Canadian Private Investment: A Key Focus For CAAT Pension Plan

Table of Contents

Why CAAT Focuses on Canadian Private Investment

CAAT's strategic focus on Canadian private investment isn't arbitrary; it's driven by several key advantages. Investing domestically offers significant benefits, particularly when compared to international investments. These include:

- Reduced Currency Risk: Fluctuations in exchange rates can significantly impact returns on international investments. By focusing on Canadian assets, CAAT mitigates this risk, ensuring greater stability and predictability for its pension fund.

- Deeper Market Understanding: CAAT benefits from a superior understanding of the Canadian economic landscape, regulatory environment, and business culture. This in-depth knowledge allows for more informed investment decisions and stronger due diligence.

- Stronger Portfolio Company Relationships: Proximity facilitates stronger relationships with portfolio companies. This fosters better communication, collaboration, and ultimately, improved investment outcomes. Direct engagement allows for a more proactive approach to value creation.

- Diversification within the Canadian Market: While focusing domestically, CAAT maintains a diverse portfolio across various sectors and geographical locations within Canada. This approach spreads risk and capitalizes on growth opportunities in different regions and industries.

Key Advantages of Domestic Investment for CAAT:

- Reduced currency fluctuation risks

- Access to unique investment opportunities unavailable internationally

- Stronger local network and enhanced due diligence capabilities

- Alignment with Canadian economic growth and its diverse sectors

Types of Canadian Private Investments in CAAT's Portfolio

CAAT's Canadian private investment portfolio is carefully diversified across several asset classes, including:

- Private Equity: This encompasses various strategies, including venture capital (investments in early-stage companies), growth equity (investments in expanding companies), and buyouts (acquisitions of established businesses).

- Infrastructure: CAAT invests in essential infrastructure projects such as renewable energy facilities (wind, solar, hydro), transportation networks, and utilities, contributing to Canada’s economic development.

- Real Estate: Both commercial and residential real estate assets form part of the portfolio, providing stable income streams and long-term capital appreciation potential.

- Other Alternative Assets: CAAT may also invest in other alternative asset classes within the Canadian market, depending on market opportunities and strategic objectives. This might include specialized sectors like forestry or agriculture.

While specific investment details are often confidential, CAAT's public disclosures provide high-level insight into the scale and diversity of its private investment holdings in Canada.

The Role of Responsible Investing in CAAT's Canadian Private Investments

CAAT is a staunch advocate of responsible investing, integrating Environmental, Social, and Governance (ESG) factors throughout its investment process. This commitment isn't merely a trend; it's a core principle shaping its Canadian private investment strategy.

- ESG Integration: ESG criteria are systematically integrated into CAAT's investment due diligence, aiming to identify and select companies with robust ESG practices and strong long-term prospects.

- Focus on Sustainable Businesses: CAAT prioritizes investments in companies demonstrating a commitment to sustainability and responsible business practices. This includes businesses aligned with the UN Sustainable Development Goals.

- Engagement with Portfolio Companies: CAAT actively engages with portfolio companies, encouraging and supporting their efforts to improve their ESG performance. This proactive approach fosters positive change and enhances long-term value.

- Transparency and Reporting: CAAT maintains transparency in its ESG reporting, providing regular updates on its progress and impact.

Future Outlook for CAAT's Canadian Private Investment Strategy

CAAT's long-term vision for its Canadian private investment portfolio is one of continued growth and strategic expansion. The plan anticipates:

- Portfolio Growth Projections: CAAT expects continued growth in its Canadian private investment portfolio, fueled by strategic acquisitions and expansion in promising sectors.

- Targeting High-Growth Sectors: The pension plan will actively seek opportunities in high-growth sectors within Canada, leveraging technological advancements and evolving economic trends.

- Adapting to Market Changes: CAAT recognizes the dynamic nature of the investment landscape and remains committed to adapting its strategy to address emerging market trends and potential challenges.

- Ongoing Commitment to Responsible Investment: CAAT's commitment to responsible investing will remain a cornerstone of its future investment decisions in the Canadian private market.

Conclusion: Securing the Future with Strategic Canadian Private Investment

CAAT's strategic focus on Canadian private investment offers significant advantages, including enhanced diversification, robust risk management, attractive return potential, and alignment with responsible investment principles. This commitment to domestic private investment is integral to CAAT's long-term strategy to secure a strong financial future for its members. Learn more about how CAAT is leading the way in Canadian private investment and securing a strong future for its pension plan members by visiting their website. Discover the potential of strategic Canadian private investment for your organization.

