Thousands Receive HMRC Letters: New Tax Thresholds Explained

Table of Contents

What are the New Tax Thresholds for the 2024/2025 Tax Year?

The 2024/2025 tax year brought significant changes to several key tax thresholds. Understanding these adjustments is crucial to accurately calculating your tax liability. Here's a breakdown of the key changes:

- Personal Allowance: The personal allowance, the amount you can earn tax-free, has remained at £12,570.

- Higher-Rate Threshold: The higher-rate threshold, at which you start paying the higher rate of income tax, has increased to £50,270.

- Additional Rate Threshold: The additional rate threshold, triggering the additional rate of income tax, remains at £125,140.

These changes directly impact how much income tax you will pay. For instance, if your income falls between £12,571 and £50,270, you’ll pay income tax at the basic rate. Income above £50,270 is taxed at the higher rate, and income exceeding £125,140 is subject to the additional rate. It's also important to note any potential impact on your National Insurance contributions, as these thresholds may also have been adjusted. Always refer to the official HMRC guidance for the most up-to-date information.

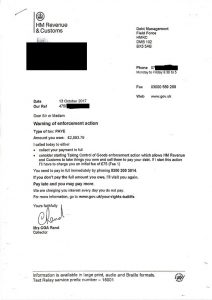

Why Did I Receive an HMRC Letter?

You've likely received an HMRC letter to inform you about the new tax year and the associated changes in tax thresholds. These letters serve several crucial purposes:

- Notification of New Tax Year Thresholds: The primary reason is to formally communicate the updated thresholds for the new tax year.

- Potential Tax Adjustments: The letter might indicate necessary adjustments to your tax code or payments based on your previous year's tax return.

- Request for Additional Information: In some cases, HMRC may request further information to ensure the accuracy of your tax records.

Receiving an HMRC letter is a normal part of the tax process. Proactive communication from HMRC is key to ensuring accurate tax calculations and preventing potential issues. Don't ignore your HMRC correspondence; addressing it promptly will help you stay compliant.

Deciphering Your HMRC Letter: Key Information to Look For

Your HMRC letter contains vital information. Knowing what to look for ensures you understand your tax obligations. Carefully examine your letter for these key elements:

- Your Unique Tax Reference Number (UTR): This unique identifier is crucial for all communication with HMRC.

- Your Personal Allowance: Verify the personal allowance amount applied to your tax calculations.

- Your Tax Code: This code determines how much income tax is deducted from your salary or wages.

- Any Tax Adjustments or Payments Due: Note any outstanding tax payments or adjustments required.

- Deadlines for Actions: Pay close attention to any deadlines for responding to the letter or making payments.

Potential Impacts of the New Tax Thresholds on Your Tax Bill

The new tax thresholds can positively or negatively impact your tax bill depending on your income level. For example:

- Lower-income earners: Those earning below the personal allowance will see no change in their tax liability.

- Middle-income earners: Individuals earning between the personal allowance and the higher-rate threshold may see a slightly higher tax bill if their income has increased significantly.

- Higher-income earners: Those earning above the higher-rate threshold will likely experience a greater impact, though the specific effect will depend on the extent of their income exceeding the new threshold.

Using online tax calculators can help you estimate the impact of these changes on your personal tax liability. Proactive tax planning can also help you optimize your tax efficiency.

What to Do if You Have Questions or Concerns

If you have any questions or concerns regarding your HMRC letter or the new tax thresholds, several resources are available:

- HMRC Website: The official HMRC website provides comprehensive information on tax regulations, allowances, and frequently asked questions.

- HMRC Helpline: Contact the HMRC helpline for assistance with specific queries.

- Tax Advisor: Consider consulting a qualified tax advisor for personalized guidance and support.

Conclusion: Taking Action on Your HMRC Letter Regarding New Tax Thresholds

The changes to tax thresholds for the 2024/2025 tax year are significant and impact taxpayers across various income levels. Understanding the information contained within your HMRC letter is crucial. Carefully review the details, paying attention to your tax code, personal allowance, and any adjustments or payments due. Don't ignore your HMRC letter! Review the information carefully and contact HMRC or a tax professional if you have any questions about the new tax thresholds. Remember to check the HMRC website for the latest updates and guidance regarding the new tax year. Proactive engagement ensures you remain compliant and manage your tax obligations effectively.

Featured Posts

-

Bbc Deepfake Scandal The Agatha Christie Case

May 20, 2025

Bbc Deepfake Scandal The Agatha Christie Case

May 20, 2025 -

Hmrc Targeting E Bay Vinted And Depop Sellers With Nudge Letters

May 20, 2025

Hmrc Targeting E Bay Vinted And Depop Sellers With Nudge Letters

May 20, 2025 -

Suki Waterhouse Calls Fans Twinks In Viral Tik Tok Video 97 1k Views

May 20, 2025

Suki Waterhouse Calls Fans Twinks In Viral Tik Tok Video 97 1k Views

May 20, 2025 -

Pro D2 Colomiers Contre Oyonnax Et Montauban Contre Brive Un Week End De Rugby Intense

May 20, 2025

Pro D2 Colomiers Contre Oyonnax Et Montauban Contre Brive Un Week End De Rugby Intense

May 20, 2025 -

Hmrc Child Benefit Communication Action Required

May 20, 2025

Hmrc Child Benefit Communication Action Required

May 20, 2025

Latest Posts

-

Jennifer Lawrence Majcinstvo I Drugo Dijete

May 20, 2025

Jennifer Lawrence Majcinstvo I Drugo Dijete

May 20, 2025 -

Novo Dijete Jennifer Lawrence Objava I Detalji

May 20, 2025

Novo Dijete Jennifer Lawrence Objava I Detalji

May 20, 2025 -

Potvrda Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Potvrda Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Drugo Dijete Jennifer Lawrence Vijesti I Reakcije

May 20, 2025

Drugo Dijete Jennifer Lawrence Vijesti I Reakcije

May 20, 2025 -

Jennifer Lawrence Rodila Drugo Dijete Detalji O Rodenju

May 20, 2025

Jennifer Lawrence Rodila Drugo Dijete Detalji O Rodenju

May 20, 2025