Choppy Trade, Flat Finish: Analyzing Today's Sensex And Nifty 50 Performance

Table of Contents

Sensex and Nifty 50 Performance Overview: A Day of Ups and Downs

The Sensex and Nifty 50 experienced a rollercoaster ride today. Let's examine the key figures:

- Sensex: Opened at 65,200, reached a high of 65,550, dipped to a low of 64,800, and finally closed at 65,250. This represents a marginal increase of 0.1% compared to yesterday's closing price.

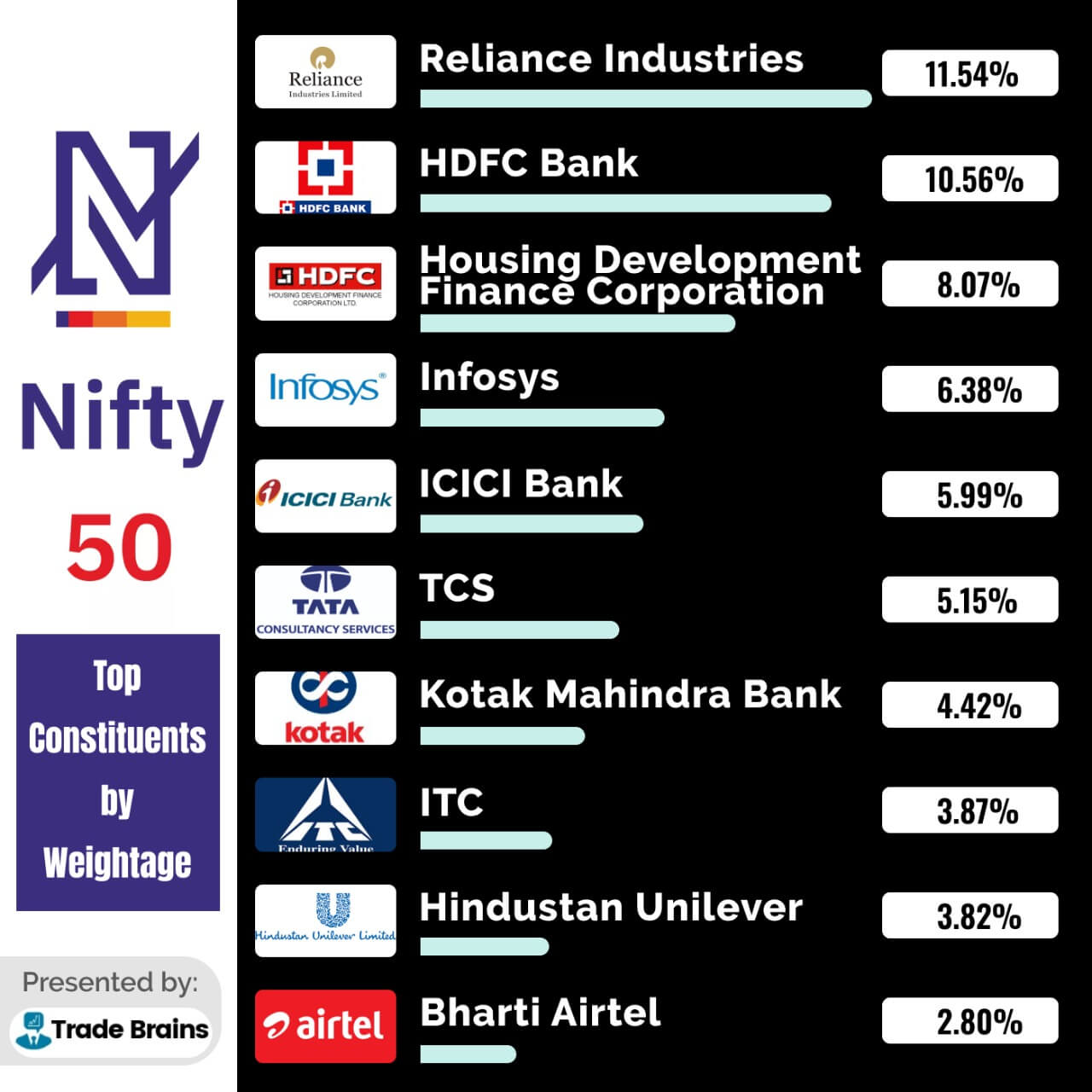

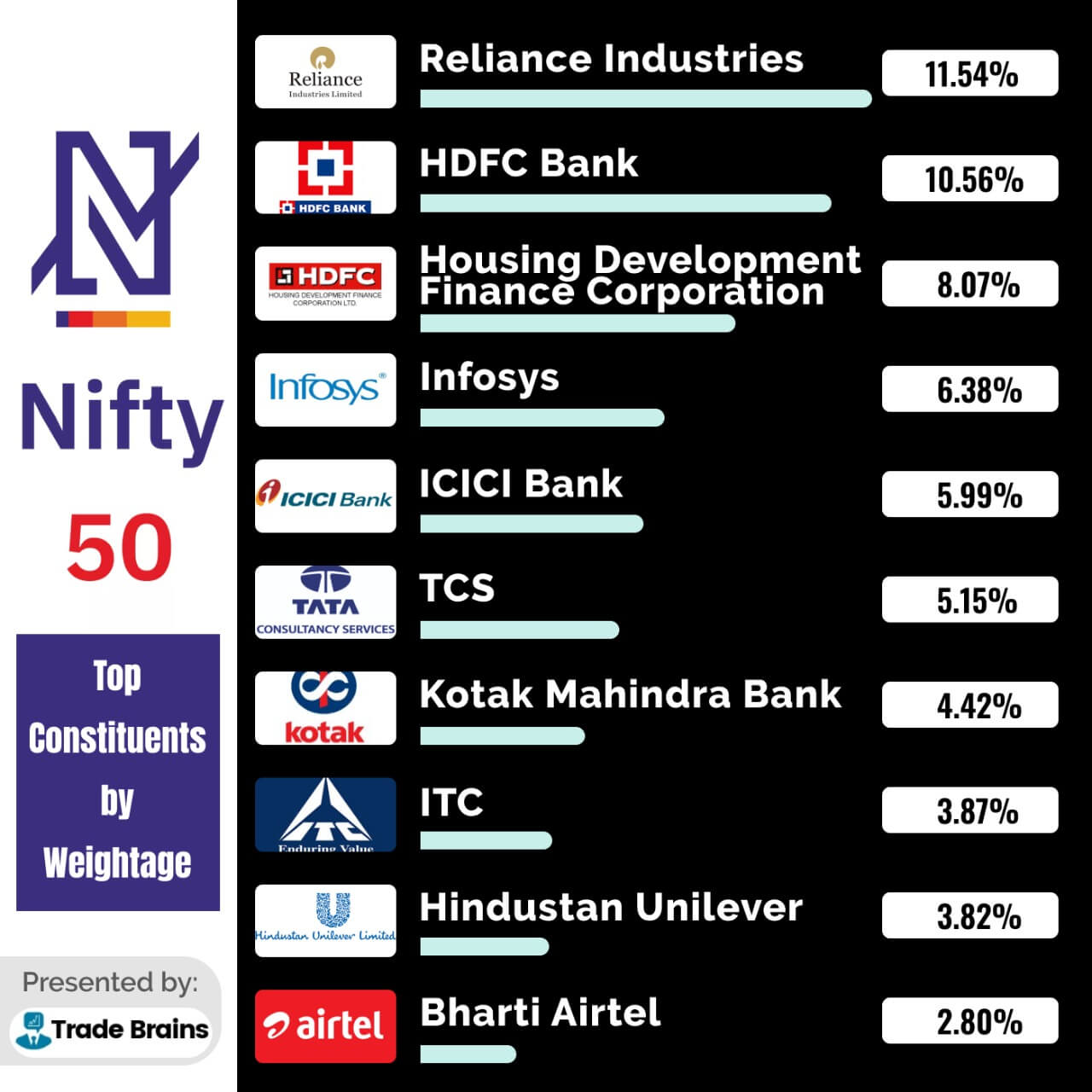

- Nifty 50: Opened at 19,400, hit a high of 19,500, saw a low of 19,350, and closed at 19,420. This represents a 0.15% gain compared to the previous day's close.

[Insert chart/graph here visually representing the Sensex and Nifty 50 price movements throughout the day.]

This seemingly small percentage change masks the significant intraday fluctuations, highlighting the choppy trade that characterized the market. Keywords: Sensex closing price, Nifty 50 closing price, daily market movement, index performance.

