Canadian Dollar Overvalued: Economists Urge Swift Action

Table of Contents

Factors Contributing to a Canadian Dollar Overvalued Assessment

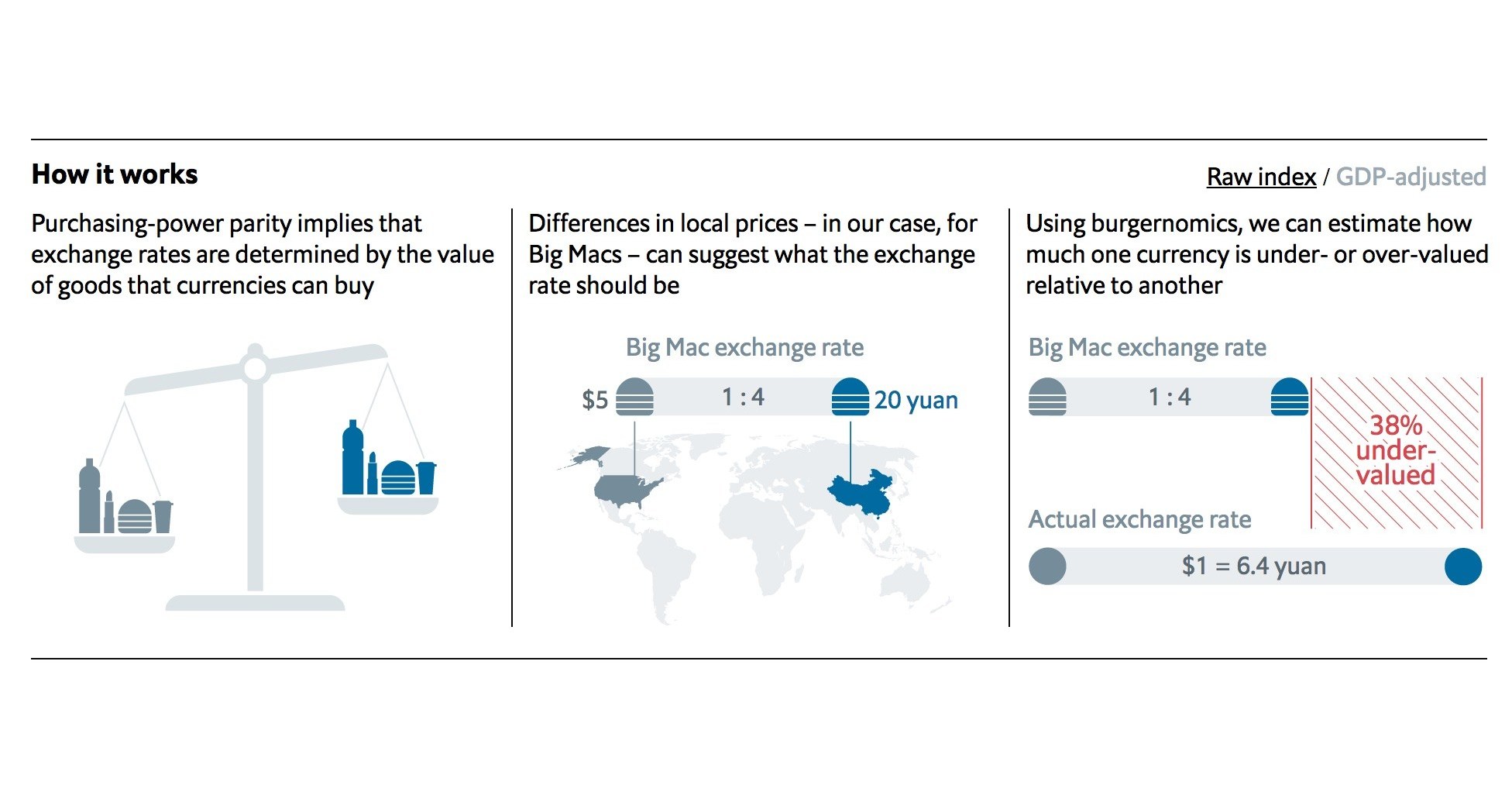

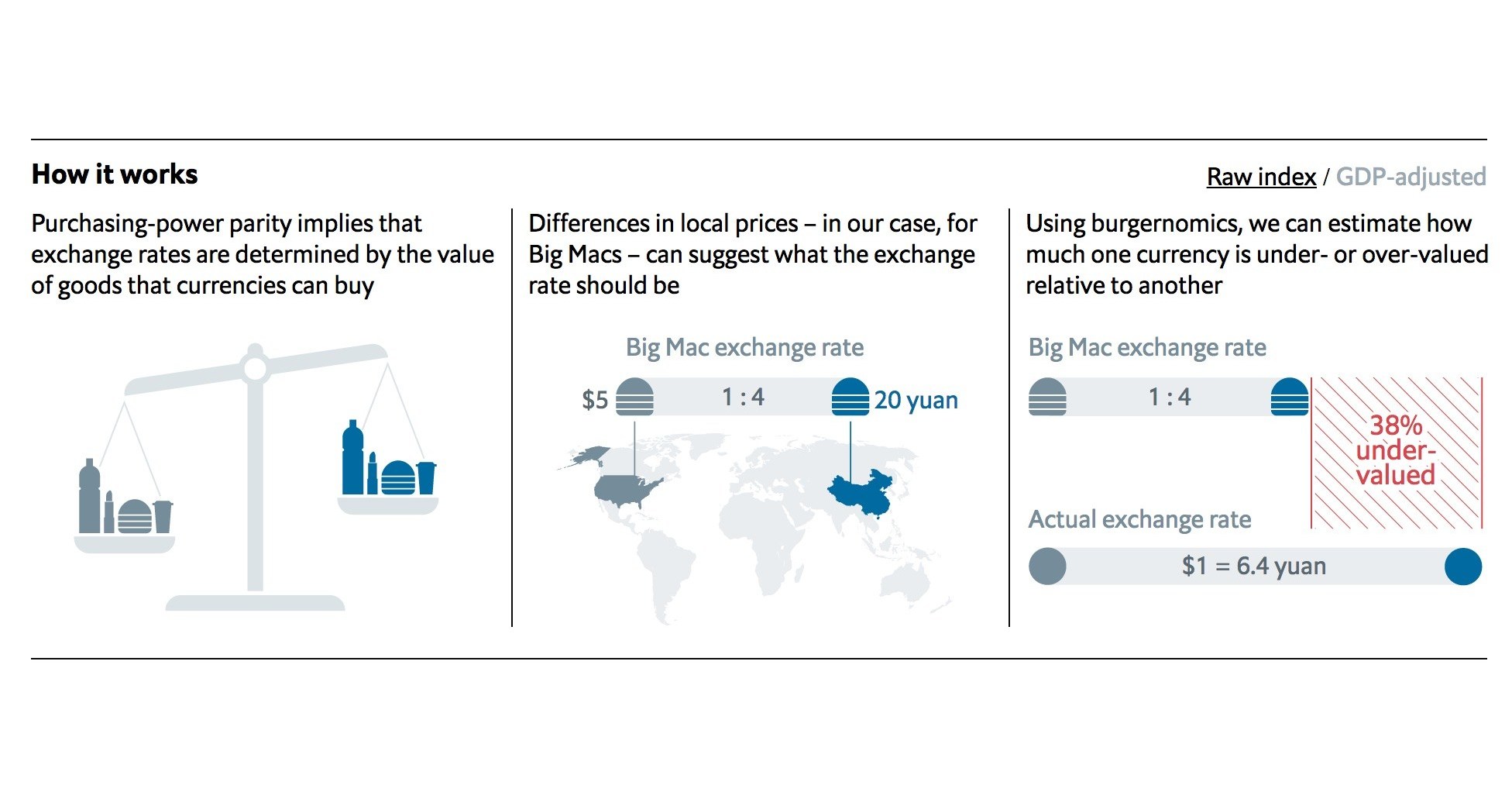

Several factors contribute to the assessment that the Canadian dollar (CAD) may be overvalued. Understanding these factors is crucial to comprehending the current economic landscape and its potential impact.

Strong Commodity Prices

High oil and other commodity prices significantly impact the Canadian dollar's strength. Canada is a major commodity exporter, and increased global demand for these resources boosts the value of the Canadian dollar.

- Increased demand: Higher demand for Canadian commodities like oil, lumber, and potash leads to increased export revenue, strengthening the CAD.

- Unsustainable price levels: However, these price levels may not be sustainable in the long term. A sudden correction in commodity prices could negatively impact the CAD.

- Risk of correction: The current strength of the CAD, partially fueled by commodity prices, carries the inherent risk of a future correction if these prices decline.

Recent data shows a strong correlation between commodity prices and the CAD's value. For example, the surge in oil prices in the first half of 2023 was mirrored by a strengthening of the Loonie against the US dollar. This demonstrates the significant influence commodity markets have on the Canadian currency's valuation.

Interest Rate Differentials

Interest rate differentials between Canada and other major economies play a crucial role in influencing the CAD's value. Higher interest rates in Canada attract foreign investment, increasing demand for the Canadian dollar.

- Attractive interest rates: The Bank of Canada's interest rate decisions directly influence the CAD's attractiveness to foreign investors seeking higher returns.

- Capital inflow: Higher Canadian interest rates incentivize foreign capital inflow, strengthening the Loonie.

- Bank of Canada's role: The Bank of Canada's monetary policy plays a pivotal role in managing interest rates and, consequently, the CAD's value.

Currently, Canada's interest rates are comparatively higher than those in several other major economies, such as the Eurozone and, at times, the US. This differential attracts foreign investment, putting upward pressure on the Canadian dollar.

US Dollar Weakness

A weaker US dollar (USD) indirectly contributes to the Canadian dollar's relative strength. The CAD is often traded in relation to the USD, and a weaker USD can artificially inflate the CAD's perceived value.

