Crack The Code: 5 Do's And Don'ts To Land A Job In The Private Credit Industry

Table of Contents

Do's: Maximize Your Chances in the Private Credit Industry Job Hunt

1. Network Strategically

Building a strong network is paramount in the private credit industry. Private credit networking opportunities abound, and leveraging them effectively can significantly boost your chances.

- Attend industry events: Conferences, workshops, and seminars offer invaluable opportunities to connect with professionals and learn about emerging trends in private debt.

- Harness the power of LinkedIn: Actively engage on LinkedIn, connect with professionals in private credit, join relevant groups, and participate in discussions. This is a crucial aspect of private credit networking.

- Informational interviews: Reach out to individuals working in private credit for informational interviews. These conversations provide invaluable insights into the industry and can lead to unexpected job opportunities.

- Build relationships with recruiters: Cultivate relationships with recruiters specializing in finance and private credit placements. They often have exclusive access to unadvertised positions.

2. Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count!

- Highlight relevant skills: Emphasize skills crucial for private credit roles, such as financial modeling, credit analysis, underwriting, and due diligence. A strong private credit resume will clearly showcase these.

- Quantify your achievements: Instead of simply stating responsibilities, quantify your accomplishments. For example, "increased portfolio returns by 15%" is far more impactful than "managed portfolio returns."

- Customize for each application: Never submit a generic resume or cover letter. Each application should be tailored to the specific requirements and culture of the target company. This is especially critical for a credit analyst resume or underwriting resume.

3. Master the Interview Process

The interview stage is your chance to shine.

- Practice behavioral questions: Utilize the STAR method (Situation, Task, Action, Result) to structure your responses to behavioral interview questions. This demonstrates your problem-solving skills.

- Thorough research: Research the company, its investment strategies, and the interviewers. This demonstrates genuine interest and preparation. A private credit interview requires this level of diligence.

- Prepare insightful questions: Asking thoughtful questions demonstrates your engagement and interest.

- Demonstrate your understanding: Showcase your knowledge of private credit strategies, market trends, and current economic conditions.

4. Showcase Your Financial Acumen

Demonstrate your expertise in financial analysis and modeling.

- Master financial modeling: Develop proficiency in financial modeling using Excel or specialized software. Financial modeling private credit is a key skill.

- Credit risk assessment: Showcase your understanding of credit risk assessment methodologies and your ability to evaluate the creditworthiness of borrowers. Credit risk assessment is crucial in this field.

- Financial statement analysis: Demonstrate your expertise in analyzing financial statements to assess the financial health of companies. Financial statement analysis informs key investment decisions.

- Stay updated: Keep abreast of market trends, regulatory changes, and industry news.

5. Obtain Relevant Certifications

Certifications enhance your credibility and demonstrate your commitment to professional development.

- Consider certifications: CFA, CAIA, or other relevant certifications can significantly boost your resume and highlight your expertise. CFA private credit and CAIA private credit are highly regarded.

- Continuous learning: Demonstrate continuous professional development by pursuing additional training and education. Highlight any specialized knowledge in areas like distressed debt or mezzanine financing.

Don'ts: Avoid These Common Mistakes When Applying for Private Credit Jobs

1. A Generic Approach

- Avoid generic applications: Never use a generic resume and cover letter. Tailoring each application is essential. Don't underestimate the value of a personalized approach.

- Network actively: Don't underestimate the power of networking. Actively build relationships and attend industry events.

2. Lack of Industry Knowledge

- Understand the nuances: Don't go into an interview without a thorough understanding of private credit strategies and market dynamics.

- Research thoroughly: Don't fail to research the specific firm and its investment strategy before each interview.

3. Poor Communication Skills

- Communicate clearly: Don't be unclear or hesitant in your communication. Practice and refine your communication skills.

- Develop strong communication: Demonstrate strong written and verbal communication abilities throughout the application and interview process.

4. Ignoring the Details

- Proofread carefully: Don't overlook small details like typos and formatting errors in your application materials.

- Maintain a strong online presence: Ensure your online presence reflects professionalism and expertise.

5. Lack of Follow-Up

- Follow up after interviews: Always send a thank-you note after each interview.

- Be proactive: Don't be passive in your job search. Actively pursue opportunities and network consistently.

