Liberal Spending: Is Canada's Fiscal Health At Risk?

Table of Contents

Analyzing Current Government Spending Levels

Breakdown of Federal Budget Allocations

The Canadian federal budget allocates funds across various sectors. Understanding this distribution is vital to assess the impact of Liberal spending. Visual representations, such as charts and graphs, are essential for clear communication. For example, a significant portion of the budget is dedicated to healthcare, followed by social programs like Old Age Security and the Canada Pension Plan. Infrastructure projects, defense spending, and various social initiatives also consume substantial resources.

- Healthcare: Billions are allocated annually to provincial healthcare systems through transfer payments, representing a major chunk of federal spending.

- Social Programs: Significant funds support programs like Employment Insurance, social assistance, and various family benefits.

- Infrastructure: Investments in roads, bridges, public transit, and other infrastructure projects contribute to economic growth and job creation.

- Defense: Maintaining a strong national defense requires substantial budgetary allocation.

Comparing Spending to Previous Governments

Analyzing historical spending data provides crucial context. While comparing spending levels across different administrations requires careful consideration of economic conditions and policy priorities, several key differences emerge. For example, certain periods might show increased emphasis on infrastructure projects, while others prioritize debt reduction. By examining both Liberal and Conservative governments' spending patterns, we can better assess the current situation's uniqueness.

- Increased Social Spending: The current Liberal government has increased spending on social programs compared to some previous administrations.

- Infrastructure Investments: Significant investments in infrastructure have characterized recent budgets, aiming to stimulate economic growth.

- Debt-to-GDP Ratio: Comparing the debt-to-GDP ratio under different governments helps contextualize the current level of national debt.

Impact of Economic Factors on Spending

Global events and domestic economic conditions significantly influence government spending. Economic growth allows for increased spending without necessarily increasing the deficit. However, economic downturns often necessitate increased spending on social programs and stimulus packages, potentially widening the deficit. Inflation also impacts spending, as higher prices necessitate increased allocations to maintain existing programs.

- Recessions: Economic downturns usually lead to higher government spending on social safety nets and unemployment benefits.

- Inflation: Rising inflation necessitates increased spending to maintain the real value of government programs.

- Global Uncertainty: Global economic instability can impact Canada's economy and necessitate adjustments in government spending.

Potential Risks Associated with Liberal Spending

Growing National Debt and Deficit

The increasing national debt is a significant concern. While deficit spending can be a necessary tool for economic stimulus, uncontrolled debt accumulation can have severe consequences. High debt levels lead to increased interest payments, potentially crowding out other essential government spending. A continually rising debt-to-GDP ratio could also lead to credit rating downgrades, increasing borrowing costs.

- Interest Payments: A substantial portion of the budget is now allocated to servicing the national debt.

- Credit Rating Downgrades: A lower credit rating increases borrowing costs for the government.

- Reduced Government Services: High debt levels may force cuts in essential public services.

Impact on Inflation and Interest Rates

Increased government spending can contribute to inflationary pressures. When demand exceeds supply, prices rise. This can further lead to the central bank raising interest rates to curb inflation. Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing economic growth. This creates a complex interplay between fiscal and monetary policy.

- Demand-Pull Inflation: Increased government spending can increase aggregate demand, leading to inflation.

- Interest Rate Hikes: Central banks may raise interest rates to combat inflation, potentially slowing economic growth.

- Impact on Businesses and Consumers: Higher interest rates increase borrowing costs for businesses and consumers.

Long-Term Sustainability of Social Programs

Canada's aging population presents significant challenges to the long-term sustainability of social programs like healthcare and pensions. The increasing number of seniors relying on these programs strains the system's financial viability. Addressing this requires careful planning and potential reforms to ensure these vital programs remain sustainable.

- Aging Population: The rising proportion of seniors places increasing pressure on healthcare and pension systems.

- Healthcare Costs: Healthcare costs are rising rapidly, posing a significant challenge to long-term sustainability.

- Pension Reform: Reforms to pension plans may be necessary to ensure their long-term viability.

