China's Canola Shift: New Sources After Canada Dispute

Table of Contents

The Impact of the Canada-China Canola Dispute

The Canada-China canola dispute, which began in 2019, significantly altered the landscape of global canola trade. China, once the largest importer of Canadian canola, imposed restrictions and tariffs on Canadian shipments, citing concerns about pest infestations and the presence of unauthorized genetically modified organisms (GMOs). Before the dispute, Canada supplied approximately 40% of China's canola imports, amounting to billions of dollars in annual trade. This abrupt disruption had severe economic consequences for both countries.

- Accusations against Canadian Canola: Chinese authorities alleged the presence of harmful pests and unapproved GMOs in Canadian canola shipments, leading to investigations and subsequent trade restrictions.

- Tariffs and Trade Restrictions: China imposed hefty tariffs and import restrictions, effectively barring most Canadian canola from its market.

- Losses for Canadian Farmers: Canadian farmers experienced substantial losses due to reduced exports and decreased canola prices. The impact cascaded through the entire supply chain, affecting transportation, processing, and related industries.

- Impact on Chinese Vegetable Oil Production: The reduced access to Canadian canola forced China to seek alternative sources, potentially impacting the cost and availability of vegetable oil for domestic consumers.

New Canola Suppliers Stepping Up

Faced with a shortage of Canadian canola, China has actively sought alternative suppliers. Several countries have stepped in to fill the gap, although each presents its own set of advantages and challenges:

-

Australia: Australia has emerged as a major beneficiary, significantly increasing its canola exports to China. Its large-scale production and relatively close proximity offer logistical advantages.

-

Ukraine: Ukraine is another significant supplier, known for its high-quality canola production. However, geopolitical instability and logistical challenges can impact the reliability of its supply.

-

Russia: Russia also exports canola to China, but its production capacity and export capabilities are subject to fluctuations influenced by international sanctions and trade regulations.

-

Brazil: Brazil, while possessing significant agricultural potential, currently plays a smaller role in supplying canola to China, primarily due to the focus on other crops.

-

Quality and Characteristics: Canola from different regions varies slightly in its characteristics, including oil content and fatty acid profiles. China assesses these variations to determine suitability for different applications.

-

Increased Production Potential: Existing suppliers are investing heavily to increase production and meet the growing demand from China.

-

Trade Agreements and Partnerships: New trade agreements and partnerships are being forged between China and alternative canola suppliers to secure consistent and reliable supplies.

-

Geopolitical Factors: Geopolitical events and trade tensions continue to influence the reliability and stability of canola supply chains.

Australia's Expanding Role

Australia's canola industry has significantly expanded its exports to China in response to the Canada-China dispute. Australia benefits from a favorable climate and established agricultural infrastructure. However, challenges remain in terms of further expanding production capacity and securing efficient transportation routes to maintain consistent supply to China.

- Investment in Production: Australian canola producers are investing in technology and infrastructure to enhance production efficiency.

- Export Infrastructure Upgrades: Upgrades to port facilities and transportation networks are crucial to meet the growing demand from China.

- Impact on Australian Farmers: The increased demand has boosted the incomes of Australian farmers, contributing positively to the national economy.

The Future of China's Canola Market

The long-term implications of China's canola shift are far-reaching. Diversification of supply sources is likely to continue, reducing reliance on any single country and potentially enhancing market stability. However, geopolitical factors and evolving trade policies will continue to play a significant role.

- Future Demand: China's growing population and increasing demand for vegetable oil will likely drive continued high demand for canola.

- New Trade Agreements: The development of new trade agreements and partnerships will influence the flow of canola to China.

- Genetically Modified Canola: The use of GMO canola in China is a complex issue with evolving regulations and consumer perceptions.

- Sustainable Farming Practices: Sustainable and environmentally friendly canola farming practices will gain importance in shaping the future of China's canola imports.

Conclusion

China's canola shift, primarily driven by the disruption of its trade relationship with Canada, has fundamentally reshaped the global canola market. The emergence of new major suppliers like Australia, coupled with the challenges faced by existing suppliers, highlights the complexities of international trade and the need for diversification. Understanding the ongoing challenges and opportunities presented by China's canola shift is crucial for all stakeholders in the global agricultural sector. To stay informed on the evolving dynamics of China's canola shift and its impact on the global agricultural landscape, continue following our updates on the latest developments in international trade and agricultural markets. Understand the ongoing challenges and opportunities presented by China's canola shift.

