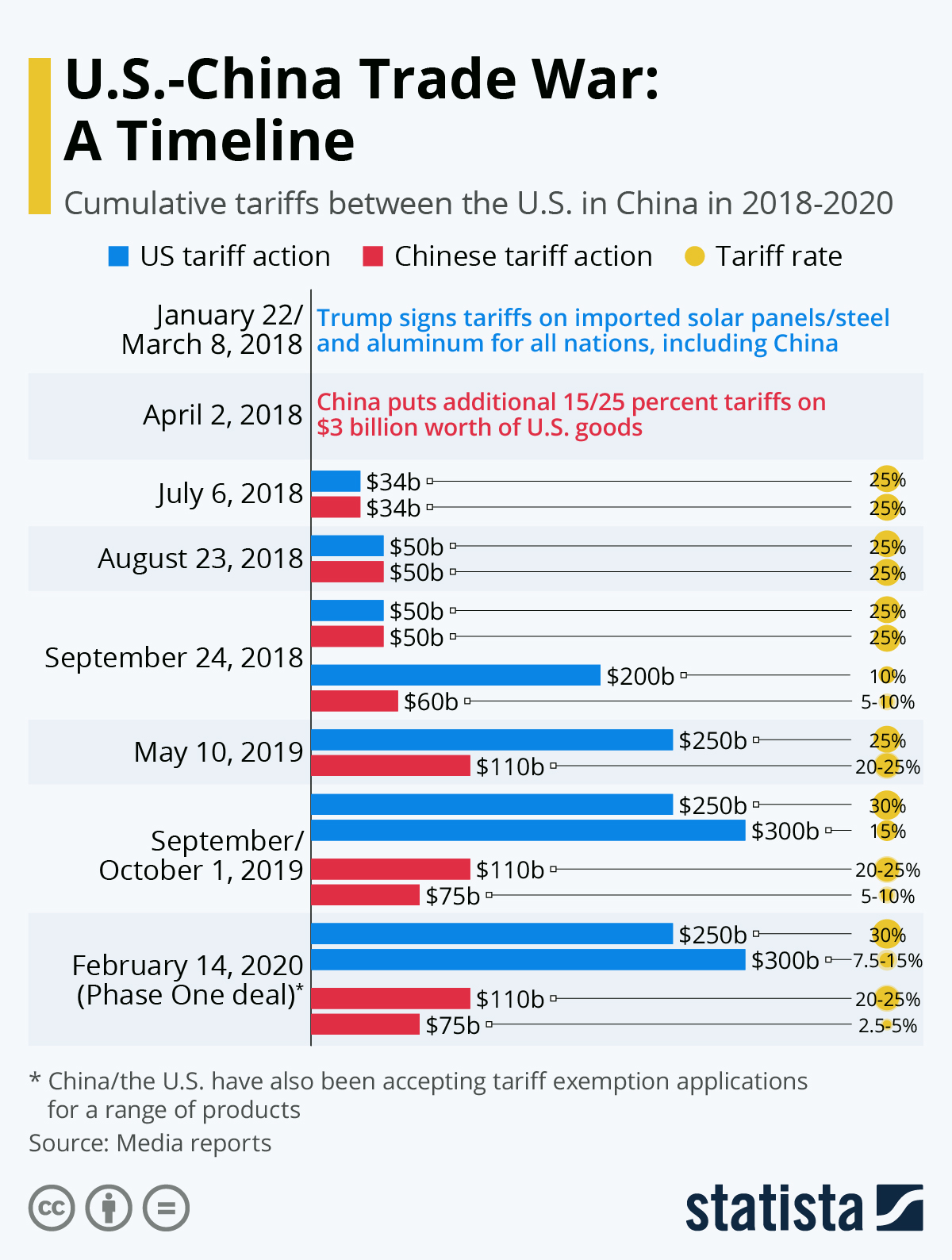

California's robust economy, a powerhouse of the US, faces a significant threat: the lingering impact of Trump-era tariffs. This article will explore how these trade policies continue to jeopardize California's revenue streams and economic stability, examining the multifaceted consequences of California Revenue and Trump's Tariffs.

<h2>Agricultural Sector Under Siege</h2>

California's agricultural sector, a cornerstone of its economy, has been severely impacted by Trump's tariffs. The imposition of tariffs led to retaliatory measures from other countries, significantly reducing California's agricultural exports and increasing input costs. This has created a perfect storm threatening the livelihood of farmers and the overall state revenue.

<h3>Reduced Exports to Key Markets</h3>

Retaliatory tariffs imposed by major trading partners like China, Mexico, and the European Union (EU) severely hampered California's agricultural exports.

- Specific examples of affected agricultural products: Almonds, wine, dairy products, and fresh fruits experienced significant export declines. China, once a major importer of California almonds, imposed substantial tariffs, leading to a drastic reduction in exports. Similarly, Mexican tariffs on California wine impacted the state's wine industry significantly.

- Quantifiable data on export losses and revenue decline: Reports from the California Department of Food and Agriculture (CDFA) and other agricultural organizations highlight substantial revenue losses in the billions of dollars since the implementation of tariffs. Specific figures should be cited here, referencing reliable sources such as government reports and academic studies.

