The Trade War And Crypto: Is This Coin Immune?

Table of Contents

How Trade Wars Affect Global Markets (and Crypto)

Trade wars significantly impact global financial markets. Increased tariffs and trade restrictions lead to decreased investor confidence, heightened market volatility, and capital flight as investors seek safer havens. These macroeconomic effects inevitably ripple into the cryptocurrency market, which, despite its decentralized nature, is not entirely immune to global economic trends.

- Increased risk aversion: When global uncertainty rises, investors tend to sell off riskier assets, including cryptocurrencies, to protect their capital. This often leads to significant price drops across the crypto market.

- Changes in regulatory landscapes: Geopolitical tensions can influence regulatory responses towards cryptocurrencies. Countries might tighten regulations or even ban crypto trading in response to economic instability caused by trade wars.

- Impact on fiat currency values: Fluctuations in the value of fiat currencies due to trade wars directly affect cryptocurrency prices, as most cryptocurrencies are priced in USD or other major fiat currencies. A weakening dollar, for instance, can impact the USD value of Bitcoin.

Bitcoin's Performance During Trade Wars

Bitcoin, the original cryptocurrency, has experienced periods of both growth and decline during times of trade tensions. Analyzing historical data reveals a complex relationship. While some argue Bitcoin acts as a safe haven asset due to its decentralized nature and global reach, others see it as a highly volatile investment just as susceptible to global market sentiment as traditional assets.

- Examples of Bitcoin price fluctuations: Examining Bitcoin's price during previous trade disputes reveals mixed results. Sometimes it has moved in tandem with traditional markets, while at other times it has shown relative independence, depending on various influencing factors like regulatory announcements and market sentiment.

- Correlation with major stock market indices: Studies show a degree of correlation between Bitcoin's price and major stock market indices, implying that major economic events can still affect the cryptocurrency market.

- Bitcoin as a decentralized, global asset: Bitcoin's decentralized and borderless nature offers a potential hedge against some aspects of trade wars, but it doesn't completely insulate it from market turmoil.

Altcoins and Their Vulnerability to Trade Wars

Altcoins, alternative cryptocurrencies beyond Bitcoin, exhibit varying degrees of vulnerability to trade war impacts. Their resilience depends largely on factors like their underlying technology, market capitalization, and adoption rate.

- Altcoins highly correlated with traditional markets: Many altcoins closely track the performance of traditional assets, making them susceptible to the negative impacts of trade wars.

- Altcoins with greater independence: Some altcoins with unique technological features or strong community support might demonstrate greater independence from traditional market movements.

- Role of project fundamentals: The strength of a project’s fundamentals – its utility, technology, team, and community – can significantly influence its ability to withstand the volatility caused by trade wars. Stronger projects tend to weather the storm better.

Stablecoins: A Safe Haven in Times of Uncertainty?

Stablecoins, pegged to fiat currencies like the US dollar, are designed to maintain price stability. This makes them an attractive option for investors seeking to hedge against market volatility during trade wars. However, they are not without risks.

- Maintaining price stability: Stablecoins aim to maintain a 1:1 peg with the underlying fiat currency, theoretically shielding investors from market fluctuations.

- Performance during previous trade war periods: While stablecoins have generally held their peg relatively well during periods of trade uncertainty, their performance can still be impacted by broader economic anxieties and regulatory scrutiny.

- Risks associated with stablecoins: Regulatory uncertainty and potential issues with the reserves backing some stablecoins introduce risk.

Factors Determining Crypto's Resilience to Trade Wars

Several key factors determine a cryptocurrency's resilience to global trade disputes:

- Adoption rate and network effect: Widespread adoption strengthens a cryptocurrency's resilience, making it less susceptible to market swings. A larger network effect generally indicates greater stability.

- Technological innovation and development: Cryptocurrencies with robust technology and ongoing development tend to attract more investors and maintain their value.

- Regulatory clarity and governmental stance: Clear regulations and supportive government policies can boost investor confidence and protect cryptocurrencies from extreme volatility.

- Overall market sentiment and investor confidence: Positive market sentiment and strong investor confidence are crucial for withstanding market downturns caused by trade wars.

Conclusion: Navigating the Trade War Landscape with Cryptocurrencies

The relationship between trade wars and cryptocurrencies is complex. While some crypto assets, particularly stablecoins, can offer a degree of protection against market volatility, others remain significantly vulnerable to global economic headwinds. Bitcoin's performance shows a mixed picture, indicating it is not entirely immune. Altcoins, especially those with weak fundamentals and strong correlation to traditional markets, show the most vulnerability. Understanding the specific characteristics of each cryptocurrency, along with the interplay of broader economic factors and market sentiment, is crucial for navigating the trade war and crypto landscape effectively. Conduct further research, stay informed about global trade developments, and make informed decisions about your cryptocurrency investments. Understanding the trade war and crypto landscape is key to building a resilient crypto portfolio.

Featured Posts

-

Get Ready For Andor Season 2 A Pre Show Guide

May 08, 2025

Get Ready For Andor Season 2 A Pre Show Guide

May 08, 2025 -

The Ripple Effect Evaluating Xrp As A Long Term Investment Strategy

May 08, 2025

The Ripple Effect Evaluating Xrp As A Long Term Investment Strategy

May 08, 2025 -

Arsenal Vs Psg Champions League Semi Final A Tactical Breakdown

May 08, 2025

Arsenal Vs Psg Champions League Semi Final A Tactical Breakdown

May 08, 2025 -

Bitcoins Recovery Signs Of A Long Term Trend

May 08, 2025

Bitcoins Recovery Signs Of A Long Term Trend

May 08, 2025 -

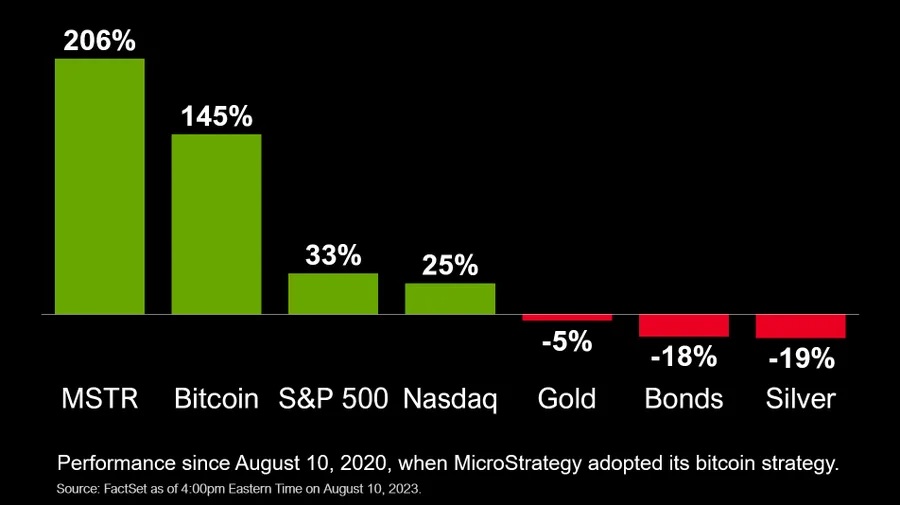

Bitcoin Or Micro Strategy Stock A Smart Investment Strategy For 2025

May 08, 2025

Bitcoin Or Micro Strategy Stock A Smart Investment Strategy For 2025

May 08, 2025