Cobalt Market Reaction: Analyzing Congo's Export Ban And Future Quota

Table of Contents

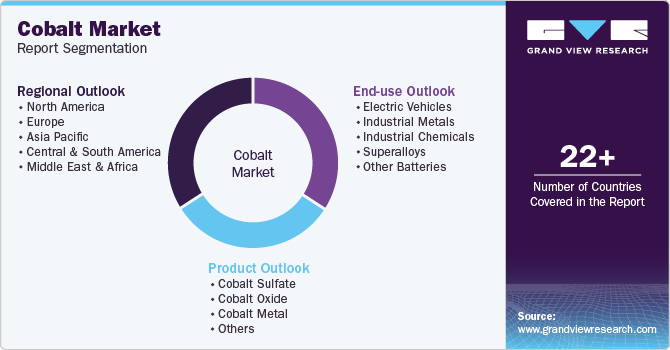

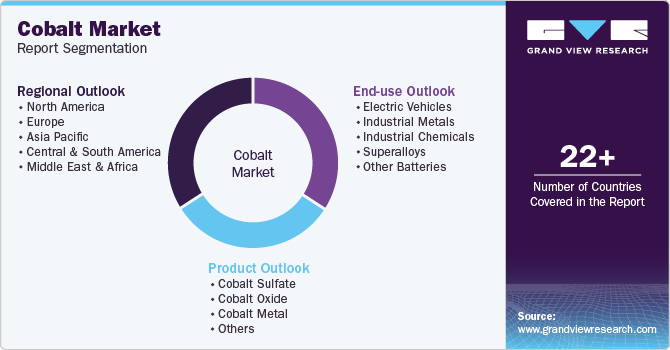

Congo's Export Ban: Immediate Market Impact

Price Volatility and Supply Chain Disruptions

The DRC's export ban announcement immediately triggered a surge in cobalt prices. This price volatility significantly disrupted the global supply chain, impacting battery manufacturers and EV producers who rely heavily on consistent cobalt supplies. The ban forced companies to scramble for alternative cobalt sources, leading to increased costs and sourcing challenges.

- Increased cobalt prices: Prices skyrocketed, impacting production costs across the EV and battery sectors.

- Supply chain bottlenecks: The sudden reduction in supply created significant bottlenecks, delaying production and impacting delivery schedules.

- Sourcing challenges for manufacturers: Companies were forced to explore less reliable and potentially more expensive sources, increasing their risk.

Geopolitical Implications and International Relations

The DRC's motivations behind the export ban are multifaceted, potentially involving attempts to increase domestic processing of cobalt, secure greater revenue, and exert greater control over its natural resources. This decision sparked reactions from other countries and international organizations, raising concerns about trade disruptions and the stability of the global cobalt supply chain. Potential trade disputes and diplomatic efforts are expected to follow.

- International pressure: The DRC faces potential pressure from international bodies and trading partners to reconsider its ban.

- Potential trade sanctions: International sanctions or retaliatory trade measures are possible responses to the export ban.

- Negotiations on cobalt trade: The DRC may engage in negotiations with other countries to find a solution that balances its interests with global demand.

Analyzing the Future Cobalt Quota System

Predicting Production Levels and Market Stability

The implementation of a new quota system aims to regulate cobalt production and exports. However, predicting the exact impact on cobalt supply and long-term price stability remains challenging. The potential for market manipulation through quota allocation will need careful monitoring.

- Projected cobalt production: Analysts offer varying projections, depending on the strictness of the quota system and the capacity of domestic processing facilities.

- Price forecast: Prices are expected to remain volatile until the market adjusts to the new quota system and alternative supply sources become more established.

- Market transparency: The success of the quota system hinges on its transparency and fairness to ensure equitable access to cobalt resources.

The Role of Sustainable Mining Practices and Environmental Concerns

Ethical and sustainable cobalt mining practices are paramount. The environmental impact of cobalt extraction in the DRC, including deforestation, water pollution, and soil degradation, is a significant concern. Promoting responsible sourcing and implementing stricter environmental regulations are critical for mitigating these negative effects.

- Environmental regulations: The DRC and other stakeholders need to strengthen environmental regulations and enforcement to minimize environmental damage.

- Ethical sourcing initiatives: Certifications and initiatives that promote responsible sourcing are necessary to ensure that cobalt is mined ethically and sustainably.

