Canada's Resource Sector Gets A "Bulldog" Banker: Addressing Key Challenges

Table of Contents

Navigating the Volatility of Commodity Prices

The inherent instability of global commodity markets presents a persistent challenge for Canada's resource industry. Fluctuations in oil, gas, and mineral prices directly impact profitability and investment decisions. Effective strategies are critical to mitigate these risks and ensure the long-term sustainability of Canadian resource extraction.

Risk Management Strategies

Successfully navigating price volatility requires robust risk management strategies. Financial institutions play a crucial role in helping companies mitigate these risks.

- Hedging: Employing hedging strategies, such as futures contracts and options, allows companies to lock in prices and reduce exposure to market fluctuations. Successful examples include oil producers using futures contracts to secure future sales at predetermined prices.

- Diversification: Diversifying investments across different resource commodities (oil, gas, mining, forestry, etc.) is another essential strategy. This approach reduces reliance on any single commodity and minimizes the impact of price swings in one sector.

- Long-Term Planning: Developing long-term investment plans that account for potential price cycles is paramount. This involves meticulous forecasting, scenario planning, and a commitment to sustained investment even during periods of low commodity prices.

Government Policies and Support

Government policies significantly influence the stability of Canada's resource sector. Supportive regulations, subsidies, and tax incentives can attract investment and encourage growth. However, poorly designed policies can hinder development.

- Supportive Policies: Examples include tax credits for exploration and development, infrastructure investments in resource-rich regions, and streamlined permitting processes.

- Policy Reform: Areas needing reform include streamlining environmental regulations to balance environmental protection with economic development and creating clearer, more predictable tax policies.

- Lobbying and Advocacy: The new leadership can leverage its influence to advocate for policies that benefit the sector while maintaining environmental responsibility and social equity.

Environmental, Social, and Governance (ESG) Concerns

The increasing importance of ESG factors is transforming the investment landscape, with investors demanding greater transparency and accountability from resource companies. Canada's resource sector must adapt to meet these expectations to remain competitive.

Sustainable Resource Extraction

Sustainable resource extraction is no longer optional; it's a necessity. Companies must integrate environmental considerations into every stage of their operations.

- Sustainable Practices: Examples include transitioning to renewable energy sources to power operations, implementing carbon capture and storage technologies, and adopting responsible waste management practices.

- Certifications and Standards: Securing certifications such as ISO 14001 for environmental management systems demonstrates a commitment to sustainability and builds investor confidence. This strengthens the reputation of Canada's resource industry.

Indigenous Relations and Community Engagement

Building strong, mutually beneficial relationships with Indigenous communities and local stakeholders is crucial. Respecting Indigenous rights and engaging in meaningful consultation are paramount for the long-term success of any resource project.

- Community Engagement Initiatives: Successful initiatives include collaborating with Indigenous communities on resource development projects, sharing benefits equitably, and supporting local economies.

- Free, Prior, and Informed Consent (FPIC): Adhering to the principle of FPIC ensures that Indigenous communities have the right to give or withhold their consent to projects affecting their lands and territories.

- Collaborative Resource Management: Collaborative resource management models, where Indigenous communities and companies work together, can lead to more sustainable and equitable outcomes.

Attracting Investment and Talent

Securing investment and attracting a skilled workforce are essential for the growth and prosperity of Canada's resource sector. Highlighting the country's competitive advantages and modernizing the industry are critical strategies.

Showcasing Canada's Competitive Advantages

Canada boasts significant competitive advantages in the global resource market.

- Abundant Natural Resources: Canada possesses vast reserves of oil, gas, minerals, and forestry resources.

- Strong Regulatory Environment: A stable political environment and a robust regulatory framework provide a predictable and attractive investment climate.

- Skilled Labour Pool: Canada has a skilled workforce with expertise in resource extraction and related technologies.

- Geopolitical Stability: Canada's geopolitical stability makes it a desirable destination for international investment.

Modernizing the Industry

Modernizing the industry through technological advancements is vital for improving efficiency and attracting young talent.

- Technological Advancements: Adopting automation, artificial intelligence (AI), and other advanced technologies can significantly improve productivity and reduce operational costs.

- STEM Education and Training: Investing in STEM education and training programs is essential to develop a pipeline of skilled workers for the future.

- Attracting Foreign Investment: Promoting innovation and showcasing Canada's technological capabilities can attract significant foreign investment.

