Ignoring High Stock Market Valuations: BofA's Rationale For Investors

Table of Contents

BofA's Argument Against Immediate Market Corrections

BofA's argument against an immediate market correction rests on several key pillars: persistently low interest rates, strong corporate earnings, and a scarcity of attractive alternative investments. Let's examine each in detail.

Low Interest Rates as a Supporting Factor

BofA points to historically low interest rates as a significant factor supporting higher stock valuations. This perspective suggests that even with perceived overvaluation, the current environment isn't necessarily primed for a crash.

- Reduced cost of borrowing for companies: Low interest rates make it cheaper for corporations to borrow money, fueling expansion, innovation, and ultimately, higher stock prices. This increased investment translates to stronger earnings and justifies, to some extent, higher price-to-earnings (P/E) ratios.

- Attractive yields compared to bonds: When bond yields are low, equities become a more attractive alternative for investors seeking reasonable returns. This increased demand further drives up stock prices, even if traditional valuation metrics suggest overvaluation.

- Historical context of low-rate environments and stock market performance: Looking back at historical periods with similarly low interest rates, BofA likely points to instances where the market continued to perform well, despite concerns about high valuations. This historical analysis forms a key part of their argument.

Strong Corporate Earnings and Profitability

BofA's analysis emphasizes the robustness of corporate earnings and profitability as a counterpoint to concerns about high stock market valuations. Many companies are reporting strong financial results, suggesting that current prices are at least partially justified by underlying fundamentals.

- Examples of strong performing sectors and companies: BofA likely highlights specific sectors and companies exhibiting exceptional growth and profitability, demonstrating that the market isn't uniformly overvalued. Tech giants, for instance, often feature prominently in this analysis.

- Analysis of earnings growth projections: BofA's projections for future earnings growth play a significant role in their valuation assessment. If earnings are expected to continue rising, even high current valuations may seem less concerning.

- Comparison of current earnings to historical data: By comparing current earnings to historical data, BofA aims to demonstrate that current profitability is strong relative to past performance, providing further justification for higher stock prices.

Limited Attractive Alternatives

BofA's perspective also considers the lack of compelling alternatives to equities in the current market environment. With low bond yields and concerns in other asset classes, stocks remain a relatively attractive option for many investors, despite the high valuations.

- Low bond yields: The low returns offered by bonds make them less appealing compared to the potential returns from equities, even with the risk of higher valuations.

- Concerns about real estate markets: Concerns about potential bubbles or corrections in the real estate market may make stocks seem like a comparatively safer—though potentially riskier in terms of valuation—investment.

- Other asset classes and their comparative risk/reward profiles: Compared to other asset classes like commodities or alternative investments, the relative risk/reward profile of equities might still be deemed favorable by BofA, even with the high stock market valuations.

Potential Risks and Counterarguments to BofA's Stance

While BofA presents a compelling case, it's crucial to acknowledge the potential risks and counterarguments.

Valuation Metrics and Their Limitations

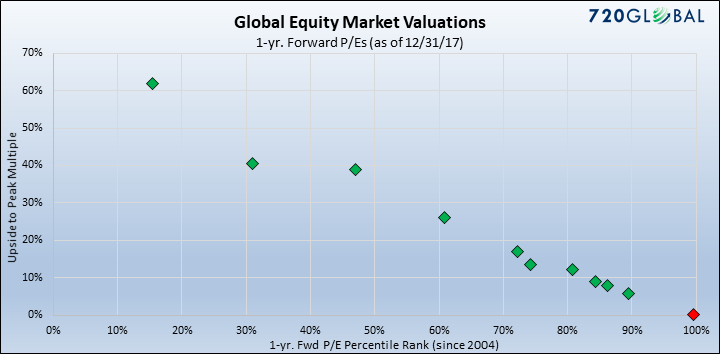

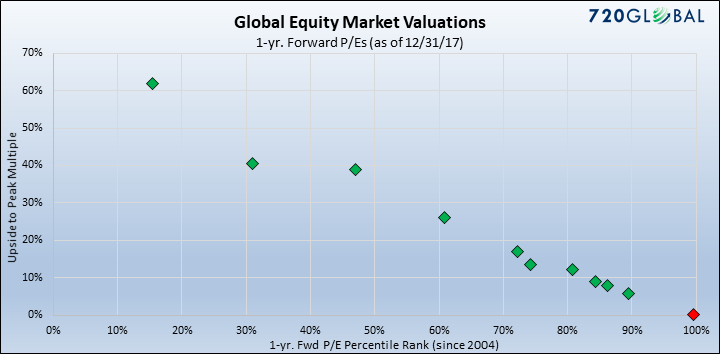

Traditional valuation metrics, while helpful, have limitations. The current market environment might render them less reliable indicators of intrinsic value.

