MicroStrategy Stock Vs Bitcoin: A 2025 Investment Comparison

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy, a publicly traded business analytics company, has made a bold move by embracing Bitcoin as a core part of its corporate strategy. This 2025 investment comparison requires understanding this unusual approach.

MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy's core business involves providing enterprise analytics, mobile software, and cloud-based services. However, its most significant recent development is its massive accumulation of Bitcoin. This strategy reflects a belief in Bitcoin's long-term value and potential as a store of value.

- Size of Holdings: As of [Insert Latest Data - find the most up-to-date number of Bitcoins held by MicroStrategy], MicroStrategy holds a substantial amount of Bitcoin, making it one of the largest corporate holders of the cryptocurrency.

- Average Purchase Price: MicroStrategy's average purchase price of Bitcoin has varied over time, impacting its overall profit or loss depending on market fluctuations. (Insert data on average purchase price if available).

- Balance Sheet Impact: The significant Bitcoin holdings have had a notable impact on MicroStrategy's balance sheet, leading to both appreciation and depreciation depending on Bitcoin's price performance. This makes understanding Bitcoin's price trajectory crucial for assessing MicroStrategy stock performance. This is a key factor in our MicroStrategy Stock vs Bitcoin comparison for a 2025 investment.

Keywords: MicroStrategy Bitcoin, Bitcoin Investment Strategy, MicroStrategy Business Model, Balance Sheet Impact.

Risks and Rewards of Investing in MicroStrategy Stock

Investing in MicroStrategy stock presents a unique risk-reward profile. While it offers exposure to Bitcoin's growth potential, it also amplifies the inherent volatility associated with the cryptocurrency market.

- Key Risks:

- Market Volatility: The price of MicroStrategy stock is heavily influenced by the price of Bitcoin, making it highly susceptible to market fluctuations.

- Bitcoin Price Fluctuations: Significant drops in Bitcoin's price directly impact MicroStrategy's balance sheet and its stock price.

- Regulatory Uncertainty: Changes in regulations surrounding Bitcoin could significantly affect MicroStrategy's business and its stock valuation.

- Potential Rewards:

- Bitcoin Price Appreciation: If the price of Bitcoin increases, MicroStrategy's Bitcoin holdings will appreciate, potentially boosting its stock price.

- Potential Dividends (if applicable): Depending on MicroStrategy's financial performance and board decisions, there might be potential for dividends.

- Growth Potential: MicroStrategy's core business still has growth potential, independent of its Bitcoin holdings, although this is less prominent than its Bitcoin exposure.

Keywords: MicroStrategy Stock Risk, MicroStrategy Stock Reward, Investment Risk, Market Volatility.

Bitcoin's Potential in 2025: A Long-Term Perspective

Bitcoin's future remains a topic of considerable debate, but understanding its technological underpinnings and adoption rate is crucial for any 2025 investment comparison.

Bitcoin's Technological Advantages and Adoption

Bitcoin's decentralized nature, secure blockchain technology, and limited supply are key factors driving its potential long-term growth.

- Institutional Adoption: Increasing numbers of institutional investors are allocating a portion of their portfolios to Bitcoin, signifying growing acceptance and legitimacy.

- Lightning Network Development: The Lightning Network aims to improve Bitcoin's scalability and transaction speed, addressing some of its current limitations.

- Regulatory Developments: While regulatory clarity remains a challenge, ongoing discussions and evolving regulatory frameworks across jurisdictions are shaping Bitcoin's future.

Keywords: Bitcoin Technology, Bitcoin Adoption, Decentralized Finance, Cryptocurrency, Digital Asset.

Predicting Bitcoin's Price in 2025: Factors to Consider

Predicting Bitcoin's price in 2025 is inherently speculative. However, several factors could significantly influence its trajectory:

- Technological Advancements: Further development of the Lightning Network and other scaling solutions could boost Bitcoin's adoption and utility.

- Regulatory Changes: Clearer and more favorable regulatory frameworks could increase institutional investment and mainstream adoption.

- Macroeconomic Conditions: Global economic factors, such as inflation and interest rates, can significantly impact investor sentiment towards Bitcoin.

- Market Sentiment: Overall market sentiment and investor confidence will play a crucial role in driving price movements.

It's crucial to remember that any Bitcoin price prediction is inherently uncertain. Both bullish and bearish scenarios are possible. This uncertainty is a critical consideration in our MicroStrategy Stock vs Bitcoin analysis.

Keywords: Bitcoin Price Prediction, Bitcoin Market Analysis, Crypto Market Forecast, Investment Forecasting.

MicroStrategy Stock vs. Bitcoin: A Direct Comparison for 2025

Let's directly compare MicroStrategy stock and Bitcoin as potential 2025 investments.

Comparing Risk Profiles

Both investments carry significant risk, but their risk profiles differ considerably.

| Investment | Volatility | Market Risk | Regulatory Risk | Operational Risk |

|---|---|---|---|---|

| MicroStrategy Stock | High | High | High | Moderate |

| Bitcoin | Very High | Very High | High | Low |

These are generalizations and the specific risks will vary based on several factors.

Keywords: Investment Risk Comparison, Volatility Comparison, Risk Tolerance.

Diversification and Portfolio Considerations

Both MicroStrategy stock and Bitcoin can play a role in a diversified portfolio, but their inclusion depends on your risk tolerance and investment goals.

- Conservative Investors: Might avoid both assets due to their high volatility.

- Moderate Investors: Could consider a small allocation to either asset as part of a broader, diversified portfolio.

- Aggressive Investors: Might allocate a larger portion of their portfolio to Bitcoin or MicroStrategy stock, understanding the increased risk.

Keywords: Portfolio Diversification, Asset Allocation, Investment Strategy, Risk Management.

