Canada's Conservatives: Tax Cuts And Deficit Reduction Plan

Table of Contents

Proposed Tax Cuts: Details and Target Demographics

The Conservative Party's tax cut proposals are central to their economic platform. These cuts target both individuals and corporations, aiming to boost economic activity through increased disposable income and business investment.

Individual Income Tax Reductions

The plan proposes significant reductions in individual income tax rates across various brackets.

- Proposed Cuts: For example, they may propose a reduction of X% for individuals earning between $Y and $Z, and a reduction of A% for those earning above $Z. Specific numbers would need to be inserted here based on the latest party platform.

- Impact on Income Groups: Lower-income earners might see a smaller percentage reduction, while higher-income earners would benefit more significantly from the proposed changes in percentage terms. However, the actual dollar amount saved would vary greatly depending on individual income levels.

- Tax Credits and Deductions: The party may also propose adjustments to existing tax credits or introduce new ones, potentially further impacting the disposable income of specific demographics. For example, potential changes to the Canada Child Benefit or other similar programs should be included here.

- Estimated Effects: * Increased disposable income for many Canadians. * Potential for increased consumer spending. * Potential for increased inequality, depending on the structure of the proposed cuts.

Corporate Tax Rate Reductions

The Conservatives' plan also includes reducing the corporate income tax rate.

- Proposed Changes: A reduction of X% in the current corporate tax rate is often proposed, aiming to make Canada more competitive internationally and attract foreign investment.

- Impact on Business Investment and Job Creation: Supporters argue this will stimulate investment, leading to increased job creation and economic growth. Critics, however, express concerns about the potential for increased corporate profits without corresponding job growth or wage increases.

- International Comparison: The proposed rate would be compared to corporate tax rates in other G7 countries, highlighting Canada's competitiveness (or lack thereof) in attracting international businesses.

- Anticipated Economic Impacts: *Increased business investment. *Potential for increased job creation. *Potential for increased corporate profits without commensurate wage increases.

