Corruption Case Threatens Colombia's New Pension Law

Table of Contents

Details of the Alleged Corruption Scandal

The alleged corruption within Colombia's new pension system involves accusations of bribery, embezzlement, and the misuse of public funds intended for pension contributions and infrastructure development related to the new law. Several high-ranking officials within the government and private companies involved in the implementation of the pension reform have been implicated. The investigation is ongoing, but preliminary reports suggest a complex web of illicit activities.

- Specific examples of alleged corrupt practices: Reports indicate that millions of pesos were diverted from designated pension funds through inflated contracts, ghost employees, and fraudulent accounting practices. Bribery allegedly facilitated the awarding of contracts to companies with questionable credentials.

- The estimated financial losses involved: The exact amount of misappropriated funds remains unclear, but initial estimates suggest losses in the billions of pesos. This figure could escalate as the investigation progresses.

- The potential impact on the implementation of the pension law: The scandal has already cast doubt on the integrity of the pension reform, potentially delaying its full implementation and affecting its effectiveness in providing long-term financial security for Colombian citizens.

Impact on Colombia's New Pension System

The Colombia pension law corruption scandal severely undermines public trust in the new pension system. This erosion of confidence can have severe repercussions for the long-term sustainability and effectiveness of the reform.

- Increased skepticism among citizens regarding the pension reform: Many Colombians are now questioning the fairness and transparency of the new system, leading to decreased participation and reduced contributions.

- Potential for reduced contributions to the pension system: If citizens lose faith in the system, they may be less inclined to contribute, jeopardizing the financial stability of the pension funds.

- Risk of decreased benefits for retirees: The misappropriation of funds directly impacts the resources available to pay retirement benefits, potentially reducing payouts for future retirees.

- Possible political fallout and legislative changes: The scandal is likely to lead to significant political upheaval, including calls for investigations, resignations, and potential changes to the pension law itself.

Government Response and Ongoing Investigations

The Colombian government has publicly acknowledged the allegations and initiated investigations into the Colombia pension law corruption. However, the response has been met with criticism from various sectors of society, with many demanding a more thorough and transparent investigation.

- Statements made by government officials: While officials have expressed commitment to addressing the corruption, concrete action has been slow, leading to further public distrust.

- Actions taken to address the corruption claims: Investigations are underway, with several individuals and companies facing legal scrutiny. However, the pace of these investigations is a cause for concern among many.

- Timeline for the investigations: The length of the investigations is uncertain, adding to the uncertainty surrounding the future of the pension reform.

- Potential legal repercussions for those involved: Depending on the findings of the investigation, those implicated could face significant legal penalties, including prison sentences and financial penalties.

Long-Term Implications for Colombia's Economy and Social Security

The long-term consequences of this scandal extend beyond the pension system, potentially impacting Colombia's overall economic stability and social security net.

- Potential for increased national debt: The misappropriated funds could necessitate government intervention to cover the shortfall, potentially leading to an increase in national debt.

- Impact on foreign investment: The scandal could damage Colombia's international reputation, potentially deterring foreign investment and hindering economic growth.

- Long-term effects on retirement savings and benefits: The reduced contributions and potential shortfall in funds could severely limit retirement benefits for future generations.

- Need for increased transparency and accountability in the pension system: The scandal underscores the critical need for robust oversight mechanisms, transparency in financial transactions, and greater accountability within the government and private entities involved in the management of pension funds.

Conclusion

The corruption allegations surrounding the Colombia pension law represent a significant crisis with far-reaching consequences. The scandal undermines public trust, jeopardizes the financial security of millions of Colombians, and threatens the long-term stability of the nation's social security system. The ongoing investigations and the government's response will be crucial in determining the future of the pension reform and in restoring public confidence. Stay informed about the developments in this crucial case and demand transparency and accountability in the Colombian government's handling of the Colombia pension law corruption case. Further investigation into the Colombia pension law and corruption is vital for the future financial security of Colombian citizens.

Featured Posts

-

Partido Sin Goles Atalanta Y Venezia No Se Hacen Dano

May 13, 2025

Partido Sin Goles Atalanta Y Venezia No Se Hacen Dano

May 13, 2025 -

2025 Texas Rangers Baseball Schedule Tv Listings And Blackout Restrictions

May 13, 2025

2025 Texas Rangers Baseball Schedule Tv Listings And Blackout Restrictions

May 13, 2025 -

Gauff Falls To Sabalenka In Madrid Open Final Match

May 13, 2025

Gauff Falls To Sabalenka In Madrid Open Final Match

May 13, 2025 -

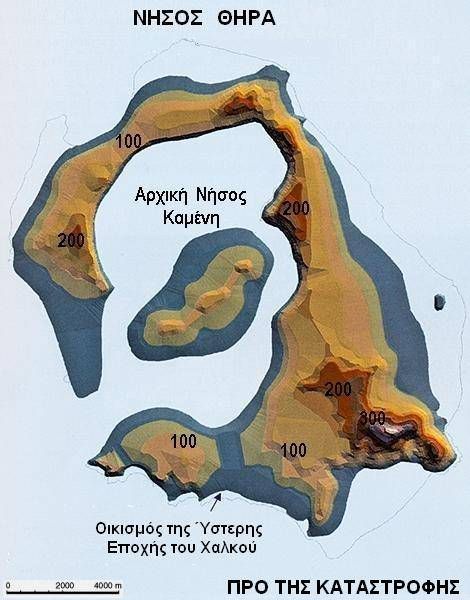

O Kataklysmos Tis Mesogeioy Aities Epiptoseis Kai Nea Anakalypseis

May 13, 2025

O Kataklysmos Tis Mesogeioy Aities Epiptoseis Kai Nea Anakalypseis

May 13, 2025 -

Remembering Sue Crane A Legacy Of Public Service In Portola Valley

May 13, 2025

Remembering Sue Crane A Legacy Of Public Service In Portola Valley

May 13, 2025

Latest Posts

-

Klarna Reports 24 Revenue Jump In Us Ipo Filing

May 14, 2025

Klarna Reports 24 Revenue Jump In Us Ipo Filing

May 14, 2025 -

500 Million Ipo E Toros Renewed Funding Drive

May 14, 2025

500 Million Ipo E Toros Renewed Funding Drive

May 14, 2025 -

Latest Company News Your Monday Morning Update 1 Am Et

May 14, 2025

Latest Company News Your Monday Morning Update 1 Am Et

May 14, 2025 -

Klarna Us Ipo 24 Revenue Increase Announced

May 14, 2025

Klarna Us Ipo 24 Revenue Increase Announced

May 14, 2025 -

E Toro Unpauses Ipo Seeks 500 Million Investment

May 14, 2025

E Toro Unpauses Ipo Seeks 500 Million Investment

May 14, 2025