- Specific examples of overvalued sectors or individual stocks: Despite overall strong earnings, some sectors or individual stocks might be demonstrably overvalued according to various metrics. Identifying these is crucial for risk management.

- Discussion of limitations of traditional valuation metrics in rapidly evolving markets: Rapid technological changes and unexpected shifts in market sentiment can render traditional valuation metrics like P/E ratios less effective.

- Alternative valuation methodologies to consider: Investors should consider alternative valuation approaches, such as discounted cash flow analysis or relative valuation, to gain a more comprehensive understanding of potential overvaluation.

Geopolitical and Economic Uncertainty

Unforeseen events can significantly impact the market, regardless of current valuations.

- Discussion of major geopolitical risks: Geopolitical tensions, trade wars, or unexpected international conflicts can trigger market corrections, irrespective of underlying company fundamentals.

- Economic indicators that may signal future market downturn: Key economic indicators, such as inflation rates, unemployment figures, and consumer confidence, should be monitored closely for signs of an impending downturn.

- Strategies to mitigate risk in an uncertain environment: Diversification, hedging strategies, and a cautious approach to investment are crucial for mitigating risk in uncertain times.

Market Volatility and Its Impact

Even with a positive outlook, the market's inherent volatility presents a significant risk.

- Historical examples of market corrections after periods of high valuation: History shows that periods of high valuations are often followed by corrections. Understanding this pattern is key.

- Strategies for managing portfolio risk during periods of volatility: Employing strategies like stop-loss orders and diversifying across asset classes can help manage risk during periods of high volatility.

- Importance of diversification in investment portfolios: Diversification across different asset classes and sectors remains the cornerstone of effective risk management in any market environment, especially one characterized by high stock market valuations.

Conclusion

BofA's rationale for potentially overlooking high stock market valuations highlights the influence of low interest rates, strong corporate earnings, and a lack of compelling alternatives. However, it's crucial to acknowledge the inherent risks associated with high valuations, including the limitations of traditional valuation metrics, geopolitical uncertainty, and the potential for increased market volatility. While BofA's analysis provides valuable insight, investors should conduct their own thorough due diligence and consider their risk tolerance before making investment decisions. Carefully assess high stock market valuations and develop a well-informed investment strategy based on your personal financial goals and risk profile. Don't ignore high stock market valuations completely, but understand BofA's perspective and its limitations before acting. Remember, responsible investment involves a comprehensive understanding of both the bullish and bearish arguments.

