Continued China Tariffs: Trump's 30% Duty To Persist Until Late 2025

Table of Contents

The Origin and Scope of the 30% Tariffs

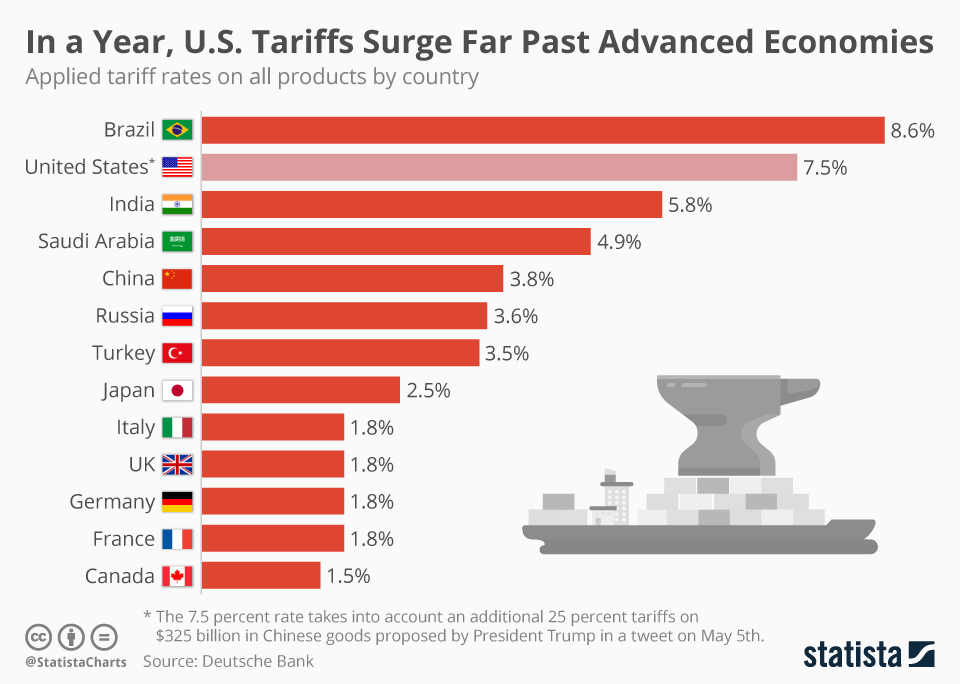

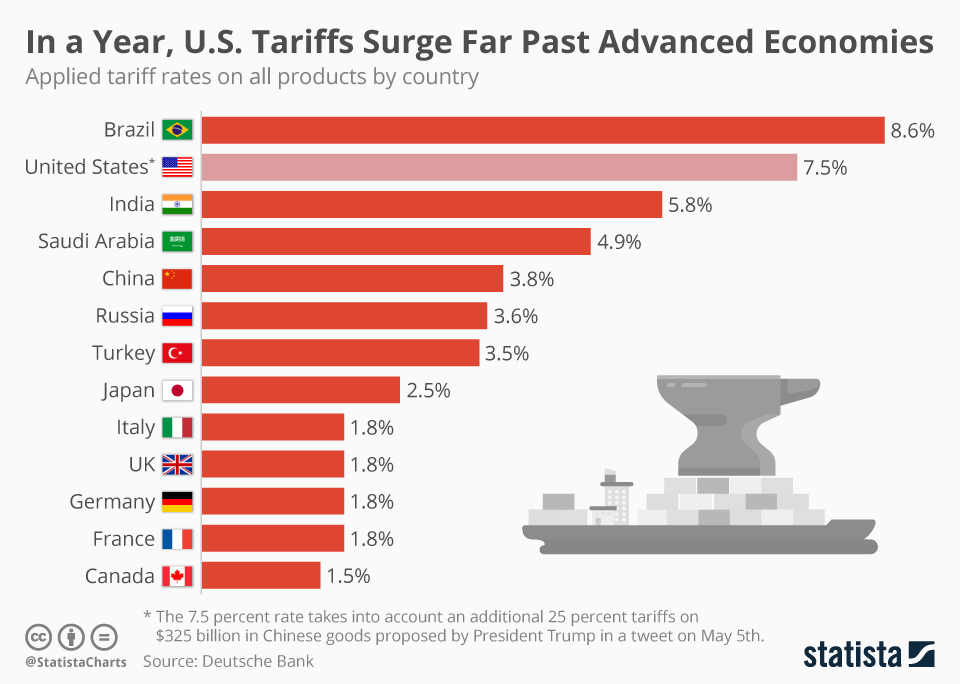

The imposition of the 30% tariffs on various Chinese goods began under the Trump administration, escalating a trade war between the two economic superpowers. The initial wave of tariffs, announced in 2018, targeted a wide range of products, aiming to pressure China to address concerns about intellectual property theft, forced technology transfer, and trade imbalances. Goods affected include a significant portion of consumer electronics, machinery, textiles, and agricultural products. Key sectors of the Chinese economy, such as manufacturing and technology, were directly targeted.

- Key Industries Impacted: Manufacturing (electronics, textiles, machinery), Technology (semiconductors, telecommunications equipment), Agriculture (soybeans, pork).

- Value of Goods Affected: Estimates place the value of goods subject to the 30% tariffs in the hundreds of billions of US dollars annually.

