Canadian Home Prices: Correction On The Horizon?

Table of Contents

Recent Trends in Canadian Home Prices:

The Rise and Fall (or Plateau):

The Canadian housing market experienced a dramatic surge in prices over the past decade, particularly in major urban centers like Toronto and Vancouver. However, recent data suggests a potential shift. While prices haven't plummeted across the board, the rate of appreciation has significantly slowed or even reversed in some areas.

- Toronto: While still expensive, Toronto saw a slight decrease in average home prices in Q3 2023 compared to Q2 2023, according to the Toronto Regional Real Estate Board (TRREB). This represents a significant change from the double-digit percentage increases seen in previous years.

- Vancouver: Similar trends are visible in Vancouver, with price growth significantly moderating. The Real Estate Board of Greater Vancouver (REBGV) reported a decrease in sales activity and a slowdown in price appreciation.

- Calgary & Montreal: These cities experienced more moderate price increases in recent years and are showing signs of stabilization.

[Insert graph or chart illustrating home price trends in major Canadian cities over the past 5 years, sourced from CREA or other reputable sources]

Factors Fueling the Market's Previous Growth:

The rapid appreciation of Canadian home prices in recent years was driven by several interconnected factors:

- Low Interest Rates: Historically low interest rates made mortgages significantly more affordable, fueling demand.

- Increased Immigration: Canada's robust immigration policies contributed to increased demand for housing.

- Supply Shortages: A chronic shortage of housing inventory, particularly in major cities, further propelled prices upward.

- Investor Activity: Significant investment in the Canadian real estate market from both domestic and foreign investors also played a role.

Indicators Suggesting a Potential Correction:

Rising Interest Rates and Their Impact:

The Bank of Canada's aggressive interest rate hikes are significantly impacting the housing market. Higher interest rates translate to:

- Increased Mortgage Payments: Borrowers face substantially higher monthly mortgage payments, reducing their purchasing power.

- Reduced Borrowing Power: With higher interest rates, buyers can qualify for smaller mortgages, limiting their ability to purchase homes.

- Decreased Market Activity: The combination of higher rates and reduced affordability has led to a noticeable slowdown in sales activity across many Canadian markets.

Changing Demographics and Buyer Sentiment:

Shifts in demographics and buyer sentiment are also playing a role.

- Cooling Immigration: While immigration remains significant, its pace might be moderating, impacting housing demand.

- Decreased Buyer Confidence: Surveys indicate a decline in buyer confidence, with many potential homebuyers adopting a wait-and-see approach.

- Increased Affordability Concerns: The affordability crisis is making homeownership increasingly challenging for many Canadians.

Increased Inventory Levels:

While still below historical averages, inventory levels in some Canadian markets are rising, signaling a potential shift in the supply-demand dynamic.

- Increased Listings: The number of homes listed for sale is gradually increasing in certain regions.

- Longer Days on Market: Properties are staying on the market for longer periods, indicating less competition among buyers.

- Potential for Price Adjustments: Increased supply could put downward pressure on prices, particularly in overheated markets.

Potential Scenarios for the Future of Canadian Home Prices:

A "Soft Landing":

A "soft landing" scenario would see a gradual stabilization of prices, with only moderate price declines in some areas. This outcome would depend on:

- Gradual Interest Rate Increases: A more moderate approach to interest rate hikes by the Bank of Canada.

- Increased Housing Supply: Significant increases in housing construction to meet demand.

- Sustained Economic Growth: Continued economic strength to support buyer confidence.

A More Significant Correction:

A more significant correction, involving a steeper decline in home prices, could occur if:

- Interest Rates Rise Further: The Bank of Canada increases interest rates more aggressively than anticipated.

- Economic Recession: A significant economic downturn could severely impact buyer confidence and purchasing power.

- Significant Increase in Inventory: A substantial surge in housing inventory could lead to a buyer's market.

Regional Variations:

The impact of a potential correction will vary across different regions of Canada. Some markets, particularly those that experienced the most rapid price appreciation, may experience more substantial declines than others.

Conclusion: Navigating the Uncertainties in the Canadian Home Price Market

The Canadian housing market is at a crucial juncture. While a significant correction isn't guaranteed, the confluence of rising interest rates, changing demographics, and increased inventory suggests a significant shift from the rapid price growth of recent years. Understanding the potential scenarios – a soft landing or a more substantial correction – is vital for both buyers and sellers. Staying informed about the latest developments in Canadian home prices, consulting with real estate professionals, and carefully considering individual financial circumstances are crucial steps in navigating this uncertain market. The long-term outlook for Canadian home prices remains complex and dependent on a variety of economic and demographic factors. Therefore, continuous monitoring and informed decision-making are paramount.

