Could XRP Reach $5 By 2025? Factors To Consider

Table of Contents

Meta Description: Explore the possibility of XRP reaching $5 by 2025. We analyze key factors influencing XRP's price, including market adoption, regulatory landscape, and technological advancements.

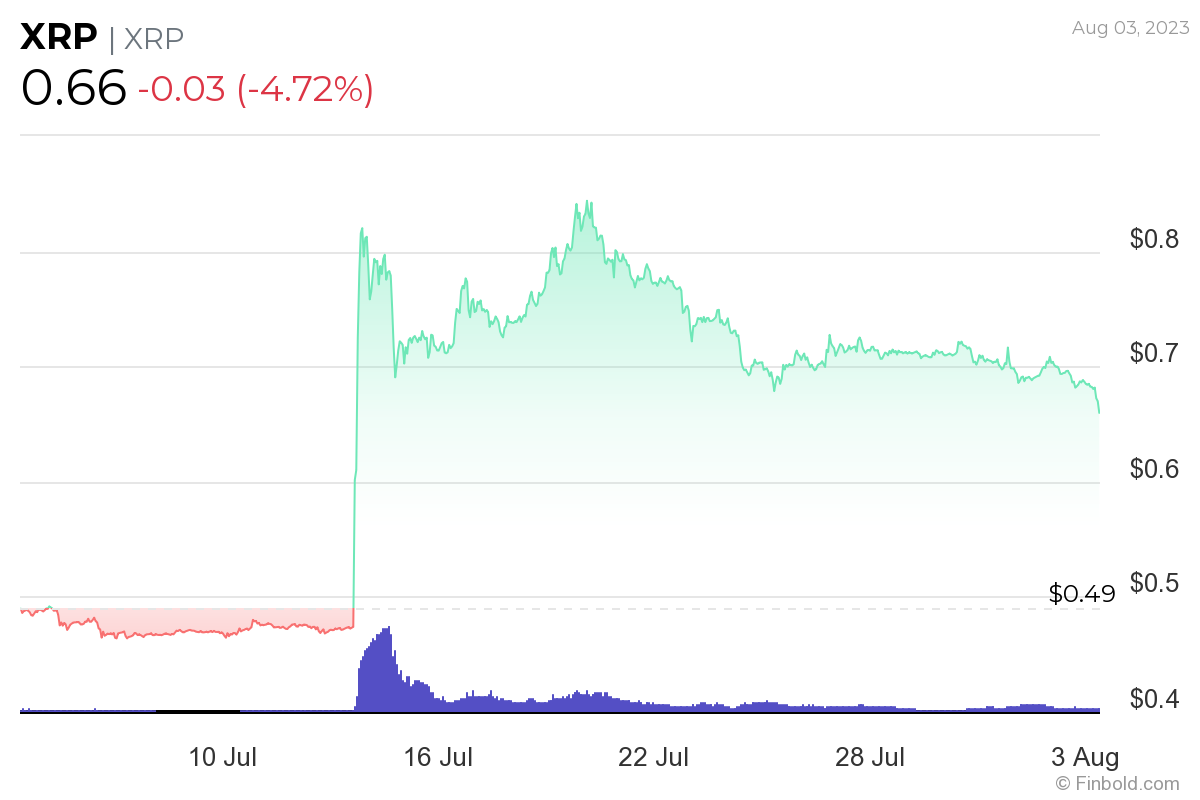

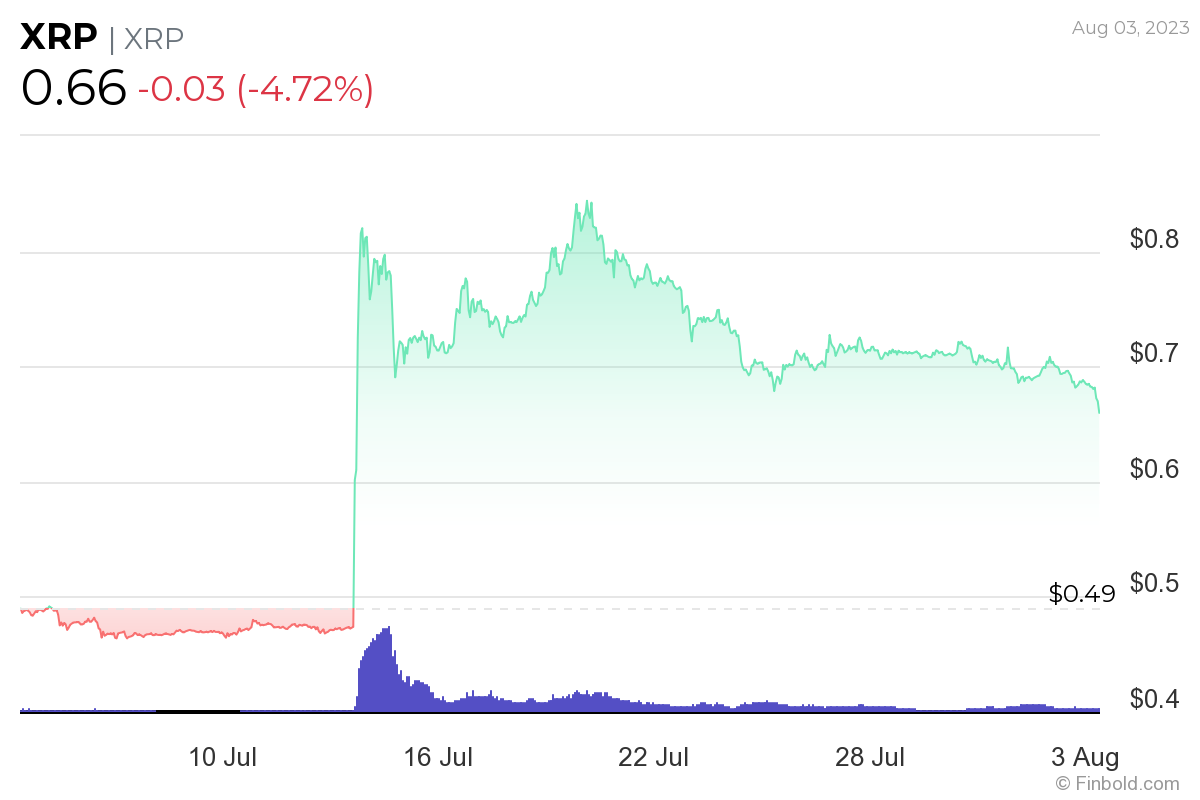

The cryptocurrency market is volatile, and predicting future prices is inherently risky. However, analyzing market trends and influencing factors can help us assess the potential of cryptocurrencies like XRP. This article will explore the possibility of XRP reaching $5 by 2025, examining crucial factors that could contribute to, or hinder, such significant growth. We will delve into the technological advancements, regulatory environment, and market adoption that could impact XRP’s price trajectory. The question, "Could XRP reach $5 by 2025?" is complex, and requires careful consideration of various interconnected elements.

XRP's Technological Advancements and Scalability

XRP's potential for reaching $5 by 2025 is intrinsically linked to its underlying technology and its capacity to scale. The XRP Ledger (XRPL) is designed for speed and efficiency, offering features that could potentially disrupt the existing financial system.

Improved Transaction Speeds and Efficiency

The XRPL boasts significantly faster transaction speeds and lower fees compared to other prominent cryptocurrencies like Bitcoin and Ethereum. This efficiency is crucial for widespread adoption, particularly in applications requiring high-throughput transactions.

- Transaction Time: XRPL transactions are typically confirmed within a few seconds, contrasting sharply with Bitcoin's minutes and Ethereum's potentially longer periods.

- Transaction Fees: XRP's low transaction fees make it a cost-effective solution for various applications, especially for smaller, high-volume transactions.

- Scalability Enhancements: Ongoing development efforts are focused on further improving XRPL's scalability, aiming to handle even larger transaction volumes in the future. These improvements are crucial for supporting mass adoption and potentially contributing to price appreciation.

Use Cases and Integrations

Beyond its speed and efficiency, the increasing number of use cases and integrations for XRP is driving its adoption. Its primary use in cross-border payments is gaining traction, with several financial institutions exploring its potential for streamlining international transactions.

- RippleNet: Ripple's RippleNet network facilitates cross-border payments, leveraging XRP's speed and efficiency to reduce transaction costs and processing times.

- Financial Institution Partnerships: Several financial institutions are experimenting with and integrating XRP into their payment systems, showcasing its growing acceptance within the traditional financial sector. These partnerships are essential for increasing the legitimacy and adoption of XRP.

