Cryptocurrency Markets Soar: Bitcoin Benefits From US-China Trade Uncertainty

Table of Contents

Bitcoin as a Safe Haven Asset During Geopolitical Uncertainty

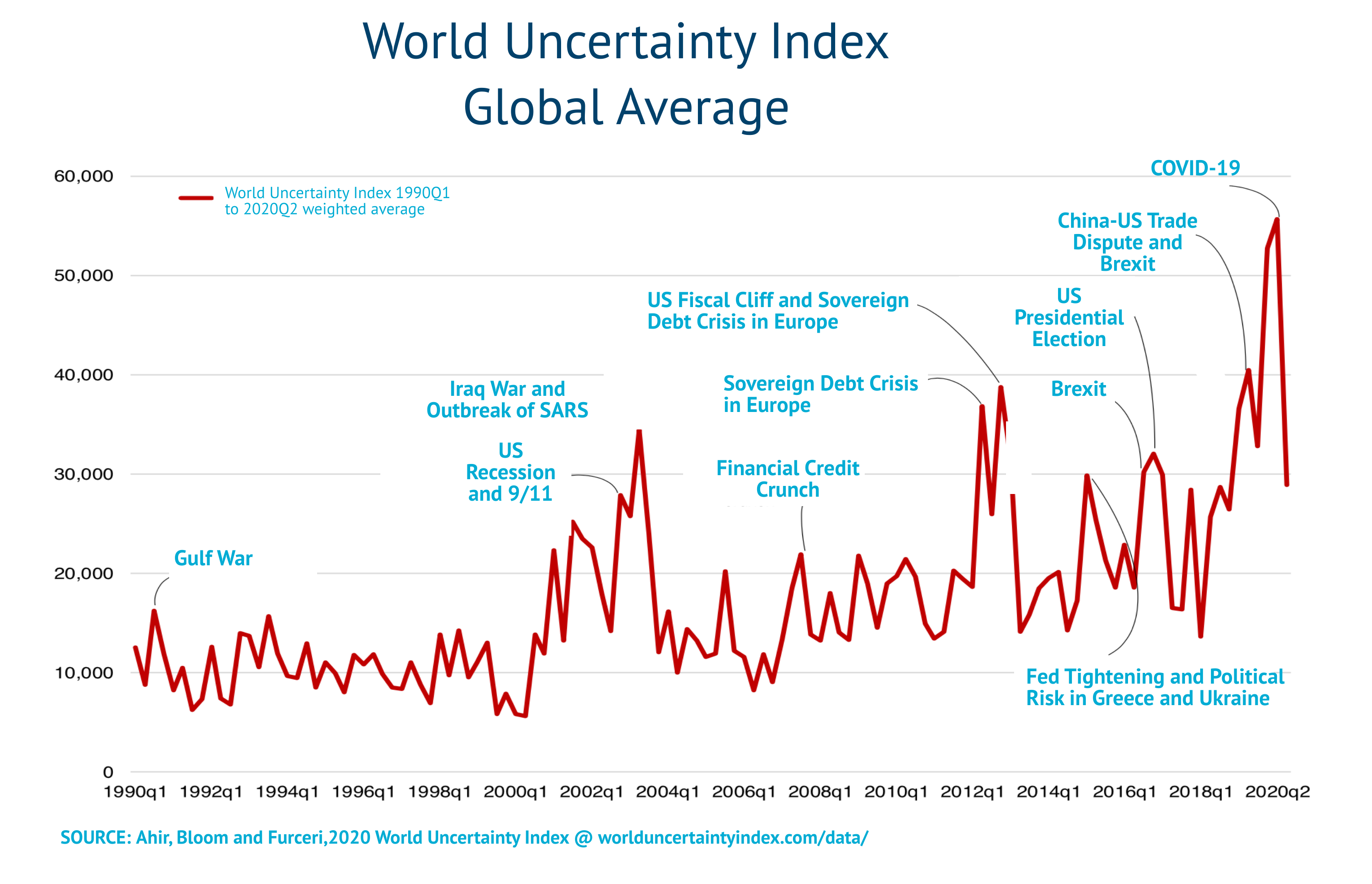

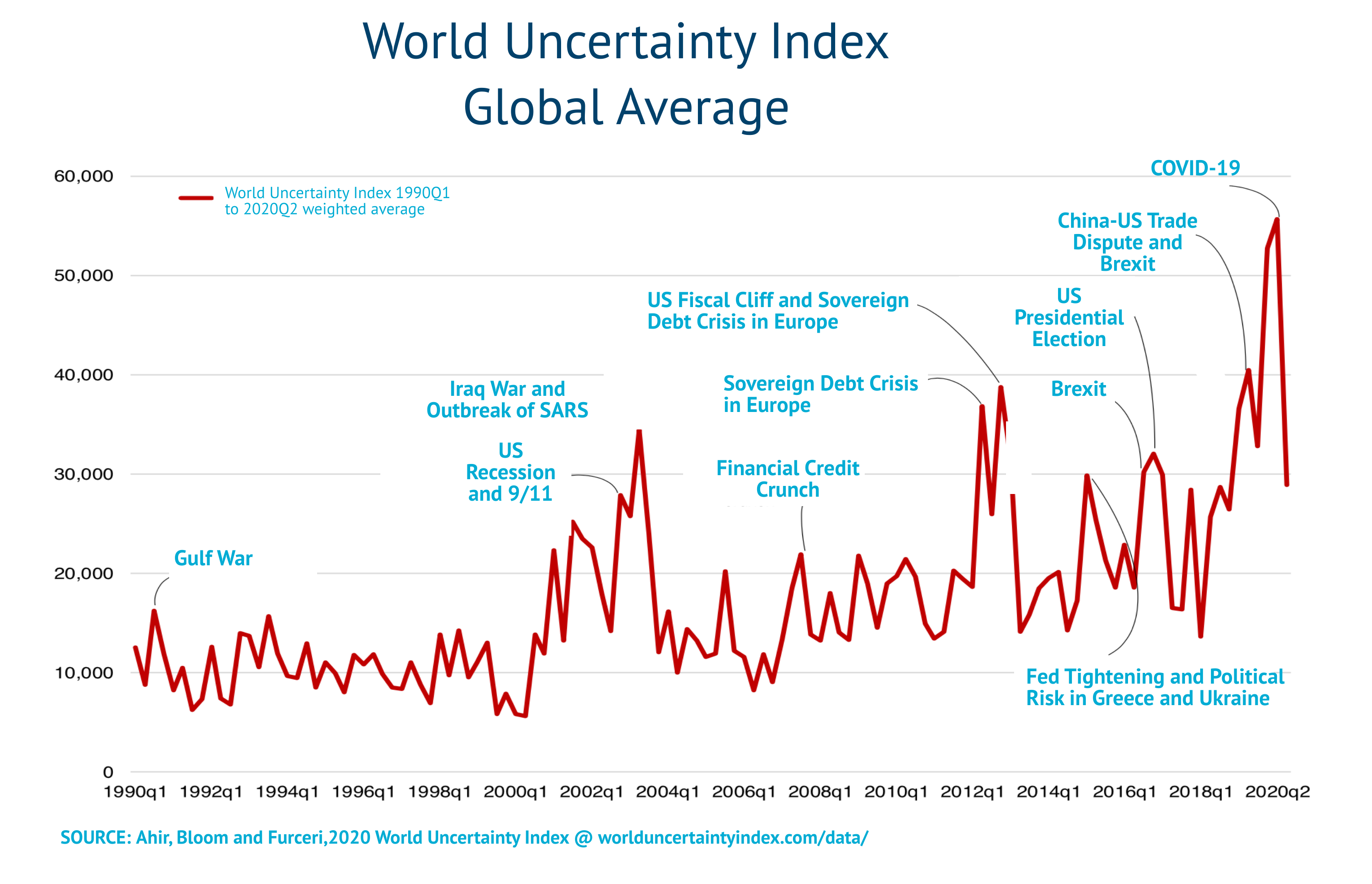

The unpredictable nature of the US-China trade war and similar geopolitical events has pushed investors to seek shelter from the volatility in traditional markets. Bitcoin, with its decentralized structure and unique characteristics, is increasingly viewed as a safe haven asset.

Diversification and Risk Mitigation

Investors are actively seeking ways to diversify their portfolios and reduce their exposure to the risks associated with traditional assets heavily influenced by trade wars. Bitcoin offers a compelling solution.

- Reduced reliance on volatile stock markets and weakening currencies: The correlation between Bitcoin and traditional markets is relatively low, making it an attractive option for diversifying away from equities and bonds. Currency fluctuations stemming from trade disputes can also significantly impact investment portfolios, making Bitcoin's relative stability appealing.

- Bitcoin's decentralized nature provides protection against government intervention or economic sanctions: Unlike fiat currencies, Bitcoin is not controlled by any single government or institution, making it resilient to political pressures and economic sanctions.

