Canadian Dollar Weakening Despite US Dollar Gains

Table of Contents

Factors Contributing to the Canadian Dollar's Weakness

Several interconnected factors are contributing to the current weakness of the Canadian dollar against its US counterpart. Let's examine some of the most influential elements.

Interest Rate Differentials

Interest rate differentials between Canada and the US play a significant role in determining the CAD/USD exchange rate. The Bank of Canada's (BoC) monetary policy decisions, particularly regarding interest rates, directly impact the attractiveness of the Canadian dollar to foreign investors. Similarly, the Federal Reserve's actions influence the USD's strength.

- Current Interest Rate Comparison: Currently, the interest rate differential between Canada and the US is [insert current interest rate data for both countries]. This difference in rates affects investor flows.

- Future Rate Expectations: Market analysts predict [insert analyst predictions for future interest rate changes in both countries]. If the US Federal Reserve continues its tightening cycle while the Bank of Canada maintains a more dovish stance, the USD is likely to strengthen further relative to the CAD.

- Implications: A widening interest rate differential in favor of the US generally leads to increased demand for the USD, thus weakening the Canadian dollar.

Commodity Prices and Their Influence

Canada's economy is heavily reliant on commodity exports, particularly oil and natural gas. Fluctuations in global commodity prices directly impact the Canadian dollar's value.

- Recent Commodity Price Trends: Recent trends show [insert recent data on oil and natural gas prices]. A decline in these prices weakens the Canadian dollar as export revenues decrease.

- Impact on the Canadian Economy: Lower commodity prices reduce the overall strength of the Canadian economy, making the CAD less attractive to foreign investors. This, in turn, leads to a weaker CAD.

- Resource-Based Economy Vulnerability: Canada's reliance on a resource-based economy makes it particularly vulnerable to shifts in global commodity markets.

Geopolitical Factors and Global Uncertainty

Global events and uncertainties significantly impact investor sentiment and currency markets. Risk aversion, often triggered by geopolitical instability, can lead to a flight to safety, boosting the USD's value and weakening the CAD.

- Examples of Geopolitical Factors: Recent examples include [mention specific recent geopolitical events such as the war in Ukraine, trade tensions, or global economic slowdowns] which contribute to global uncertainty and impact the value of the Canadian dollar.

- Investor Sentiment: Negative global news often leads to investors seeking safer havens, like the US dollar, leading to decreased demand for riskier currencies like the CAD.

- Currency Volatility: Geopolitical events often cause increased volatility in the forex market, making accurate predictions challenging.

Impact of a Weakening Canadian Dollar

A weakening Canadian dollar has far-reaching consequences across various sectors of the Canadian economy.

Implications for Canadian Businesses

Fluctuations in the CAD/USD exchange rate significantly impact Canadian businesses, particularly those involved in international trade.

- Import/Export Costs: A weaker CAD makes imports more expensive for Canadian businesses, potentially squeezing profit margins and increasing inflation. Conversely, it makes Canadian exports more competitive in global markets.

- Competitiveness: A weaker Canadian dollar can enhance the competitiveness of Canadian exporters, boosting sales abroad, though this advantage is contingent on sufficient global demand.

- Challenges: Businesses need to carefully manage currency risks by implementing strategies such as hedging to mitigate potential losses due to currency fluctuations.

Impact on Canadian Consumers

The weakening Canadian dollar directly affects Canadian consumers through increased prices for imported goods and services.

- Cost of Imported Goods: A weaker CAD increases the cost of imported goods, impacting everything from electronics to clothing, leading to higher consumer prices.

- Travel Costs: Travelling abroad becomes more expensive as the CAD buys fewer foreign currencies.

- Inflationary Pressures: The increase in the price of imported goods adds to inflationary pressures within the Canadian economy.

Investment Implications

Navigating a weakening Canadian dollar requires strategic investment planning.