- Impact on farmers and agricultural businesses: Many farmers faced financial hardship, leading to farm closures and job losses in rural communities. The reduced income also impacted related businesses like processing plants and transportation companies.

<h3>Increased Input Costs</h3>

Tariffs on imported goods essential for agriculture, such as machinery, fertilizers, and pesticides, significantly increased production costs for California farmers.

- Examples of specific imported goods affected by tariffs: Tractors, specialized agricultural equipment, and certain fertilizers saw increased prices due to tariffs.

- Data on the increase in input costs and its impact on profitability: The increased cost of inputs, coupled with reduced export revenue, squeezed profit margins for farmers, forcing many to operate at a loss or scale back production.

- Potential for reduced output and farm closures: The combination of reduced export revenue and increased input costs has led to a decrease in agricultural output and an increase in farm closures, impacting California's agricultural production and overall revenue.

<h2>Manufacturing and Trade Impacted</h2>

California's manufacturing sector, heavily reliant on global trade, also suffered significantly from the impact of tariffs. Disrupted supply chains and reduced competitiveness in international markets led to substantial economic consequences.

<h3>Disrupted Supply Chains</h3>

Tariffs caused major disruptions in California's supply chains, leading to increased costs and production delays.

- Examples of industries particularly affected: The technology and aerospace sectors, both significant contributors to California's economy, experienced significant disruptions due to reliance on imported components and materials.

- Discussion of increased shipping costs and delays: Tariffs increased shipping costs and led to significant delays, further impacting the manufacturing sector’s efficiency and profitability.

- Impact on job creation and economic growth: The disruptions to supply chains hindered job creation and slowed down economic growth in the manufacturing sector.

<h3>Reduced Competitiveness</h3>

Tariffs reduced the competitiveness of California-made goods in international markets, leading to market share losses and potential job losses.

- Examples of specific products affected: Specific examples of California-manufactured goods affected by reduced competitiveness should be listed, along with evidence of market share loss.

- Analysis of market share losses: Data showing the decline in market share for California-made goods in key export markets should be presented, referencing reliable sources.

- Potential for job losses in the manufacturing sector: The reduced competitiveness of California-made goods resulted in job losses and reduced investment in the manufacturing sector.

<h2>The Ripple Effect on California's Economy</h2>

The reduced revenue from the agricultural and manufacturing sectors created a ripple effect throughout California's economy, impacting the state budget and consumers alike.

<h3>State Budget Shortfalls</h3>

Decreased revenue from tariffs directly impacted the California state budget, limiting its ability to fund crucial public services.

- Data on state revenue shortfalls attributed to tariff impacts: Data showing the connection between tariff-related economic slowdowns and state budget shortfalls should be included, referencing reliable sources.

- Mention potential cuts to public services (education, healthcare): The state budget shortfalls led to potential cuts in essential public services like education and healthcare.

- Discussion of the potential for increased state taxes: To compensate for the revenue shortfall, the state may have had to consider raising taxes, impacting consumers and businesses.

<h3>Consumer Impact</h3>

Increased prices due to tariffs directly affected California consumers, reducing consumer spending and impacting overall economic growth.

- Examples of products with increased prices due to tariffs: Specific examples of products whose prices increased due to tariffs should be given.

- Discussion of the impact on consumer spending and overall economic growth: Increased prices led to a decrease in consumer spending and negatively affected overall economic growth.

- Mention the potential for reduced consumer confidence: The increased prices and economic uncertainty led to reduced consumer confidence, further hindering economic recovery.

<h2>Conclusion</h2>

The lingering effects of Trump's tariffs continue to pose a significant threat to California's revenue, impacting its agricultural sector, manufacturing, and the overall state economy. The ripple effect includes budget shortfalls, increased consumer prices, and reduced competitiveness in global markets. Understanding the continuing impact of California Revenue and Trump's Tariffs is crucial for policymakers and businesses alike. We need proactive strategies to mitigate these effects and build a more resilient California economy. Further research into the long-term impacts of these trade policies is essential to safeguard California's economic future. Learn more about the ongoing challenges facing California's revenue by exploring [link to relevant resource].