- Exemptions and Exclusions: While initially broad, some exemptions and exclusions were granted for specific goods or companies, often based on requests demonstrating hardship or national security concerns. However, these exceptions have been limited and subject to change.

Economic Impacts of Continued China Tariffs

The continued presence of these tariffs has profound economic consequences. US businesses face increased costs for imported goods, reducing their competitiveness in both domestic and international markets. Consumers shoulder the burden through higher prices for a wide array of products. The global supply chain has also been significantly disrupted, leading to production delays and uncertainties.

- Businesses Affected: Retailers dealing in consumer electronics, manufacturers relying on imported components, and agricultural exporters have all experienced significant impacts.

- Price Increases: Studies have shown substantial price increases for various consumer goods, ranging from clothing and electronics to furniture and appliances.

- Job Losses/Gains: While some argue tariffs protect domestic jobs, others contend that they lead to job losses due to reduced competitiveness and higher production costs. The overall impact is complex and varies across industries.

Political Ramifications and Future Outlook

The continued China tariffs carry significant political weight, both domestically and internationally. The Trump administration justified the tariffs as a necessary tool to address trade imbalances and unfair practices. However, the Biden administration, while expressing concerns about China's trade practices, has shown a more measured approach. While not immediately reversing the tariffs, the Biden administration has signaled a willingness to engage in dialogue and negotiations with China, potentially leading to adjustments or a gradual phase-out of the tariffs in the future.

- Political Pressures: Domestic businesses affected by the tariffs exert pressure for their removal. However, concerns about national security and China's trade practices create countervailing pressure to maintain or even increase tariffs.

- Statements from Key Figures: Statements from key political figures regarding the tariffs vary depending on party affiliation and economic interests. The overall political landscape surrounding the tariffs remains complex and fluid.

- Trade Negotiations: Ongoing and future trade negotiations between the US and China will play a crucial role in determining the long-term fate of these tariffs.

Strategies for Businesses to Adapt to Continued China Tariffs

Businesses must develop strategies to mitigate the impact of the continued China tariffs. Diversifying supply chains by sourcing goods from alternative countries, implementing cost-cutting measures, and investing in automation to enhance efficiency are crucial steps. Businesses should also actively explore alternative sourcing options and engage in lobbying efforts to influence policy changes.

- Adaptation Strategies: Reshoring (moving production back to the US), nearshoring (moving production to nearby countries), exploring alternative suppliers in Southeast Asia or other regions.

- Successful Adaptation Examples: Some companies have successfully mitigated tariff impacts by improving operational efficiency, automating processes, or focusing on higher-value-added products.

- Resources for Businesses: Government agencies and trade organizations offer resources and guidance to businesses navigating the complexities of trade policy and tariff implications.

Conclusion

The continued China tariffs, initially imposed under the Trump administration, are expected to remain in place until at least late 2025. This has significant economic implications, increasing costs for businesses and consumers, and disrupting global supply chains. The political ramifications are equally substantial, influencing trade relations between the US and China, and shaping domestic policy debates. Businesses must proactively adapt to this reality by diversifying their supply chains and implementing cost-saving measures. Staying informed about developments concerning continued China tariffs and engaging in informed discussions about their impact is crucial for both businesses and consumers. To further understand how to navigate these complexities, explore resources from the US Trade Representative's office and other relevant government agencies.

Featured Posts

-

Jbs Jbss 3 Withdraws From Banco Master Asset Acquisition Talks

May 18, 2025

Jbs Jbss 3 Withdraws From Banco Master Asset Acquisition Talks

May 18, 2025 -

Snl Cold Open Republican Senators Fail At High School Group Chat

May 18, 2025

Snl Cold Open Republican Senators Fail At High School Group Chat

May 18, 2025 -

Omakase In Hong Kong A Review Of Roucous Cheese Centric Menu

May 18, 2025

Omakase In Hong Kong A Review Of Roucous Cheese Centric Menu

May 18, 2025 -

Only Fans And Amanda Bynes A New Chapter After Hollywood

May 18, 2025

Only Fans And Amanda Bynes A New Chapter After Hollywood

May 18, 2025 -

Ego Nwodim And Weekend Update Hosts React To Snl Audience Outburst

May 18, 2025

Ego Nwodim And Weekend Update Hosts React To Snl Audience Outburst

May 18, 2025

Latest Posts

-

Bowen Yang And Shane Gillis The Truth Behind The Snl Exit Rumors

May 18, 2025

Bowen Yang And Shane Gillis The Truth Behind The Snl Exit Rumors

May 18, 2025 -

Bowen Yangs Revelation His Plea To Lorne Michaels About A Controversial Role

May 18, 2025

Bowen Yangs Revelation His Plea To Lorne Michaels About A Controversial Role

May 18, 2025 -

Did Bowen Yang Get Shane Gillis Fired From Snl A Look At The Controversy

May 18, 2025

Did Bowen Yang Get Shane Gillis Fired From Snl A Look At The Controversy

May 18, 2025 -

Snls Jd Vance Bowen Yang Advocates For A New Cast Member

May 18, 2025

Snls Jd Vance Bowen Yang Advocates For A New Cast Member

May 18, 2025 -

Snls Bowen Yang And The Jd Vance Role He Refused

May 18, 2025

Snls Bowen Yang And The Jd Vance Role He Refused

May 18, 2025