Conclusion

Securing a job in the private credit industry requires a strategic and proactive approach. By following these "do's" and avoiding the "don'ts," you'll significantly enhance your chances of landing your dream role. Remember the importance of networking, tailoring your applications, mastering the interview process, showcasing your financial acumen, and pursuing relevant certifications. By applying this advice, you can significantly increase your chances of cracking the code and securing a fulfilling career in the dynamic private credit industry. Start your job search today!

Featured Posts

-

Professional Hair And Tattoo Artists Inspired By Ariana Grandes Makeover

Apr 27, 2025

Professional Hair And Tattoo Artists Inspired By Ariana Grandes Makeover

Apr 27, 2025 -

Ariana Grandes Hair And Tattoo Transformation A Professional Analysis

Apr 27, 2025

Ariana Grandes Hair And Tattoo Transformation A Professional Analysis

Apr 27, 2025 -

Controversy Erupts Hhs Taps Anti Vaccine Advocate To Investigate Debunked Autism Vaccine Claims

Apr 27, 2025

Controversy Erupts Hhs Taps Anti Vaccine Advocate To Investigate Debunked Autism Vaccine Claims

Apr 27, 2025 -

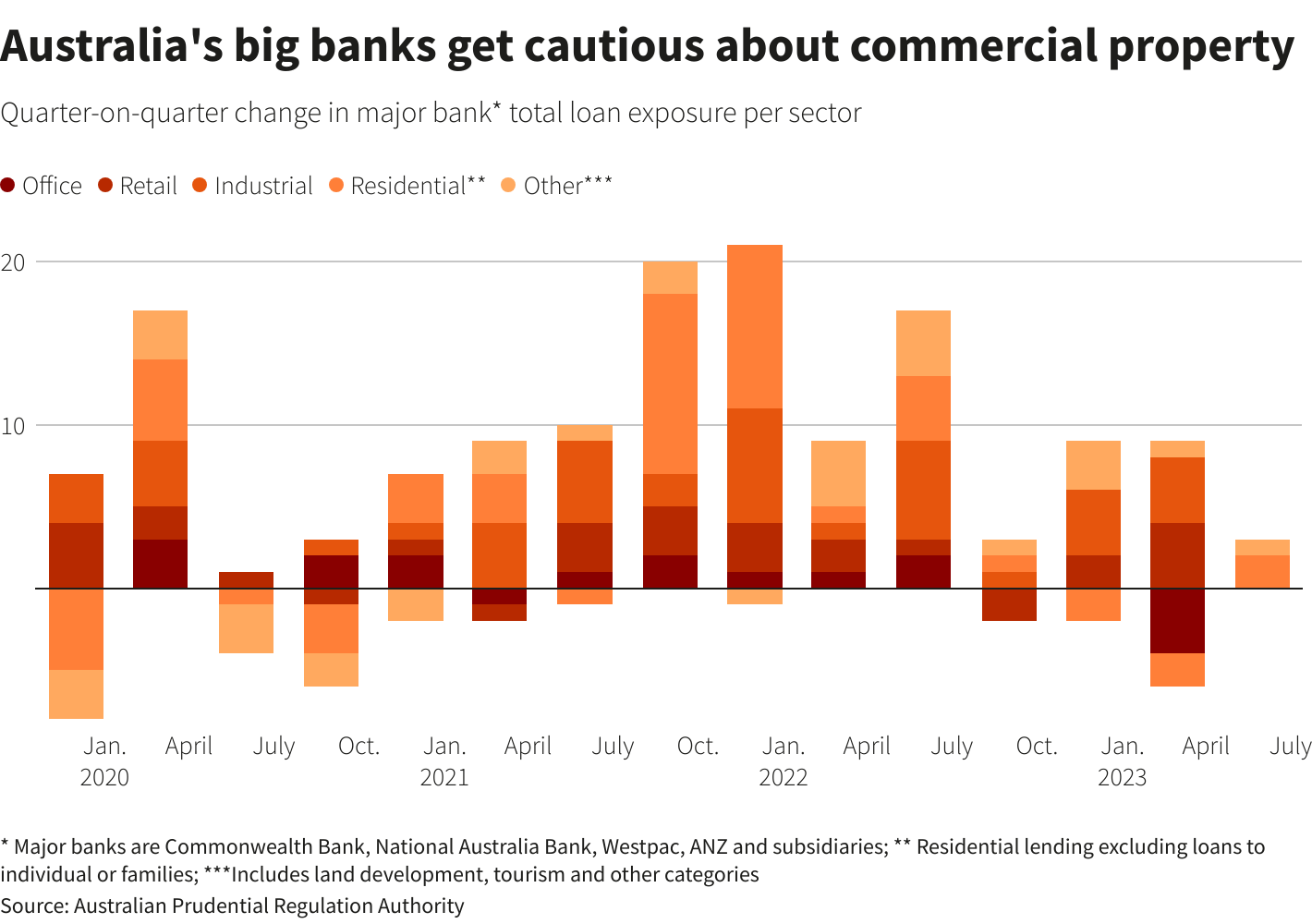

High Stock Market Valuations Bof As Arguments For Investor Calm

Apr 27, 2025

High Stock Market Valuations Bof As Arguments For Investor Calm

Apr 27, 2025 -

Trumps Tariff Threat Unforeseen Posthaste Job Losses In Canadas Auto Industry

Apr 27, 2025

Trumps Tariff Threat Unforeseen Posthaste Job Losses In Canadas Auto Industry

Apr 27, 2025

Latest Posts

-

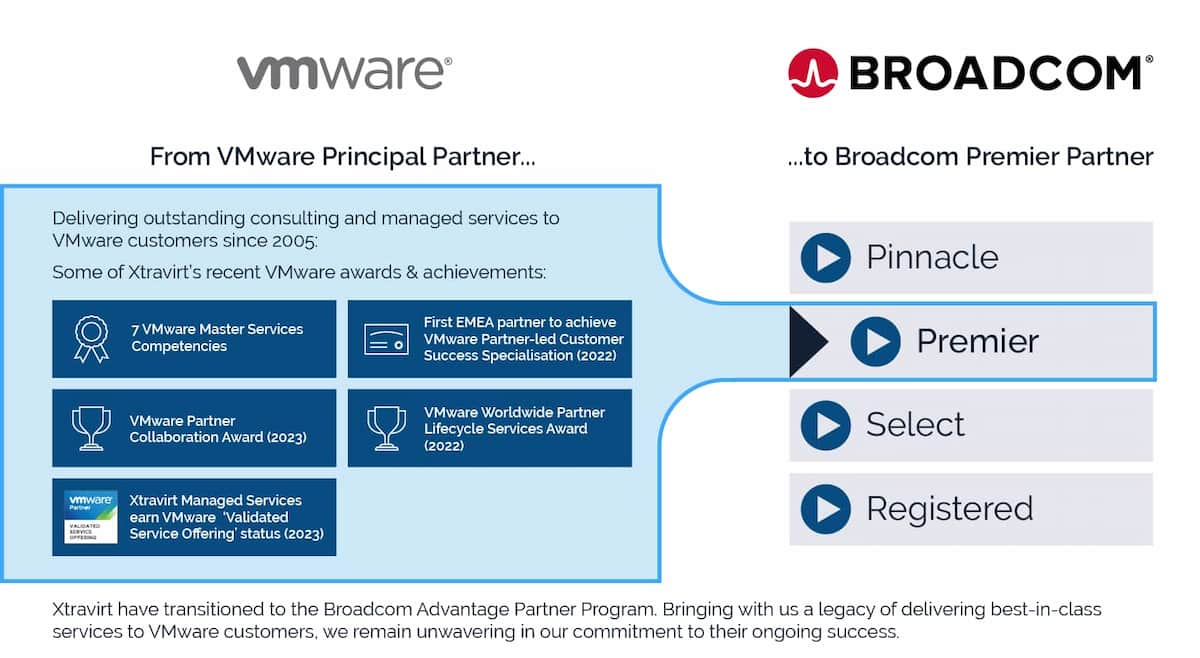

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025 -

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025 -

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025 -

Assessing The Us Economy The Immediate Effects Of A Canadian Travel Boycott

Apr 28, 2025

Assessing The Us Economy The Immediate Effects Of A Canadian Travel Boycott

Apr 28, 2025