Can Film Tax Credits Boost Minnesota's TV And Film Industry?

Table of Contents

The Economic Impact of Film Tax Credits

Film tax credits are powerful economic development tools. By offering financial incentives, states can attract film and television productions, generating substantial economic benefits.

Job Creation and Local Spending

Film productions are remarkably labor-intensive. A single project creates hundreds, if not thousands, of jobs, ranging from highly skilled directors and cinematographers to less experienced crew members, actors, and support staff. This influx of workers stimulates the local economy through increased spending in various sectors. Hotels, restaurants, equipment rental companies, and local transportation services all benefit directly from the increased demand.

Studies in states like New York and Georgia show a significant increase in employment related to film production since implementing tax credits. For instance, Georgia saw a [Insert Percentage and Citation if available]% rise in film-related jobs following the introduction of its generous tax credit program.

- Increased revenue for local businesses: Restaurants, hotels, and transportation services see a surge in revenue.

- Attraction of skilled labor: Film tax credits attract skilled professionals, boosting the local talent pool.

- Support for emerging filmmakers: Incentives can help nurture local talent and stimulate the growth of independent productions.

Attracting Productions and Increasing Tourism

Film tax credits make Minnesota a more competitive filming location. By offsetting production costs, they incentivize studios and production companies to choose Minnesota over states with less attractive incentives. This increased production activity translates directly into economic gains for the state.

Furthermore, the locations used in films and television shows can become significant tourist attractions. Think about the tourism boom experienced by locations featured in popular shows or movies. Imagine a major production choosing to film in Minnesota's stunning Boundary Waters; this could create a new stream of tourism revenue. Productions like [Insert Example of a Production that Could Film in Minnesota] could benefit greatly from such incentives, bringing both economic activity and positive media attention to the state.

- Improved state image: Filming in Minnesota projects a positive image to a wider audience.

- Increased tourism revenue: Film locations become tourist attractions, boosting the state’s tourism sector.

- Attraction of high-profile productions: Competitive incentives lure major productions, creating high-impact economic benefits.

Potential Challenges and Considerations of Film Tax Credits

While the potential benefits of film tax credits are substantial, it's crucial to acknowledge potential challenges. Careful planning and program design are essential for success.

Budgetary Constraints and Program Design

Implementing a film tax credit program requires a substantial financial commitment. Careful budget allocation is critical to ensuring the program's effectiveness and sustainability. The design of the program itself—whether the credits are refundable or non-refundable, the eligibility criteria for productions, and the overall cap—all need careful consideration. Transparency and robust oversight mechanisms are crucial to prevent any potential abuse or misuse of funds.

- Careful budget allocation: Establishing a clear budget and adhering to it is essential for program sustainability.

- Effective program design to maximize impact: A well-structured program can significantly amplify the benefits.

- Robust oversight to prevent abuse: Strong oversight mechanisms are vital for ensuring accountability and transparency.

Competition from Other States

Minnesota faces stiff competition from neighboring states and others across the country that also offer film tax credits. To be successful, Minnesota's incentives must be competitive, offering a compelling package that encourages production companies to choose Minnesota as their filming location. A holistic strategy encompassing more than just tax credits is needed, including investment in workforce development, infrastructure improvements (e.g., studio space), and targeted marketing campaigns to showcase Minnesota's unique attributes as a filming location.

- Competitive incentive packages: Offering competitive incentives is key to attracting productions away from other states.

- Strategic marketing and outreach: Promoting Minnesota's advantages as a filming location is crucial.

- Collaboration with neighboring states: Working collaboratively can sometimes lead to a more beneficial regional approach.

Conclusion

Film tax credits hold immense potential for stimulating Minnesota's television and film industry. By creating jobs, boosting local economies, and attracting major productions, a well-designed program can be transformative. While challenges like budgetary constraints and competition exist, a thoughtfully crafted and effectively managed program can overcome these obstacles. The potential economic benefits and the positive impact on Minnesota’s image make the investment worthwhile. Contact your state representatives today to advocate for the implementation of robust Minnesota film tax credits and help propel the state’s film production incentives to new heights, fostering significant film industry growth.

