High Stock Market Valuations: BofA's Arguments For Investor Calm

Table of Contents

Deconstructing BofA's Rationale for Investor Calm

BofA's reassuring stance on high stock market valuations is built on several key pillars. Let's examine these arguments in detail.

The Role of Low Interest Rates in Justifying High Valuations

Historically low interest rates play a significant role in justifying current stock valuations. These low rates directly influence the cost of capital for businesses and indirectly impact investor behavior.

- Lower discount rates increase the present value of future earnings: When interest rates are low, the present value of a company's future earnings is higher. This means that investors are willing to pay more for a stock today, as the future cash flows are discounted less heavily.

- Comparison of current interest rates to historical averages: Current interest rates remain significantly below historical averages, a crucial factor underpinning higher valuations. This low-cost borrowing environment allows companies to invest more and grow faster, supporting higher stock prices.

- Impact of quantitative easing (QE) on market liquidity and valuations: The implementation of QE policies by central banks has injected significant liquidity into the market, further fueling asset price appreciation, including stocks. This increased liquidity directly impacts stock valuation models and contributes to higher prices.

Long-Term Growth Prospects and Their Influence on Market Valuation

BofA's analysis emphasizes the robust long-term growth prospects of the global economy as a key justification for current high stock market valuations. The bank's economists and strategists see several factors driving this growth:

- Technological innovation and its impact on future earnings: Rapid technological advancements across various sectors are expected to drive significant future earnings growth for many companies. This potential for innovation significantly impacts long-term stock valuation models.

- Global economic recovery and its influence on corporate profits: Following a period of economic uncertainty, a global recovery is underway, resulting in increased corporate profits and boosting investor confidence. This recovery directly contributes to higher stock prices and justifies the current valuations to some extent.

- Emerging market growth and its potential contribution to overall market performance: The continued growth of emerging markets presents significant opportunities for global companies, further bolstering overall market performance and contributing to higher valuations.

Addressing the "Overvalued" Narrative: A Deeper Dive into Valuation Metrics

Many critics argue that the market is "overvalued." However, BofA counters this narrative by suggesting a more nuanced approach to valuation metrics.

- Discussion of alternative valuation metrics beyond P/E ratios (e.g., Price-to-Sales, Price-to-Book): Relying solely on Price-to-Earnings (P/E) ratios can be misleading. BofA likely suggests considering alternative metrics like Price-to-Sales and Price-to-Book ratios to gain a more comprehensive understanding of valuation.

- Analysis of sector-specific valuations to highlight discrepancies: Not all sectors are created equal. BofA's analysis likely points out that certain sectors might appear overvalued while others remain attractively priced, highlighting the importance of sector-specific analysis.