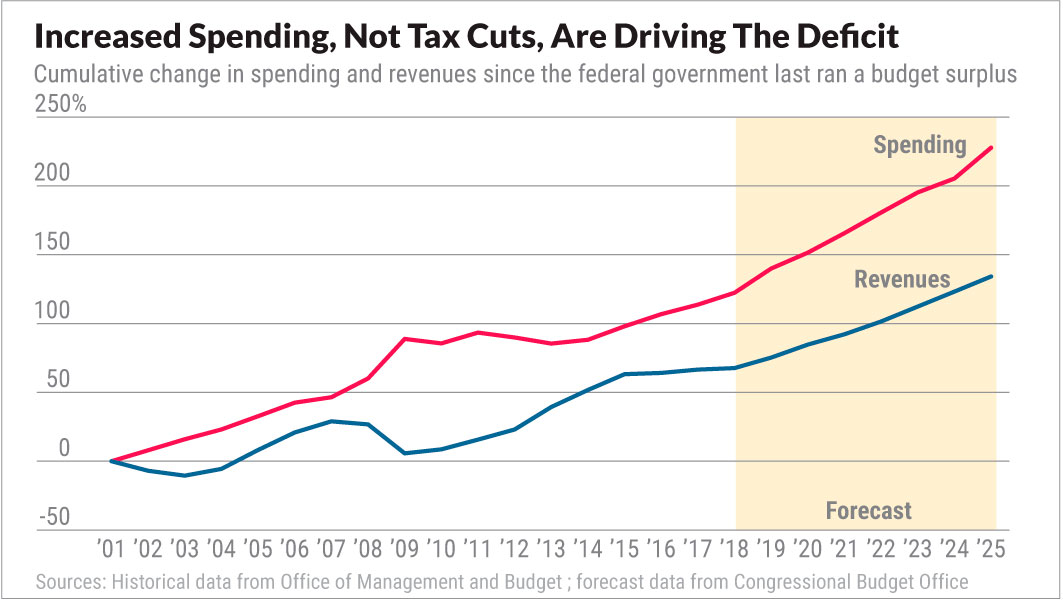

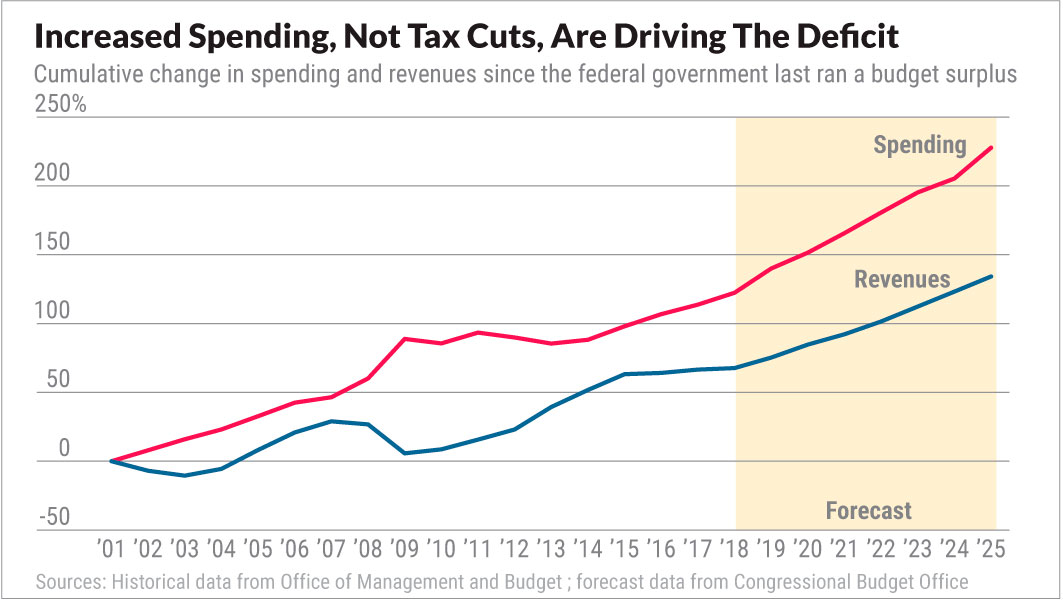

Impact on Government Revenue

A significant consequence of the proposed tax cuts is the projected loss of government revenue.

- Estimated Revenue Loss: Independent economic analyses and those conducted by the party itself will offer varying estimates of the revenue loss. These estimates should be included here with citations.

- Offsetting Measures: The Conservatives will likely argue that the tax cuts will be offset by increased economic activity, leading to higher tax revenues in the long term. This would need to be substantiated with economic modelling and forecasts.

- Differing Opinions: Economists and analysts will hold differing opinions on the accuracy of these revenue projections, and these differing viewpoints should be presented to ensure a balanced perspective.

- Revenue Loss and Counter-Effects: *Estimated annual revenue loss (with citations). *Projected increase in GDP (with citations). *Debate on the effectiveness of the proposed counter-effects.

Strategies for Deficit Reduction: Spending Cuts and Efficiency Initiatives

To offset the revenue loss from tax cuts and achieve deficit reduction, the Conservatives propose a combination of spending cuts and efficiency initiatives.

Targeted Spending Cuts

The plan details specific areas where spending will be reduced.

- Proposed Cuts: These might include cuts to specific government programs, departments, or initiatives. Specific examples should be included here with details on the proposed cuts.

- Rationale: The rationale behind each proposed cut will need to be explained, demonstrating how these cuts align with the party's overall fiscal policy goals.

- Impact on Essential Services: Concerns about potential negative impacts on essential services and social programs need to be addressed.

- List of Proposed Cuts: *Specific program/department 1: proposed cut amount and rationale. *Specific program/department 2: proposed cut amount and rationale. *etc.

Government Efficiency Measures

Improving government efficiency is another key component of the plan.

- Reforms and Streamlining: The plan likely includes proposals for streamlining government processes, reducing bureaucratic inefficiencies, and eliminating redundancies. Specific examples are needed here.

- Examples of Reforms: *Modernizing IT systems. *Reducing administrative overhead. *Streamlining regulatory processes.

- Expected Savings: The plan should estimate the potential savings resulting from these efficiency initiatives.

- Detailed Efficiency Measures: *Measure 1: projected savings. *Measure 2: projected savings. *etc.

Economic Growth Projections

The Conservatives will present projections of economic growth under their plan.

- Growth Projections: The party will likely claim that the tax cuts and efficiency measures will stimulate economic growth. These projections should be included.

- Offsetting Revenue Losses: The party will argue that this increased economic growth will generate higher tax revenues, thereby offsetting the revenue losses from tax cuts.

- Comparison to Independent Forecasts: Independent economic forecasts should be included for comparison, highlighting the potential differences in projections.

- Growth Projections Summary: *Projected annual GDP growth rate. *Underlying assumptions behind the projections. *Comparison to independent forecasts.

Analysis and Potential Criticisms of the Plan

The Conservative Party's plan is not without its critics. Several potential drawbacks need to be considered.

- Impact on Social Programs: Critics might argue that spending cuts could negatively impact social programs and vulnerable populations.

