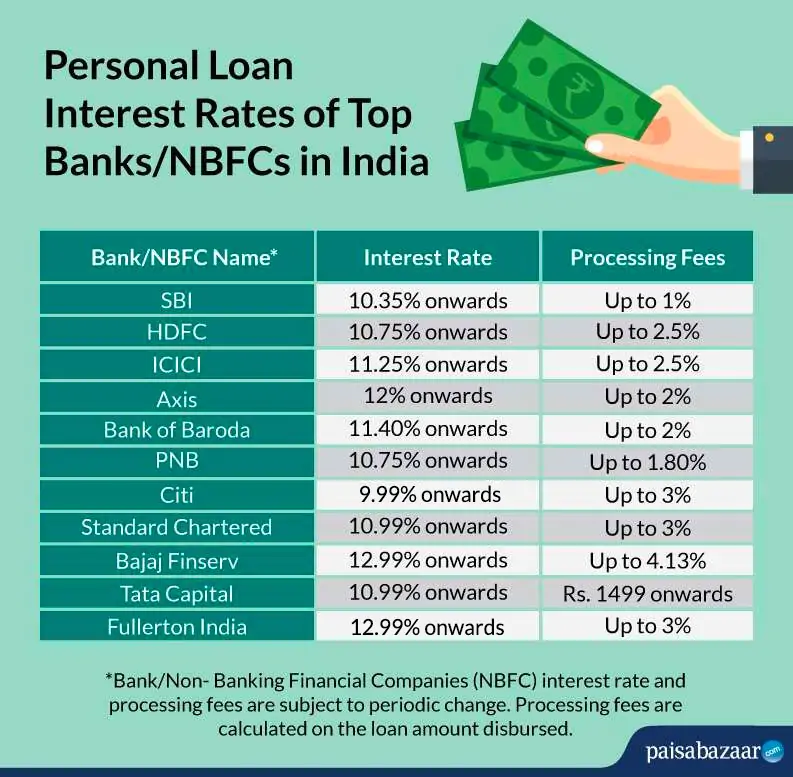

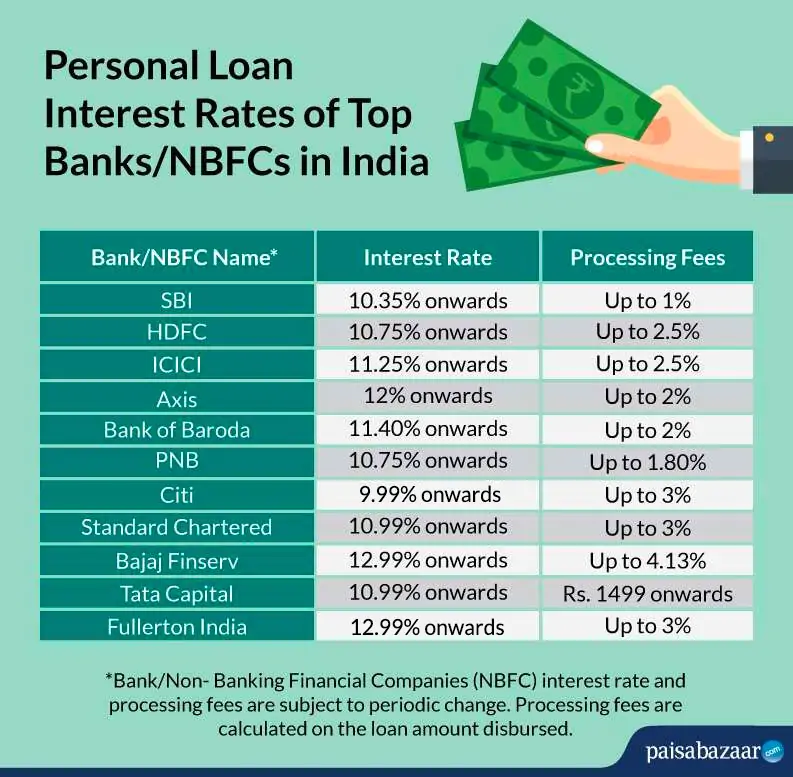

Compare Personal Loan Rates Today: Get The Best Deal

Table of Contents

Understanding Personal Loan Interest Rates

Understanding personal loan interest rates is fundamental to securing a good deal. Interest rates determine the cost of borrowing money. They are typically expressed as an annual percentage rate (APR). There are two main types:

- Fixed Interest Rates: These rates remain constant throughout the loan term, offering predictability in your monthly payments. This provides stability in budgeting.

