Celtics Sale To Private Equity: A $6.1 Billion Deal And Fan Concerns

Table of Contents

The $6.1 Billion Deal: Details and Implications

Who bought the Celtics?

The Boston Celtics were acquired by an undisclosed private equity firm, whose identity remains shrouded in some secrecy at this time. Further details are expected to be released in the coming weeks, including more information on their investment strategies and overall plans for the team. While specifics are scarce, the sheer magnitude of the $6.1 billion acquisition highlights the immense value placed on NBA franchises and the growing interest of private equity in the sports industry. This investment group, with a history of significant acquisitions in various sectors, will likely bring a new approach to managing the Celtics. Their experience will be vital to navigate the complex financial landscape of the NBA and maximize the franchise's potential.

- Purchase Price: $6.1 billion, setting a new record for an NBA franchise sale.

- Ownership Structure: Details regarding the exact ownership structure are still emerging.

- Timeline: The deal is expected to close within the next few months, pending league approval.

Impact on the Celtics' Valuation

The $6.1 billion price tag represents a record-breaking valuation for an NBA franchise, significantly surpassing previous sales. This unprecedented figure reflects the Celtics' enduring legacy, their consistent on-court success, their strong brand recognition globally, and their advantageous location in the vibrant Boston market. The Celtics' market capitalization now places them among the most valuable sports franchises worldwide. This sale highlights a significant trend of escalating sports franchise values, driven by factors like lucrative media rights deals, global fan bases, and the ever-growing popularity of professional basketball.

- Comparison to Other Teams: The Celtics' valuation surpasses that of many other prominent NBA franchises, solidifying their position at the top of the league in terms of financial worth.

- Market Trends: The deal underscores a broader trend of increasing valuations across major sports leagues, driven by factors including robust media contracts and expanding global fan bases.

Fan Concerns Regarding the Celtics Sale

Ticket Prices and Accessibility

One of the most prominent concerns amongst Celtics fans revolves around the potential impact on ticket prices and overall accessibility to games. The influx of private equity capital could lead to strategies that prioritize maximizing revenue, potentially resulting in increased ticket costs and reduced affordability for long-time supporters. Dynamic pricing models and an expansion of premium seating options could further exacerbate these concerns, making attending games more challenging for average fans.

- Potential Strategies: The new ownership might implement dynamic pricing, increasing ticket costs based on demand and opponent.

- Season Ticket Changes: Existing season ticket holders might face price increases or altered seat locations.

Impact on Team Management and Player Decisions

Changes in team management and player recruitment strategies are another major source of fan anxiety. Private equity firms often prioritize financial returns, which could influence decisions related to coaching staff, player acquisitions, and contract negotiations. Concerns exist about a potential shift away from a player-centric approach in favor of more cost-effective strategies that might jeopardize the team's competitive edge.

- Potential Scenarios: The new owners might opt for a more data-driven approach to player acquisitions, prioritizing cost-effectiveness over star power.

- Front Office Changes: Significant changes to the Celtics' front office are likely, potentially leading to a shift in team culture and operational strategies.

Maintaining the Celtics' Legacy and Brand Identity

Preserving the Celtics' rich history, iconic brand identity, and unique team culture is paramount. Fans fear that a new ownership group, primarily focused on profit maximization, might inadvertently compromise the team's legacy and core values. Maintaining community engagement, supporting local initiatives, and sustaining the team's strong connection with its fanbase will be crucial for the new owners to navigate this transition successfully.

- Community Engagement: Continued investment in community outreach programs will be essential to maintaining the Celtics’ strong ties with the city of Boston.

- Fan Outreach Programs: Initiatives to directly engage with fans and address their concerns will be crucial for maintaining positive relations with the fanbase.

Conclusion

The $6.1 billion sale of the Boston Celtics to a private equity firm represents a landmark event in NBA history, setting a new benchmark for franchise valuations. While this deal signals the immense financial potential of the franchise, it also understandably fuels significant concerns among fans regarding ticket prices, team management, and the preservation of the Celtics' rich legacy. The new owners must prioritize maintaining a balance between financial success and the long-term interests of the team and its loyal fanbase.

What are your thoughts on the Celtics sale to private equity? Share your concerns and expectations in the comments below. The future of the Boston Celtics, following this historic sale, will depend significantly on how the new ownership navigates the challenges and expectations that lie ahead. The Celtics sale to private equity is a pivotal moment for the team and its future, demanding careful consideration of its long-term implications.

