D-Wave Quantum (QBTS) Stock Price Fall In 2025: Factors And Future Outlook

Table of Contents

Macroeconomic Factors Impacting QBTS Stock Performance

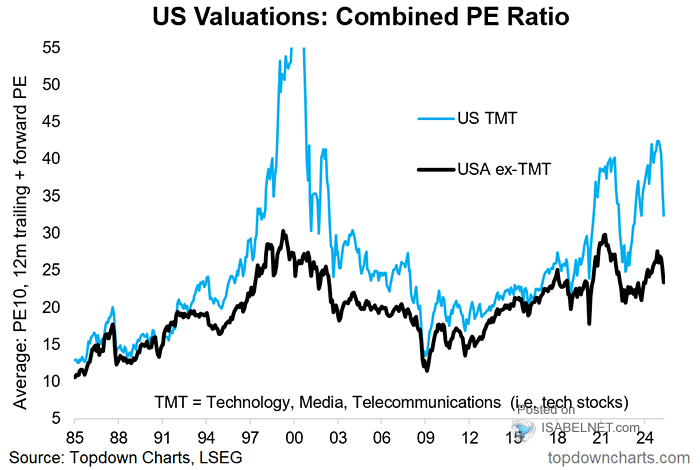

Broader economic conditions significantly influence investor sentiment and, consequently, the valuation of tech stocks like QBTS. A recession, for example, can lead to decreased investor confidence and a sell-off in growth stocks, including those in the burgeoning quantum computing sector. Inflation and rising interest rates also play a crucial role.

- Correlation between market downturns and tech stock performance: Historically, tech stocks have shown a strong negative correlation with broader market downturns. During economic uncertainty, investors often shift towards safer investments, leading to a decline in riskier assets like quantum computing stocks.

- Impact of rising interest rates on growth stock valuations: Higher interest rates increase the opportunity cost of holding growth stocks, which typically have higher valuations based on future earnings potential. This can lead to a downward pressure on QBTS stock price.

- Investor risk aversion during economic uncertainty: When economic uncertainty rises, investors tend to become more risk-averse, moving capital away from speculative investments like QBTS towards more stable assets.

Data from reputable sources like the Financial Times and Bloomberg consistently demonstrate the strong relationship between macroeconomic indicators and technology stock performance. A significant economic downturn could easily translate into a decline in the D-Wave Quantum (QBTS) stock price.

Competitive Landscape and Technological Advancements

The quantum computing industry is fiercely competitive. D-Wave, while a pioneer in quantum annealing, faces intense pressure from companies developing alternative quantum computing technologies like superconducting qubits (IBM, Google) and trapped ions (IonQ).

- Key competitors and their advancements: IBM and Google are aggressively pursuing their respective superconducting qubit technologies, consistently achieving higher qubit counts and improved coherence times. IonQ's trapped-ion approach also presents a viable alternative.

- Potential for disruptive technologies: The emergence of superior technologies could render D-Wave's annealing approach less competitive, impacting its market share and potentially leading to a decline in its stock price.

- Government funding and its impact: Significant government funding directed towards competing technologies could further exacerbate the competitive pressure on D-Wave.

The rate of technological breakthroughs in quantum computing is crucial. Slower-than-expected progress in D-Wave's technology, relative to competitors, could negatively influence investor confidence and QBTS stock valuation.

D-Wave Quantum's Financial Performance and Business Strategy

D-Wave's financial health is a key factor influencing investor perception and QBTS stock price. Analyzing its revenue streams, profitability, and debt levels provides crucial insights.

- Financial reports and projections: Examining D-Wave's quarterly and annual reports, including revenue growth, operating expenses, and profitability margins, is essential to assess its financial stability.

- Business model and customer acquisition: The success of D-Wave's business model in attracting and retaining customers is critical. Analyzing its customer base and its ability to generate recurring revenue streams is vital.

- Challenges in scaling operations and achieving profitability: D-Wave faces the considerable challenge of scaling its operations while simultaneously striving for profitability. Investors will closely monitor its progress in this area.

Investor Sentiment and Market Speculation

Market speculation and investor sentiment can significantly impact QBTS stock price, often independent of the company's fundamental performance. Hype, fear, and uncertainty can all drive rapid price fluctuations.