Conclusion

Canada's resource sector faces significant challenges, including navigating volatile commodity prices, addressing growing ESG concerns, and attracting investment and talent. The arrival of a decisive financial leader promises a more proactive approach to overcoming these obstacles. By implementing robust risk management strategies, fostering strong relationships with Indigenous communities, promoting sustainable practices, and embracing technological advancements, Canada's resource sector can secure a prosperous future. The future of Canada's resource sector is being shaped. Stay informed and contribute to the discussion on sustainable growth and responsible resource management in Canada’s resource industry. Further reading on topics such as sustainable resource management in Canada and the impact of ESG on the Canadian resource sector is highly recommended.

Featured Posts

-

Market Surge Sensex Up Bse Stocks With 10 Gains

May 15, 2025

Market Surge Sensex Up Bse Stocks With 10 Gains

May 15, 2025 -

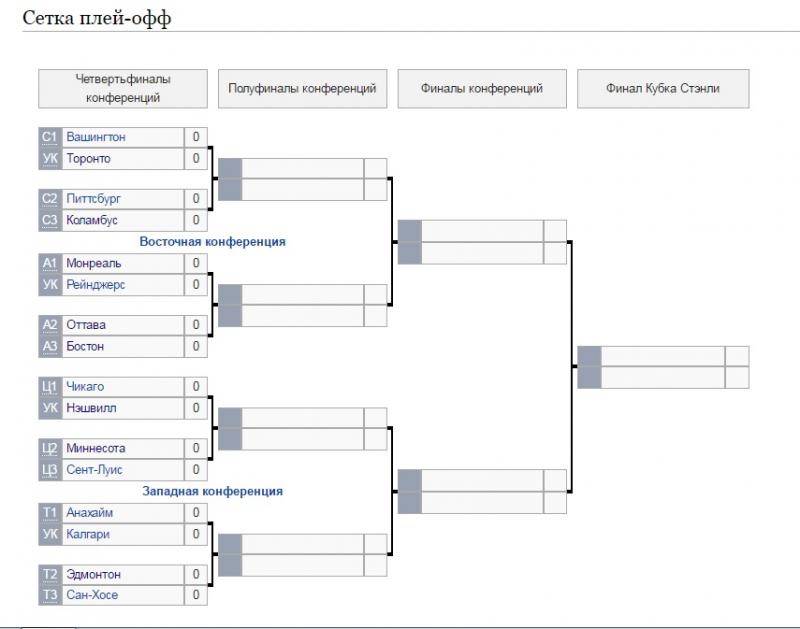

Ovechkin Zabil No Vashington Proigral Match Pley Off

May 15, 2025

Ovechkin Zabil No Vashington Proigral Match Pley Off

May 15, 2025 -

N Kh L Pley Off Vashington Poterpel Porazhenie Gol Ovechkina

May 15, 2025

N Kh L Pley Off Vashington Poterpel Porazhenie Gol Ovechkina

May 15, 2025 -

The Political End Of The King Of Davos A Critical Examination

May 15, 2025

The Political End Of The King Of Davos A Critical Examination

May 15, 2025 -

Paddy Pimbletts Ufc 314 Hit List Ilia Topuria Leads The Pack

May 15, 2025

Paddy Pimbletts Ufc 314 Hit List Ilia Topuria Leads The Pack

May 15, 2025

Latest Posts

-

Istoricheskoe Dostizhenie Ovechkina 12 Ya Strochka V Spiske Luchshikh Snayperov Pley Off

May 15, 2025

Istoricheskoe Dostizhenie Ovechkina 12 Ya Strochka V Spiske Luchshikh Snayperov Pley Off

May 15, 2025 -

Karolina Vashington Itogi Matcha Pley Off N Kh L I Analiz Igry

May 15, 2025

Karolina Vashington Itogi Matcha Pley Off N Kh L I Analiz Igry

May 15, 2025 -

Ovechkin Podnimaetsya V Reytinge Luchshikh Snayperov Pley Off N Kh L

May 15, 2025

Ovechkin Podnimaetsya V Reytinge Luchshikh Snayperov Pley Off N Kh L

May 15, 2025 -

Razgromnoe Porazhenie Vashingtona Ot Karoliny V Pley Off N Kh L

May 15, 2025

Razgromnoe Porazhenie Vashingtona Ot Karoliny V Pley Off N Kh L

May 15, 2025 -

Ovechkin 12 E Mesto V Istorii N Kh L Po Golam V Pley Off

May 15, 2025

Ovechkin 12 E Mesto V Istorii N Kh L Po Golam V Pley Off

May 15, 2025