- Currency Hedging: Investors can utilize currency hedging strategies to mitigate the risk of losses due to currency fluctuations.

- Diversification: Diversifying investments across different asset classes and currencies can help reduce overall portfolio risk.

- Forex Trading: Sophisticated investors might consider forex trading opportunities to profit from currency movements, but this carries significant risk.

Conclusion

The weakening Canadian dollar, despite a strengthening US dollar, is a complex issue stemming from a confluence of factors: interest rate differentials, volatile commodity prices, and persistent global uncertainty. This trend has notable implications for Canadian businesses, affecting their import/export costs and competitiveness, and significantly impacts consumers through increased prices for imported goods. Investors must also actively manage their portfolios to mitigate risk. To effectively navigate this dynamic environment, staying informed about currency exchange rate trends and consulting financial professionals for personalized advice is paramount. Further research into Canadian dollar forecasts and related economic indicators will provide a more comprehensive understanding of this evolving situation and allow you to make informed decisions regarding your financial future. Understanding the dynamics of the weakening Canadian dollar is crucial for mitigating risk and maximizing opportunities in today’s volatile global market.

Featured Posts

-

Ai Transforms Repetitive Scatological Documents Into A Profound Poop Podcast

Apr 24, 2025

Ai Transforms Repetitive Scatological Documents Into A Profound Poop Podcast

Apr 24, 2025 -

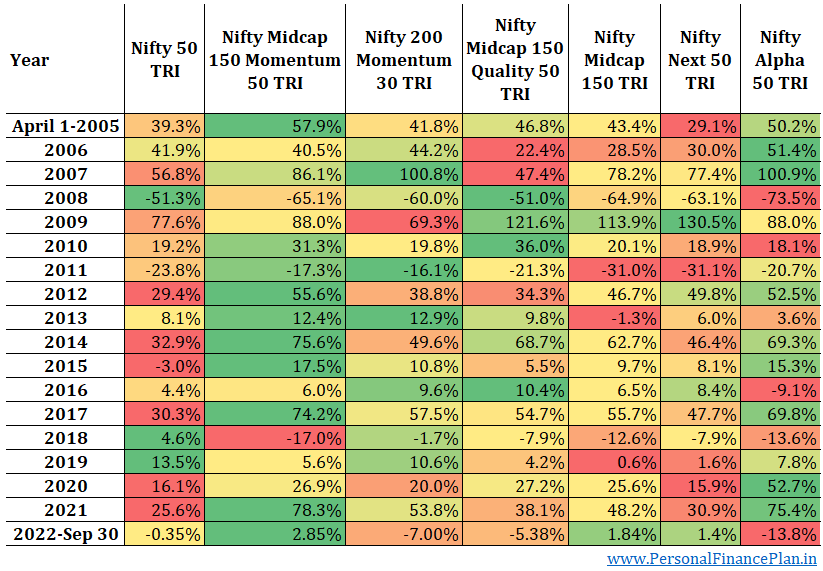

Indias Nifty Index Understanding The Current Bullish Momentum

Apr 24, 2025

Indias Nifty Index Understanding The Current Bullish Momentum

Apr 24, 2025 -

Dram Market Shift Sk Hynixs Rise To The Top Driven By Ai Advancements

Apr 24, 2025

Dram Market Shift Sk Hynixs Rise To The Top Driven By Ai Advancements

Apr 24, 2025 -

Ohio Train Derailment Lingering Toxic Chemicals In Buildings

Apr 24, 2025

Ohio Train Derailment Lingering Toxic Chemicals In Buildings

Apr 24, 2025 -

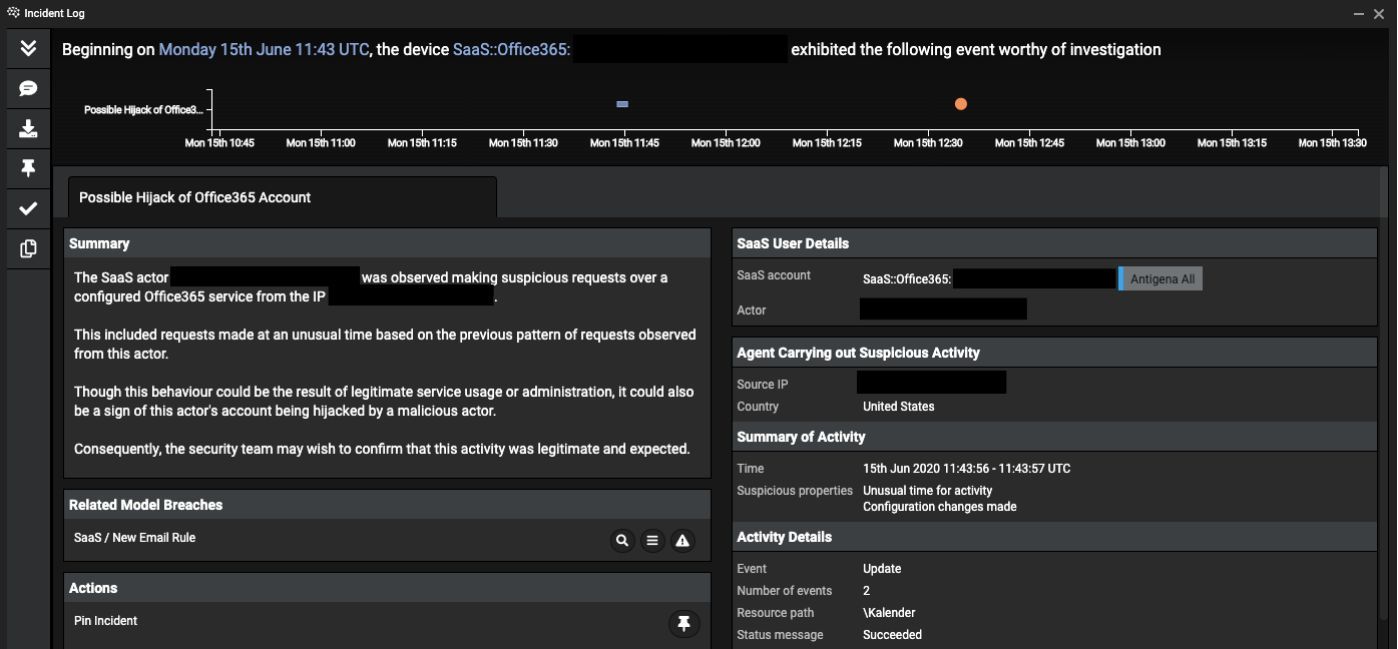

Cybercriminal Accused Of Millions In Office365 Account Compromises

Apr 24, 2025

Cybercriminal Accused Of Millions In Office365 Account Compromises

Apr 24, 2025

Latest Posts

-

Mm Amania Coms Ufc 315 Betting Odds Analysis Weekend Picks

May 12, 2025

Mm Amania Coms Ufc 315 Betting Odds Analysis Weekend Picks

May 12, 2025 -

Ufc 315 Betting Odds And Predictions From Mm Amania Com

May 12, 2025

Ufc 315 Betting Odds And Predictions From Mm Amania Com

May 12, 2025 -

Shevchenko Open To Zhang Weili Superfight Will It Happen

May 12, 2025

Shevchenko Open To Zhang Weili Superfight Will It Happen

May 12, 2025 -

Ufc 315 Betting Odds Your Weekend Lock Mm Amania Coms Predictions

May 12, 2025

Ufc 315 Betting Odds Your Weekend Lock Mm Amania Coms Predictions

May 12, 2025 -

Valentina Shevchenko Vs Zhang Weili A Superfight On The Horizon

May 12, 2025

Valentina Shevchenko Vs Zhang Weili A Superfight On The Horizon

May 12, 2025