Arguments in Defense of Liberal Spending

Economic Stimulus and Job Creation

Government spending can act as a powerful economic stimulus, creating jobs and boosting economic growth. Investments in infrastructure projects, for instance, generate employment opportunities directly through construction and indirectly through related industries. Similarly, targeted social programs can stimulate demand and support vulnerable populations.

- Infrastructure Projects: Investments in infrastructure create jobs and improve the country's infrastructure.

- Social Programs: Targeted social assistance programs can stimulate demand and provide crucial support.

- Keynesian Economics: This economic theory supports government intervention to stimulate demand during economic downturns.

Investing in Human Capital and Social Infrastructure

Investments in education, healthcare, and social services represent investments in human capital, yielding significant long-term benefits. A healthier, better-educated population is more productive and contributes to a stronger economy. These investments also contribute to reduced social inequality and improved quality of life.

- Education Spending: Improved education leads to a more skilled workforce and increased productivity.

- Healthcare Investment: A healthy population is a more productive population.

- Social Equity: Investing in social programs reduces inequality and improves overall social well-being.

Addressing Pressing Social and Environmental Issues

Government spending is crucial for addressing pressing social and environmental issues such as climate change and poverty. Initiatives like investments in renewable energy and social assistance programs are essential to creating a more sustainable and equitable society. These investments often have long-term benefits, offsetting initial costs.

- Climate Change Initiatives: Investments in renewable energy and climate adaptation are crucial for long-term sustainability.

- Poverty Reduction Programs: Social assistance programs are essential to combat poverty and inequality.

- Environmental Protection: Protecting the environment is essential for long-term economic and social well-being.

Conclusion: Assessing the Fiscal Health of Canada Under Liberal Spending

Analyzing Liberal spending reveals a complex picture. While increased spending on social programs and infrastructure stimulates economic growth and addresses critical social needs, it also contributes to a growing national debt and potential inflationary pressures. The long-term sustainability of social programs in the face of an aging population remains a significant concern. Therefore, a balanced approach is needed – one that prioritizes responsible fiscal management while addressing Canada's pressing social and economic challenges. The question of whether Canada's fiscal health is truly at risk depends on the government's ability to manage spending effectively and implement sustainable economic policies. It is crucial for citizens to engage in informed discussions on responsible fiscal policy and the implications of Liberal spending for Canada's future. Further research and engagement with government bodies are encouraged to foster a deeper understanding of this critical issue.

