D-Wave Quantum (QBTS) Stock Drop: Unpacking Monday's Sharp Decline

Table of Contents

Analyzing the Immediate Triggers of the QBTS Stock Drop

Several factors could have contributed to the immediate selling pressure on D-Wave Quantum (QBTS) stock on Monday. Pinpointing the exact cause requires careful examination of the events surrounding the drop. Potential triggers include:

-

Financial Reports and Guidance: A missed earnings target, lowered revenue guidance for the next quarter, or a less-than-optimistic outlook on future performance could trigger a significant sell-off. Investors often react negatively to news suggesting a company is underperforming expectations. For example, a significant decrease in projected year-over-year growth could be a major contributing factor.

-

Negative Press and Regulatory Concerns: Negative press coverage, even if unfounded, can create uncertainty and lead to investors dumping their shares. Similarly, any news related to regulatory hurdles or investigations could negatively impact investor confidence. Specific instances, like a report on a potential technological setback or a regulatory investigation, could significantly impact the stock price.

-

Analyst Downgrades and Price Target Reductions: A major brokerage firm downgrading its rating on QBTS stock and lowering its price target could significantly influence investor sentiment. This signals to the market that a particular analyst believes the stock is overvalued and is likely to fall further. For instance, an analyst at Morgan Stanley downgrading QBTS to a "Sell" rating due to concerns about competition could trigger substantial selling.

-

Wider Market Downturns: The overall performance of the stock market, particularly within the technology sector, plays a significant role. A broader market downturn, especially affecting tech stocks and speculative investments, often pulls down even fundamentally strong companies like D-Wave. This can create a domino effect impacting even relatively stable quantum computing stocks.

Specific Examples: While specifics weren't available at the time of writing, a hypothetical example could be: "Analyst at Goldman Sachs downgraded QBTS to 'Neutral' citing concerns over slower-than-anticipated customer adoption of their latest quantum annealing system."

The Broader Context: Quantum Computing Sector Trends

Understanding the broader trends in the quantum computing sector is crucial for interpreting the QBTS stock drop. Is the entire sector experiencing a downturn, or is D-Wave facing unique challenges?

-

Performance of Other Quantum Computing Stocks: Comparing D-Wave's performance to other publicly traded quantum computing companies provides valuable context. Are other stocks in the sector also experiencing declines, suggesting a broader market correction or specific sector-wide headwinds? Looking at the performance of IonQ (IONQ) or Rigetti Computing (RGTI) would give a clearer picture.

-

Market Sentiment Towards Quantum Computing: The overall investor sentiment towards quantum computing technology as a whole can have a cascading effect. Periods of increased skepticism or reduced investment enthusiasm can negatively impact even promising companies. Factors like reduced venture capital funding in the sector might contribute to overall negative sentiment.

-

Macroeconomic Factors: Higher interest rates, inflation, or a general economic slowdown can significantly impact investor appetite for riskier investments, including those in emerging technologies like quantum computing. Reduced investment in speculative technologies is a common side effect of macroeconomic instability.

-

Competition in the Quantum Computing Field: The highly competitive nature of the quantum computing field also impacts individual companies. The emergence of new players or significant breakthroughs by competitors could put pressure on D-Wave's market share and stock valuation. This increased competition creates pressure on revenue growth and market dominance.

D-Wave Quantum's Recent Performance and Future Outlook

Analyzing D-Wave Quantum's recent performance and strategic decisions is crucial for understanding the stock drop. Were there any internal factors contributing to the decline?

-

Financial Results and Strategic Moves: Examining D-Wave's recent financial reports, including revenue growth, profitability, and cash flow, reveals its financial health. Any significant deviations from expectations or strategic shifts could trigger negative market reactions. For example, a significant increase in operating expenses without corresponding revenue growth could negatively affect the stock price.

-

Technological Advancements and Market Acceptance: The level of technological advancement and market acceptance of D-Wave's quantum annealing technology are key factors. Slower-than-expected adoption or technological setbacks could lead to investor concerns. Significant technological breakthroughs or successful partnerships, however, can have a positive impact.