Featured Posts

-

Warren Buffetts Apple Stock Sale What Does It Mean For Investors

Apr 23, 2025

Warren Buffetts Apple Stock Sale What Does It Mean For Investors

Apr 23, 2025 -

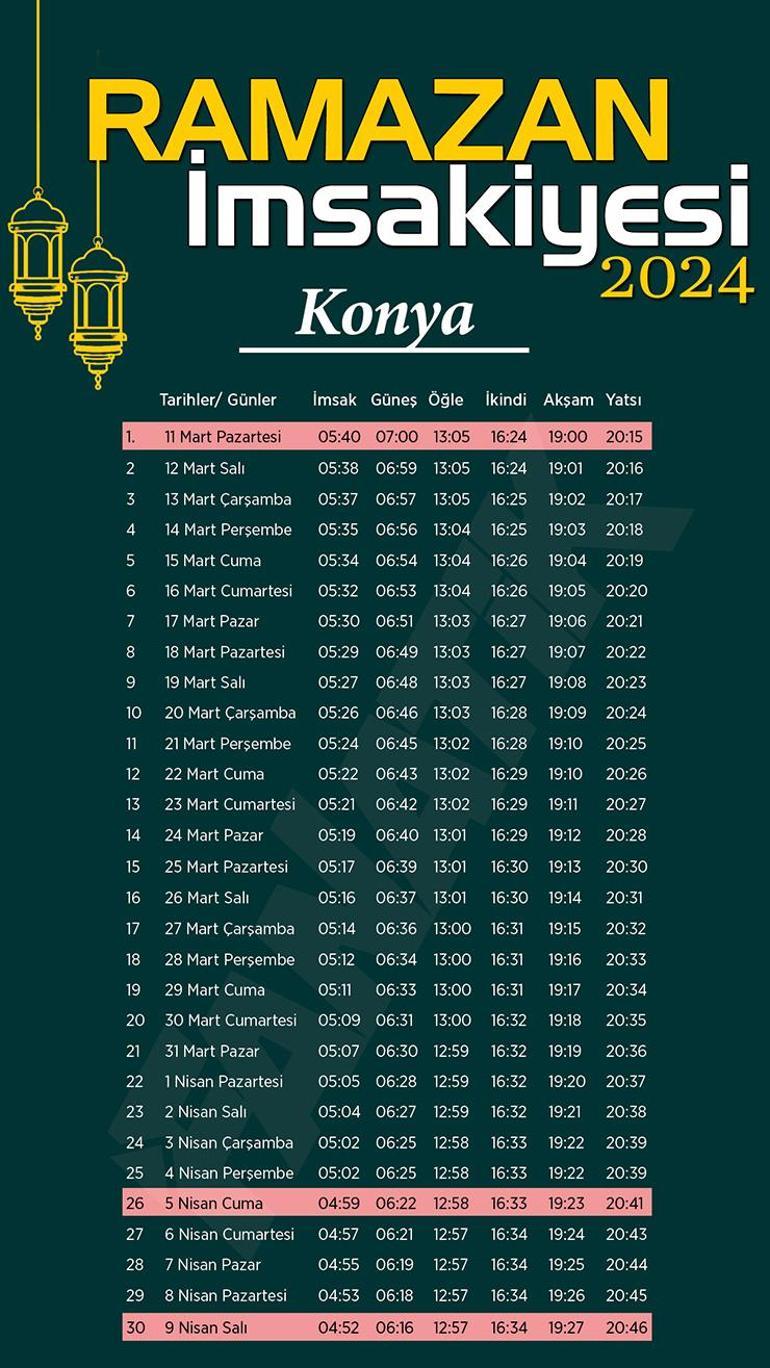

2024 Ramazan Imsakiyesi Tuerkiye Nin Bueyuek Sehirlerinde Iftar Ve Sahur Saatleri

Apr 23, 2025

2024 Ramazan Imsakiyesi Tuerkiye Nin Bueyuek Sehirlerinde Iftar Ve Sahur Saatleri

Apr 23, 2025 -

Brewers Surprise Unexpected Clutch Hitting In 2025

Apr 23, 2025

Brewers Surprise Unexpected Clutch Hitting In 2025

Apr 23, 2025 -

Five Run Ninth Diamondbacks Defeat Brewers In Walk Off Thriller

Apr 23, 2025

Five Run Ninth Diamondbacks Defeat Brewers In Walk Off Thriller

Apr 23, 2025 -

Top 10 Cardinal Candidates To Become The Next Pope

Apr 23, 2025

Top 10 Cardinal Candidates To Become The Next Pope

Apr 23, 2025