Featured Posts

-

Us Four Star Admiral Found Guilty Charges And Sentencing

May 20, 2025

Us Four Star Admiral Found Guilty Charges And Sentencing

May 20, 2025 -

Abidjan Lancement Du Marche Africain Des Solutions Spatiales Mass

May 20, 2025

Abidjan Lancement Du Marche Africain Des Solutions Spatiales Mass

May 20, 2025 -

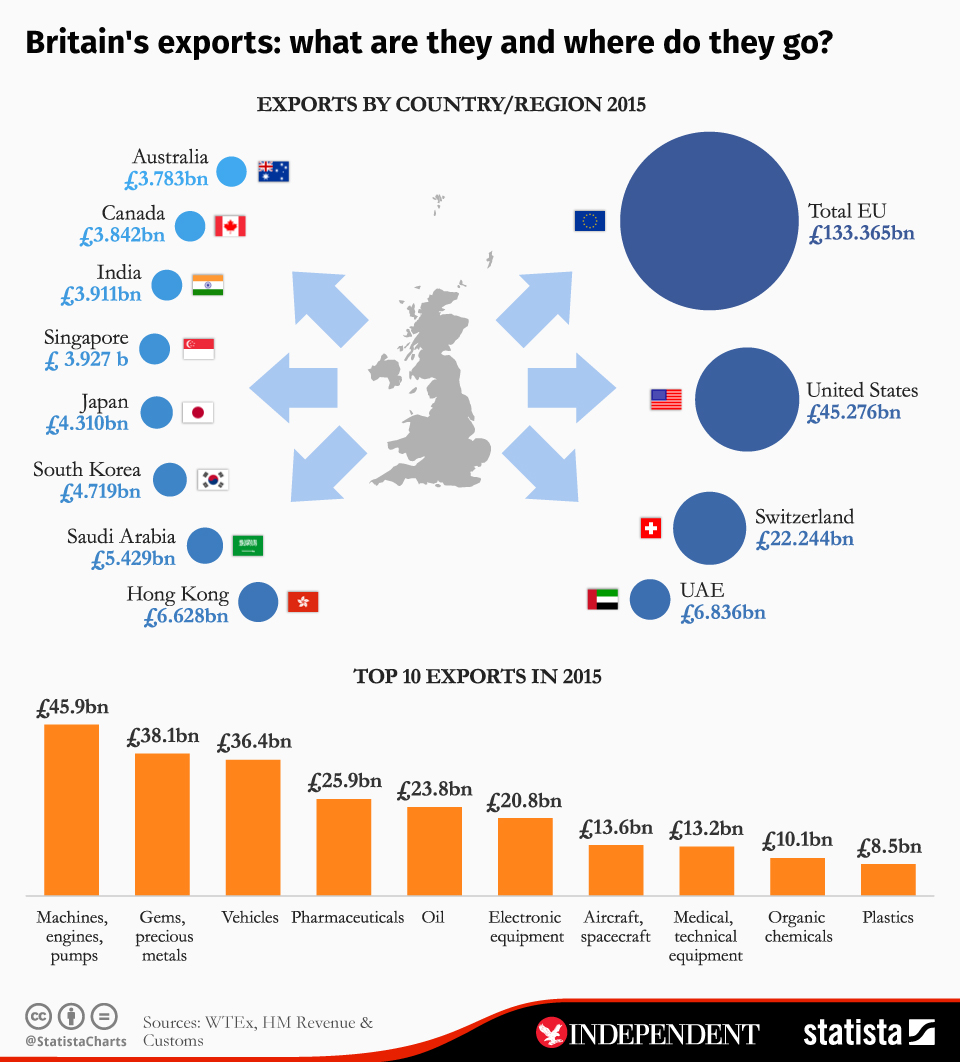

Analysis Brexits Impact On Uk Luxury Exports To The Eu

May 20, 2025

Analysis Brexits Impact On Uk Luxury Exports To The Eu

May 20, 2025 -

Find The Answers Nyt Mini Crossword March 31

May 20, 2025

Find The Answers Nyt Mini Crossword March 31

May 20, 2025 -

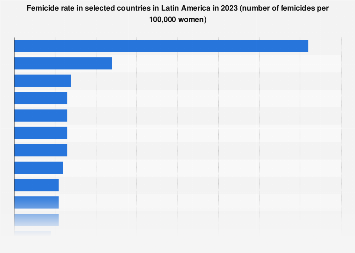

Understanding Femicide Statistics Causes And Solutions

May 20, 2025

Understanding Femicide Statistics Causes And Solutions

May 20, 2025

Latest Posts

-

Understanding D Wave Quantum Qbts Stocks Significant Monday Dip

May 20, 2025

Understanding D Wave Quantum Qbts Stocks Significant Monday Dip

May 20, 2025 -

D Wave Quantum Qbts Stock Drop Unpacking Mondays Sharp Decline

May 20, 2025

D Wave Quantum Qbts Stock Drop Unpacking Mondays Sharp Decline

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Plunge Mondays Market Crash Explained

May 20, 2025

D Wave Quantum Inc Qbts Stock Plunge Mondays Market Crash Explained

May 20, 2025 -

Gretzkys Allegiance To Trump Analyzing The Fallout And Its Long Term Effects

May 20, 2025

Gretzkys Allegiance To Trump Analyzing The Fallout And Its Long Term Effects

May 20, 2025 -

Did Wayne Gretzkys Loyalty Cost Him His Legacy A Look At His Trump Association

May 20, 2025

Did Wayne Gretzkys Loyalty Cost Him His Legacy A Look At His Trump Association

May 20, 2025