OECD Forecasts Flat Canadian Economic Growth For 2025, Recession Averted

Table of Contents

OECD's Forecast Details: A Closer Look at the 2025 Prediction

The OECD's prediction of flat Canadian economic growth for 2025 is based on a rigorous analysis of macroeconomic indicators and data. Their methodology incorporates various data sources, including GDP figures, inflation rates, consumer spending data, and employment statistics. The specific percentage growth rate predicted by the OECD for Canada in 2025 is remarkably close to zero, signifying a period of economic stagnation rather than significant expansion or contraction. This prediction deviates significantly from several previous forecasts that had projected a mild recession for Canada in 2025.

- GDP Growth: The OECD projects near-zero GDP growth for 2025, a significant departure from earlier predictions of negative growth.

- Key Sectors: The forecast suggests mixed performance across sectors, with some sectors like technology and healthcare potentially experiencing modest growth, while others like manufacturing and construction might see slower expansion.

- OECD Report: [Insert Link to OECD Report Here] For detailed information, consult the full OECD report.

Factors Contributing to Flat Canadian Economic Growth in 2025

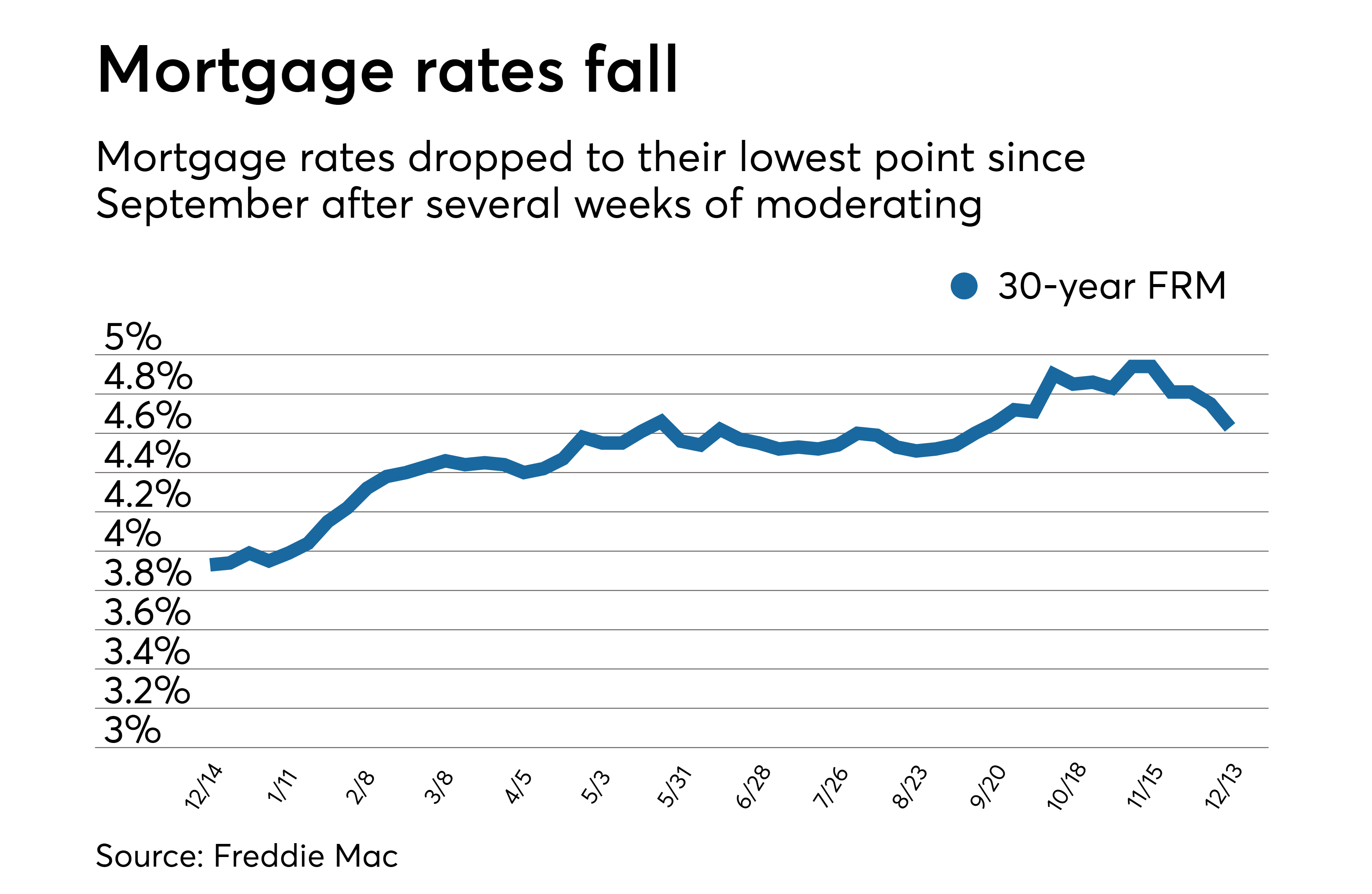

Several intertwined macroeconomic factors contribute to the OECD's prediction of flat Canadian economic growth in 2025. These factors include persistent inflation, relatively high interest rates, and ongoing global economic uncertainty.

