Canada's Economy To Stagnate In 2025: OECD Recession Forecast Avoided

Table of Contents

Factors Contributing to Stagnation

Several interconnected factors contribute to the projected stagnation of Canada's economy in 2025. These include persistent inflation, the impact of interest rate hikes, a global economic slowdown, a housing market correction, and consequently, reduced consumer spending.

Persistent Inflation

High inflation continues to be a major drag on Canada's economic growth. The persistent rise in the Consumer Price Index (CPI) erodes consumer purchasing power, forcing households to cut back on spending.

- CPI Data: Recent CPI data shows inflation remaining stubbornly high, exceeding the Bank of Canada's target range.

- Bank of Canada Interest Rate Hikes: The Bank of Canada has responded with aggressive interest rate hikes, aiming to cool the economy and curb inflation.

- Impact on Household Budgets: These hikes directly impact household budgets, increasing borrowing costs and reducing disposable income. This further dampens consumer spending and overall economic activity.

Impact of Interest Rate Hikes

While necessary to combat inflation, the Bank of Canada's interest rate increases have had a chilling effect on economic activity. Higher borrowing costs make it more expensive for businesses to invest and for consumers to borrow money.

- Mortgage Rates: Increased mortgage rates are impacting the housing market, cooling demand and potentially leading to further price corrections.

- Business Investment Slowdown: Higher interest rates discourage business investment, hindering expansion plans and job creation.

- Impact on Small Businesses: Small businesses, often reliant on borrowing for operational expenses, are particularly vulnerable to higher interest rates.

Global Economic Slowdown

Canada's economy is deeply intertwined with the global economy. A slowdown in key trading partners, such as the United States, directly impacts Canadian exports and overall economic health.

- Impact of Global Recessionary Pressures: Global recessionary pressures are dampening demand for Canadian goods and services, impacting various sectors.

- Trade Relations with the US and Other Countries: The health of Canada's trading relationships with its major partners plays a crucial role in its economic performance.

- Supply Chain Disruptions: Lingering supply chain disruptions continue to pose challenges for Canadian businesses, adding to inflationary pressures and impacting production.

Housing Market Correction

The Canadian housing market, a significant driver of economic growth in previous years, is experiencing a correction. This impacts not only the housing sector but also related industries like construction and real estate.

- House Price Declines: House prices are declining in many areas, impacting consumer wealth and confidence.

- Impact on Consumer Wealth: Falling house prices reduce consumer wealth, potentially leading to reduced spending and a decrease in economic activity.

- Implications for the Construction Sector: The slowdown in the housing market has significant implications for the construction sector and related industries, leading to job losses and reduced investment.

Reduced Consumer Spending

The confluence of inflation, higher interest rates, and housing market uncertainty has led to a decrease in consumer spending, a cornerstone of economic growth.

- Retail Sales Data: Retail sales data reflects a slowdown in consumer spending, indicating reduced confidence and purchasing power.

- Consumer Confidence Index: The consumer confidence index reflects a decline in consumer optimism about the future economic outlook.

- Impact on Various Sectors: The reduction in consumer spending negatively impacts various sectors, including retail, hospitality, and tourism.

Avoiding a Full-Blown Recession: A Closer Look at the OECD's Forecast

While the OECD predicts stagnation, not a full-blown recession, several factors contribute to Canada's relative economic resilience.

Resilient Labor Market

A relatively strong labor market, characterized by low unemployment, provides a crucial buffer against a sharper economic downturn.

- Unemployment Rate: Canada's unemployment rate remains comparatively low, indicating a strong labor market.

- Job Creation Figures: Job creation figures, while potentially slowing, continue to show positive growth in several sectors.

- Labor Force Participation Rate: A healthy labor force participation rate suggests a strong capacity for economic activity.

Government Spending and Investments

Government spending on infrastructure projects and social programs acts as a significant support for economic activity, mitigating the impact of other negative factors.

- Federal Budget Allocations: Federal budget allocations towards infrastructure and social programs contribute to economic stimulus.

- Provincial Spending Priorities: Provincial governments also play a role through their own spending priorities, influencing regional economic growth.

- Infrastructure Projects: Government investments in infrastructure create jobs and stimulate economic activity in various sectors.

Diversified Economy

Canada's diverse economy, with strengths in various sectors beyond natural resources, provides resilience against shocks affecting specific industries.

- Importance of Natural Resources: While still significant, the reliance on natural resources has lessened over time.

- Technology Sector Growth: The technology sector continues to be a significant driver of economic growth and job creation.

- Strength of the Financial Sector: A robust financial sector contributes to economic stability and provides support during periods of uncertainty.

Remaining Risks and Uncertainties

Despite the avoidance of a recession, significant risks and uncertainties remain.

- Geopolitical Risks: Geopolitical instability and unforeseen events pose a threat to the global economy and could impact Canada.

- Potential Supply Chain Disruptions: Supply chain disruptions could re-emerge, further impacting inflation and economic growth.

