D-Wave Quantum (QBTS) Stock Soars: Analyzing The Week's Price Increase

Table of Contents

Analyzing the Potential Catalysts for the QBTS Stock Price Increase

Several factors could have contributed to the recent surge in D-Wave Quantum (QBTS) stock price. Let's delve into the most likely catalysts.

Positive News and Announcements

Positive news and announcements often significantly impact a company's stock price. For D-Wave Quantum, several recent developments could be contributing to the current upward trend.

- New Partnerships: The announcement of strategic partnerships with major technology companies or research institutions could boost investor confidence and drive up the QBTS stock price. These partnerships might involve collaborative research projects, technology integration, or access to new markets.

- Successful Product Launches: The successful launch of a new quantum computing product or a significant upgrade to an existing offering could attract considerable investor interest. Demonstrating technological advancements and market readiness is crucial for quantum computing companies.

- Contract Wins: Securing substantial contracts with government agencies or large corporations showcases the commercial viability of D-Wave's technology and its potential for revenue generation. Significant contract wins directly translate into increased revenue projections.

- Positive Research Breakthroughs: Publications of significant research breakthroughs or the demonstration of improved quantum computing capabilities can attract attention from investors and researchers alike, resulting in increased demand for D-Wave Quantum (QBTS) stock. Any advancement in qubit performance or algorithm development would be a catalyst.

- Press Releases and Financial Reports: Positive press releases highlighting any of the above points or exceeding expectations in financial reports can significantly boost investor sentiment and drive up the stock price.

These factors, coupled with ongoing advancements in quantum computing, contribute to a narrative of positive growth for D-Wave Quantum, attracting investment.

Market Sentiment and Investor Confidence

The overall market sentiment towards quantum computing stocks plays a vital role in influencing the price of QBTS. A generally positive outlook on the future of quantum computing technology boosts investor confidence, leading to increased demand for stocks in the sector.

- Investor Sentiment: Positive media coverage, industry conferences, and successful funding rounds in the quantum computing space can all contribute to a positive investor sentiment.

- Market Trends: Broader market trends, including overall stock market performance and sector-specific trends, also impact investor confidence in QBTS.

- Quantum Computing Investment: Increased investment from venture capitalists and other institutional investors into the quantum computing industry can signal a belief in its future, indirectly influencing QBTS stock performance.

- Stock Market Volatility: It's important to note that even within a positive market sentiment, the inherent volatility of the quantum computing stock market can lead to short-term fluctuations.

A confluence of positive market trends and investor confidence can fuel a rapid increase in D-Wave Quantum (QBTS) stock price.

Competitive Landscape and Industry Developments

D-Wave's position within the competitive quantum computing landscape also influences its stock performance.

- Quantum Computing Competitors: Positive developments from competitors can indirectly benefit QBTS by increasing overall investor interest in the quantum computing sector. However, significant breakthroughs by a competitor could also negatively impact D-Wave's stock.

- Industry Growth: Strong overall growth in the quantum computing industry, fueled by increased funding, technological advancements, and market adoption, can lift all boats, including D-Wave Quantum.

- Market Share: Any increase in D-Wave's market share relative to competitors would be a positive indicator for investors.

- Technological Advancements: Advancements in quantum computing technology, even if not solely attributed to D-Wave, can increase overall industry excitement and drive investor interest.

Technical Analysis of the QBTS Stock Chart

Understanding the technical aspects of the QBTS stock chart can provide additional insights into the recent price surge.

Chart Patterns and Indicators

Analyzing the QBTS stock chart using technical indicators can help explain the price movements.

- Moving Averages: The behavior of moving averages (e.g., 50-day, 200-day) can indicate the overall trend and potential support/resistance levels.

- RSI (Relative Strength Index): RSI can help identify overbought or oversold conditions, potentially signaling a reversal or continuation of the trend.

- Volume Analysis: High trading volume during the price surge indicates strong conviction behind the upward movement.

- Chart Patterns: Identifying chart patterns such as breakouts from consolidation patterns or pennants can offer insights into the price direction. (Note: Visual aids, like charts and graphs illustrating these patterns would be included here in a published article.)

Technical analysis provides a quantitative perspective on the price action, supplementing the fundamental analysis discussed earlier.

