High Stock Market Valuations: Why BofA Believes Investors Shouldn't Worry

Table of Contents

BofA's Bullish Case: Why High Valuations Aren't Necessarily a Bear Market Indicator

BofA's positive outlook on the market, despite high valuations, rests on several key pillars. Their analysts argue that several factors mitigate the risks associated with seemingly inflated price-to-earnings ratios. This isn't a blind optimism; their conclusions are backed by rigorous analysis and consideration of various economic indicators.

-

Strong corporate earnings growth outweighing valuation concerns: BofA points to robust corporate earnings growth as a key factor supporting higher valuations. Many companies are exceeding expectations, generating significant profits that justify, at least partially, the higher prices. This strong earnings growth is predicted to continue, further bolstering their case.

-

Low interest rates supporting higher price-to-earnings ratios: Low interest rates make borrowing cheaper for businesses, leading to increased investment and potentially higher earnings. These low rates also incentivize investors to seek higher returns in the stock market, pushing valuations higher. This dynamic, according to BofA's research, isn't necessarily unsustainable.

-

Positive economic outlook fueling investor confidence: BofA's analysts highlight a positive economic outlook, which is feeding investor confidence and driving demand for stocks. This optimistic outlook supports the higher valuations, as investors are willing to pay more for assets they expect to appreciate further. This is further supported by various economic forecasts and government reports.

-

BofA's supporting reports: Several BofA research reports, including [insert link to relevant BofA report if available], directly address these points and provide detailed analysis supporting their bullish stance. These reports delve into specific sectors and offer granular data to back up their conclusions.

Understanding Current Market Valuations: A Deeper Dive

To understand BofA's perspective, it's crucial to understand the metrics used to assess market valuations.

-

Price-to-Earnings Ratio (P/E): The P/E ratio is a key metric that compares a company's stock price to its earnings per share (EPS). A high P/E ratio generally suggests that investors are willing to pay more for each dollar of earnings, indicating potentially higher expectations for future growth.

-

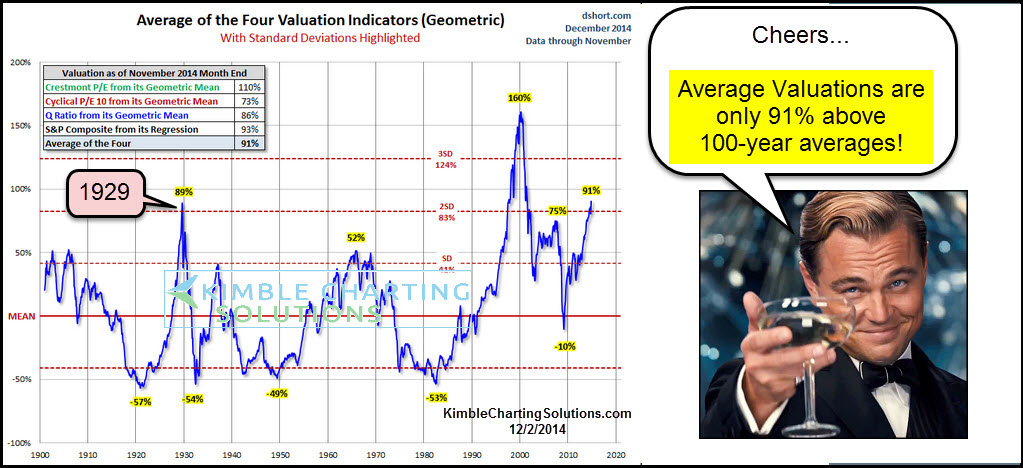

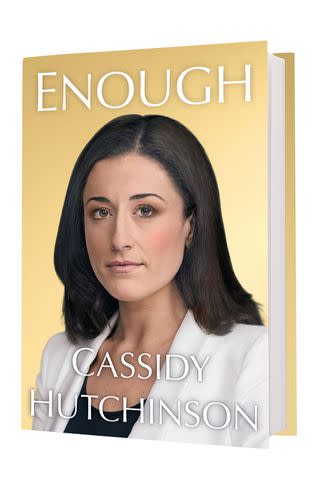

Comparison of current P/E ratios to historical averages: While current P/E ratios might seem high compared to historical averages, BofA's analysis considers these figures within the context of low interest rates and strong earnings growth. A simple comparison to historical data without accounting for these factors can be misleading.

-

Other relevant valuation metrics: Beyond the P/E ratio, other valuation metrics like the Shiller PE (CAPE ratio), which considers inflation-adjusted earnings over a longer period, provide a broader perspective. BofA’s analysis likely incorporates these additional metrics for a more holistic view.

