Delinquent Student Loans: The Government's Aggressive Pursuit And Your Rights

Table of Contents

The Government's Aggressive Collection Methods for Delinquent Student Loans

When student loan payments are consistently missed, the loan enters a delinquent status, eventually leading to default. The government employs several aggressive collection tactics to recover these delinquent student loans.

Wage Garnishment

Wage garnishment is a common method used to collect delinquent student loans. This involves the government seizing a portion of your wages directly from your employer. The percentage garnished can be substantial, significantly impacting your financial stability.

- Process: The Department of Education issues a notice, then your employer is legally obligated to deduct a percentage of your disposable income (typically up to 15%).

- State Laws: Some states have specific laws regarding exemptions and limitations on wage garnishment for student loans.

- Impact: Wage garnishment can create significant financial hardship, making it difficult to meet basic living expenses. Exploring income-driven repayment plans might be a viable alternative.

Tax Refund Offset

The government can intercept your federal tax refund to repay delinquent student loans. This is a powerful tool, as it directly affects your expected tax return.

- Process: The IRS automatically offsets your refund if you owe delinquent student loan debt.

- Eligibility: This applies to both federal and some private student loans in default.

- Hardship Waivers: In some cases, borrowers facing extreme financial hardship may be eligible for a waiver.

Bank Levy

In cases of significant delinquency, the government can levy your bank accounts, seizing funds to repay the debt. This action can leave your account with insufficient funds to cover essential expenses.

- Legal Process: This involves a legal order seizing funds, usually after other collection attempts have failed.

- Thresholds: The amount seized will depend on the outstanding balance and your available funds.

- Recourse: While challenging, legal recourse may be available depending on your specific circumstances.

Credit Reporting

Delinquent student loans have a severe negative impact on your credit score. This can make it difficult to obtain credit in the future, such as mortgages, car loans, or even credit cards.

- Credit Score Damage: A delinquent loan significantly lowers your credit score, often remaining on your report for seven years.

- Impact Duration: The negative impact persists until the debt is resolved or the seven-year period expires.

- Credit Repair: Strategies like loan rehabilitation or consolidation can help improve your credit score over time.

Understanding Your Rights as a Borrower with Delinquent Student Loans

Navigating delinquent student loans requires understanding your rights as a borrower. Knowing your options and legal protections can significantly impact your ability to manage your debt effectively.

Due Process Rights

Borrowers facing aggressive collection tactics have due process rights. These rights protect against unfair or abusive collection practices.

- Right to Appeal: You have the right to appeal decisions regarding your loan status or collection actions.

- Right to a Hearing: In certain cases, you may be entitled to a hearing to present your case and explain your circumstances.

- Fair Treatment: The government is obligated to treat borrowers fairly and according to established procedures.

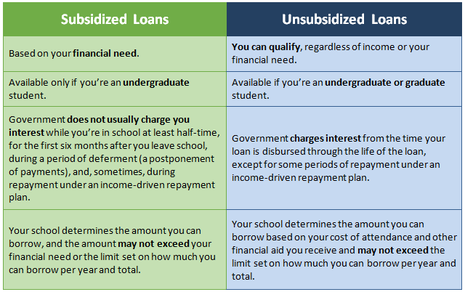

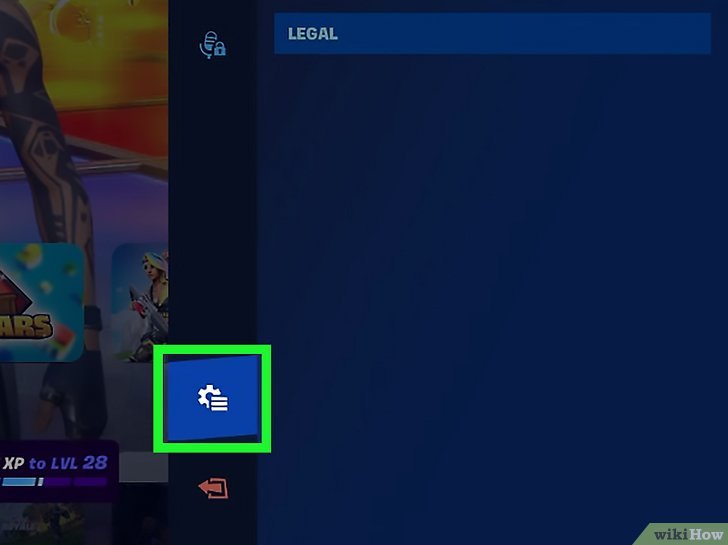

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans offer alternative repayment options based on your income and family size. These plans can make your monthly payments more affordable.