- Increased Inequality: The tax cut proposals could potentially exacerbate income inequality, benefiting higher-income earners disproportionately.

- Counterarguments: The Conservatives will likely counter these criticisms by highlighting the long-term benefits of economic growth and the importance of fiscal responsibility.

- Balanced Perspectives: Including perspectives from various economists, social scientists, and stakeholders will contribute to a balanced assessment of the plan's potential impacts.

- Potential Drawbacks and Counterarguments: *Criticism 1: potential impact and Conservative response. *Criticism 2: potential impact and Conservative response. *etc.

Conclusion: Evaluating Canada's Conservative Tax Cuts and Deficit Reduction Plan

Canada's Conservatives propose a plan built on significant tax cuts for individuals and corporations, alongside targeted spending reductions and efficiency initiatives. While the party argues this approach will stimulate economic growth and reduce the deficit, critics raise concerns about the potential impact on social programs and the widening of income inequality. The feasibility and long-term effects of this plan remain a subject of ongoing debate and require careful scrutiny. To learn more about the specifics of "Canada's Conservatives: Tax Cuts and Deficit Reduction Plan," visit the official Conservative Party website and consult independent economic analyses for a comprehensive understanding. Engaging in informed discussion about this plan is crucial for Canadian citizens.

Featured Posts

-

Trumps Transgender Sports Ban Faces Legal Challenge From Minnesota Ag

Apr 24, 2025

Trumps Transgender Sports Ban Faces Legal Challenge From Minnesota Ag

Apr 24, 2025 -

Ja Morant Under Nba Investigation Latest Updates And Implications

Apr 24, 2025

Ja Morant Under Nba Investigation Latest Updates And Implications

Apr 24, 2025 -

Liberal Spending Is Canadas Fiscal Health At Risk

Apr 24, 2025

Liberal Spending Is Canadas Fiscal Health At Risk

Apr 24, 2025 -

Tarantinov Stav Prema Filmu S Travoltom Neocekivani Razlog

Apr 24, 2025

Tarantinov Stav Prema Filmu S Travoltom Neocekivani Razlog

Apr 24, 2025 -

High Stock Market Valuations A Bof A Analysis For Investors

Apr 24, 2025

High Stock Market Valuations A Bof A Analysis For Investors

Apr 24, 2025

Latest Posts

-

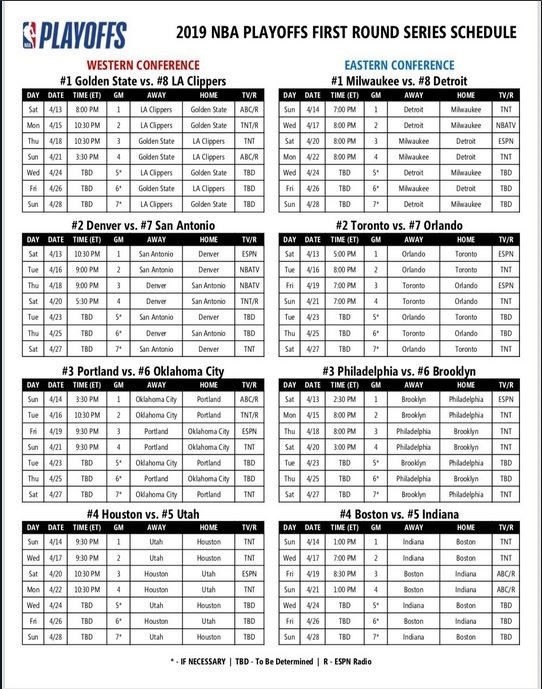

Nba Playoffs Plires Programma Agonon And Analyseis

May 12, 2025

Nba Playoffs Plires Programma Agonon And Analyseis

May 12, 2025 -

Magic Johnson Weighs In Who Will Win The Knicks Pistons Series

May 12, 2025

Magic Johnson Weighs In Who Will Win The Knicks Pistons Series

May 12, 2025 -

Nba Playoffs Magic Johnsons Knicks Pistons Series Forecast

May 12, 2025

Nba Playoffs Magic Johnsons Knicks Pistons Series Forecast

May 12, 2025 -

Magic Johnson Predicts The Winner Knicks Vs Pistons Playoffs

May 12, 2025

Magic Johnson Predicts The Winner Knicks Vs Pistons Playoffs

May 12, 2025 -

Nba Legend Magic Johnsons Knicks Pistons Series Prediction

May 12, 2025

Nba Legend Magic Johnsons Knicks Pistons Series Prediction

May 12, 2025