- Variable Interest Rates: These rates fluctuate based on market conditions. While they might start lower, they can increase or decrease over time, leading to unpredictable monthly payments.

Several factors influence your personal loan interest rate:

-

Credit Score: Your creditworthiness is a primary determinant. A higher credit score (generally above 700) typically qualifies you for lower interest rates.

-

Loan Amount: Larger loan amounts might attract slightly higher interest rates.

-

Loan Term: Choosing a longer loan term reduces your monthly payment but increases the total interest paid over the loan's life. A shorter term means higher monthly payments but less interest paid overall.

-

APR (Annual Percentage Rate) vs. Interest Rate: The APR includes the interest rate and other fees associated with the loan, giving you the true cost of borrowing. It’s crucial to compare APRs when comparing loan offers.

-

High credit score = lower interest rates

-

Longer loan terms = lower monthly payments but higher overall interest

-

Lower loan amounts = potentially lower rates

-

APR (Annual Percentage Rate) includes all fees, providing a complete cost picture.

Where to Compare Personal Loan Rates

Finding the best personal loan requires comparing offers from various lenders. Several avenues are available:

- Online Lenders: Platforms like LendingClub, Upstart, and others offer convenience and often competitive rates. They streamline the application process, making it quick and easy to compare options.

- Banks and Credit Unions: Traditional financial institutions often provide personalized service and potentially lower rates, especially for existing customers. They may also offer more flexible repayment options.

- Comparison Websites: Websites dedicated to comparing loan offers provide a quick overview of multiple lenders' rates and terms, allowing you to easily assess your options. Be aware that these websites may be affiliated with specific lenders.

Remember to always check lender reviews and ratings from reputable sources like the Better Business Bureau before applying for a loan to ensure you're dealing with a trustworthy institution.

Factors to Consider Beyond Interest Rates

While the interest rate is a key factor, it's not the only one. Consider these additional aspects:

- Loan Fees: Origination fees and prepayment penalties can significantly impact the overall cost.

- Loan Term Length: A longer term results in lower monthly payments, but you'll pay more interest in the long run. A shorter term means higher monthly payments but less total interest.

- Monthly Payment Amounts: Ensure the monthly payment fits comfortably within your budget.

- Total Cost of the Loan: This includes all fees and interest, giving a complete picture of the loan's expense.

- Repayment Flexibility: Some lenders offer options like skip-a-payment or extended payment plans, which can be beneficial during financial hardship.

Tips for Getting the Best Personal Loan Rate

To improve your chances of securing a favorable interest rate:

-

Improve Your Credit Score: Before applying, check your credit report for errors and take steps to improve your score, such as paying down existing debts and maintaining consistent on-time payments.

-

Shop Around: Compare offers from multiple lenders to find the most competitive rates and terms. Don't settle for the first offer you receive.

-

Negotiate: Once you've received multiple offers, don't hesitate to negotiate with lenders for a better interest rate. They may be willing to lower the rate to secure your business.

-

Consider Pre-qualification: This allows you to see what rates you qualify for without impacting your credit score. You can then shop around with confidence knowing your range of potential interest rates.

-

Check your credit report for errors.

-

Pay down existing debt to improve credit utilization.

-

Negotiate with lenders for a better rate.

-

Consider pre-qualification to avoid impacting your credit score.

Avoiding Personal Loan Scams

Be vigilant about potential scams and predatory lending practices:

-

Beware of Guaranteed Approval: Legitimate lenders don't guarantee approval; they assess your creditworthiness.

-

Research the Lender: Thoroughly research any lender before providing personal information. Look for reviews and verify their legitimacy.

-

Secure Websites: Only share sensitive information on secure websites with "https" in the address bar and a padlock icon.

-

Be wary of lenders promising guaranteed approval.

-

Research the lender thoroughly before applying.

-

Never share sensitive information unless you're on a secure website.

Conclusion: Make the Smart Choice and Compare Personal Loan Rates Today!

Comparing personal loan rates is essential for securing the best possible deal. Remember to consider all factors, not just the interest rate, and be aware of potential scams. By carefully comparing offers and following the tips in this article, you can find a personal loan that fits your financial needs and budget. Don't delay – compare personal loan rates today and secure the best deal for your financial needs!