- Inflation Persistence: Persistent inflation remains a major risk, potentially necessitating further interest rate hikes and dampening economic activity.

Implications for Businesses and Consumers

The projected economic stagnation has significant implications for both businesses and consumers, requiring strategic adaptations.

Strategic Planning for Businesses

Businesses must adapt their strategies to navigate the economic uncertainty.

- Cost-Cutting Measures: Implementing cost-cutting measures to maintain profitability in a slowing economy is crucial.

- Diversification Strategies: Diversifying revenue streams and reducing reliance on specific markets is a key strategy.

- Investment in Technology: Investing in technology to improve efficiency and productivity can enhance competitiveness.

Financial Planning for Consumers

Consumers need to carefully manage their finances given the persistent inflation and higher interest rates.

- Budgeting Strategies: Developing robust budgeting strategies to manage expenses and prioritize savings is essential.

- Debt Management: Focusing on debt reduction and minimizing new debt is crucial during periods of economic uncertainty.

- Saving Plans: Building emergency savings and long-term savings plans are paramount to weathering economic downturns.

Conclusion

While Canada has narrowly avoided a recession according to the OECD's forecast, the projected economic stagnation in 2025 presents significant challenges. This stagnation is a result of persistent inflation, higher interest rates, a global economic slowdown, and a housing market correction. However, a resilient labor market and government spending offer some degree of support. Businesses and consumers must proactively adapt their strategies to navigate this period of economic uncertainty. Understanding the intricacies of Canada's economic stagnation in 2025 is crucial for making informed decisions. Monitor key economic indicators like the CPI and unemployment rate, and adapt your financial and business strategies accordingly to mitigate potential risks associated with Canada's economic outlook. Staying informed is key to navigating this challenging period for Canada's economy.

Featured Posts

-

Fenerbahce Nin Ronaldo Cagrisi Olasi Transferin Artilari Ve Eksileri

May 28, 2025

Fenerbahce Nin Ronaldo Cagrisi Olasi Transferin Artilari Ve Eksileri

May 28, 2025 -

Pernyataan Surya Paloh Soal Krisis Infrastruktur Jalan Di Bali

May 28, 2025

Pernyataan Surya Paloh Soal Krisis Infrastruktur Jalan Di Bali

May 28, 2025 -

Hujan Di Semarang Siang Hari Ramalan Cuaca Jawa Tengah 22 April

May 28, 2025

Hujan Di Semarang Siang Hari Ramalan Cuaca Jawa Tengah 22 April

May 28, 2025 -

65 Billion Dutch Investment Firm Issues Warning To Us Money Managers

May 28, 2025

65 Billion Dutch Investment Firm Issues Warning To Us Money Managers

May 28, 2025 -

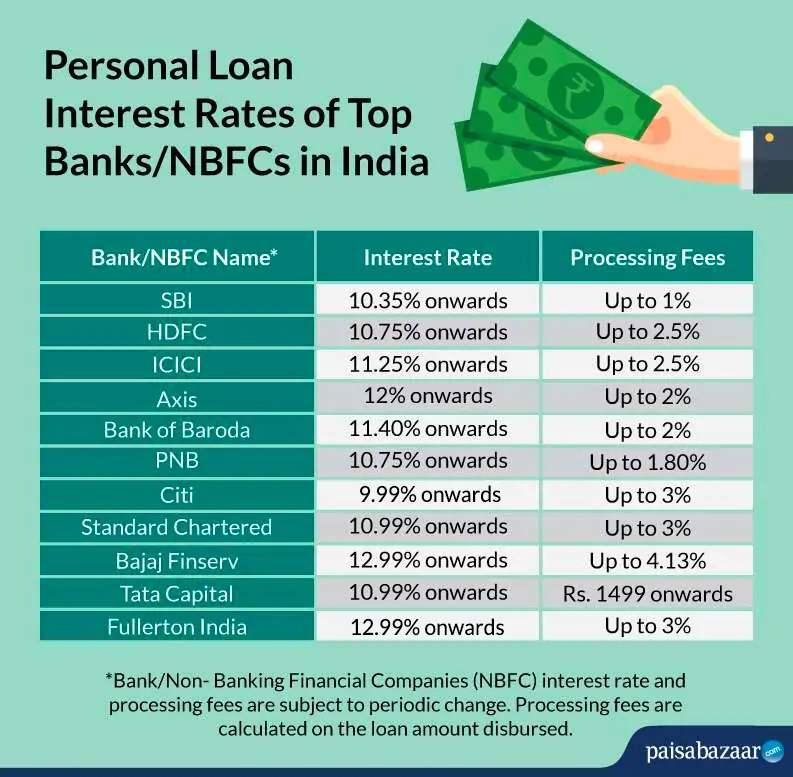

Compare Personal Loan Rates Today Get The Best Deal

May 28, 2025

Compare Personal Loan Rates Today Get The Best Deal

May 28, 2025