-

Addressing potential overvaluation in specific sectors: It's important to note that not all sectors are equally valued. BofA's analysis likely considers sector-specific valuations, identifying potential overvaluation in certain areas while acknowledging strong growth potential in others.

Factors Supporting Continued Market Growth Despite High Valuations

BofA's positive outlook isn't solely based on corporate earnings. Several macroeconomic factors contribute to their confidence in continued market growth.

-

Technological advancements driving future earnings growth: Technological innovation is a key driver of future earnings growth across various sectors. BofA highlights the transformative potential of technologies like artificial intelligence, cloud computing, and renewable energy, expecting these sectors to contribute significantly to future market growth.

-

Impact of government stimulus and infrastructure spending: Government stimulus packages and infrastructure spending can boost economic activity, positively impacting corporate earnings and investor sentiment. BofA likely accounts for the potential impact of these measures in their projections.

-

Global economic recovery contributing to positive sentiment: A global economic recovery further supports the optimistic outlook. Increased global trade and consumer spending contribute to stronger corporate earnings and a more positive market sentiment.

-

Specific industries expected to perform well: BofA's analysis likely identifies specific industries poised for strong growth, such as technology, healthcare, and renewable energy. Investing in these sectors might offer attractive opportunities despite overall high market valuations.

Managing Risk in a High-Valuation Market: BofA's Advice to Investors

Even with a positive outlook, managing risk in a high-valuation market is crucial. BofA likely advises investors to employ the following strategies:

-

Importance of diversification across asset classes: Diversification is key to mitigating risk. Investors shouldn't concentrate their holdings in a single sector or asset class. A well-diversified portfolio can help cushion against potential losses in any particular area.

-

Strategies for mitigating risk in a high-valuation environment: Strategies like dollar-cost averaging (investing a fixed amount at regular intervals) can help reduce the impact of market volatility.

-

Advice on sector selection based on BofA's analysis: Investors should consider BofA's analysis of specific sectors, focusing on those with strong growth potential and reasonable valuations.

-

The role of long-term investing in navigating market volatility: A long-term investment strategy is essential to weather market fluctuations. Short-term market movements should not dictate long-term investment decisions.

High Stock Market Valuations: Don't Let Fear Dictate Your Investments

In conclusion, while high stock market valuations are a legitimate concern, BofA's analysis suggests that panic is unwarranted. Strong corporate earnings, low interest rates, a positive economic outlook, and technological advancements contribute to their optimistic perspective. However, managing risk through diversification and a long-term investment strategy remains crucial. Don't let fear of high stock market valuations paralyze your investment strategy. Learn more about BofA's perspective and make informed decisions about your portfolio by consulting their research reports and seeking professional financial advice. [Insert links to relevant BofA reports and resources here].

Featured Posts

-

Move Over Quinoa Introducing The Next Big Health Food

Apr 29, 2025

Move Over Quinoa Introducing The Next Big Health Food

Apr 29, 2025 -

160 Mlb

Apr 29, 2025

160 Mlb

Apr 29, 2025 -

Us Attorney Generals Transgender Athlete Ban Warning To Minnesota

Apr 29, 2025

Us Attorney Generals Transgender Athlete Ban Warning To Minnesota

Apr 29, 2025 -

Los Angeles Palisades Fire Impact On Celebrity Homes Full List

Apr 29, 2025

Los Angeles Palisades Fire Impact On Celebrity Homes Full List

Apr 29, 2025 -

Cassidy Hutchinsons Fall Memoir Insights From The January 6th Hearings

Apr 29, 2025

Cassidy Hutchinsons Fall Memoir Insights From The January 6th Hearings

Apr 29, 2025

Latest Posts

-

Exploring The Data Center Landscape Of Negeri Sembilan Malaysia

Apr 29, 2025

Exploring The Data Center Landscape Of Negeri Sembilan Malaysia

Apr 29, 2025 -

Understanding High Stock Market Valuations Bof As Take For Investors

Apr 29, 2025

Understanding High Stock Market Valuations Bof As Take For Investors

Apr 29, 2025 -

April 8th Treasury Market What Happened And What It Means

Apr 29, 2025

April 8th Treasury Market What Happened And What It Means

Apr 29, 2025 -

Negeri Sembilan A Strategic Location For Data Centers In Southeast Asia

Apr 29, 2025

Negeri Sembilan A Strategic Location For Data Centers In Southeast Asia

Apr 29, 2025 -

High Stock Market Valuations A Bof A Analysis And Investor Guidance

Apr 29, 2025

High Stock Market Valuations A Bof A Analysis And Investor Guidance

Apr 29, 2025