Featured Posts

-

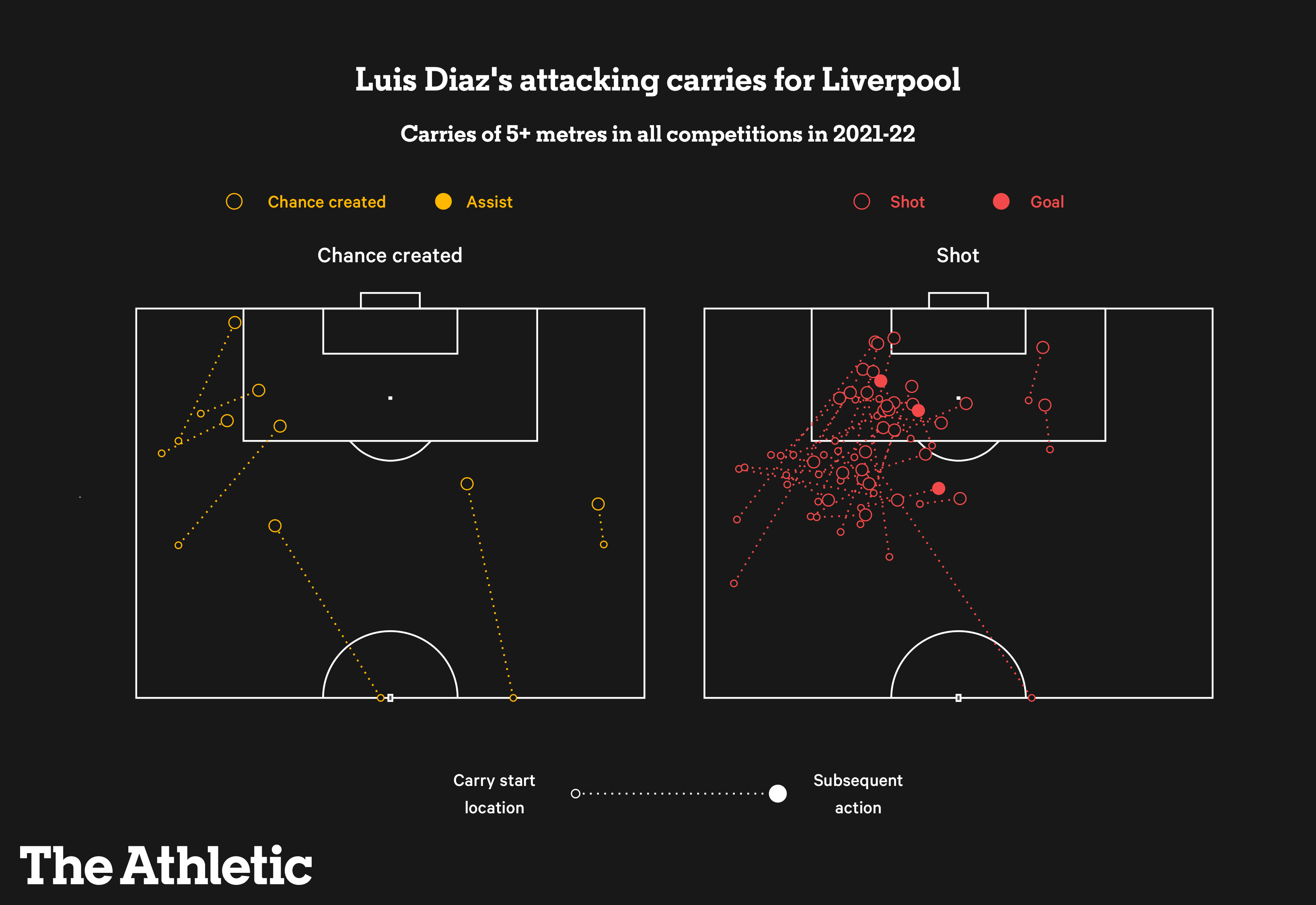

Arsenal Considering Shock Move For Luis Diaz

May 28, 2025

Arsenal Considering Shock Move For Luis Diaz

May 28, 2025 -

Ryan Reynolds Faces Backlash Justin Baldonis Lawyer Vows To Fight On

May 28, 2025

Ryan Reynolds Faces Backlash Justin Baldonis Lawyer Vows To Fight On

May 28, 2025 -

Ramalan Cuaca Bali Sebagian Besar Berawan Hujan Ringan Terbatas

May 28, 2025

Ramalan Cuaca Bali Sebagian Besar Berawan Hujan Ringan Terbatas

May 28, 2025 -

Cristiano Ronaldo Ile Adanali Ronaldonun Oyun Stillerinin Karsilastirilmasi

May 28, 2025

Cristiano Ronaldo Ile Adanali Ronaldonun Oyun Stillerinin Karsilastirilmasi

May 28, 2025 -

Why Current Stock Market Valuations Shouldnt Deter Investors Bof As Analysis

May 28, 2025

Why Current Stock Market Valuations Shouldnt Deter Investors Bof As Analysis

May 28, 2025

