Could These ETFs Profit From Uber's Autonomous Vehicle Push?

Table of Contents

Understanding Uber's Autonomous Vehicle Strategy

Uber's ambition in the autonomous vehicle market is undeniable. They've made substantial investments, forging partnerships, and developing cutting-edge technology aimed at disrupting the transportation landscape. Success in this arena could redefine urban mobility, significantly impacting ride-sharing, logistics, and even delivery services. However, the path to autonomous dominance is paved with challenges. Uber faces stiff competition from established automakers like Tesla and Waymo, as well as other tech giants actively pursuing self-driving technology.

- Uber's history with self-driving technology: Uber's journey began with acquisitions and partnerships, bolstering its technological capabilities and expertise.

- Key partnerships and collaborations: Collaborations with leading technology firms and research institutions are vital to Uber's autonomous vehicle development.

- Technological advancements made by Uber: Uber continually refines its autonomous driving systems, focusing on safety, reliability, and efficiency.

- Potential challenges and risks: Competition, regulatory hurdles, and the inherent complexity of autonomous driving present substantial obstacles.

Identifying ETFs with Exposure to Autonomous Vehicle Technology

Several ETFs offer exposure to companies involved in autonomous vehicle technology, providing investors with a diversified way to participate in this growth sector. These ETFs can be categorized into several groups:

- Technology ETFs: These ETFs often hold shares of major technology companies heavily involved in developing autonomous vehicle components, software, and infrastructure.

- Transportation ETFs: These ETFs focus on companies within the transportation industry, encompassing ride-sharing services, automotive manufacturers, and logistics providers.

- Robotics ETFs: This category includes ETFs focused on companies involved in robotics and automation technologies, crucial elements of autonomous vehicle development.

Examples of specific ETFs (Note: This is not financial advice. Always conduct your own thorough research before investing):

- (Example Technology ETF 1) - A broadly diversified technology ETF with holdings in companies developing autonomous vehicle technology.

- (Example Transportation ETF 1) - An ETF focused on companies involved in transportation and logistics, potentially including ride-sharing companies.

- (Example Robotics ETF 1) - An ETF specializing in companies creating robotic systems applicable to autonomous vehicles.

Analyzing the weighting of Uber (or related companies) within these ETFs is crucial for assessing the potential impact of Uber's autonomous vehicle success on the ETF's performance.

Analyzing the Risk and Reward of Investing in These ETFs

Investing in emerging technologies like autonomous vehicles carries inherent risks. While the potential for high returns is significant, the possibility of significant losses is equally real.

- Market volatility risks: The autonomous vehicle market is subject to significant volatility, influenced by technological advancements, regulatory changes, and investor sentiment.

- Regulatory hurdles and their impact: Government regulations regarding autonomous vehicles are still evolving, creating uncertainty that can impact investment returns.

- Technological risks and challenges: Technological setbacks, software glitches, and unforeseen safety issues can affect the development and adoption of autonomous vehicles.

- Potential for long-term growth and high returns: Despite the risks, the long-term growth potential of the autonomous vehicle market is substantial, potentially yielding significant returns for investors.

Diversification Strategies for ETF Portfolios

Diversification is essential when investing in high-growth, high-risk sectors like autonomous vehicles. By spreading investments across different ETFs and asset classes, investors can mitigate risk and improve the overall portfolio stability.

- Benefits of diversification: Diversification reduces the impact of poor performance in any single investment.

- Examples of diversification strategies: Diversify across different technology sectors, geographic regions, and investment styles.

- Importance of aligning investments with risk tolerance: Investment choices should always align with your individual risk tolerance and investment goals.

Could These ETFs Profit from Uber's Autonomous Vehicle Push? A Final Look

Uber's foray into autonomous vehicles presents a significant opportunity for growth within the transportation sector. Certain ETFs offer exposure to this potential, providing investors with a way to participate in this emerging market. However, it is vital to remember that investing in this technology involves significant risk. Market volatility, regulatory uncertainties, and technological challenges all contribute to the potential for losses. Diversification across various ETFs and asset classes is crucial for mitigating risk. By carefully considering your risk tolerance and investment goals, you can determine if investing in ETFs with exposure to autonomous vehicle technology is a suitable addition to your portfolio. Conduct thorough research, explore different ETFs for autonomous vehicle technology, and consider consulting a financial advisor before making any investment decisions.

Featured Posts

-

Crude Oil Market Report News And Insights For May 16

May 17, 2025

Crude Oil Market Report News And Insights For May 16

May 17, 2025 -

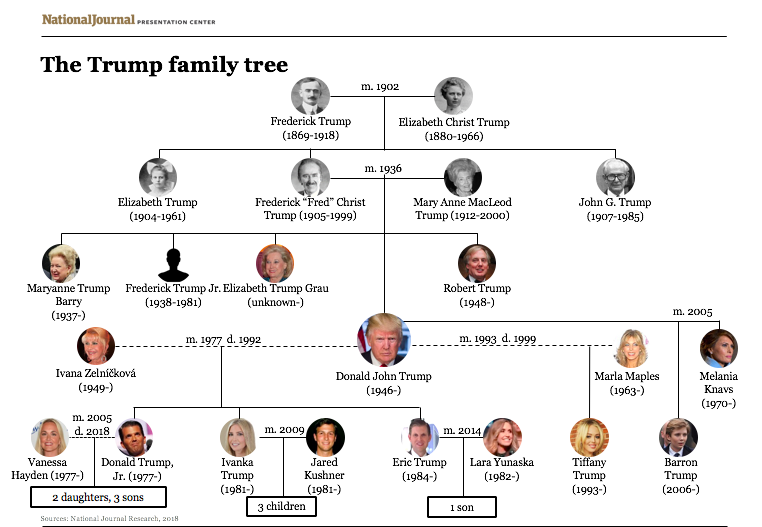

Tracing The Roots The Family Tree Of Donald Trump And His Relatives

May 17, 2025

Tracing The Roots The Family Tree Of Donald Trump And His Relatives

May 17, 2025 -

Jalen Brunsons Return Knicks Playoff Push Intensifies

May 17, 2025

Jalen Brunsons Return Knicks Playoff Push Intensifies

May 17, 2025 -

Jackbit Best Crypto Casino With Instant Withdrawals

May 17, 2025

Jackbit Best Crypto Casino With Instant Withdrawals

May 17, 2025 -

Creatine Supplements Everything You Need To Know

May 17, 2025

Creatine Supplements Everything You Need To Know

May 17, 2025

Latest Posts

-

Knicks Fans Petition Replace Lady Libertys Face With Jalen Brunson

May 17, 2025

Knicks Fans Petition Replace Lady Libertys Face With Jalen Brunson

May 17, 2025 -

Brunsons Imminent Return A Pivotal Moment For Knicks Playoff Chances

May 17, 2025

Brunsons Imminent Return A Pivotal Moment For Knicks Playoff Chances

May 17, 2025 -

Knicks News Jalen Brunson Injury Update Tyler Koleks Extended Role And Remaining Schedule Breakdown

May 17, 2025

Knicks News Jalen Brunson Injury Update Tyler Koleks Extended Role And Remaining Schedule Breakdown

May 17, 2025 -

Jalen Brunsons Ankle Knicks Suffer Overtime Loss To Lakers

May 17, 2025

Jalen Brunsons Ankle Knicks Suffer Overtime Loss To Lakers

May 17, 2025 -

Jalen Brunsons Return Knicks Playoff Push Intensifies

May 17, 2025

Jalen Brunsons Return Knicks Playoff Push Intensifies

May 17, 2025