-

Customer Base and Future Revenue Streams: A strong and growing customer base, diversified revenue streams, and successful partnerships with major corporations are crucial indicators of long-term success. Any concerns about the stability or growth of these aspects could contribute to the stock price drop. The number of enterprise clients and the scale of their contracts are key metrics.

-

Long-Term Growth Prospects: The long-term prospects of the quantum computing industry and D-Wave's position within it are critical. Assessing the potential for significant future growth in this field and D-Wave's ability to capture market share is essential. Expert opinions and industry reports on the future of quantum computing will help provide a realistic outlook.

Conclusion

This article explored several potential reasons behind Monday's significant drop in D-Wave Quantum (QBTS) stock. We examined immediate triggers, the broader context of the quantum computing sector, and D-Wave's own recent performance. The situation highlights the inherent volatility of investing in emerging technologies. Understanding the intertwining of macroeconomic factors, sector-wide trends, and company-specific events is crucial for navigating this dynamic market.

Call to Action: Understanding the factors influencing QBTS stock price fluctuations is crucial for investors in the quantum computing market. Stay informed about D-Wave Quantum's progress, market trends, and expert analysis to make informed decisions regarding your D-Wave Quantum (QBTS) investments and other quantum computing stocks. Continue researching D-Wave Quantum (QBTS) and related quantum computing investments to navigate this dynamic market effectively. Careful monitoring of news releases, financial reports, and analyst opinions is key to minimizing risk and capitalizing on opportunities in this promising but volatile sector.

Featured Posts

-

Antes Del Regreso La Conversacion Que Predijo El Fracaso De Schumacher En La F1

May 20, 2025

Antes Del Regreso La Conversacion Que Predijo El Fracaso De Schumacher En La F1

May 20, 2025 -

Open Ai Simplifies Voice Assistant Development Unveiled At 2024 Event

May 20, 2025

Open Ai Simplifies Voice Assistant Development Unveiled At 2024 Event

May 20, 2025 -

Is Bbai Stock Right For You Evaluating The Penny Stock Investment

May 20, 2025

Is Bbai Stock Right For You Evaluating The Penny Stock Investment

May 20, 2025 -

Escola Na Tijuca Incendio Causa Luto E Rememoracoes Em Ex Alunos

May 20, 2025

Escola Na Tijuca Incendio Causa Luto E Rememoracoes Em Ex Alunos

May 20, 2025 -

Cote D Ivoire 4eme Pont D Abidjan Delai De Realisation Budget Et Depenses Prevues

May 20, 2025

Cote D Ivoire 4eme Pont D Abidjan Delai De Realisation Budget Et Depenses Prevues