Latest Posts

-

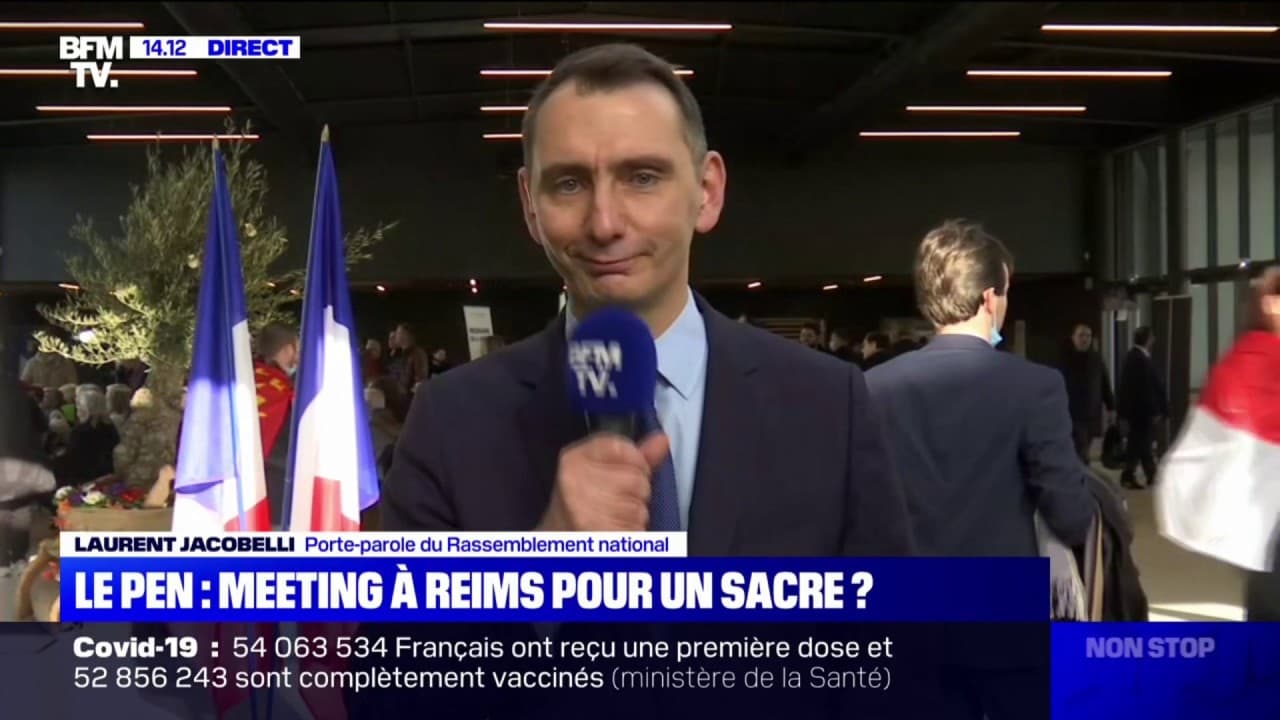

Depute Rn Marine Le Pen N Est Ni Au Dessus Ni En Dessous Des Lois

May 30, 2025

Depute Rn Marine Le Pen N Est Ni Au Dessus Ni En Dessous Des Lois

May 30, 2025 -

Hbo To Adapt Gisele Pelicots Memoir A French Rape Survivors Story

May 30, 2025

Hbo To Adapt Gisele Pelicots Memoir A French Rape Survivors Story

May 30, 2025 -

Marine Le Pen Et La Justice Jacobelli Defend Une Immunite Implicite

May 30, 2025

Marine Le Pen Et La Justice Jacobelli Defend Une Immunite Implicite

May 30, 2025 -

Grand Est Subvention Pour Concert De Medine Vives Reactions Politiques

May 30, 2025

Grand Est Subvention Pour Concert De Medine Vives Reactions Politiques

May 30, 2025 -

Concert De Medine Subventionne En Grand Est La Colere Du Rn

May 30, 2025

Concert De Medine Subventionne En Grand Est La Colere Du Rn

May 30, 2025