Featured Posts

-

Is Anthony Edwards Playing Tonight Lakers Timberwolves Injury Update

Apr 29, 2025

Is Anthony Edwards Playing Tonight Lakers Timberwolves Injury Update

Apr 29, 2025 -

Trumps Transgender Athlete Ban Us Attorney General Issues Minnesota Compliance Warning

Apr 29, 2025

Trumps Transgender Athlete Ban Us Attorney General Issues Minnesota Compliance Warning

Apr 29, 2025 -

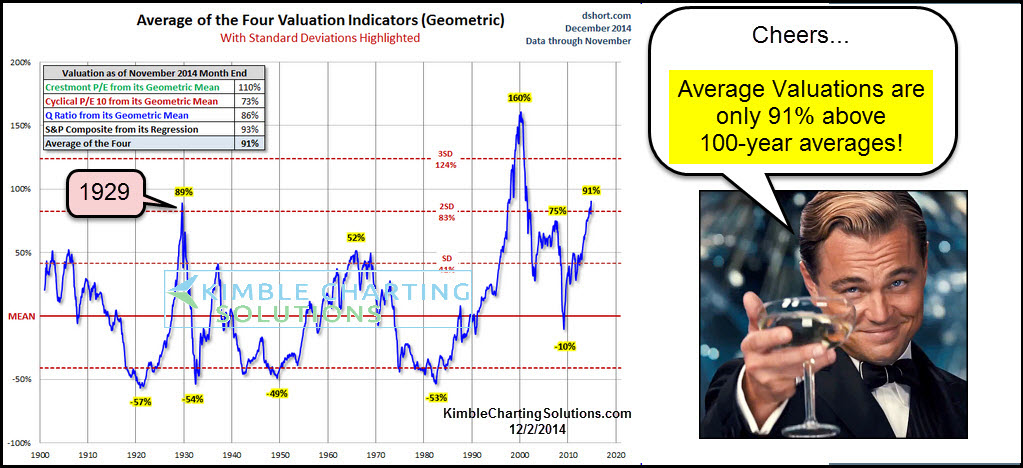

High Stock Market Valuations Why Bof A Believes Investors Shouldnt Worry

Apr 29, 2025

High Stock Market Valuations Why Bof A Believes Investors Shouldnt Worry

Apr 29, 2025 -

Chinas Nuclear Energy Sector Expands With Approval Of 10 New Reactors

Apr 29, 2025

Chinas Nuclear Energy Sector Expands With Approval Of 10 New Reactors

Apr 29, 2025 -

160 Mlb

Apr 29, 2025

160 Mlb

Apr 29, 2025

Latest Posts

-

Israel Under Pressure To Reopen Aid Channels To Gaza Strip

Apr 29, 2025

Israel Under Pressure To Reopen Aid Channels To Gaza Strip

Apr 29, 2025 -

Humanitarian Crisis In Gaza Urgent Need For Israel To Lift Aid Restrictions

Apr 29, 2025

Humanitarian Crisis In Gaza Urgent Need For Israel To Lift Aid Restrictions

Apr 29, 2025 -

Food Fuel And Water Scarcity In Gaza Calls To End Israeli Aid Ban Intensify

Apr 29, 2025

Food Fuel And Water Scarcity In Gaza Calls To End Israeli Aid Ban Intensify

Apr 29, 2025 -

Gaza Crisis International Pressure Mounts On Israel To End Aid Blockade

Apr 29, 2025

Gaza Crisis International Pressure Mounts On Israel To End Aid Blockade

Apr 29, 2025 -

Israel Faces Pressure To Lift Gaza Aid Ban Amidst Shortages

Apr 29, 2025

Israel Faces Pressure To Lift Gaza Aid Ban Amidst Shortages

Apr 29, 2025