Trading Volume and Volatility

The trading volume accompanying the price increase is crucial in understanding the strength of the move.

- Trading Volume: High trading volume during the price surge suggests significant buying pressure and a strong conviction among investors.

- Price Volatility: While the price surge indicates positive sentiment, the inherent volatility of the quantum computing sector requires careful consideration of potential risks.

- Risk Assessment: Investors should assess their risk tolerance before investing in QBTS, considering the potential for both substantial gains and losses.

- Stock Market Fluctuations: External market fluctuations can also affect the price volatility of QBTS, independent of company-specific news.

Risks and Future Outlook for D-Wave Quantum (QBTS) Stock

While the recent price surge is encouraging, investors need to consider potential risks and the long-term outlook.

Potential Downside Risks

Several factors could negatively impact QBTS stock price.

- Competition: Intense competition from other quantum computing companies poses a risk to D-Wave's market share and profitability.

- Technological Hurdles: Unforeseen technological challenges in developing and scaling quantum computing technology could hinder D-Wave's progress.

- Financial Performance: D-Wave's financial performance, including revenue growth and profitability, will significantly impact its stock price.

- Market Risks: Broader economic downturns or shifts in investor sentiment toward the technology sector can negatively affect QBTS stock.

Long-Term Growth Potential

Despite the risks, the long-term growth potential for D-Wave and the quantum computing market remains significant.

- Long-Term Investment: Investing in QBTS is a long-term strategy with the potential for substantial returns, but also the risk of significant losses.

- Growth Potential: The quantum computing market is expected to experience significant growth in the coming years, creating opportunities for companies like D-Wave.

- Future Outlook: The future outlook for D-Wave depends on its ability to innovate, secure contracts, and navigate the competitive landscape.

- Quantum Computing Market Forecast: Positive forecasts for the overall quantum computing market bolster the long-term growth prospects for D-Wave Quantum.

Conclusion: Investing in D-Wave Quantum (QBTS) Stock: A Look Ahead

The recent surge in D-Wave Quantum (QBTS) stock appears to be driven by a combination of positive news, favorable market sentiment, and potentially technical factors. However, investors must also consider the potential downside risks associated with investing in a company in the still-developing quantum computing industry. High growth potential exists, but so does high volatility. While this analysis provides insights into the recent D-Wave Quantum (QBTS) stock surge, it's crucial to conduct thorough due diligence before making any investment decisions. Learn more about D-Wave Quantum (QBTS) stock and the quantum computing industry to develop your own informed investment strategy.