Featured Posts

-

Kevin Durant Trade To Celtics A Hypothetical Nba Earthquake

May 15, 2025

Kevin Durant Trade To Celtics A Hypothetical Nba Earthquake

May 15, 2025 -

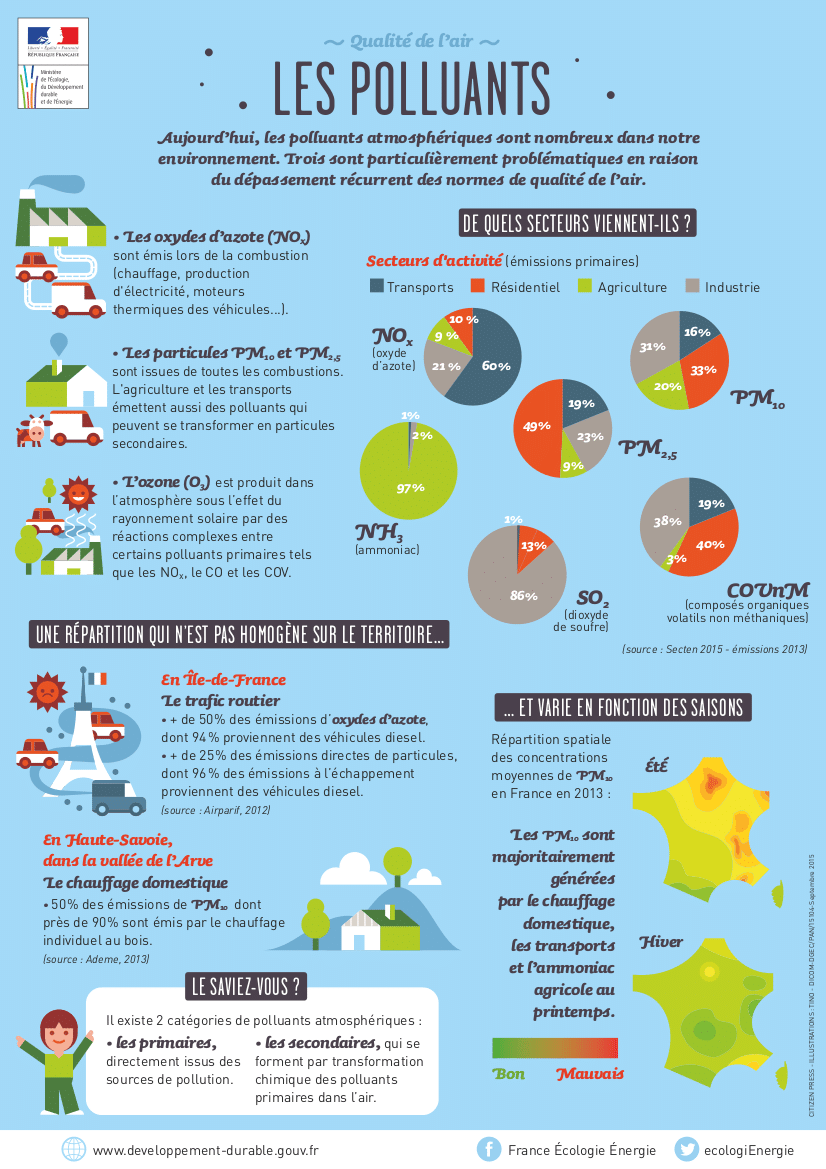

Filtration D Eau Eliminer Les Polluants De Votre Eau Du Robinet

May 15, 2025

Filtration D Eau Eliminer Les Polluants De Votre Eau Du Robinet

May 15, 2025 -

The Economic Fallout Trumps Tariffs And Californias 16 Billion Revenue Loss

May 15, 2025

The Economic Fallout Trumps Tariffs And Californias 16 Billion Revenue Loss

May 15, 2025 -

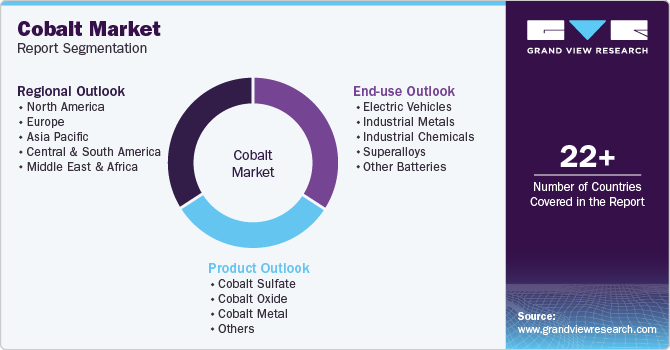

Cobalt Market Reaction Analyzing Congos Export Ban And Future Quota

May 15, 2025

Cobalt Market Reaction Analyzing Congos Export Ban And Future Quota

May 15, 2025 -

6 1 Billion Celtics Sale Impact On The Team And Its Fans

May 15, 2025

6 1 Billion Celtics Sale Impact On The Team And Its Fans

May 15, 2025

Latest Posts

-

Foot Lockers New Global Headquarters A Florida Relocation

May 15, 2025

Foot Lockers New Global Headquarters A Florida Relocation

May 15, 2025 -

Foot Locker Summer Campaign Championing Local Voices

May 15, 2025

Foot Locker Summer Campaign Championing Local Voices

May 15, 2025 -

Foot Lockers Near Term Prospects The Influence Of Nikes Q3 Results

May 15, 2025

Foot Lockers Near Term Prospects The Influence Of Nikes Q3 Results

May 15, 2025 -

Xs New Name Is Gorklon Rust What Does This Mean For Elon Musks Company

May 15, 2025

Xs New Name Is Gorklon Rust What Does This Mean For Elon Musks Company

May 15, 2025 -

St Petersburg Welcomes Foot Lockers Global Headquarters

May 15, 2025

St Petersburg Welcomes Foot Lockers Global Headquarters

May 15, 2025