Featured Posts

-

Agression Sauvage A Dijon Trois Hommes Attaques Au Lac Kir

May 09, 2025

Agression Sauvage A Dijon Trois Hommes Attaques Au Lac Kir

May 09, 2025 -

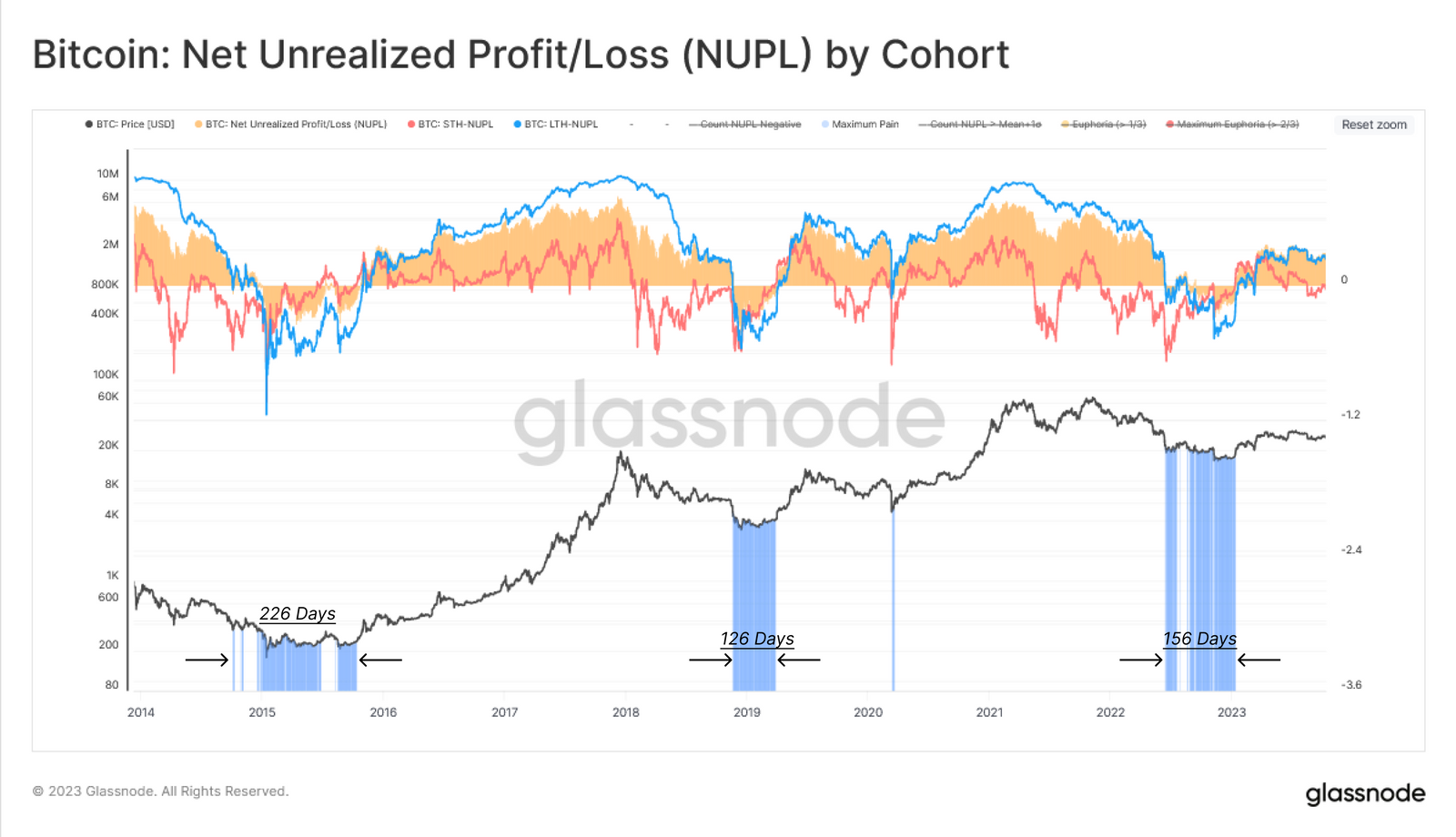

Is The Bitcoin Rebound Sustainable A Look At Market Indicators

May 09, 2025

Is The Bitcoin Rebound Sustainable A Look At Market Indicators

May 09, 2025 -

Retired Judge Deborah Taylor To Lead Nottingham Attacks Inquiry

May 09, 2025

Retired Judge Deborah Taylor To Lead Nottingham Attacks Inquiry

May 09, 2025 -

Jack Doohans No Nonsense Response At F1 75 Launch The Colapinto Question

May 09, 2025

Jack Doohans No Nonsense Response At F1 75 Launch The Colapinto Question

May 09, 2025 -

Tf Ls Commitment To Wheelchair Accessibility On The Elizabeth Line

May 09, 2025

Tf Ls Commitment To Wheelchair Accessibility On The Elizabeth Line

May 09, 2025