May 20, 2025

Latest Posts

-

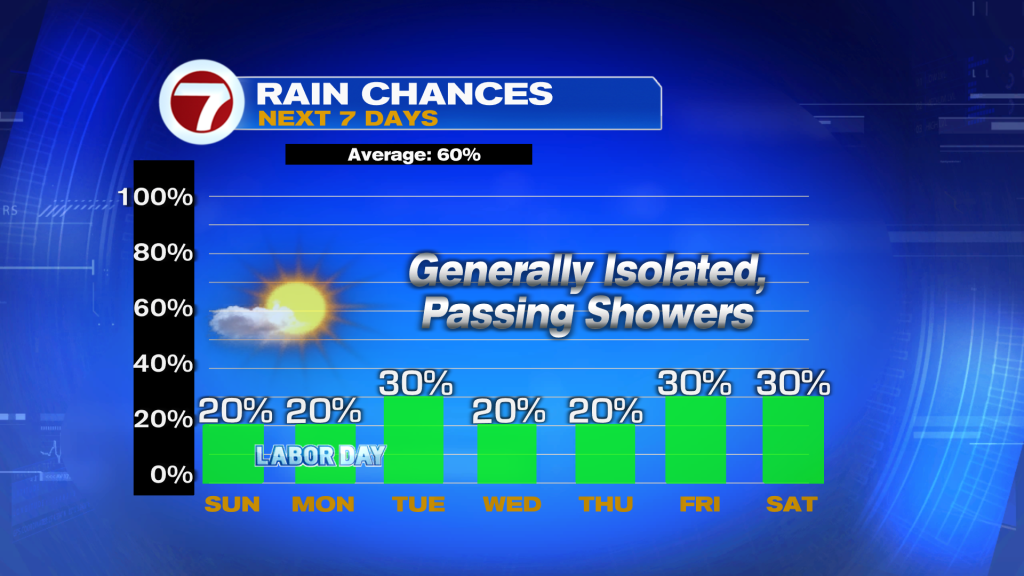

Preparing For The Upcoming Drier Weather

May 20, 2025

Preparing For The Upcoming Drier Weather

May 20, 2025 -

Is Drier Weather In Sight Your Regional Forecast

May 20, 2025

Is Drier Weather In Sight Your Regional Forecast

May 20, 2025 -

Drier Weather Is In Sight What To Expect

May 20, 2025

Drier Weather Is In Sight What To Expect

May 20, 2025 -

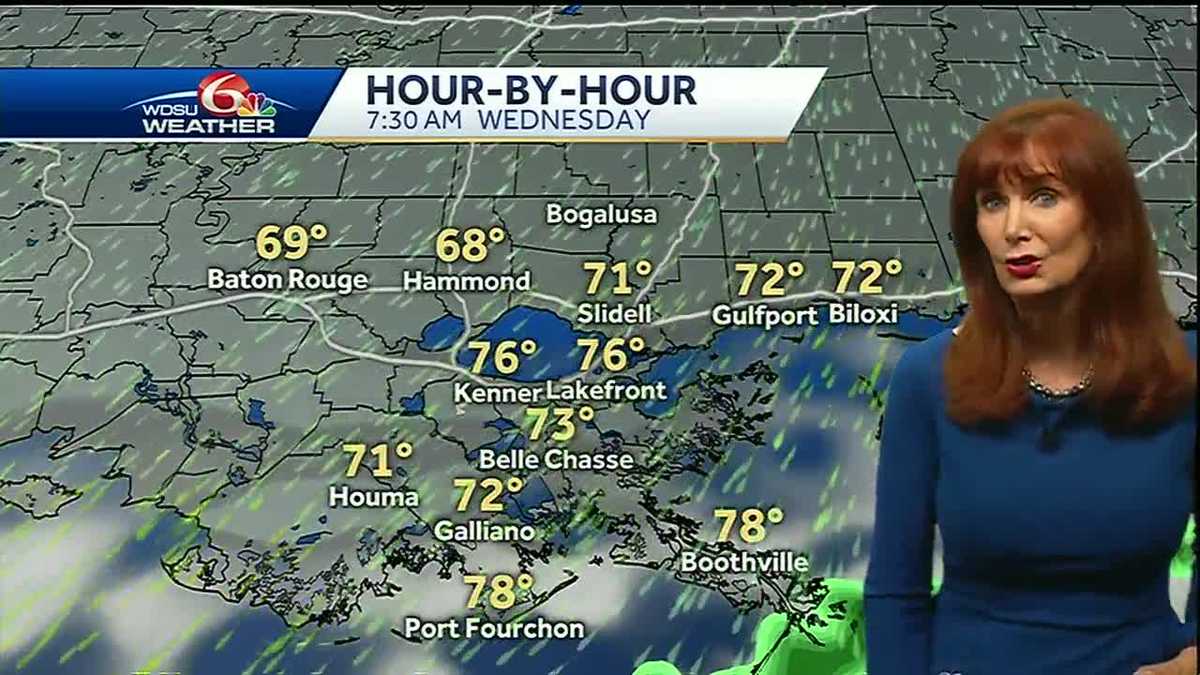

Checking For Rain The Latest Hourly And Daily Updates

May 20, 2025

Checking For Rain The Latest Hourly And Daily Updates

May 20, 2025 -

Rain Predictions The Most Up To Date Forecast

May 20, 2025

Rain Predictions The Most Up To Date Forecast

May 20, 2025