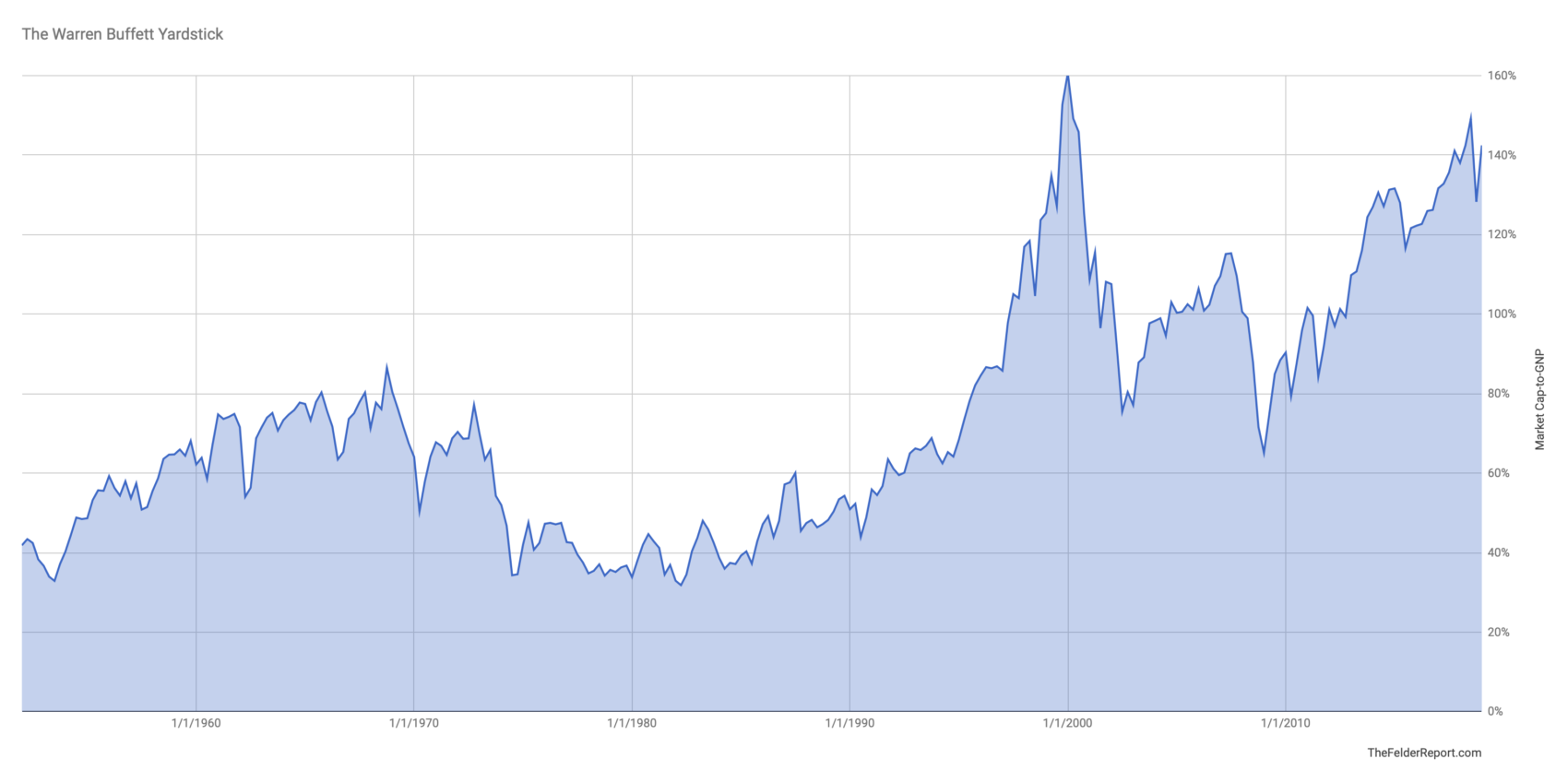

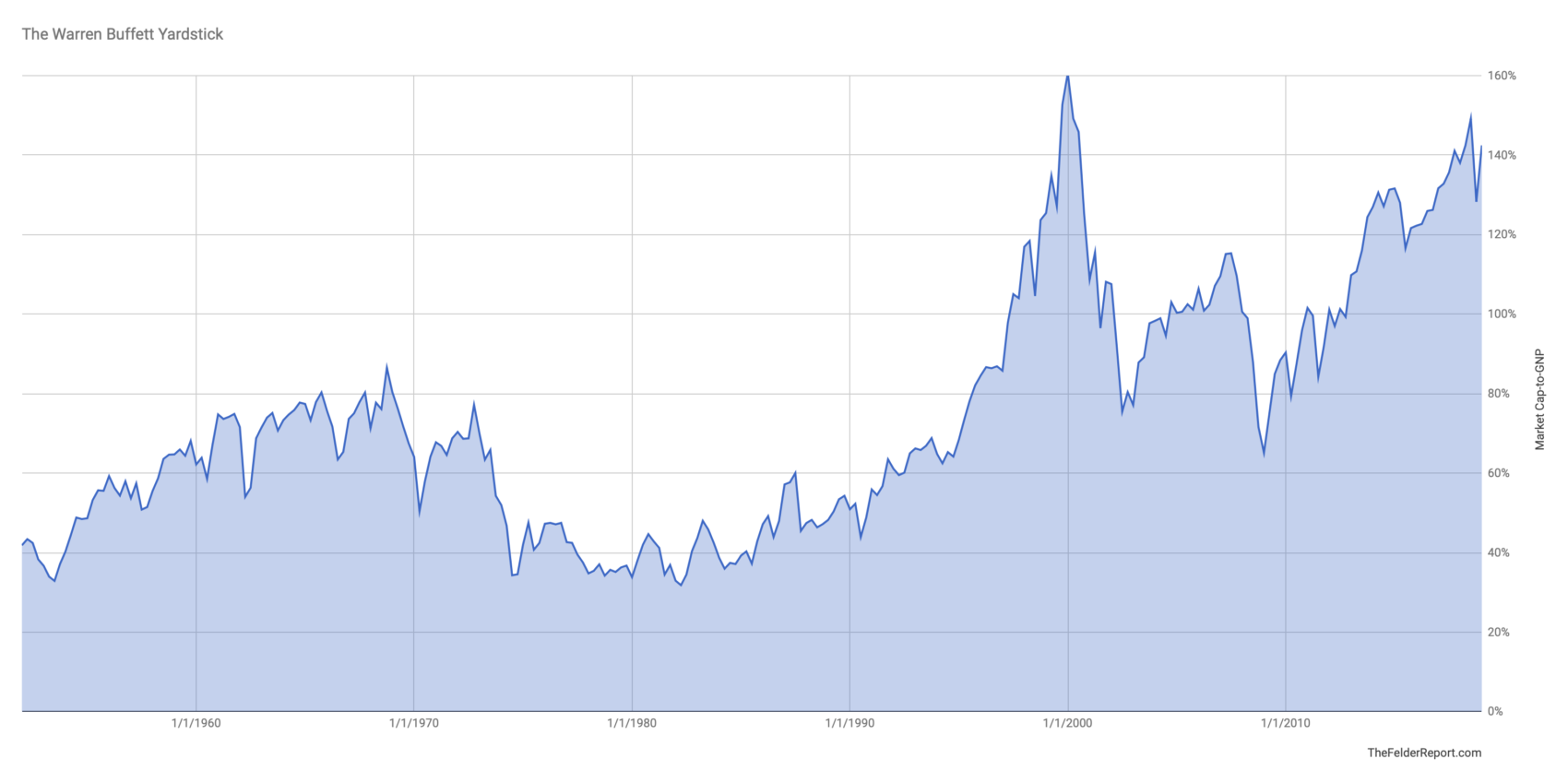

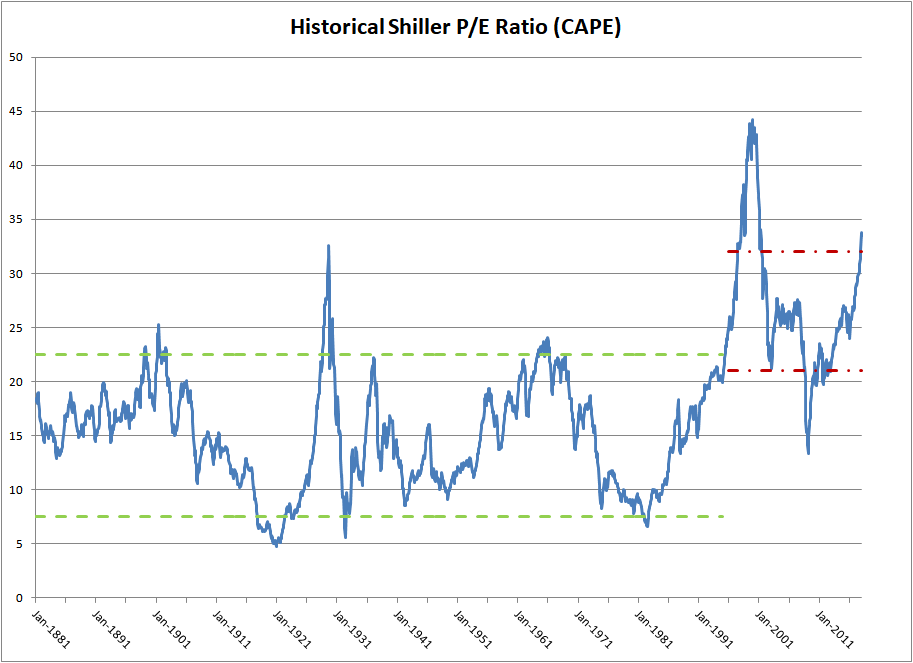

- Mention of cyclically adjusted price-to-earnings ratios (CAPE) and their implications: The CAPE ratio offers a longer-term perspective on valuation. BofA's analysis might consider CAPE ratios to provide context and counterbalance concerns about short-term market volatility.

Strategic Asset Allocation: BofA's Recommendations for Investors

Despite the seemingly high valuations, BofA doesn't advocate for a complete market pullback. Instead, they likely recommend a strategic approach to asset allocation:

- Diversification strategies across asset classes: Diversifying across various asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk and potentially benefit from different market performances.

- Importance of a long-term investment horizon: A long-term perspective is crucial for weathering market fluctuations. Short-term volatility shouldn't dictate long-term investment decisions.

- Potential for tactical adjustments based on individual risk tolerance: Investors should adjust their portfolios based on their individual risk tolerance and financial goals.

