Cenovus CEO: MEG Acquisition Unlikely Amid Focus On Organic Growth

Table of Contents

Cenovus's Commitment to Organic Growth

Cenovus Energy is doubling down on its organic growth strategy, prioritizing internal expansion and operational efficiency over large-scale acquisitions. This approach involves a strategic reallocation of capital and a renewed focus on maximizing the potential of existing assets. This commitment to internal growth represents a significant departure from previous M&A-focused strategies in the Canadian energy landscape.

-

Focus on optimizing existing assets: Cenovus plans to enhance production and profitability from its current oil and gas reserves through technological advancements and operational improvements. This includes streamlining processes, reducing waste, and implementing best practices across its operations.

-

Strategic investments in exploration and development: The company is investing in exploration and development projects to identify and unlock new reserves, thereby ensuring long-term production growth and sustainability. These investments will focus on high-return projects with minimal environmental impact.

-

Emphasis on operational efficiency and cost reduction: Cenovus aims to improve operational efficiency across all its facilities, reducing operational costs and enhancing overall profitability. This involves leveraging technological solutions to improve production efficiency and optimizing energy consumption.

-

Improved capital allocation to high-return projects: The company is rigorously evaluating potential projects, allocating capital to those that offer the highest potential return on investment. This prioritization helps maximize shareholder value and ensures responsible capital management.

-

Reduced reliance on external acquisitions to fuel growth: Cenovus's shift towards organic growth signifies a reduced reliance on mergers and acquisitions as the primary driver of expansion. The company believes internal growth offers greater control, predictability, and potentially higher returns compared to the complexities and uncertainties associated with large acquisitions.

Why a MEG Energy Acquisition is Unlikely

While speculation about a Cenovus-MEG Energy merger has circulated, Pourbaix's statement clearly indicates this is not currently a priority. Several factors contribute to the unlikelihood of this acquisition:

-

Current valuation of MEG Energy: Cenovus believes the current market valuation of MEG Energy is too high relative to its projected internal growth and return on investment. The perceived overvaluation makes an acquisition financially unattractive at this time.

-

Potential regulatory hurdles and integration challenges: Large-scale acquisitions in the energy sector often face regulatory scrutiny and complex integration challenges. These hurdles could significantly delay the realization of any potential synergies and add substantial costs.

-

Divergent strategic objectives: While both companies operate in the Canadian oil and gas industry, their strategic objectives and operational focus may differ significantly, making successful integration difficult. This lack of strategic alignment makes a merger less likely.

-

Cenovus's focus on its existing portfolio: Cenovus's current focus on maximizing the value of its existing assets and streamlining operations diminishes the urgency for external expansion through an acquisition.

-

Lack of a clear strategic synergy: A successful acquisition requires clear synergies between the acquiring and target companies. In the case of Cenovus and MEG Energy, the lack of clear, compelling synergies further reduces the likelihood of a merger.

Implications for the Canadian Energy Sector

Cenovus's decision to prioritize organic growth has significant implications for the broader Canadian energy sector:

-

Influence on other Canadian energy companies' M&A strategies: Cenovus's shift towards organic growth could influence other Canadian energy companies to reconsider their own M&A strategies, prompting a reassessment of the value and viability of external acquisitions.

-

Impact on the overall level of consolidation: Reduced M&A activity in the Canadian energy sector could lead to a slower pace of industry consolidation. This could potentially impact market dynamics and competition.

-

Potential effects on oil prices and market competition: The decreased M&A activity may affect market dynamics and potentially influence oil prices, although this effect is difficult to predict with certainty.

-

Repercussions for investor sentiment: Investor sentiment towards the Canadian energy industry could be affected by this shift, depending on the market's perception of organic growth versus mergers and acquisitions as a path to value creation.

-

Long-term effects of Cenovus's focus on organic growth: The long-term success of Cenovus's organic growth strategy will have a lasting impact on its own performance and could set a precedent for other companies in the Canadian energy sector.

Conclusion

Cenovus Energy's CEO has clearly articulated the company's strategic shift towards organic growth, making a MEG Energy acquisition highly unlikely in the foreseeable future. This decision reflects a focus on maximizing returns from existing assets and strategically allocating capital to high-impact internal projects within the Canadian energy sector. This approach could influence the broader Canadian energy sector and impact future M&A activity. This focus on internal expansion presents a new chapter in Cenovus's growth trajectory, potentially shaping the future of the Canadian oil and gas industry.

Call to Action: Stay informed about Cenovus Energy's strategic developments and the evolving landscape of the Canadian oil and gas industry. Follow our updates on the impact of Cenovus's organic growth strategy and the future of energy sector mergers and acquisitions. Learn more about Cenovus's commitment to sustainable organic growth and its implications for the Canadian energy sector.