- Inverse relationship: The CAD and USD often exhibit an inverse relationship; a weaker USD often leads to a stronger CAD.

- Artificial inflation: A decline in the USD's value might not necessarily reflect a fundamental strengthening of the CAD, but rather a comparative effect.

- Exchange rate correlation: Charts clearly demonstrate this correlation; periods of USD weakness are frequently accompanied by CAD strength.

Observing the USD/CAD exchange rate is essential for understanding the interplay between these two currencies and the impact on the perceived overvaluation of the Canadian dollar.

Economic Implications of an Overvalued Canadian Dollar

An overvalued Canadian dollar presents several challenges for the Canadian economy. The consequences impact various sectors and require careful consideration.

Impact on Exports

An overvalued Canadian dollar makes Canadian goods and services more expensive for international buyers, negatively impacting exports.

- Reduced export volumes: A strong Loonie reduces the competitiveness of Canadian exports in global markets.

- Impact on various sectors: Sectors heavily reliant on exports, such as manufacturing, agriculture, and resource extraction, are particularly vulnerable.

- Specific examples: For example, Canadian lumber producers face challenges selling their products internationally when the CAD is strong.

The resulting decrease in export volumes can lead to reduced revenue, job losses, and slower economic growth.

Effect on Tourism

An overvalued Canadian dollar can also dampen tourism revenue. A strong Loonie makes travel to Canada more expensive for international tourists.

- Reduced tourist spending: Higher costs deter international tourists, leading to lower spending and fewer visitors.

- Impact on local businesses: Businesses in the tourism sector, including hotels, restaurants, and attractions, feel the brunt of this decreased activity.

This can have significant repercussions for local economies that rely heavily on tourism revenue.

Risks to Economic Growth

The overall macroeconomic risks associated with an overvalued currency are substantial. It can stifle economic growth and negatively impact job creation.

- Hindering exports: An overvalued currency directly impacts export competitiveness, leading to a trade deficit.

- Cheaper imports: While cheaper imports might benefit consumers in the short term, it can harm domestic industries unable to compete with lower-priced foreign goods.

- Impact on job creation: Reduced export volumes and a weakening of domestic industries can lead to job losses and slower economic growth.

Economists' Recommendations for Addressing an Overvalued Canadian Dollar

Addressing the issue of a potentially overvalued Canadian dollar requires a multifaceted approach involving government intervention, business strategies, and individual actions.

Government Intervention

The government could implement several policies to mitigate the effects of an overvalued Canadian dollar.

- Currency reserves management: Careful management of currency reserves can help stabilize the CAD's value.

- Fiscal policies: Appropriate fiscal policies can influence the demand for the CAD.

- International collaborations: Working with other nations to coordinate monetary policies can help stabilize exchange rates.

Diversification Strategies

Businesses can adopt strategies to mitigate the risks associated with an overvalued currency.

- Diversify export markets: Reducing reliance on specific markets helps lessen vulnerability to currency fluctuations.

- Hedging strategies: Using financial instruments to hedge against currency risk can protect against losses.

- Cost-reduction measures: Improving efficiency and lowering production costs can help maintain competitiveness.

Individual Actions

Individuals can also take steps to manage their personal finances in a period of currency fluctuation.

- Diversify investments: Diversifying investments across different currencies and asset classes reduces risk.

- Cautious travel planning: Being aware of exchange rate impacts when planning international travel is crucial.

- Awareness of exchange rate impacts: Understanding how exchange rates affect international transactions is essential for informed financial decisions.

Conclusion

The evidence suggests that the Canadian dollar may currently be overvalued, creating potential risks for the Canadian economy. The factors driving this valuation, from strong commodity prices to interest rate differentials, demand careful consideration. The negative implications for exports, tourism, and overall economic growth highlight the urgency of addressing this situation. Economists' recommendations, ranging from potential government interventions to diversification strategies for businesses and individuals, offer pathways to navigating this economic challenge. Understanding and addressing the issue of the Canadian dollar overvalued is crucial for ensuring the continued health and stability of the Canadian economy. Stay informed on economic developments and actively consider the implications of a potentially overvalued Canadian dollar in your financial planning and business operations.

Featured Posts

-

One Cryptocurrency Surviving The Trade War

May 08, 2025

One Cryptocurrency Surviving The Trade War

May 08, 2025 -

El Legado Historico Del Real Betis Balompie

May 08, 2025

El Legado Historico Del Real Betis Balompie

May 08, 2025 -

Check The Lotto Plus Results Saturday April 12 2025

May 08, 2025

Check The Lotto Plus Results Saturday April 12 2025

May 08, 2025 -

2 700 Ethereum Price Target Is The Wyckoff Accumulation Phase Over

May 08, 2025

2 700 Ethereum Price Target Is The Wyckoff Accumulation Phase Over

May 08, 2025 -

Bitcoin Price Prediction 2024 Trumps Influence And The 100 000 Target

May 08, 2025

Bitcoin Price Prediction 2024 Trumps Influence And The 100 000 Target

May 08, 2025