Featured Posts

-

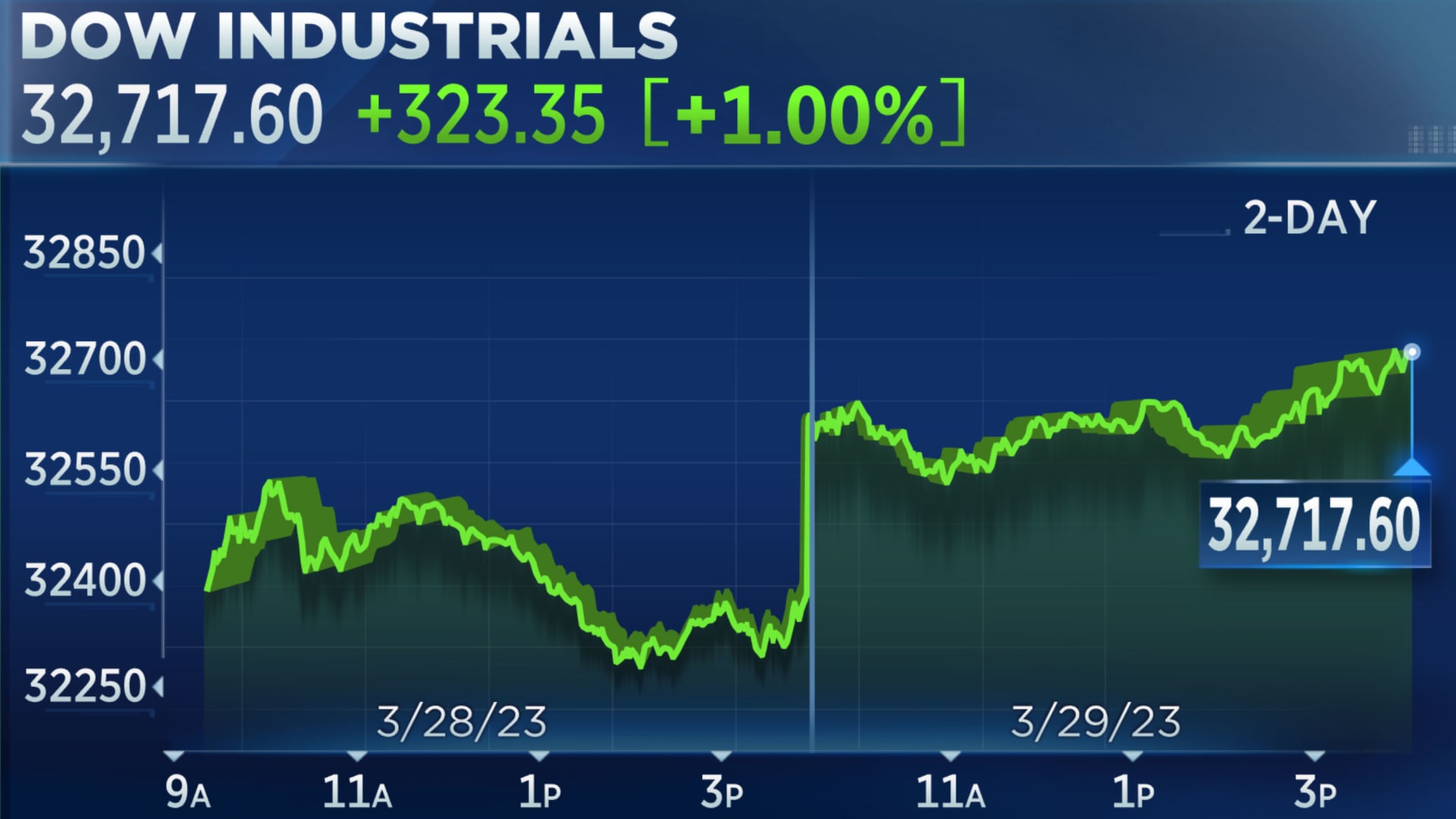

Dow Rallies 1000 Points Stock Market Update And Analysis

Apr 24, 2025

Dow Rallies 1000 Points Stock Market Update And Analysis

Apr 24, 2025 -

Startup Airlines Controversial Pivot Deportation Flights And Their Implications

Apr 24, 2025

Startup Airlines Controversial Pivot Deportation Flights And Their Implications

Apr 24, 2025 -

William Watsons Advice Examining The Liberal Partys Policies

Apr 24, 2025

William Watsons Advice Examining The Liberal Partys Policies

Apr 24, 2025 -

Credit Card Industry Impact The Fallout From Reduced Consumer Spending

Apr 24, 2025

Credit Card Industry Impact The Fallout From Reduced Consumer Spending

Apr 24, 2025 -

Is Betting On Natural Disasters Like The La Wildfires The New Normal

Apr 24, 2025

Is Betting On Natural Disasters Like The La Wildfires The New Normal

Apr 24, 2025

Latest Posts

-

Become Baba Yaga Your John Wick Experience In Las Vegas

May 12, 2025

Become Baba Yaga Your John Wick Experience In Las Vegas

May 12, 2025 -

John Wick 5 Release Date Plot Rumors And Cast Updates

May 12, 2025

John Wick 5 Release Date Plot Rumors And Cast Updates

May 12, 2025 -

John Wick 5 Confirmed What We Know About The Next Installment

May 12, 2025

John Wick 5 Confirmed What We Know About The Next Installment

May 12, 2025 -

John Wicks Las Vegas An Interactive Experience Opens Soon

May 12, 2025

John Wicks Las Vegas An Interactive Experience Opens Soon

May 12, 2025 -

Is John Wick 5 Actually Happening A Definitive Answer

May 12, 2025

Is John Wick 5 Actually Happening A Definitive Answer

May 12, 2025