Despite Apple Price Target Cut, Wedbush Remains Bullish: Should You?

Table of Contents

Wedbush's Rationale for Maintaining a Bullish Outlook on Apple

Wedbush's unwavering bullishness on Apple stems from several key factors. They believe the company's long-term growth prospects remain exceptionally strong, even amidst macroeconomic headwinds. Their rationale is supported by several key observations:

-

Strong iPhone Sales Projections: Despite economic slowdown concerns, Wedbush projects robust iPhone sales, fueled by continued demand and a loyal customer base. They cite strong pre-orders for the latest iPhone models and believe the iPhone's market dominance will continue.

-

Growth Potential in Services: Apple's services segment, encompassing Apple Music, iCloud, Apple TV+, and other offerings, is a significant driver of recurring revenue and consistent growth. Wedbush anticipates continued expansion in this area, boosting Apple's overall profitability and resilience.

-

Anticipation of New Product Launches and Innovations: The potential launch of new products, such as highly anticipated AR/VR headsets, could inject significant energy into Apple's growth trajectory. These innovations are expected to capture new market segments and further solidify Apple's leadership position.

-

Market Share Dominance and Brand Loyalty: Apple's strong brand recognition, premium pricing strategy, and loyal customer base provide a substantial competitive advantage. This entrenched market position ensures a relatively stable revenue stream, even during periods of economic uncertainty.

-

Long-Term Growth Potential in Emerging Markets: Apple continues to see significant opportunities for growth in developing economies. As these markets mature and consumer spending power increases, Apple is well-positioned to capitalize on this growth potential.

Wedbush's reports consistently emphasize these factors, supporting their conviction in Apple's long-term prospects. Their bullish outlook is not based solely on short-term market fluctuations but rather on a broader assessment of Apple's fundamental strengths.

Counterarguments to Wedbush's Bullish Stance

While Wedbush's optimism is compelling, it's crucial to acknowledge counterarguments to their bullish stance on Apple. A balanced perspective necessitates considering potential risks and challenges:

-

Global Economic Slowdown Impacting Consumer Spending: A global economic slowdown could significantly impact consumer spending on discretionary items, potentially affecting iPhone sales and other Apple products. This risk cannot be ignored, especially in the current macroeconomic environment.

-

Increased Competition in the Smartphone Market: The smartphone market is intensely competitive, with several strong players vying for market share. Increased competition could erode Apple's market dominance and put pressure on pricing and profit margins.

-

Potential Supply Chain Disruptions: Geopolitical instability and supply chain disruptions could impact Apple's ability to manufacture and deliver its products, potentially affecting sales and profitability. This is a persistent risk in the global tech industry.

-

Valuation Concerns Despite Strong Fundamentals: Despite strong fundamentals, some analysts express concerns about Apple's current valuation. They argue that the stock price may be overvalued relative to its future growth prospects.

-

Risks Associated with Investing in a Single Stock: Concentrating a significant portion of one's investment portfolio in a single stock, even a blue-chip company like Apple, carries inherent risk. Diversification is crucial for mitigating portfolio volatility.

Analyzing the Impact of the Apple Price Target Cut

The recent Apple price target cut by other analysts underscores the uncertainty surrounding the stock's future performance. Several factors contributed to this downward revision:

-

Concerns about iPhone Sales: Some analysts express concerns about slowing iPhone sales growth, citing factors such as economic uncertainty and increased competition.

-

Economic Outlook: The overall economic outlook plays a significant role in influencing analyst price targets. Concerns about a potential recession or prolonged economic slowdown have led some analysts to lower their expectations for Apple's performance.

-

Impact on Investor Confidence and Market Reaction: The price target cut has undoubtedly impacted investor confidence, leading to some market volatility. The market's reaction to these adjustments serves as a barometer of investor sentiment.

-

Comparison of Different Analyst Ratings for Apple: It's important to note that analyst ratings vary considerably. While some remain bullish, others have issued more cautious assessments, reflecting the diversity of opinions and perspectives.