Conclusion: Making Informed Decisions about MicroStrategy Stock and Bitcoin

Investing in either MicroStrategy stock or Bitcoin involves significant risk and requires careful consideration. While both offer potential for substantial gains, the volatility inherent in both assets necessitates a thorough understanding of the market and your own risk tolerance. MicroStrategy stock offers indirect exposure to Bitcoin’s price movements, while a direct Bitcoin investment offers higher risk and higher potential returns. Remember to conduct extensive research and consult with a financial advisor before making any investment decisions concerning MicroStrategy Stock, Bitcoin, or any other 2025 investment opportunity. Remember to assess your risk tolerance carefully before committing your capital. Understanding the nuances of both MicroStrategy Stock and Bitcoin is vital for navigating the 2025 investment landscape successfully.

Featured Posts

-

Kjoreforhold I Sor Norges Fjellomrader Tips Og Rad For Vinteren

May 08, 2025

Kjoreforhold I Sor Norges Fjellomrader Tips Og Rad For Vinteren

May 08, 2025 -

Is Rogue The X Mens Best Leader Yet

May 08, 2025

Is Rogue The X Mens Best Leader Yet

May 08, 2025 -

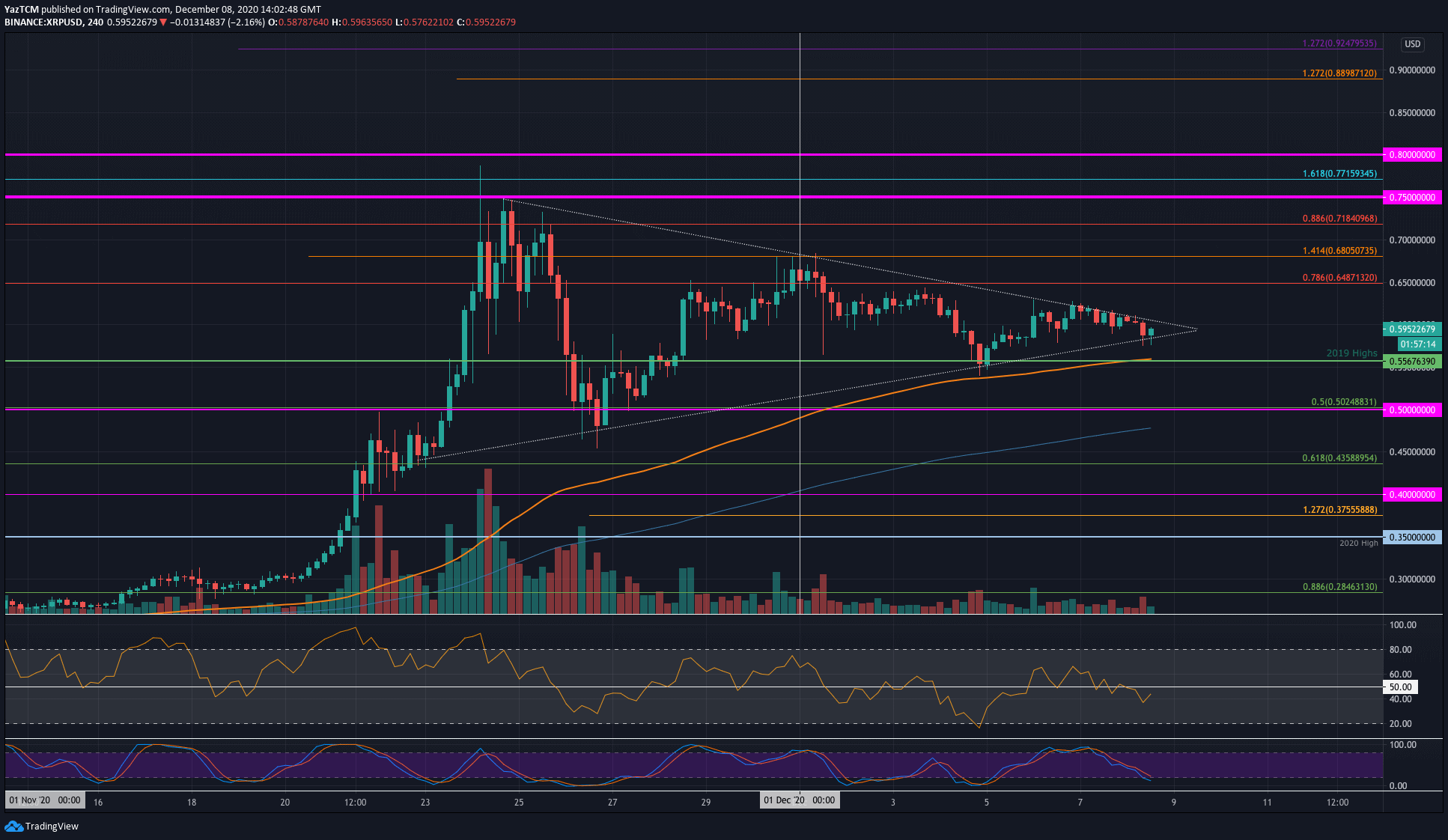

Xrp Breakout Analysis Of Ripples Potential To Reach 3 40

May 08, 2025

Xrp Breakout Analysis Of Ripples Potential To Reach 3 40

May 08, 2025 -

Made In Gujranwala Exhibition A Success Celebrated By Sufian And Gcci

May 08, 2025

Made In Gujranwala Exhibition A Success Celebrated By Sufian And Gcci

May 08, 2025 -

Lotto 6aus49 Ergebnisse Mittwoch 09 04 2025

May 08, 2025

Lotto 6aus49 Ergebnisse Mittwoch 09 04 2025

May 08, 2025