Featured Posts

-

Novelistes A L Espace Julien Avant Le Hellfest Une Ambiance Unique

May 22, 2025

Novelistes A L Espace Julien Avant Le Hellfest Une Ambiance Unique

May 22, 2025 -

Nato Protiv Rossii Patrushev O Planakh Zakhvata Kaliningrada

May 22, 2025

Nato Protiv Rossii Patrushev O Planakh Zakhvata Kaliningrada

May 22, 2025 -

The Curious Case Of Gumballs Next Adventure

May 22, 2025

The Curious Case Of Gumballs Next Adventure

May 22, 2025 -

Analyzing Core Weave Inc Crwv Stock Performance Thursdays Decline Explained

May 22, 2025

Analyzing Core Weave Inc Crwv Stock Performance Thursdays Decline Explained

May 22, 2025 -

Improving Virtual Meetings New Features From Google

May 22, 2025

Improving Virtual Meetings New Features From Google

May 22, 2025

Latest Posts

-

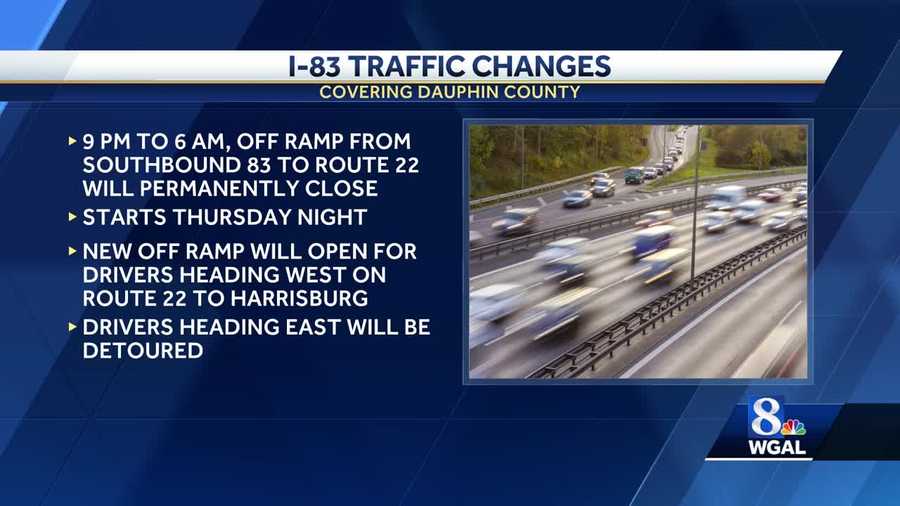

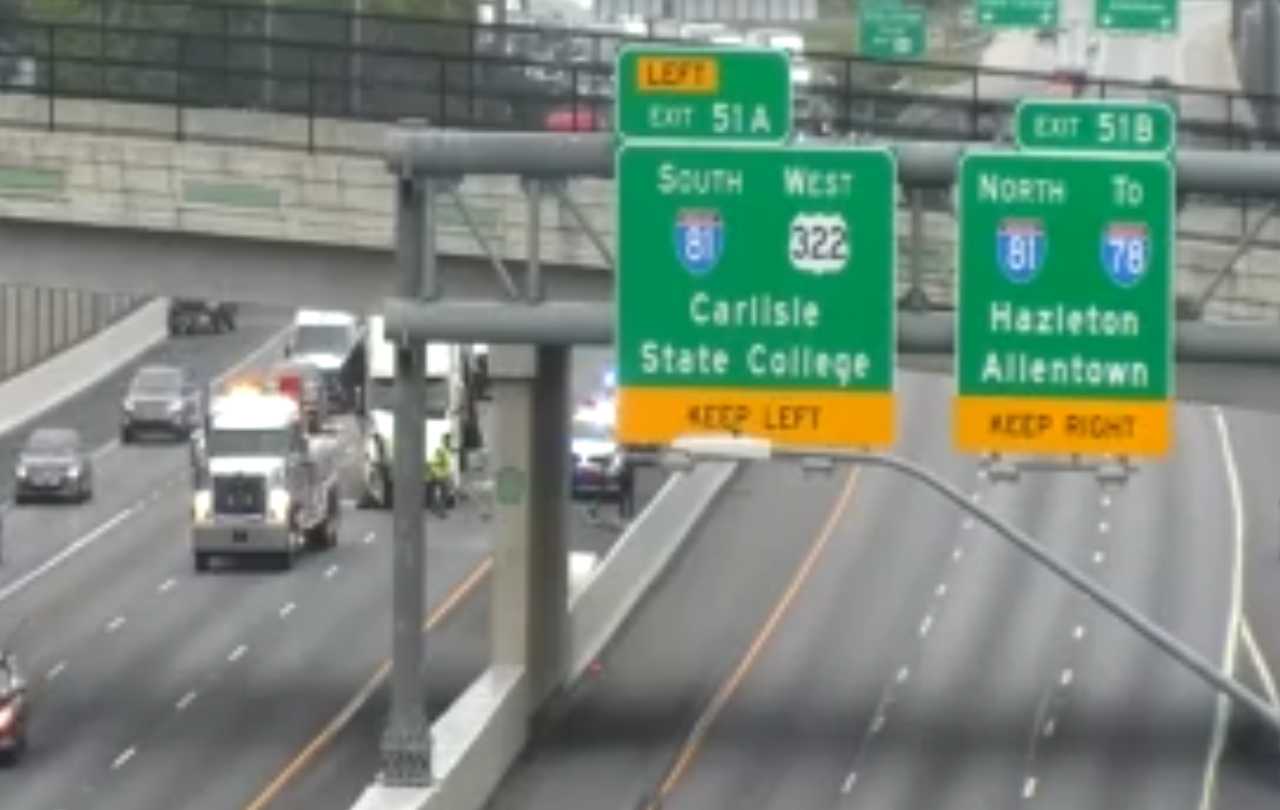

Interstate 83 Traffic Delays Due To Produce Truck Overturn

May 22, 2025

Interstate 83 Traffic Delays Due To Produce Truck Overturn

May 22, 2025 -

Route 283 Fed Ex Truck Inferno Lancaster County Incident

May 22, 2025

Route 283 Fed Ex Truck Inferno Lancaster County Incident

May 22, 2025 -

I 83 Closed Following Tractor Trailer Produce Spill

May 22, 2025

I 83 Closed Following Tractor Trailer Produce Spill

May 22, 2025 -

Lancaster County Fed Ex Truck Catches Fire On Route 283

May 22, 2025

Lancaster County Fed Ex Truck Catches Fire On Route 283

May 22, 2025 -

Produce Laden Tractor Trailer Crash On I 83

May 22, 2025

Produce Laden Tractor Trailer Crash On I 83

May 22, 2025