- IBR, PAYE, REPAYE: These are common IDR plans with varying eligibility requirements and repayment terms.

- Eligibility Criteria: Eligibility depends on factors like income, family size, and loan type.

- Benefits and Drawbacks: IDR plans offer affordability but may result in higher total interest paid over the life of the loan.

Loan Rehabilitation and Consolidation

Loan rehabilitation involves making a series of on-time payments to reinstate your defaulted loans. Consolidation combines multiple loans into one, potentially simplifying repayment.

- Eligibility: Eligibility requirements vary depending on the type of loan and your repayment history.

- Requirements: Meeting specific payment requirements is essential to complete rehabilitation successfully.

- Impact on Credit Score: Successful rehabilitation can positively impact your credit score.

Seeking Professional Help

Facing delinquent student loans can be overwhelming. Consulting a student loan counselor or attorney provides valuable support and guidance.

- Benefits of Professional Guidance: Counselors and attorneys can help you understand your options, navigate complex regulations, and negotiate with lenders.

- Reputable Resources: The National Foundation for Credit Counseling (NFCC) and other non-profit organizations offer valuable resources.

Taking Control of Your Delinquent Student Loans

The government's aggressive collection methods for delinquent student loans can be daunting, but borrowers possess significant rights and options. Remember, understanding your rights, exploring available repayment plans, and seeking professional assistance are crucial steps in managing your delinquent student loan debt. Don't let delinquent student loans overwhelm you. Take control today by exploring your options and seeking assistance. Learn more about managing your delinquent student loans and protecting your rights. Resolving delinquent student loan debt requires proactive engagement and a clear understanding of your legal protections. Find solutions tailored to your specific situation and regain control of your financial future.

Featured Posts

-

Rynok Truda Dubaya Perspektivy Dlya Rossiyan V 2025 Godu

May 17, 2025

Rynok Truda Dubaya Perspektivy Dlya Rossiyan V 2025 Godu

May 17, 2025 -

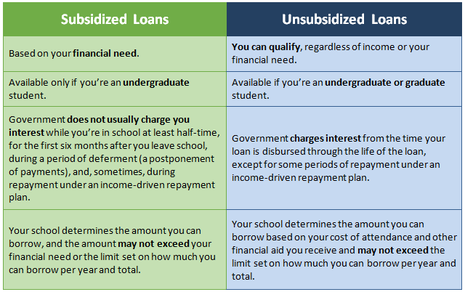

Generalna Proba Pred Evrobasket Srbija U Akciji U Bajernovoj Dvorani

May 17, 2025

Generalna Proba Pred Evrobasket Srbija U Akciji U Bajernovoj Dvorani

May 17, 2025 -

Knicks News Jalen Brunson Injury Update Tyler Koleks Extended Role And Remaining Schedule Breakdown

May 17, 2025

Knicks News Jalen Brunson Injury Update Tyler Koleks Extended Role And Remaining Schedule Breakdown

May 17, 2025 -

Crude Oil Market Report News And Insights For May 16

May 17, 2025

Crude Oil Market Report News And Insights For May 16

May 17, 2025 -

Fortnite Refund Hints At Cosmetic Policy Changes

May 17, 2025

Fortnite Refund Hints At Cosmetic Policy Changes

May 17, 2025

Latest Posts

-

105 91 Knicks Win Anunobys 27 Points Power Victory 76ers Suffer Ninth Consecutive Defeat

May 17, 2025

105 91 Knicks Win Anunobys 27 Points Power Victory 76ers Suffer Ninth Consecutive Defeat

May 17, 2025 -

Nba Season Breakdown Pistons Performance Compared To The Knicks

May 17, 2025

Nba Season Breakdown Pistons Performance Compared To The Knicks

May 17, 2025 -

Anunoby Explodes For 27 As Knicks Top 76ers 105 91 Continuing Phillys Slump

May 17, 2025

Anunoby Explodes For 27 As Knicks Top 76ers 105 91 Continuing Phillys Slump

May 17, 2025 -

Analyzing The Pistons And Knicks Key Differences This Season

May 17, 2025

Analyzing The Pistons And Knicks Key Differences This Season

May 17, 2025 -

Free Live Stream Ny Knicks Vs Brooklyn Nets Nba Season Finale 4 13 25 How To Watch

May 17, 2025

Free Live Stream Ny Knicks Vs Brooklyn Nets Nba Season Finale 4 13 25 How To Watch

May 17, 2025