Changes To HMRC Tax Codes And Their Impact On Savings

Table of Contents

Common Types of HMRC Tax Code Changes and Their Causes

HMRC tax code changes are adjustments to the numbers assigned to you by Her Majesty's Revenue and Customs. These codes dictate how much income tax is deducted from your earnings each month. Several factors can trigger these alterations:

Scenarios Leading to Tax Code Alterations:

- Change in Employment Status: Starting a new job, becoming self-employed, or leaving a job will typically result in a tax code change.

- Additional Income Sources: Any extra income, such as rental income, dividends, or freelance work, can necessitate a tax code adjustment to reflect your increased earnings.

- Tax Relief Adjustments: Changes to your eligibility for tax reliefs, such as marriage allowance or pension contributions, will also affect your tax code.

Examples of Specific Tax Code Changes:

- BR: This is the basic rate tax code, typically used for individuals with standard incomes.

- K: This code indicates that tax relief has been applied for certain expenses.

- 1100L: This code is often used for individuals receiving additional tax relief.

Common Reasons for HMRC Tax Code Adjustments:

- New job

- Change in income (promotion, pay cut, etc.)

- Marriage or civil partnership

- Pension contributions (increasing or decreasing contributions)

- Tax relief claims (child benefit, etc.)

These HMRC tax code changes, and the resulting income tax adjustments, directly impact your disposable income and savings capacity. Understanding the reasons behind these changes is the first step to effective financial planning.

How Tax Code Changes Affect Your Take-Home Pay and Savings Potential

Your HMRC tax code directly influences your take-home pay (net income) and, subsequently, your disposable income. A change in your tax code, whether an increase or decrease in the tax deducted, will impact your monthly budget and overall savings potential.

Impact of Tax Code Changes:

- Increased or decreased take-home pay: Higher tax deductions result in less money available each month, while lower deductions increase disposable income.

- Changes to monthly budgeting: A sudden change in take-home pay requires immediate adjustments to your budget to avoid financial strain.

- Impact on short-term and long-term savings goals: Reduced take-home pay may necessitate delaying or reducing contributions to savings accounts, ISAs, or pension plans.

- Effect on investment strategies: Changes in savings capacity can affect your ability to make investments or contribute to retirement funds.

For example, a shift from a basic rate tax code to a higher rate could considerably reduce your monthly savings. Conversely, a change leading to a lower tax deduction could free up funds for increased savings or investments. Careful budgeting and financial planning are key to managing these variations.

Strategies for Maximizing Savings Despite HMRC Tax Code Changes

Proactive strategies can help you manage tax code changes and mitigate their negative impacts on your savings:

Effective Strategies for Maximizing Savings:

- Regular review of payslips and tax codes: Check your payslip regularly to identify any unexpected tax code changes and promptly report any discrepancies to HMRC.

- Accurate completion of self-assessment tax returns: If self-employed or have additional income sources, accurate tax returns are crucial for avoiding unexpected tax liabilities and ensuring correct tax code allocation.

- Exploring tax-efficient savings and investment options: Consider tax-efficient savings accounts like ISAs (Individual Savings Accounts) and pension plans to reduce your overall tax burden and maximize savings.

- Seeking professional financial advice: A financial advisor can provide personalized guidance on managing your finances in light of tax code adjustments and tailor strategies to meet your individual goals.

Careful financial planning, coupled with an understanding of tax-efficient investment options, is crucial to navigate the challenges posed by HMRC tax code changes.

Understanding Your HMRC Tax Code: Resources and Support

Several resources are available to help you understand your HMRC tax code and navigate tax regulations.

Resources and Support for Taxpayers:

- HMRC website for checking tax codes: The official HMRC website offers tools and information to verify your current tax code.

- Government Gateway for online account access: Manage your tax affairs online through the Government Gateway.

- Contact details for HMRC helpline: HMRC provides a helpline for inquiries regarding tax codes and other tax-related matters.

- Links to financial advice services: Numerous professional financial advisors offer services to help you manage your finances effectively.

Don't hesitate to seek professional help if you're struggling to understand your tax code or need assistance with tax planning.

Conclusion: Taking Control of Your Finances with Informed Tax Code Awareness

Understanding HMRC tax code changes and their potential impact on your savings is vital for effective financial planning. By regularly reviewing your payslips, accurately completing tax returns, utilizing tax-efficient savings options, and seeking professional guidance when needed, you can effectively manage these changes and maintain your savings goals. Take control of your savings today by understanding your HMRC tax code and implementing effective financial strategies.

Featured Posts

-

Restaurant Rooftop Galeries Lafayette Biarritz Avant Premiere Avec Imanol Harinordoquy Et Jean Michel Suhubiette

May 20, 2025

Restaurant Rooftop Galeries Lafayette Biarritz Avant Premiere Avec Imanol Harinordoquy Et Jean Michel Suhubiette

May 20, 2025 -

Man Utds New Signing Amorims Gold Rush

May 20, 2025

Man Utds New Signing Amorims Gold Rush

May 20, 2025 -

Sporting Cp To Man Utd The Amorim Deal Explained

May 20, 2025

Sporting Cp To Man Utd The Amorim Deal Explained

May 20, 2025 -

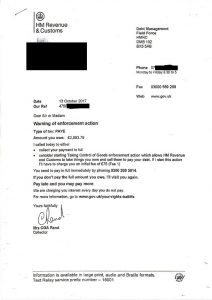

Thousands Receive Hmrc Letters New Tax Thresholds Explained

May 20, 2025

Thousands Receive Hmrc Letters New Tax Thresholds Explained

May 20, 2025 -

Premier League Forward Transfer Target For Manchester United

May 20, 2025

Premier League Forward Transfer Target For Manchester United

May 20, 2025

Latest Posts

-

Marche Africain Des Solutions Spatiales Mass Abidjan Accueille La Premiere Edition

May 20, 2025

Marche Africain Des Solutions Spatiales Mass Abidjan Accueille La Premiere Edition

May 20, 2025 -

Cote D Ivoire Le 4eme Pont D Abidjan Tout Savoir Sur Son Avancement Son Cout Et Ses Financements

May 20, 2025

Cote D Ivoire Le 4eme Pont D Abidjan Tout Savoir Sur Son Avancement Son Cout Et Ses Financements

May 20, 2025 -

Technologies Spatiales En Afrique Le Marche Africain Des Solutions Spatiales Mass Lance Sa Premiere Edition A Abidjan

May 20, 2025

Technologies Spatiales En Afrique Le Marche Africain Des Solutions Spatiales Mass Lance Sa Premiere Edition A Abidjan

May 20, 2025 -

Projet Du 4eme Pont D Abidjan Clarifications Sur L Execution Le Budget Et Les Frais

May 20, 2025

Projet Du 4eme Pont D Abidjan Clarifications Sur L Execution Le Budget Et Les Frais

May 20, 2025 -

4eme Pont D Abidjan Delais Cout Et Depenses Une Analyse Detaillee

May 20, 2025

4eme Pont D Abidjan Delais Cout Et Depenses Une Analyse Detaillee

May 20, 2025