- Increased institutional investment in Bitcoin as a portfolio diversifier: The growing adoption of Bitcoin by institutional investors signals a shift in the perception of cryptocurrencies as a legitimate asset class suitable for portfolio diversification strategies. This trend contributes to Bitcoin's stability and price growth.

Flight to Safety

During times of economic and political instability, investors often engage in a "flight to safety," moving their assets to perceived safer investments. Bitcoin is increasingly seen as a safe haven due to its unique characteristics.

- Lack of correlation between Bitcoin and traditional asset classes: Its low correlation with traditional assets makes it a suitable hedge against market downturns in stocks and bonds.

- Bitcoin's limited supply and growing adoption contribute to its perceived value stability: The fixed supply of 21 million Bitcoins creates scarcity, driving demand and potentially mitigating price volatility. Increased adoption further reinforces its value proposition.

- Examples of previous instances where Bitcoin has acted as a safe haven during market downturns: Historically, Bitcoin has demonstrated resilience during periods of market uncertainty, further supporting its role as a safe haven asset. For example, during previous global financial crises, Bitcoin's price has shown relative stability compared to traditional markets.

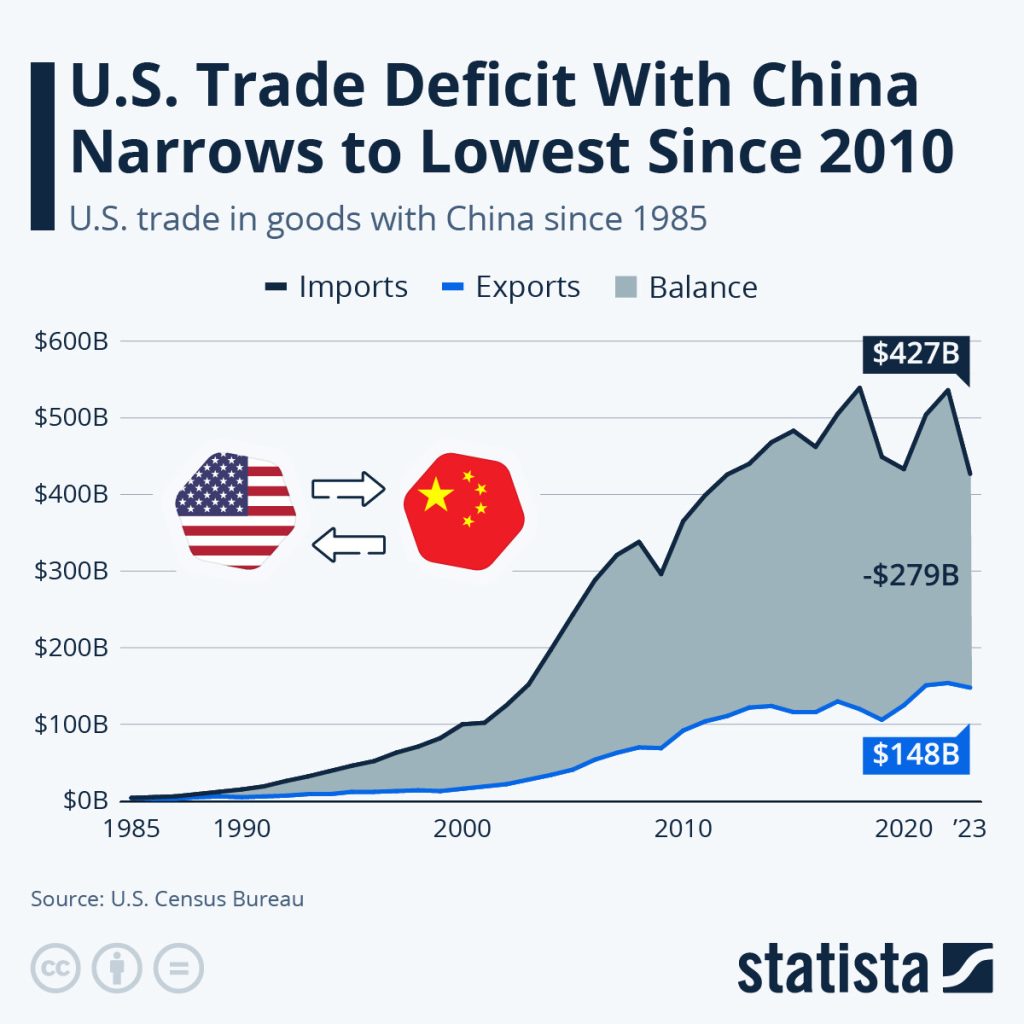

Impact of US-China Trade War on Traditional Markets

The US-China trade war has had a profound impact on traditional markets, creating uncertainty and volatility. This instability has fueled the search for alternative assets, including Bitcoin.