- Inflation's Impact: High inflation continues to erode consumer purchasing power, dampening consumer spending and impacting overall economic growth. The sustained pressure on prices necessitates the Bank of Canada's monetary policy response.

- Interest Rate Effects: The Bank of Canada's efforts to curb inflation through interest rate hikes have increased borrowing costs for businesses and consumers, reducing investment and potentially hindering economic expansion.

- Global Economic Headwinds: Geopolitical instability, ongoing supply chain disruptions, and slowing global growth all contribute to a less favourable external environment for the Canadian economy. These factors significantly impact Canadian exports and investment.

Implications of Flat Growth for the Canadian Economy and Consumers

Flat Canadian economic growth in 2025 carries significant implications for the Canadian economy and its consumers. The most immediate impact will likely be on the job market and consumer spending.

- Job Market Impacts: While not necessarily predicting widespread job losses, flat growth could translate into slower job creation, potentially leading to increased competition for available positions and slower wage growth. Certain sectors might see layoffs.

- Consumer Spending: With persistent inflation and higher interest rates, consumer confidence might remain subdued, leading to cautious spending habits and potentially reduced overall consumer demand.

- Sectoral Impacts: The impact will vary across sectors. The real estate market, already facing challenges, could see further slowing. However, sectors like healthcare and technology might show some resilience.

Recession Averted: Reasons for Optimism and Potential Risks

Despite the prediction of flat growth, the OECD believes a recession has been averted for Canada in 2025. This optimism is grounded in the resilience shown by the Canadian economy and several mitigating factors.

- Resilience Factors: Canada's relatively strong fiscal position, a diversified economy, and a robust labour market are key factors contributing to the country's resilience to global economic shocks.

- Mitigating Pressures: Government policies, such as targeted support programs and infrastructure investments, could help mitigate some of the negative impacts of inflation and interest rate hikes.

- Downside Risks: However, unforeseen global events, such as a significant escalation of geopolitical tensions or a sharper-than-expected global slowdown, could still pose significant downside risks and potentially trigger a recession.

Conclusion: Canadian Economic Growth in 2025: A Summary and Call to Action

The OECD's forecast for Canadian economic growth in 2025 paints a picture of flat growth, narrowly avoiding a recession. This prediction is a result of a complex interplay of factors including persistent inflation, higher interest rates, and ongoing global economic uncertainty. While the Canadian economy displays resilience, the implications for businesses and consumers are notable, impacting job creation, consumer spending, and investment. Understanding these trends is crucial for navigating the economic landscape. Stay informed about the latest developments in Canadian economic growth by regularly checking the OECD's reports and other reputable economic sources, paying close attention to the Canadian economic outlook and 2025 economic forecast, particularly concerning Canadian GDP growth.

Featured Posts

-

Personal Loan Rates Today How To Get The Lowest Interest Rate

May 28, 2025

Personal Loan Rates Today How To Get The Lowest Interest Rate

May 28, 2025 -

Tyrese Haliburtons Impressive Knicks Game Nba Reactions

May 28, 2025

Tyrese Haliburtons Impressive Knicks Game Nba Reactions

May 28, 2025 -

How Mc Kenna Reinvigorated Ipswich Town Under Phillips Management

May 28, 2025

How Mc Kenna Reinvigorated Ipswich Town Under Phillips Management

May 28, 2025 -

Mengenal 8 Oleh Oleh Kuliner Khas Bali Yang Tak Kalah Populer Dari Pie Susu

May 28, 2025

Mengenal 8 Oleh Oleh Kuliner Khas Bali Yang Tak Kalah Populer Dari Pie Susu

May 28, 2025 -

Watch Arizona Diamondbacks Baseball Without Cable 2025 Options

May 28, 2025

Watch Arizona Diamondbacks Baseball Without Cable 2025 Options

May 28, 2025

Latest Posts

-

Pokemon Tcg Pocket New Rayquaza Ex Event And 6 Month Anniversary Missions

May 29, 2025

Pokemon Tcg Pocket New Rayquaza Ex Event And 6 Month Anniversary Missions

May 29, 2025 -

Is The Pokemon Tcg Pocket Shining Revelry Set Too Hard To Complete

May 29, 2025

Is The Pokemon Tcg Pocket Shining Revelry Set Too Hard To Complete

May 29, 2025 -

Pokemon Tcg Pocket Celestial Guardians Expansion Launch And Special Event

May 29, 2025

Pokemon Tcg Pocket Celestial Guardians Expansion Launch And Special Event

May 29, 2025 -

Pocket Shining Revelry A Collectors Guide To A Difficult Set

May 29, 2025

Pocket Shining Revelry A Collectors Guide To A Difficult Set

May 29, 2025 -

Pokemon Tcg Pockets 6 Month Anniversary Special Missions And Rayquaza Ex Event

May 29, 2025

Pokemon Tcg Pockets 6 Month Anniversary Special Missions And Rayquaza Ex Event

May 29, 2025