China Responds To Tariffs: Lower Interest Rates And Increased Bank Lending

Table of Contents

Lowering Interest Rates: A Monetary Policy Tool

Faced with slowing economic growth fueled by external trade friction, China's central bank has employed interest rate cuts as a crucial monetary policy tool to stimulate the economy. Lowering interest rates reduces the cost of borrowing for both businesses and consumers, encouraging increased investment and spending. This "monetary easing" aims to inject much-needed liquidity into the system.

- Reduced borrowing costs for investment in infrastructure projects: Lower interest rates make it cheaper for the government and private companies to finance large-scale infrastructure projects, bolstering economic activity and creating jobs.

- Increased consumer spending due to lower loan interest: Lower interest rates translate to cheaper loans for consumers, encouraging purchases of durable goods, housing, and other big-ticket items, thus boosting consumer confidence and spending.

- Potential impact on inflation: While stimulating growth, interest rate cuts can potentially lead to higher inflation if not carefully managed. The central bank must strike a delicate balance between stimulating the economy and controlling inflationary pressures.

- Comparison to previous interest rate adjustments in China: This recent round of interest rate cuts should be viewed within the context of previous adjustments. Analyzing the effectiveness of past measures provides valuable insight into the potential success of the current strategy. Keywords: interest rate cuts, monetary easing, economic stimulus, inflation, borrowing costs, investment.

Increased Bank Lending: Fueling Economic Activity

In tandem with interest rate cuts, the Chinese government has implemented policies aimed at encouraging increased bank lending. This involves a combination of directives, incentives, and risk-mitigation measures designed to boost credit availability throughout the economy.

- Government directives to banks regarding loan targets: The government has issued directives to commercial banks, setting targets for lending to specific sectors, such as small and medium-sized enterprises (SMEs) and infrastructure projects.

- Impact on credit availability for small and medium-sized enterprises (SMEs): SMEs, the backbone of the Chinese economy, often struggle to access credit. Increased bank lending, if targeted effectively, can significantly improve their access to capital, boosting their growth and job creation potential.

- Potential for increased non-performing loans (NPLs): A rapid expansion of credit carries the risk of increased NPLs, as some borrowers may struggle to repay their loans. This necessitates robust risk assessment and monitoring by banks and regulatory bodies.

- Government measures to mitigate risks in lending: The government has introduced various measures to mitigate the risks associated with increased lending, including stricter loan approval processes, improved risk management frameworks, and support for debt restructuring. Keywords: bank lending, credit expansion, SME financing, non-performing loans, financial risk, government policy.

The Interplay Between Interest Rates and Bank Lending

The effectiveness of China's response hinges on the synergistic effect between lower interest rates and increased bank lending. Lower interest rates make borrowing cheaper, incentivizing banks to lend more aggressively. This increased lending fuels economic activity by providing capital for investment and consumption.

- How lower rates encourage banks to lend more aggressively: Lower interest rates reduce the cost of funds for banks, making lending more profitable and encouraging them to expand their loan portfolios.

- The impact on overall economic activity and investment: The combined effect of increased lending and lower borrowing costs is expected to stimulate economic activity, boosting investment, production, and employment.

- Potential challenges and limitations of this approach: While effective in stimulating short-term growth, this approach might lead to long-term challenges like asset bubbles and increased financial risks if not managed prudently. Keywords: monetary policy effectiveness, economic growth, investment stimulation, trade war impact, economic recovery.

Global Implications of China's Response

China's monetary policy adjustments have significant global implications, influencing international trade, investment flows, and global financial markets.

- Impact on global commodity prices: Increased demand for raw materials driven by infrastructure projects in China can lead to higher global commodity prices.

- Influence on other countries' monetary policies: China's actions might influence other central banks' decisions, creating ripple effects throughout the global financial system.

- Potential for escalation or de-escalation of trade tensions: China's response could impact the trajectory of trade tensions, potentially leading to either escalation or de-escalation depending on the global response and effectiveness of the measures. Keywords: global economy, international trade, investment, global financial markets, trade relations.