Maintaining Calm Amidst High Stock Market Valuations – A Call to Action

BofA's arguments highlight the importance of considering factors beyond simple P/E ratios when assessing high stock market valuations. Low interest rates, robust long-term growth prospects, and a careful consideration of alternative valuation metrics all contribute to a more nuanced perspective. Understanding these influences is crucial for developing a sound investment strategy. Don't let concerns about high stock market valuations paralyze your investment decisions. Carefully consider BofA's analysis and take steps today to develop a robust and informed investment strategy. Review your own portfolio, consider diversification, and if needed, seek professional financial advice to effectively manage your exposure to high stock market valuations.

Featured Posts

-

Aintree Grand National 2025 Previewing The Runners And Riders

Apr 27, 2025

Aintree Grand National 2025 Previewing The Runners And Riders

Apr 27, 2025 -

Pegula Stuns Collins In Thrilling Charleston Open Final

Apr 27, 2025

Pegula Stuns Collins In Thrilling Charleston Open Final

Apr 27, 2025 -

Understanding High Stock Market Valuations A Bof A Analysis For Investors

Apr 27, 2025

Understanding High Stock Market Valuations A Bof A Analysis For Investors

Apr 27, 2025 -

Bencic Triumphs At The Abu Dhabi Open

Apr 27, 2025

Bencic Triumphs At The Abu Dhabi Open

Apr 27, 2025 -

Pre 2025 Grand National Examining The Number Of Horse Fatalities

Apr 27, 2025

Pre 2025 Grand National Examining The Number Of Horse Fatalities

Apr 27, 2025

Latest Posts

-

Starbucks Union Spurns Companys Guaranteed Raise Proposal

Apr 28, 2025

Starbucks Union Spurns Companys Guaranteed Raise Proposal

Apr 28, 2025 -

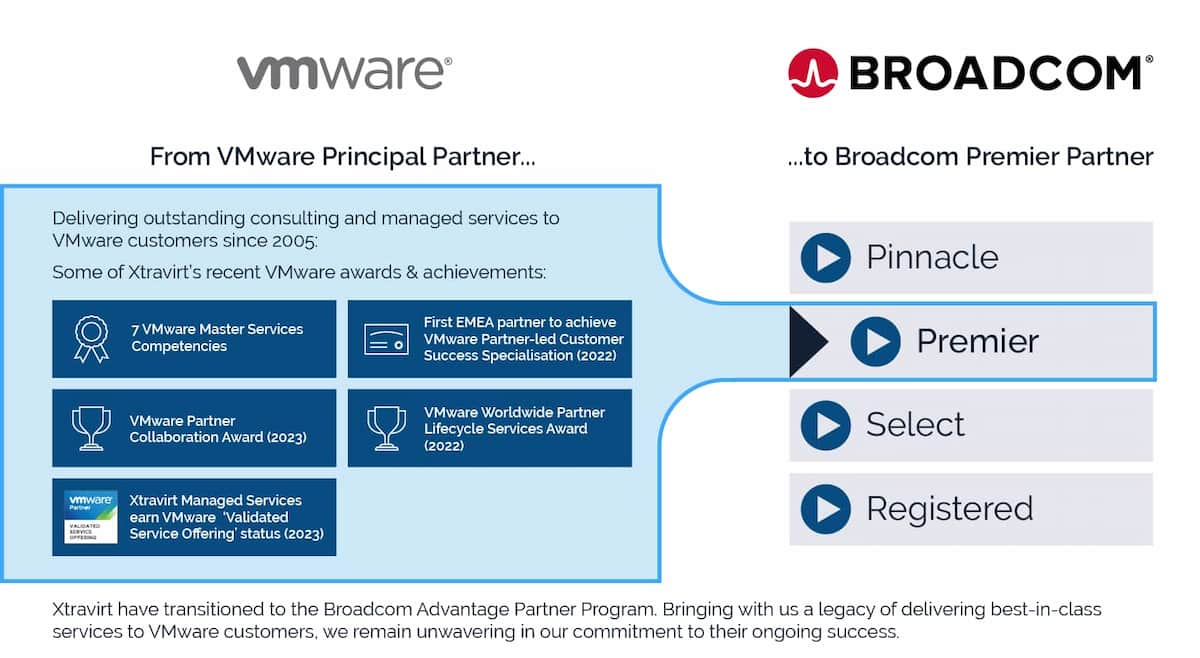

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025 -

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025 -

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025