Unraveling the Volatility: Key Market Drivers

Several factors contributed to today's choppy trade in the Indian stock market:

- Global Market Trends: Concerns about rising US interest rates and their potential impact on global growth weighed on investor sentiment. Geopolitical uncertainties also added to the nervousness.

- Domestic Economic News: The release of mixed inflation data this morning caused some initial uncertainty. While some analysts interpreted the data positively, others remained cautious. Upcoming RBI policy announcements are also likely influencing investor behavior.

- Specific Sector Performance: The IT sector continued its recent downturn, impacting the overall index performance. Conversely, the banking sector showed signs of recovery, contributing to some upward momentum. Specific stocks within these sectors had a significant effect on index movements.

- Impact of Specific Stocks: The performance of heavyweight stocks within the Sensex and Nifty 50 significantly influenced the overall trajectory of both indices. Any major shifts in these stocks' valuations caused ripple effects throughout the market.

Understanding these interacting factors is critical to interpreting the day's market volatility. Keywords: Market drivers, global market impact, domestic market factors, sector performance, stock market influences.

Sectoral Analysis: Winners and Losers of the Day

A closer look at sectoral performance reveals a mixed bag:

- Top Performers: The banking and energy sectors emerged as winners today. Stronger-than-expected earnings reports from some key players in these sectors boosted investor confidence. Regulatory changes favoring the energy sector also played a part.

- Underperformers: The IT sector continued its slide, primarily due to concerns about slowing global technology spending. The pharmaceutical sector also underperformed due to pricing pressures.

[Insert table or chart here showing the performance of various sectors.]

This sectoral divergence highlights the importance of diversification in investment strategies. Keywords: Sectoral analysis, top performing sectors, underperforming sectors, stock market sectors, sectorial trends.

Investor Sentiment and Trading Activity: A Closer Look

Today's choppy trade reflected a mix of investor sentiment:

- Overall Sentiment: While the flat finish suggests a relatively neutral overall sentiment, the intraday volatility points to significant uncertainty and indecision amongst investors.

- Trading Volume: Trading volume was relatively high, indicating a significant level of investor participation despite the uncertainty. This suggests investors are actively monitoring the market and making decisions based on the day's events.

- Open Interest: A slight increase in open interest in futures and options contracts suggests that some investors are hedging their positions or anticipating further market volatility in the coming days.

The high trading volume combined with the intraday swings provides a clear picture of the fluctuating investor sentiment throughout the day. Keywords: Investor sentiment, trading volume, market sentiment analysis, open interest, futures and options.

Navigating the Choppy Waters: Takeaways and Next Steps

Today's Sensex and Nifty 50 performance illustrated a classic example of a choppy trade resulting in a flat finish. The market's volatility was driven by a complex interplay of global and domestic factors, including interest rate concerns, economic data releases, and sector-specific performance. Understanding these diverse influences is crucial for effective investment decision-making. Diversification remains a key strategy in navigating these unpredictable market conditions, as does meticulous risk management.

Stay tuned for tomorrow's Sensex and Nifty 50 analysis, and continue to follow our updates for informed investment decisions. Understanding daily Sensex and Nifty 50 performance is crucial for success in the Indian stock market. [Link to subscription/follow button].

Featured Posts

-

Review St Albert Dinner Theatres Hilarious New Production

May 10, 2025

Review St Albert Dinner Theatres Hilarious New Production

May 10, 2025 -

Former Becker Sentencing Judge Heads Nottingham Attacks Investigation

May 10, 2025

Former Becker Sentencing Judge Heads Nottingham Attacks Investigation

May 10, 2025 -

Seattle Welcomes Canadian Sports Fans A Guide To Currency Exchange

May 10, 2025

Seattle Welcomes Canadian Sports Fans A Guide To Currency Exchange

May 10, 2025 -

Lab Owners Guilty Plea Faking Covid Test Results During Pandemic

May 10, 2025

Lab Owners Guilty Plea Faking Covid Test Results During Pandemic

May 10, 2025 -

U S And China Seek Trade De Escalation Analysis Of This Weeks Discussions

May 10, 2025

U S And China Seek Trade De Escalation Analysis Of This Weeks Discussions

May 10, 2025