- Other Applications: Beyond payments, XRP's potential applications are expanding into areas such as supply chain management and decentralized finance (DeFi), offering further opportunities for growth.

The Regulatory Landscape and Legal Battles

The regulatory landscape and the ongoing legal battles surrounding XRP significantly impact its price potential. The outcome of the SEC lawsuit against Ripple could dramatically shift investor sentiment and market perception.

SEC Lawsuit and its Potential Impact

The SEC's lawsuit against Ripple, alleging that XRP is an unregistered security, remains a major uncertainty. The outcome will significantly influence XRP's price trajectory.

- Potential Positive Outcomes: A favorable court ruling could boost investor confidence, potentially leading to a surge in XRP's price. A clear legal framework could also facilitate wider adoption.

- Potential Negative Outcomes: An unfavorable ruling could negatively impact investor sentiment and potentially lead to price declines. Regulatory uncertainty could also hinder further adoption and development.

- Uncertainty: The ongoing nature of the lawsuit creates significant uncertainty, impacting investor decisions and XRP's price volatility.

Global Regulatory Scrutiny of Cryptocurrencies

The evolving regulatory landscape for cryptocurrencies globally presents both challenges and opportunities for XRP. Increasing clarity and standardization could benefit XRP's adoption, while overly restrictive regulations could hinder growth.

- US Regulations: The US regulatory environment remains relatively unclear, posing a significant challenge for the cryptocurrency market. Clearer regulations could provide greater certainty for investors.

- EU Regulations: The EU is actively developing a regulatory framework for cryptocurrencies, aiming to balance innovation with consumer protection.

- Asia Regulations: Regulatory approaches in Asian markets vary widely, presenting both opportunities and challenges for XRP's adoption.

Market Adoption and Demand for XRP

The demand for XRP and its market adoption are key drivers of its price. Growing institutional interest and retail investor sentiment play crucial roles in shaping its price volatility.

Growing Institutional Interest

Increasing adoption of XRP by financial institutions signals a shift towards greater legitimacy and stability. Strategic partnerships with established players can significantly influence price trends.

- Institutional Investments: The entry of institutional investors into the XRP market can lead to price stability and potentially sustained growth.

- Strategic Partnerships: Collaborations with financial institutions can enhance XRP's credibility and expand its use cases, thereby increasing demand.

Retail Investor Sentiment and Market Speculation

Retail investor sentiment and market speculation significantly impact XRP's price volatility. Social media trends and news events can trigger rapid price fluctuations.

- Social Media Influence: Social media platforms play a significant role in shaping public opinion and driving price movements.

- News Events: Positive or negative news events can lead to substantial price swings, reflecting the market's sensitivity to information.

- Speculative Trading: Speculative trading can amplify price volatility, creating both opportunities and risks for investors.

Conclusion

Reaching a $5 XRP price by 2025 is a significant target, contingent upon several crucial factors. The success of Ripple’s legal battles, widespread institutional adoption, further technological development, and a generally positive regulatory environment are essential for such a price increase. However, the cryptocurrency market remains unpredictable, and significant risks exist.

While predicting the future of XRP is challenging, understanding the influencing factors is crucial for informed investment decisions. Continue researching XRP and stay updated on its progress to make well-informed choices regarding this volatile yet potentially lucrative cryptocurrency. Learn more about the factors influencing XRP price predictions and how to manage your investment risks effectively.

Featured Posts

-

New Tariffs Contribute To Reduced Canadian Trade Deficit Of 506 Million

May 08, 2025

New Tariffs Contribute To Reduced Canadian Trade Deficit Of 506 Million

May 08, 2025 -

Etf

May 08, 2025

Etf

May 08, 2025 -

Pnjab Pwlys Myn Ays Pyz Awr Dy Ays Pyz Ke Bre Pymane Pr Tbadlwn Ka Aelan

May 08, 2025

Pnjab Pwlys Myn Ays Pyz Awr Dy Ays Pyz Ke Bre Pymane Pr Tbadlwn Ka Aelan

May 08, 2025 -

Market Analysis Bitcoin Rally Predicted May 6 Chart Review

May 08, 2025

Market Analysis Bitcoin Rally Predicted May 6 Chart Review

May 08, 2025 -

Potential Loss Of Benefits Dwps Universal Credit Overhaul Explained

May 08, 2025

Potential Loss Of Benefits Dwps Universal Credit Overhaul Explained

May 08, 2025