Featured Posts

-

Leeflangs Leiderschap Bij De Npo Klachten Over Angstcultuur Onder Medewerkers

May 15, 2025

Leeflangs Leiderschap Bij De Npo Klachten Over Angstcultuur Onder Medewerkers

May 15, 2025 -

The Closure Of Anchor Brewing Company A Look Back At Its History And Legacy

May 15, 2025

The Closure Of Anchor Brewing Company A Look Back At Its History And Legacy

May 15, 2025 -

Padres 2025 Regular Season Broadcast Schedule Announced

May 15, 2025

Padres 2025 Regular Season Broadcast Schedule Announced

May 15, 2025 -

Padres Defeat Braves Gurriels Pinch Hit Rbi Delivers The Win

May 15, 2025

Padres Defeat Braves Gurriels Pinch Hit Rbi Delivers The Win

May 15, 2025 -

Paytm Payments Bank Faces R5 45 Crore Fine From Fiu Ind Over Money Laundering

May 15, 2025

Paytm Payments Bank Faces R5 45 Crore Fine From Fiu Ind Over Money Laundering

May 15, 2025

Latest Posts

-

Max Muncys Torpedo Bat Experiment 3 At Bats Then A Game Tying Double

May 15, 2025

Max Muncys Torpedo Bat Experiment 3 At Bats Then A Game Tying Double

May 15, 2025 -

Smart Mlb Dfs Picks May 8th Value Plays And Top Performers

May 15, 2025

Smart Mlb Dfs Picks May 8th Value Plays And Top Performers

May 15, 2025 -

Muncy Ditches Torpedo Bat After 3 At Bats Hits Game Tying Double

May 15, 2025

Muncy Ditches Torpedo Bat After 3 At Bats Hits Game Tying Double

May 15, 2025 -

Mlb Dfs May 8th Optimal Lineup Strategy And Player Projections

May 15, 2025

Mlb Dfs May 8th Optimal Lineup Strategy And Player Projections

May 15, 2025 -

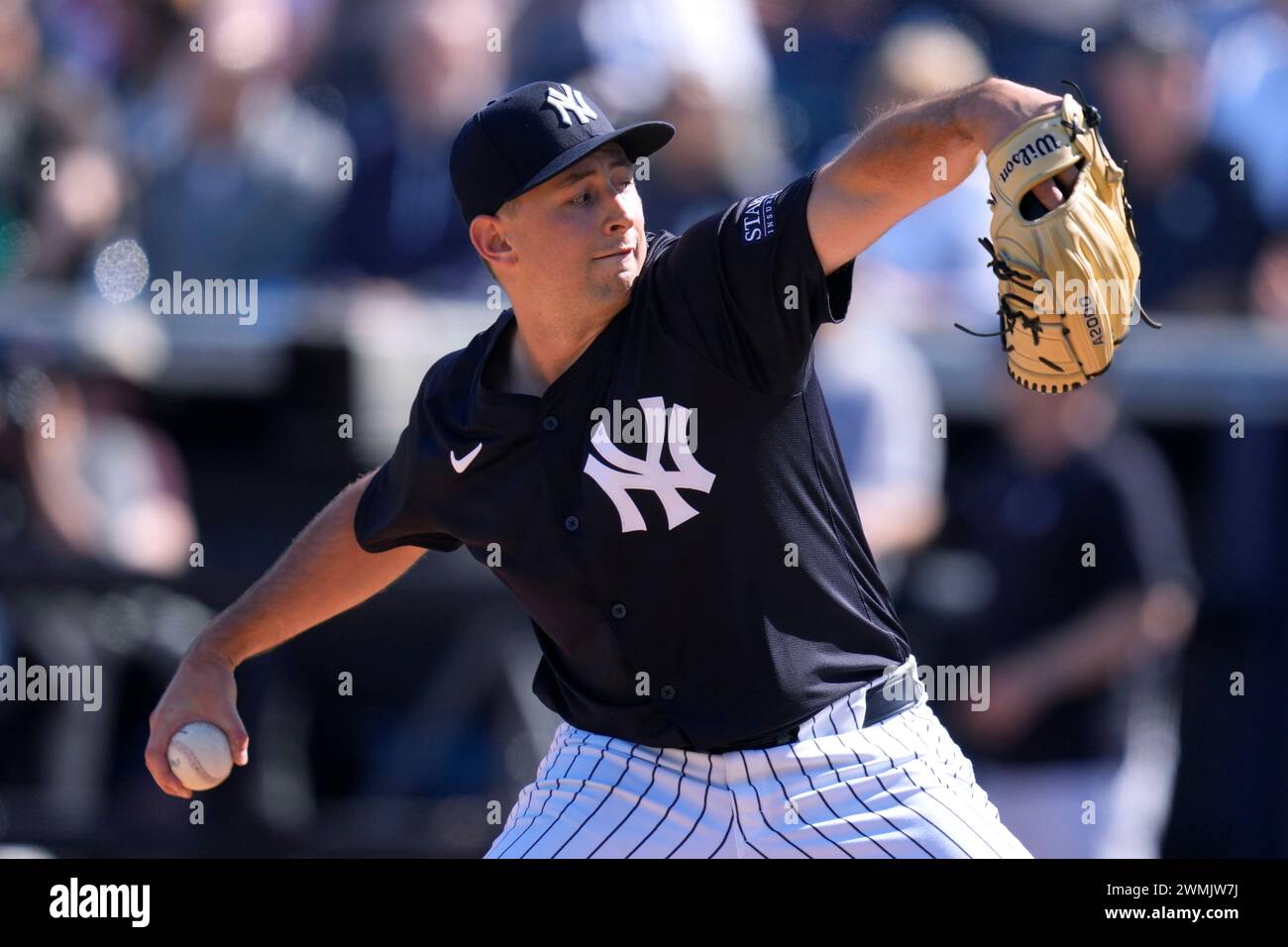

Cody Poteets Spring Training Abs Challenge Victory

May 15, 2025

Cody Poteets Spring Training Abs Challenge Victory

May 15, 2025