Conclusion: Navigating China's Economic Response to Tariffs

China's use of lower interest rates and increased bank lending represents a significant attempt to mitigate the negative economic impacts of tariffs. Understanding these policies is vital for businesses and investors seeking to navigate the evolving landscape of the Chinese economy. While these measures hold potential for stimulating growth, careful monitoring of inflation and financial risks is crucial. The effectiveness of this strategy will unfold over time, shaping the future trajectory of the Chinese economy and its global impact. Stay informed about further developments in China's response to tariffs and their implications for your business or investment strategy. Consider exploring further resources on China economic policy, trade war analysis, and investment strategy to make informed decisions. Keywords: China economic policy, trade war analysis, investment strategy, China interest rates, future outlook.

Featured Posts

-

Access To Birth Control Examining The Impact Of Over The Counter Availability Post Roe

May 08, 2025

Access To Birth Control Examining The Impact Of Over The Counter Availability Post Roe

May 08, 2025 -

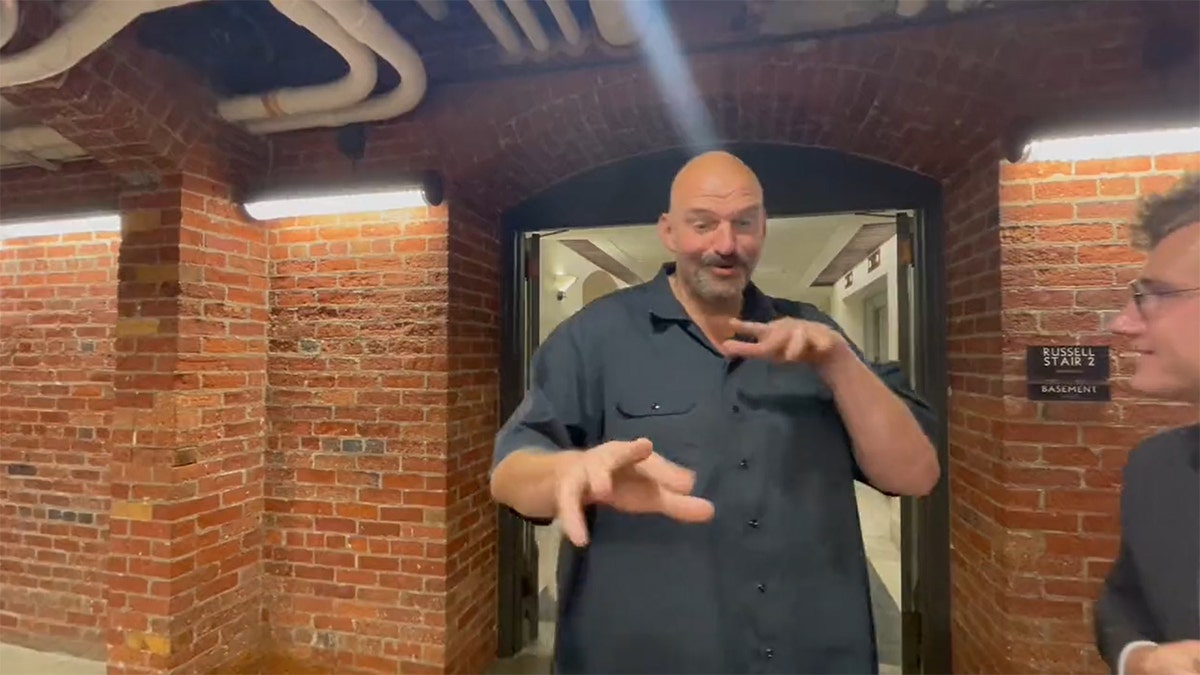

Fettermans Senate Bid Dismissing Fitness Concerns And Vowing To Stay

May 08, 2025

Fettermans Senate Bid Dismissing Fitness Concerns And Vowing To Stay

May 08, 2025 -

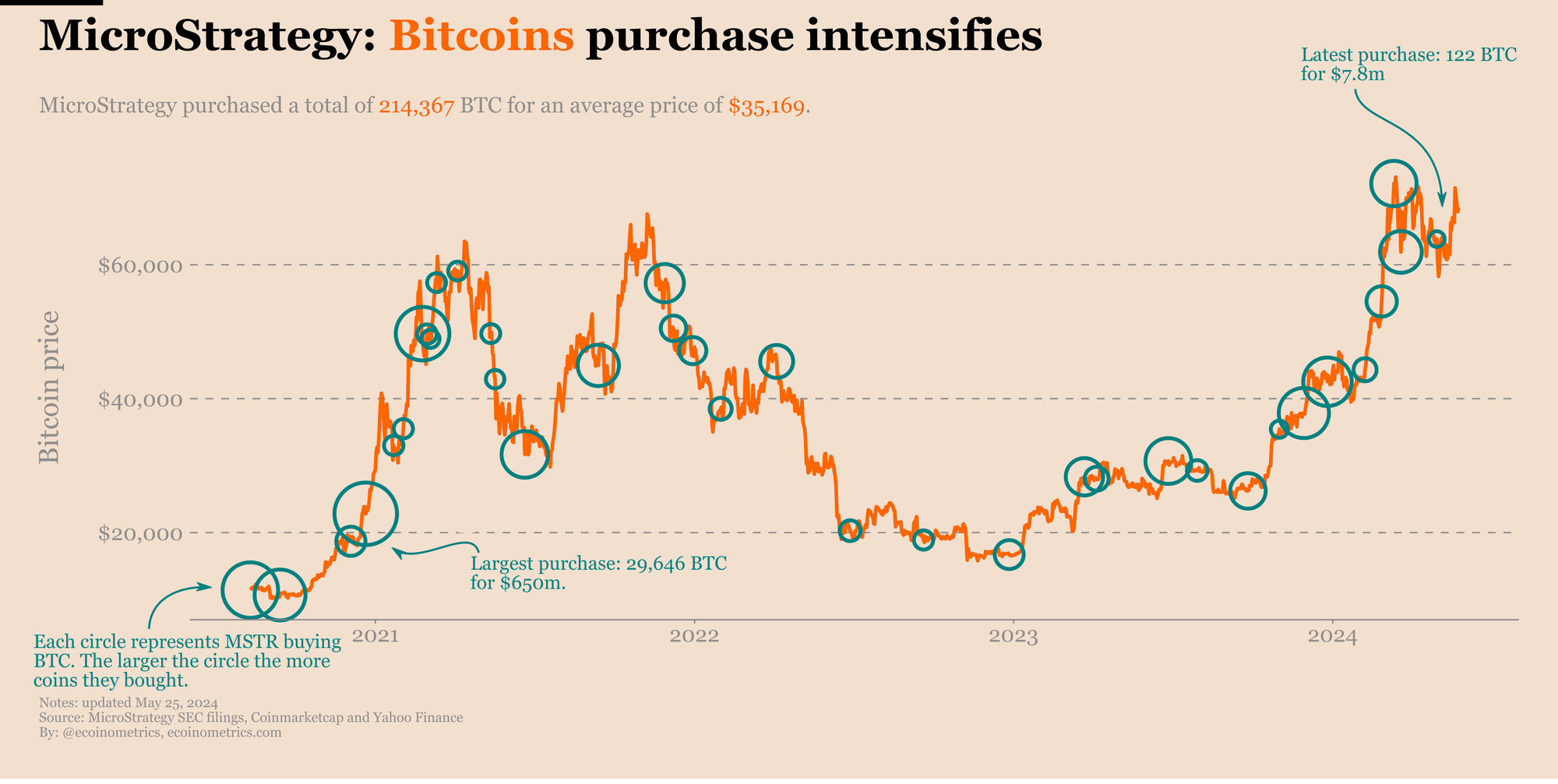

Micro Strategy Stock Vs Bitcoin A 2025 Investment Comparison