- Impact of news and announcements: Positive news, like securing major contracts or significant technological breakthroughs, can boost QBTS stock price. Negative news, however, can lead to sell-offs.

- Social media sentiment: Analyzing social media sentiment toward D-Wave and the broader quantum computing industry can provide valuable insights into investor perception and potential market trends.

- Influence of short selling and market manipulation: Short selling and market manipulation can also exert downward pressure on QBTS stock price, irrespective of the company’s actual performance.

Past examples of how news cycles and speculative trading affected other technology stocks can serve as cautionary tales, emphasizing the unpredictable nature of the market.

Mitigation Strategies and Potential for Growth

D-Wave can employ several strategies to mitigate risks and boost its stock performance. Focusing on specific high-potential applications, forming strategic partnerships, and maintaining transparent communication with investors are crucial.

- Strategic partnerships and collaborations: Collaborating with industry leaders to develop specific applications of D-Wave's quantum annealing technology can significantly improve market penetration and investor confidence.

- Focus on specific applications with high market potential: Concentrating on specific applications with demonstrable near-term value, such as optimization problems in logistics or drug discovery, can enhance the perception of D-Wave's technology and its potential for generating revenue.

- Effective communication and transparency with investors: Open and honest communication regarding the company's progress, challenges, and future plans is crucial for building investor trust and mitigating negative market sentiment.

Despite the challenges, the long-term potential for growth in the quantum computing market remains substantial. D-Wave’s strategic positioning and technological advancements could position it for future success, but significant hurdles remain.

Conclusion: Future Outlook for D-Wave Quantum (QBTS) Stock Price in 2025 and Beyond

Several factors, including macroeconomic conditions, intense competition, and the unpredictable nature of investor sentiment, could contribute to a potential D-Wave Quantum (QBTS) stock price decline in 2025. However, D-Wave's ability to execute its strategic plan, achieve profitability, and maintain investor confidence will be key determinants of its future success. While the quantum computing market offers substantial long-term growth potential, investors should conduct thorough research and understand the inherent risks before investing in D-Wave Quantum (QBTS) stock. Careful consideration of the D-Wave Quantum (QBTS) stock price trajectory within the broader quantum computing market is essential before making any investment decisions.

Featured Posts

-

Nvidia Ai

May 20, 2025

Nvidia Ai

May 20, 2025 -

Canada Posts Financial Troubles A Report Recommends Major Delivery Service Changes

May 20, 2025

Canada Posts Financial Troubles A Report Recommends Major Delivery Service Changes

May 20, 2025 -

Andelka Milivojevic Tadic Detalji Sa Sahrane I Oprostaj Milice Milse

May 20, 2025

Andelka Milivojevic Tadic Detalji Sa Sahrane I Oprostaj Milice Milse

May 20, 2025 -

Cote D Ivoire Bruno Kone Et Le Developpement Urbain Nouveaux Plans D Urbanisme Lances

May 20, 2025

Cote D Ivoire Bruno Kone Et Le Developpement Urbain Nouveaux Plans D Urbanisme Lances

May 20, 2025 -

Understanding Elevated Stock Market Valuations Insights From Bof A

May 20, 2025

Understanding Elevated Stock Market Valuations Insights From Bof A

May 20, 2025

Latest Posts

-

T Hriskeytiki Esperida Megali Tessarakosti Stin Patriarxiki Akadimia Kritis

May 20, 2025

T Hriskeytiki Esperida Megali Tessarakosti Stin Patriarxiki Akadimia Kritis

May 20, 2025 -

Ap It

May 20, 2025

Ap It

May 20, 2025 -

Pracovne Prostredie A Jeho Vplyv Na Produktivitu Home Office Vs Kancelaria

May 20, 2025

Pracovne Prostredie A Jeho Vplyv Na Produktivitu Home Office Vs Kancelaria

May 20, 2025 -

Patriarxiki Akadimia Kritis Esperida Gia Ti Megali Tessarakosti

May 20, 2025

Patriarxiki Akadimia Kritis Esperida Gia Ti Megali Tessarakosti

May 20, 2025 -

Ap

May 20, 2025

Ap

May 20, 2025