Featured Posts

-

Jenson And The Fw 22 Extended Unveiling The Collection

May 26, 2025

Jenson And The Fw 22 Extended Unveiling The Collection

May 26, 2025 -

Pennsylvania Flash Flood Warning Heavy Rain Until Thursday

May 26, 2025

Pennsylvania Flash Flood Warning Heavy Rain Until Thursday

May 26, 2025 -

Naomi Campbell And Anna Wintour Met Gala 2025 Absence Fuels Speculation Of Feud

May 26, 2025

Naomi Campbell And Anna Wintour Met Gala 2025 Absence Fuels Speculation Of Feud

May 26, 2025 -

L Affaire Baffie Ardisson Repond Aux Accusations De Sexisme

May 26, 2025

L Affaire Baffie Ardisson Repond Aux Accusations De Sexisme

May 26, 2025 -

Succes Belge A La Bourse Payot Hugo De Waha Recompense

May 26, 2025

Succes Belge A La Bourse Payot Hugo De Waha Recompense

May 26, 2025

Latest Posts

-

Oecd Forecasts Flat Canadian Economic Growth For 2025 Recession Averted

May 28, 2025

Oecd Forecasts Flat Canadian Economic Growth For 2025 Recession Averted

May 28, 2025 -

Barrick Rejects Malis Gold Mine Takeover Legal Action Anticipated

May 28, 2025

Barrick Rejects Malis Gold Mine Takeover Legal Action Anticipated

May 28, 2025 -

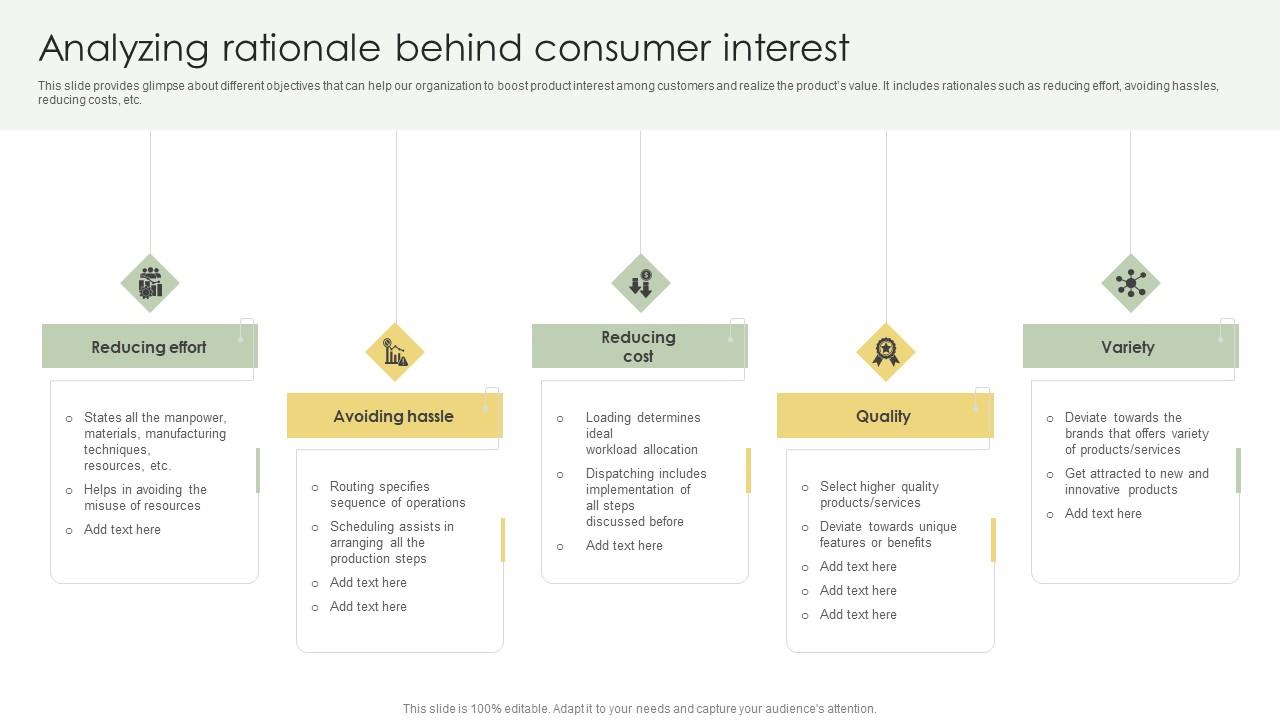

Canadian Tire And Hudsons Bay Analyzing The Rationale Behind The Merger

May 28, 2025

Canadian Tire And Hudsons Bay Analyzing The Rationale Behind The Merger

May 28, 2025 -

Trump Delays Eu Tariffs Until July 9th What It Means

May 28, 2025

Trump Delays Eu Tariffs Until July 9th What It Means

May 28, 2025 -

Rutte On Natos Path To Increased Defense Spending

May 28, 2025

Rutte On Natos Path To Increased Defense Spending

May 28, 2025