May 08, 2025

Micro Strategy Stock Vs Bitcoin A 2025 Investment Comparison

May 08, 2025 -

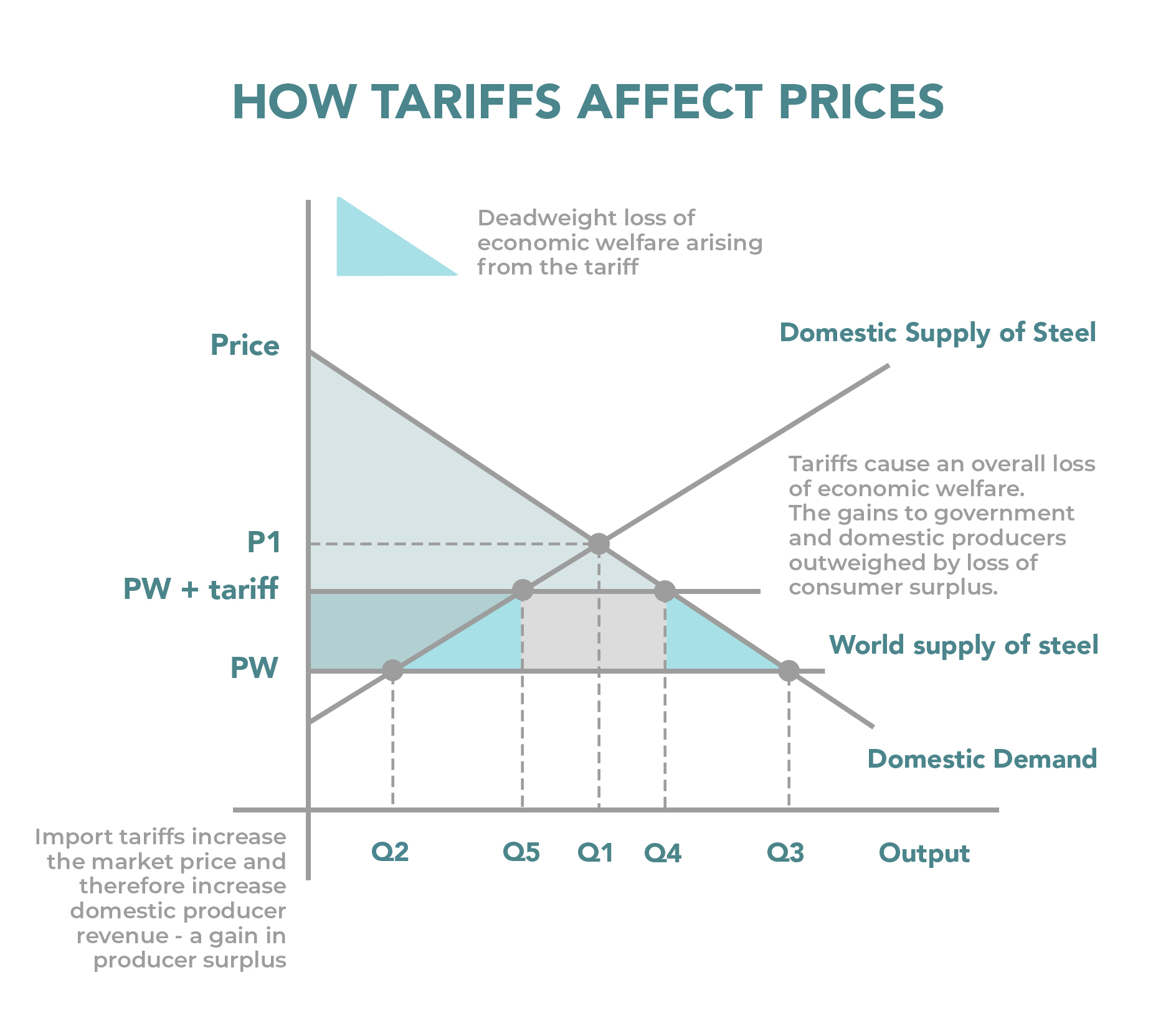

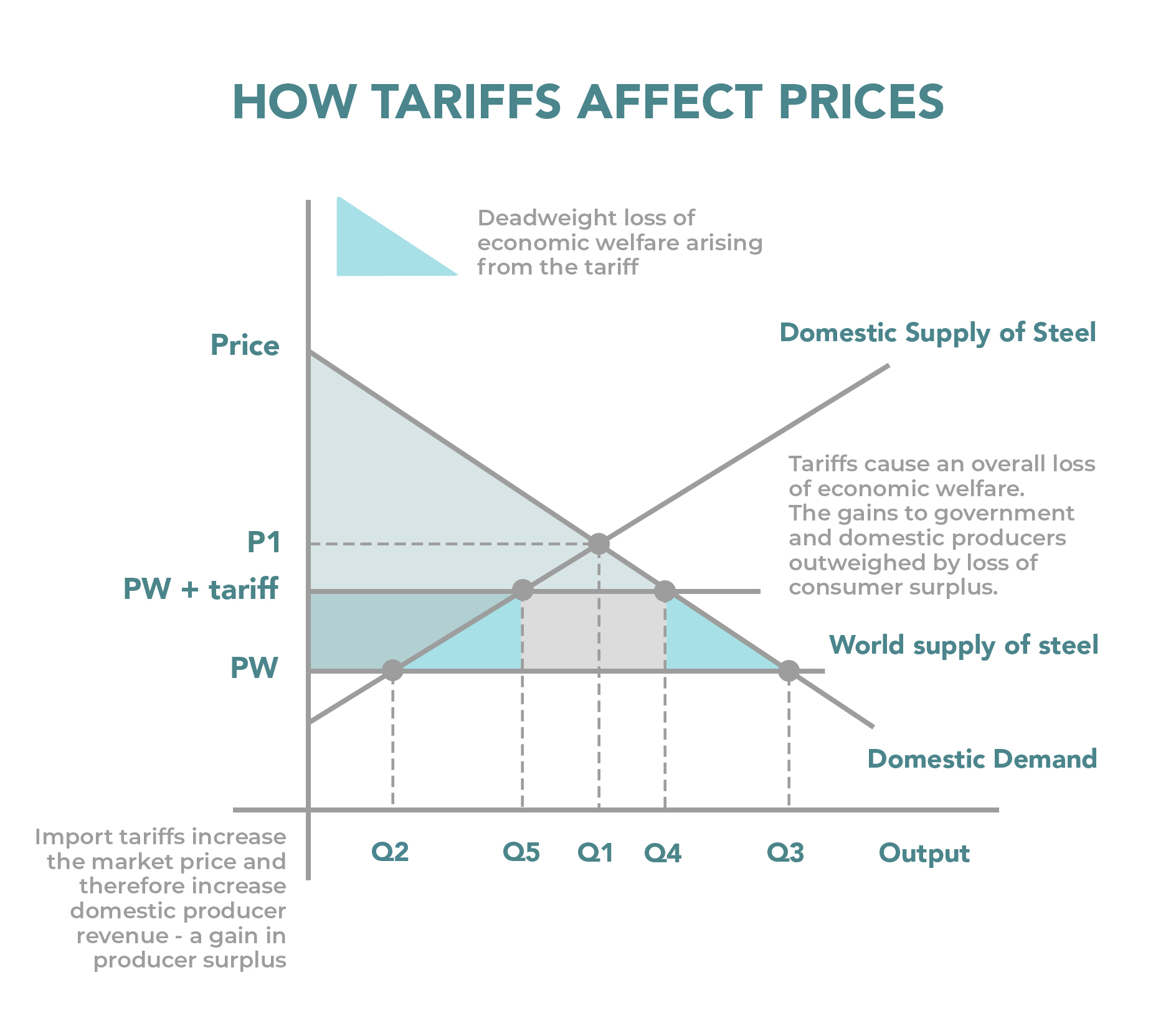

Are Us Tariffs Leading To Reduced Gm Work In Canada An Auto Analyst Weighs In

May 08, 2025

Are Us Tariffs Leading To Reduced Gm Work In Canada An Auto Analyst Weighs In

May 08, 2025 -

Exploring The Rogue Exiles Of Path Of Exile 2

May 08, 2025

Exploring The Rogue Exiles Of Path Of Exile 2

May 08, 2025