Strategies for Investors Considering Apple Stock

Given the mixed signals, investors considering Apple stock need a strategic approach:

-

Diversification Strategies to Mitigate Risk: Diversifying one's investment portfolio across different asset classes and sectors is crucial to mitigate risk. Don't put all your eggs in one basket.

-

Dollar-Cost Averaging to Manage Volatility: Dollar-cost averaging, a strategy that involves investing a fixed amount at regular intervals, helps to manage volatility and reduce the impact of market fluctuations.

-

Importance of Long-Term Investment Horizons: Investing in Apple, or any stock, requires a long-term perspective. Short-term market fluctuations should not dictate long-term investment decisions.

-

Setting Realistic Expectations and Risk Tolerance: It’s crucial to set realistic expectations for investment returns and carefully assess one's risk tolerance before investing in any stock, including Apple.

-

Considering Alternative Investment Options: Explore other investment options to create a well-diversified portfolio that aligns with your financial goals and risk tolerance.

Conclusion: Should You Stay Bullish on Apple Despite the Price Target Cut?

The decision of whether to remain bullish on Apple after the price target cut is a complex one. While Wedbush's optimistic outlook highlights Apple's strong fundamentals and growth potential, counterarguments regarding economic headwinds and increased competition must be considered. Analyze the Apple price target carefully, weighing the arguments presented in this article. Assess your own risk tolerance before investing in Apple. Conduct thorough due diligence and make informed decisions regarding your Apple stock portfolio. Remember, informed investing is key to navigating the uncertainties of the stock market. Make your decisions based on your own research and financial goals.

Featured Posts

-

Maryland Softballs Aubrey Wurst Shines In 11 1 Win Against Delaware

May 24, 2025

Maryland Softballs Aubrey Wurst Shines In 11 1 Win Against Delaware

May 24, 2025 -

Philips Annual General Meeting Of Shareholders Key Highlights

May 24, 2025

Philips Annual General Meeting Of Shareholders Key Highlights

May 24, 2025 -

Krasivaya Data 89 Svadeb Na Kharkovschine

May 24, 2025

Krasivaya Data 89 Svadeb Na Kharkovschine

May 24, 2025 -

Three Day Slump Amsterdam Stock Exchange Down 11

May 24, 2025

Three Day Slump Amsterdam Stock Exchange Down 11

May 24, 2025 -

Planning Your Memorial Day Trip In 2025 Air Travel Tips

May 24, 2025

Planning Your Memorial Day Trip In 2025 Air Travel Tips

May 24, 2025

Latest Posts

-

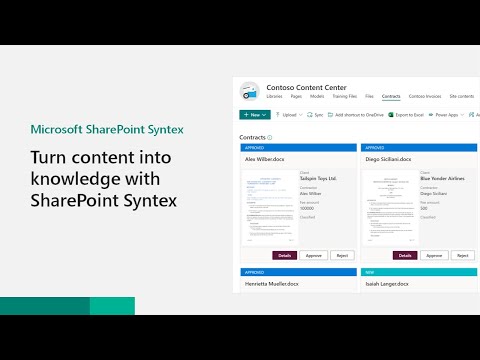

Exec Office365 Breach Millions Made Through Email Hacks Feds Claim

May 24, 2025

Exec Office365 Breach Millions Made Through Email Hacks Feds Claim

May 24, 2025 -

Repetitive Documents An Ai Solution For Creating A Poop Podcast

May 24, 2025

Repetitive Documents An Ai Solution For Creating A Poop Podcast

May 24, 2025 -

Ai Digest Transforming Repetitive Documents Into Informative Poop Podcasts

May 24, 2025

Ai Digest Transforming Repetitive Documents Into Informative Poop Podcasts

May 24, 2025 -

Lab Owners Guilty Plea Faking Covid 19 Test Results During Pandemic

May 24, 2025

Lab Owners Guilty Plea Faking Covid 19 Test Results During Pandemic

May 24, 2025 -

Utilizing Orbital Space Crystals For Superior Drug Production

May 24, 2025

Utilizing Orbital Space Crystals For Superior Drug Production

May 24, 2025