Currency Fluctuations and Market Volatility

The trade war has significantly impacted global currency markets and stock markets, increasing volatility and uncertainty.

- Weakening of the US dollar and other major currencies: The trade war has contributed to fluctuations in major currencies, making it difficult to predict the long-term value of investments denominated in these currencies.

- Increased stock market volatility due to trade war uncertainty: Uncertainty surrounding trade policies leads to increased volatility in stock markets as investors react to changing conditions.

- Impact on global supply chains and international trade: Disruptions to global supply chains caused by trade disputes further increase economic uncertainty.

Investor Search for Alternative Assets

The instability in traditional markets has led investors to seek alternatives offering better returns or stability. Bitcoin is gaining traction in this context.

- Growing interest in alternative investments like gold and cryptocurrencies: Investors are diversifying into alternative assets perceived as less susceptible to the impact of trade wars.

- Bitcoin's potential for higher returns compared to traditional assets: While cryptocurrency investments are inherently volatile, they offer the potential for higher returns than traditional assets in the long term.

- Increased accessibility and ease of trading for Bitcoin: The ease of access to Bitcoin through various exchanges and platforms makes it attractive to a wide range of investors.

Bitcoin's Growing Adoption and Institutional Interest

The increasing adoption of Bitcoin by both individual and institutional investors solidifies its position as a viable asset class and contributes to its growing appeal.

Increased Institutional Investment

Institutional investors are increasingly recognizing Bitcoin's potential, leading to significant investments.

- Examples of large companies and investment firms adding Bitcoin to their portfolios: Several prominent companies and investment firms have started allocating a portion of their assets to Bitcoin, indicating growing confidence in its long-term prospects.

- Impact of institutional investment on Bitcoin's price and market stability: Increased institutional participation can help stabilize Bitcoin's price and attract further investment.

- Development of regulated Bitcoin exchange-traded funds (ETFs): The potential introduction of regulated Bitcoin ETFs could significantly increase accessibility and reduce the perception of risk associated with cryptocurrency investment.

Technological Advancements in the Cryptocurrency Space

Advancements in blockchain technology and scaling solutions are enhancing Bitcoin's usability and appeal.

- Improvements in transaction speed and efficiency: Ongoing development aims to improve the speed and efficiency of Bitcoin transactions, making it more user-friendly.

- Development of layer-2 scaling solutions to enhance Bitcoin's capabilities: Layer-2 scaling solutions address Bitcoin's scalability challenges, paving the way for wider adoption.

- Growing adoption of Bitcoin as a payment method: Increasing numbers of merchants are accepting Bitcoin as a payment method, boosting its usability and value proposition.

Conclusion

The ongoing US-China trade uncertainty has created a volatile environment for global financial markets, pushing investors to explore alternative assets. Bitcoin, with its decentralized nature, growing institutional adoption, and technological advancements, has emerged as a compelling option, displaying its potential as a safe haven asset and diversifying tool. The surge in interest in Bitcoin underscores a significant shift in investment strategies and the increasing acceptance of cryptocurrencies as a legitimate asset class within a broader portfolio strategy. Consider diversifying your portfolio and exploring the potential of Bitcoin and other cryptocurrencies within a well-informed investment strategy. Learn more about navigating the cryptocurrency market today and understand the benefits of Bitcoin investment to prepare for future market uncertainties.

Featured Posts

-

Why Reliability And Trust Matter More Than Ever In Crypto News

May 08, 2025

Why Reliability And Trust Matter More Than Ever In Crypto News

May 08, 2025 -

Anons Pivfinaliv Ligi Chempioniv 2024 2025 Arsenal Ps Zh Barselona Inter

May 08, 2025

Anons Pivfinaliv Ligi Chempioniv 2024 2025 Arsenal Ps Zh Barselona Inter

May 08, 2025 -

Warfare On Screen 5 Movies That Balance Action And Emotion

May 08, 2025

Warfare On Screen 5 Movies That Balance Action And Emotion

May 08, 2025 -

The Trade War And Crypto Is This Coin Immune

May 08, 2025

The Trade War And Crypto Is This Coin Immune

May 08, 2025 -

Easing Trade Tensions U S And China Hold Critical Talks

May 08, 2025

Easing Trade Tensions U S And China Hold Critical Talks

May 08, 2025