- Responsible mining practices: Investing in advanced mining technologies and implementing best practices can help reduce the environmental footprint of cobalt extraction.

Investing in the Cobalt Market: Opportunities and Risks

Diversification Strategies for Investors

Investing in the cobalt market presents both significant opportunities and substantial risks. Diversification is crucial for mitigating these risks. Investors should consider a portfolio approach that includes various assets within the battery metal sector and beyond.

- Portfolio diversification: Spreading investments across different cobalt producers, battery manufacturers, and other related sectors reduces overall risk.

- Risk management strategies: Thorough due diligence, hedging strategies, and understanding geopolitical factors are essential for managing risk.

- Long-term investment outlook: Despite volatility, the long-term outlook for cobalt demand remains positive, driven by the growing EV and battery storage industries.

Technological Advancements and Cobalt Demand

Technological advancements in battery technology will play a critical role in shaping future cobalt demand. The development of new battery chemistries that require less cobalt or utilize cobalt substitutes could reduce overall demand. Cobalt recycling will also become increasingly important.

- Battery technology innovation: Innovations in battery chemistry, such as lithium iron phosphate (LFP) batteries, could reduce reliance on cobalt.

- Cobalt recycling: Recycling efforts will play a crucial role in supplying cobalt and reducing dependence on primary mining.

- Demand forecast: Demand forecasts vary, with some predicting a slowdown in cobalt demand as technology evolves.

Conclusion

The DRC's export ban and the implementation of a future quota system have significantly impacted the cobalt market, creating price volatility and supply chain disruptions. Understanding the geopolitical complexities, the drive towards sustainable mining practices, and the evolution of battery technologies are crucial for navigating the future of this vital mineral. The future of the cobalt market hinges on a delicate balance between resource management, environmental responsibility, and technological innovation.

Call to Action: Stay informed about developments in the cobalt market to make informed decisions about your investments and business strategies. Further research into the cobalt market and its future implications is essential for all stakeholders in this critical sector. Monitor news and analysis related to the cobalt market to stay ahead of the curve.

Featured Posts

-

Kktc Ye 12 Milyon Avroluk Destek Tuerk Devletlerinin Karari Ve Analizi

May 15, 2025

Kktc Ye 12 Milyon Avroluk Destek Tuerk Devletlerinin Karari Ve Analizi

May 15, 2025 -

Paddy Pimbletts Path To Victory Expert Analysis By Michael Venom Page

May 15, 2025

Paddy Pimbletts Path To Victory Expert Analysis By Michael Venom Page

May 15, 2025 -

The 2026 Bmw I X Best Case Electric Vehicle Or Overhyped

May 15, 2025

The 2026 Bmw I X Best Case Electric Vehicle Or Overhyped

May 15, 2025 -

Navigate The Private Credit Boom 5 Dos And Don Ts To Land Your Dream Job

May 15, 2025

Navigate The Private Credit Boom 5 Dos And Don Ts To Land Your Dream Job

May 15, 2025 -

Padres Resistance To Dodgers Master Plan A Deep Dive

May 15, 2025

Padres Resistance To Dodgers Master Plan A Deep Dive

May 15, 2025

Latest Posts

-

How Ha Seong Kims Friendship With Blake Snell Supports Korean Players In Major League Baseball

May 15, 2025

How Ha Seong Kims Friendship With Blake Snell Supports Korean Players In Major League Baseball

May 15, 2025 -

Dodgers Defeat Marlins Again Freeman And Ohtani Power Home Run Victory

May 15, 2025

Dodgers Defeat Marlins Again Freeman And Ohtani Power Home Run Victory

May 15, 2025 -

Analyzing The Positive Influence Of Ha Seong Kim And Blake Snells Relationship On Korean Baseball

May 15, 2025

Analyzing The Positive Influence Of Ha Seong Kim And Blake Snells Relationship On Korean Baseball

May 15, 2025 -

Dodgers Minor League Standouts Evan Phillips Sean Paul Linan And Eduardo Quintero

May 15, 2025

Dodgers Minor League Standouts Evan Phillips Sean Paul Linan And Eduardo Quintero

May 15, 2025 -

Kim And Snells Friendship Support System For Korean Mlb Players

May 15, 2025

Kim And Snells Friendship Support System For Korean Mlb Players

May 15, 2025