Featured Posts

-

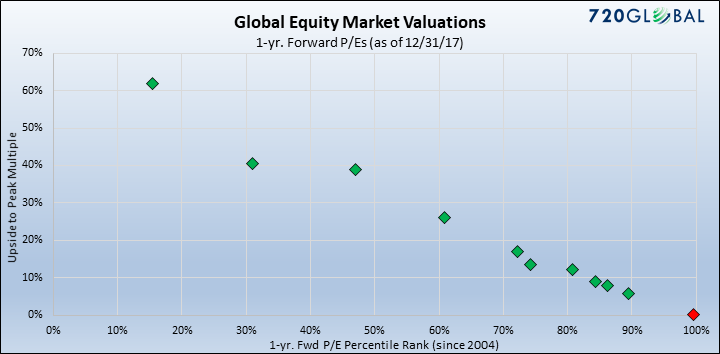

Ignoring High Stock Market Valuations Bof As Rationale For Investors

May 20, 2025

Ignoring High Stock Market Valuations Bof As Rationale For Investors

May 20, 2025 -

Risparmia Hercule Poirot Su Play Station 5 A Meno Di 10 E Su Amazon

May 20, 2025

Risparmia Hercule Poirot Su Play Station 5 A Meno Di 10 E Su Amazon

May 20, 2025 -

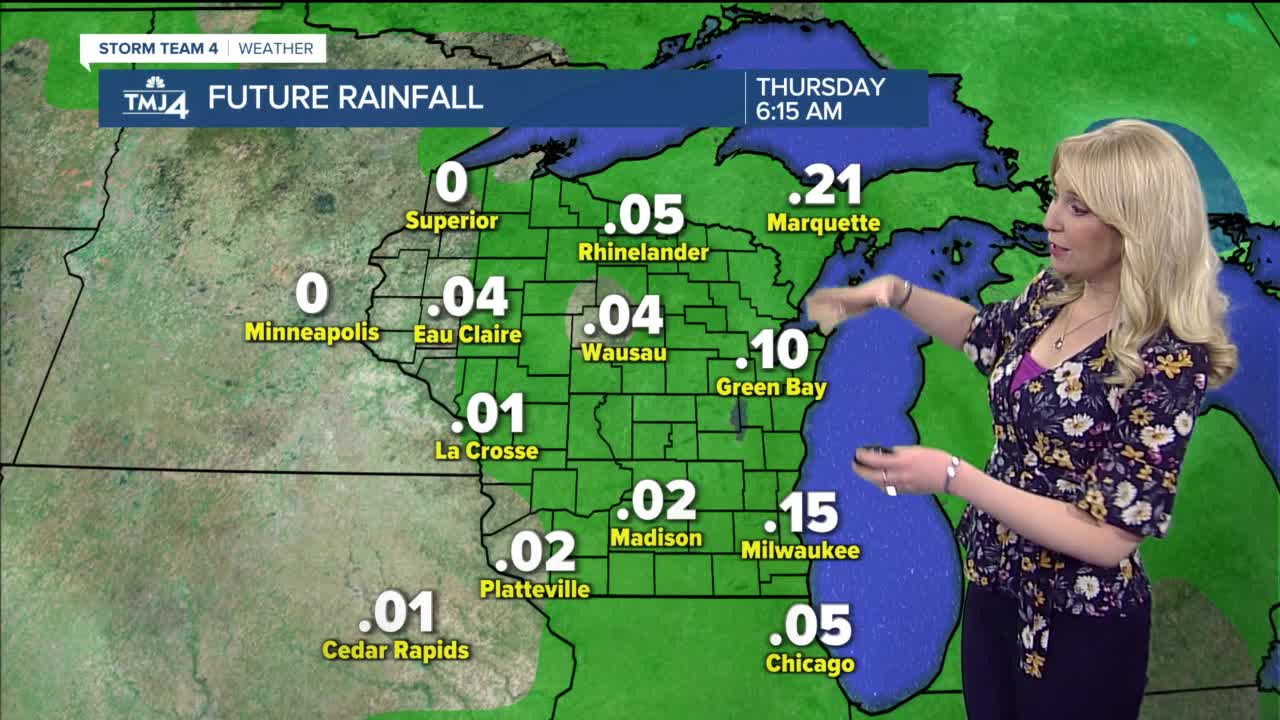

Enjoying Breezy And Mild Weather A Guide To Comfort

May 20, 2025

Enjoying Breezy And Mild Weather A Guide To Comfort

May 20, 2025 -

Rtl Group On Track For Streaming Profitability In 2024

May 20, 2025

Rtl Group On Track For Streaming Profitability In 2024

May 20, 2025 -

Todays Nyt Mini Crossword Answers For March 18

May 20, 2025

Todays Nyt Mini Crossword Answers For March 18

May 20, 2025

Latest Posts

-

Giakoymakis Odigei Tin Kroyz Azoyl Ston Teliko Toy Champions League

May 20, 2025

Giakoymakis Odigei Tin Kroyz Azoyl Ston Teliko Toy Champions League

May 20, 2025 -

Protomagia Sto Oropedio Evdomos Odigos Gia Mia Aksexasti Empeiria

May 20, 2025

Protomagia Sto Oropedio Evdomos Odigos Gia Mia Aksexasti Empeiria

May 20, 2025 -

Kroyz Azoyl Champions League I Poreia Toy Giakoymaki Ston Teliko

May 20, 2025

Kroyz Azoyl Champions League I Poreia Toy Giakoymaki Ston Teliko

May 20, 2025 -

Prokrisi Kroyz Azoyl O Giakoymakis Ston Teliko Champions League

May 20, 2025

Prokrisi Kroyz Azoyl O Giakoymakis Ston Teliko Champions League

May 20, 2025 -

Dimotiko Odeio Rodoy Synaylia Ton Kathigiton Stin Dimokratiki

May 20, 2025

Dimotiko Odeio Rodoy Synaylia Ton Kathigiton Stin Dimokratiki

May 20, 2025