Canada Facing Deeper Recession: Posthaste Analysis Of Economic Risks

Table of Contents

Rising Interest Rates and Their Impact on the Canadian Economy

The Bank of Canada's aggressive interest rate hikes, aimed at curbing inflation, are having a significant and multifaceted impact on the Canadian economy recession. While intended to cool down an overheated economy, these increases in interest rates Canada are creating a ripple effect with far-reaching consequences. The higher borrowing costs are impacting consumer spending, the housing market, and business investment, potentially pushing the country towards a more severe economic downturn.

- Increased mortgage payments leading to reduced disposable income: Higher interest rates translate directly into increased mortgage payments for homeowners, leaving less disposable income for spending on other goods and services. This dampens consumer demand, a key driver of economic growth.

- Slowdown in housing construction and sales: The higher cost of borrowing is making it more expensive for developers to build new homes and for individuals to purchase existing ones. This slowdown in the Canadian housing market is already visible, impacting employment in the construction sector and reducing overall economic activity.

- Reduced business investment due to higher borrowing costs: Businesses rely on loans for expansion and investment. Higher interest rates increase the cost of borrowing, making it less attractive for businesses to invest, hindering growth and potentially leading to job losses.

- Potential for increased bankruptcies and job losses: As businesses struggle with higher borrowing costs and reduced demand, the risk of bankruptcies and job losses increases significantly, exacerbating the economic downturn and contributing to the potential Canada deeper recession.

Global Economic Slowdown and its Ripple Effect on Canada

The Canadian economy is not immune to global economic headwinds. The current global climate, characterized by persistent inflation, the ongoing war in Ukraine, and an energy crisis, is casting a long shadow over Canadian exports. This global recession impact Canada is further amplified by persistent supply chain disruptions, impacting both imports and exports.

- Reduced demand for Canadian commodities in international markets: Global economic uncertainty leads to reduced demand for Canadian commodities like oil, lumber, and agricultural products, negatively affecting export revenues and economic growth.

- Increased input costs for businesses due to supply chain disruptions: Supply chain bottlenecks continue to drive up input costs for businesses, reducing profitability and potentially leading to price increases for consumers, further fueling inflation and impacting consumer spending Canada.

- Potential for a decline in foreign investment in Canada: Global economic uncertainty can lead to a decline in foreign investment in Canada, limiting access to capital for businesses and hindering economic growth. The already fragile global market makes attracting foreign capital a significant challenge for Canada in the face of a potential Canada deeper recession.

Inflation and its Persistent Pressure on Canadian Households

Canadian inflation remains stubbornly high, putting immense pressure on Canadian households. The rising cost of essential goods and services is eroding the purchasing power of consumers and impacting their ability to manage their budgets. This sustained cost of living Canada increase is a major contributor to the economic anxieties fueling concerns about a Canada deeper recession.

- Increased grocery prices and energy costs: The cost of groceries and energy, two essential components of household budgets, has skyrocketed, leaving less disposable income for other spending.

- Erosion of purchasing power for Canadian consumers: High inflation erodes the purchasing power of Canadian consumers, limiting their ability to purchase goods and services, and further slowing down economic activity.

- Potential for social unrest due to rising inequality: The unequal distribution of the burden of inflation can exacerbate social inequality, potentially leading to social unrest and political instability, further complicating the economic situation and making a Canada deeper recession more likely.

The Housing Market Crisis and its Systemic Risk

The Canadian housing market presents another significant risk. High levels of household debt tied to mortgages, coupled with rising interest rates, create a vulnerable situation with the potential for a significant correction. A housing bubble Canada bursting could have devastating consequences for the overall economy.

- High levels of household debt tied to mortgages: Canadian households have accumulated significant levels of mortgage debt, making them highly vulnerable to rising interest rates and potential house price declines.

- Potential for a sharp decline in house prices: A sharp decline in house prices could trigger a wave of defaults and foreclosures, negatively impacting banks and the financial system.

- Impact on consumer confidence and spending: A decline in house prices can significantly impact consumer confidence, leading to reduced spending and further slowing down economic activity, potentially worsening the Canada deeper recession scenario.

Conclusion: Canada Recession Predictions

The interconnected nature of rising interest rates, the global economic slowdown, persistent inflation, and the vulnerabilities in the Canadian housing market paint a concerning picture for the Canadian economy. These factors collectively point to a significant risk of a deeper recession than initially anticipated. The current economic climate demands caution. To avoiding a Canada deeper recession, Canadians need to carefully manage their personal finances, stay informed about evolving economic conditions, and brace for a potentially challenging period. Understanding the Canada deeper recession risks is crucial for navigating the coming months and years. Staying informed and adapting to the changing economic landscape is vital for both individuals and businesses to mitigate the potential impacts of a Canada deeper recession.

Featured Posts

-

Back From Surgery Christian Yelichs Return To Power

Apr 23, 2025

Back From Surgery Christian Yelichs Return To Power

Apr 23, 2025 -

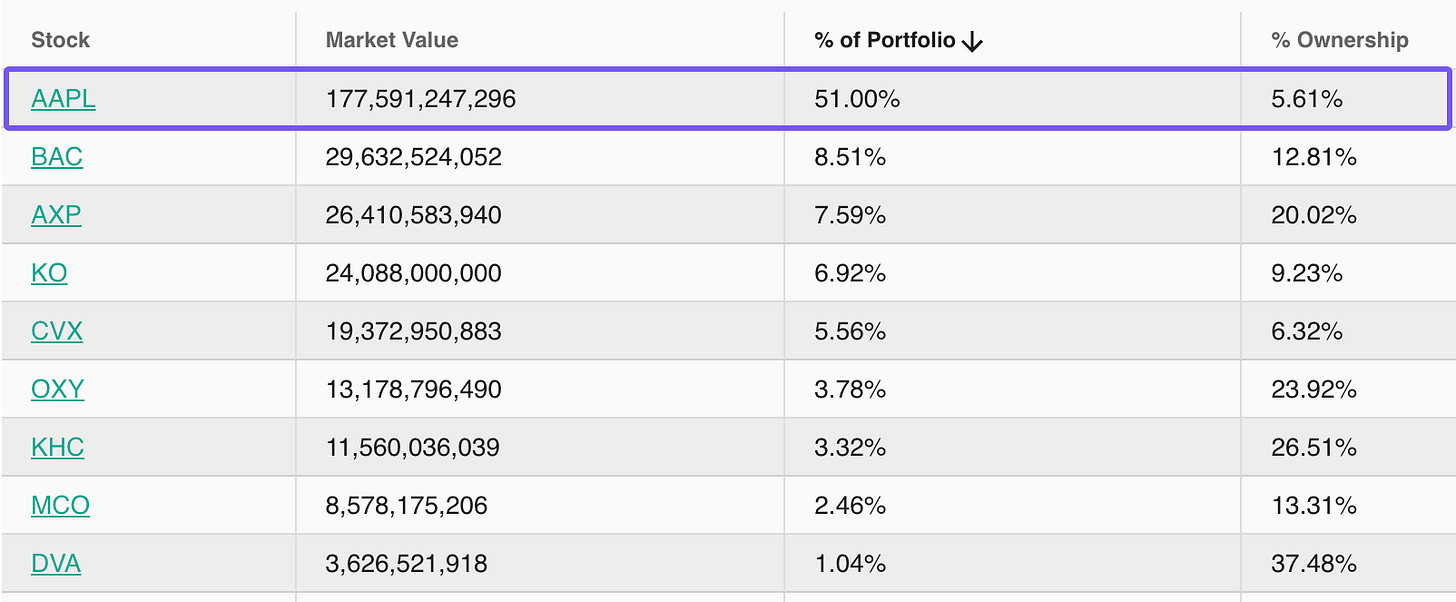

Did Warren Buffett Sell Apple At The Perfect Time A Market Analysis

Apr 23, 2025

Did Warren Buffett Sell Apple At The Perfect Time A Market Analysis

Apr 23, 2025 -

Portefeuille Bfm Revue D Arbitrage Semaine Du 17 Fevrier 2024

Apr 23, 2025

Portefeuille Bfm Revue D Arbitrage Semaine Du 17 Fevrier 2024

Apr 23, 2025 -

Canadian Immigration Dreams Shattered Impact Of Trump Administration Policies

Apr 23, 2025

Canadian Immigration Dreams Shattered Impact Of Trump Administration Policies

Apr 23, 2025 -

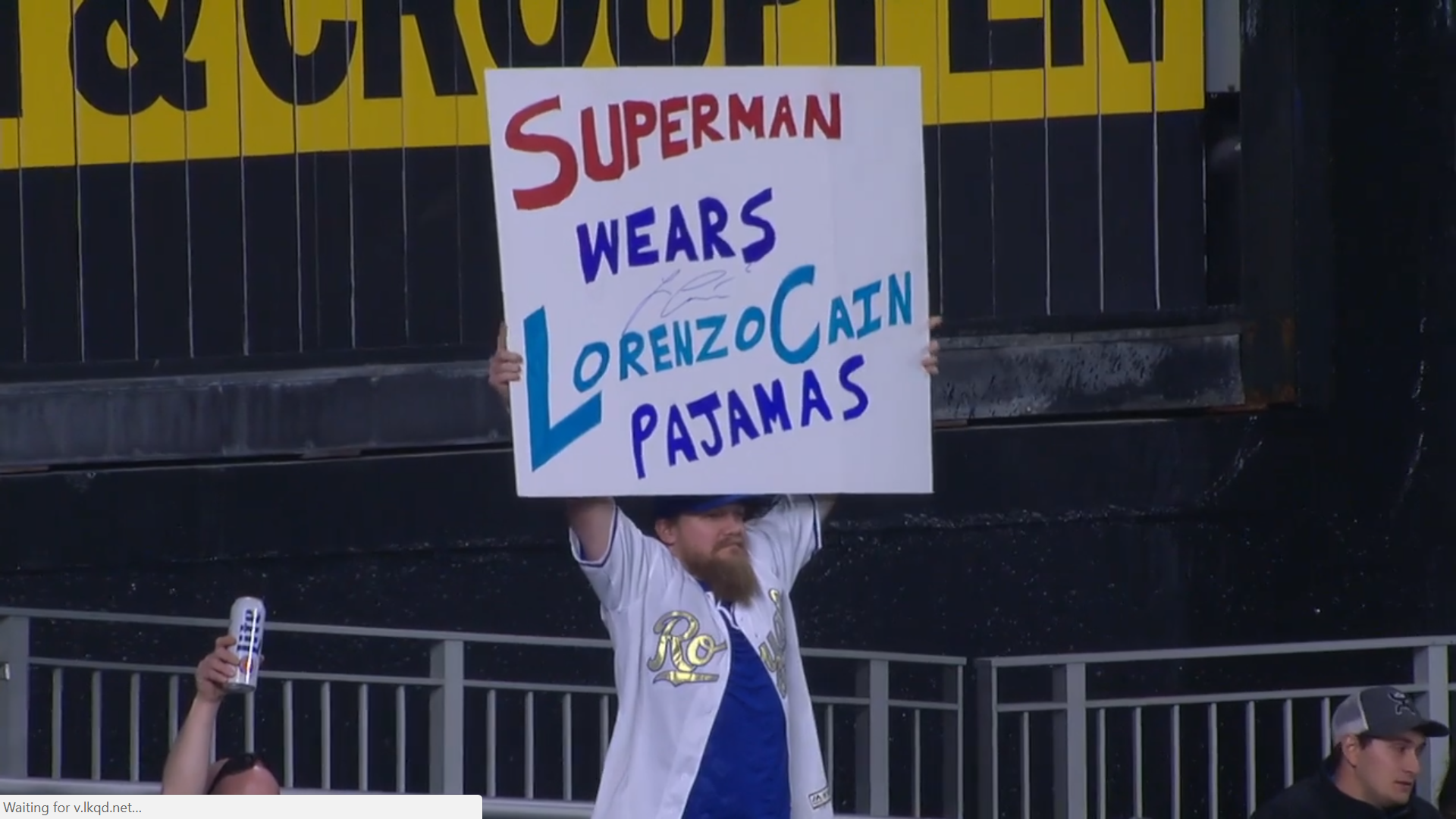

Royals Suffer Walk Off Bunt Loss To Brewers In 11th

Apr 23, 2025

Royals Suffer Walk Off Bunt Loss To Brewers In 11th

Apr 23, 2025