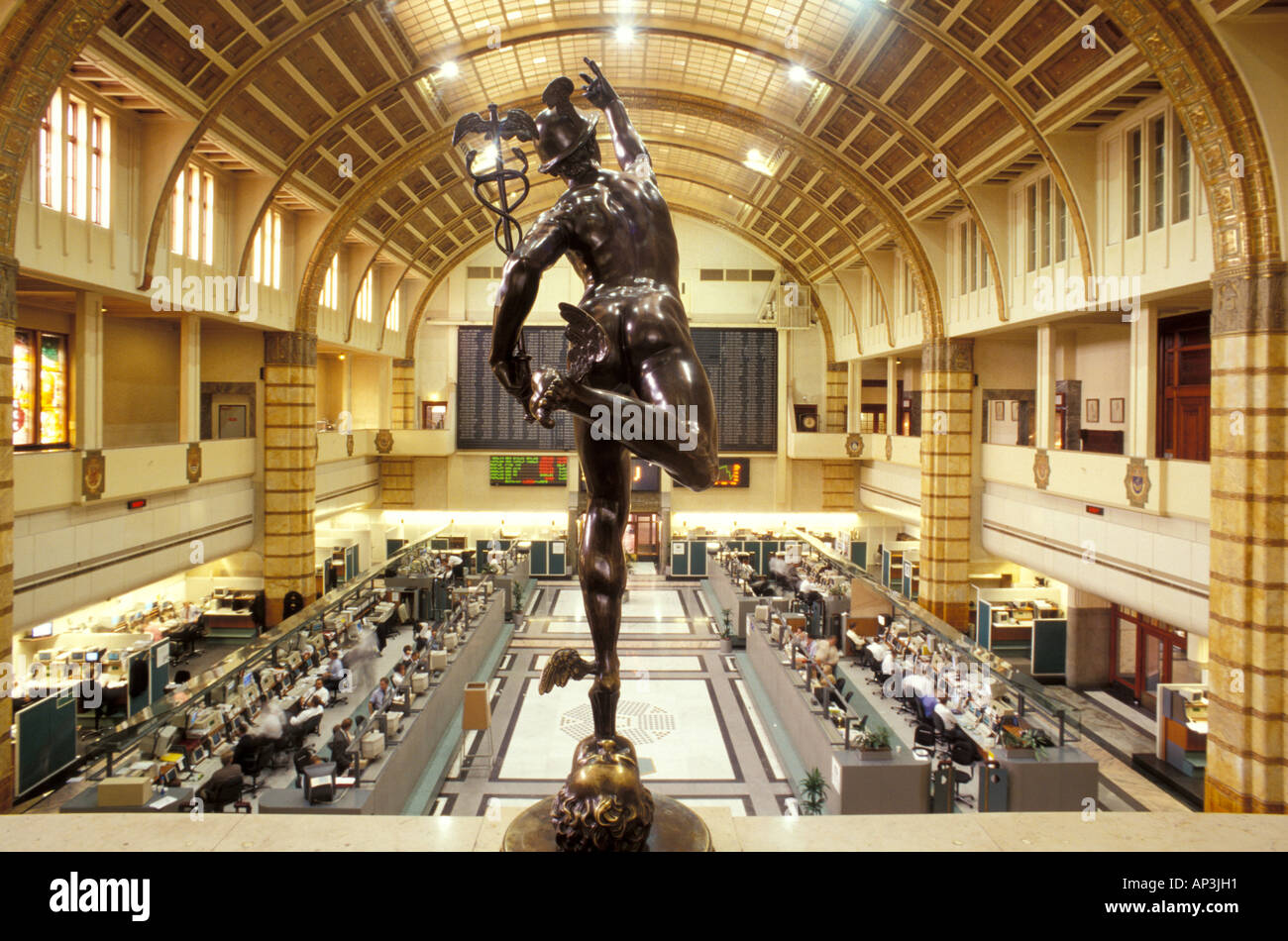

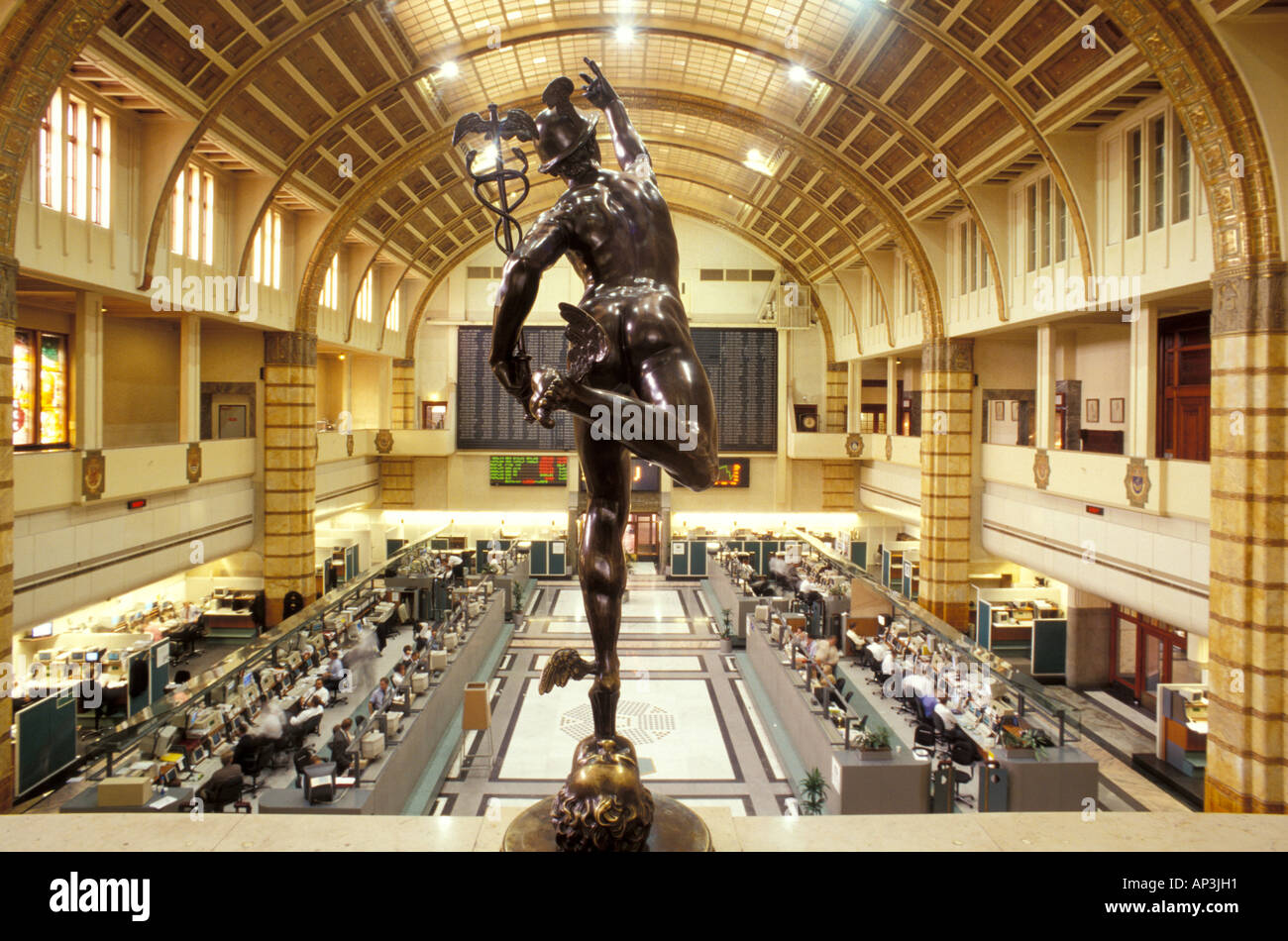

Three-Day Slump: Amsterdam Stock Exchange Down 11%

Table of Contents

Causes of the Amsterdam Stock Exchange's Sharp Decline

Several interconnected factors contributed to the sharp decline in the AEX index over the three-day period. Understanding these underlying causes is crucial for assessing the situation's severity and predicting future market movements.

Global Economic Uncertainty

The global economic climate played a significant role in the AEX's downturn. Rising inflation rates across many countries, coupled with aggressive interest rate hikes by central banks, fueled recessionary fears. This global market volatility significantly impacted investor confidence, leading to widespread selling across various asset classes, including those listed on the AEX.

- Impact of Inflation: High inflation erodes purchasing power and increases the cost of borrowing, dampening economic activity and impacting corporate profits.

- Interest Rate Hikes: Central banks' efforts to curb inflation through interest rate hikes increase borrowing costs for businesses and consumers, potentially slowing economic growth.

- Recession Risk: The combination of high inflation and rising interest rates increases the risk of a global recession, prompting investors to seek safer havens for their capital.

- Geopolitical Instability: Ongoing geopolitical tensions and uncertainties further exacerbate investor anxieties, adding to the already fragile global economic outlook. The AEX index, like other global markets, is highly sensitive to such developments.

Sector-Specific Weakness in the Amsterdam Market

The decline wasn't uniform across all sectors listed on the AEX. Specific sectors experienced disproportionately large losses, reflecting individual vulnerabilities within the Dutch economy.

- Technology Sector: The technology sector, often sensitive to interest rate changes and economic downturns, saw particularly significant losses. Higher borrowing costs directly impact the valuations of growth-oriented tech companies.

- Energy Sector: Fluctuations in global energy prices, influenced by geopolitical events and supply chain disruptions, affected energy companies listed on the AEX.

- Financial Sector: Banks and other financial institutions faced pressure due to rising interest rates and concerns about potential loan defaults in a slowing economy. AEX performance in this sector directly reflects broader economic anxieties.

- Individual Stock Performance: Analysis of individual stock performance within each sector revealed varied responses to the market downturn. Some companies demonstrated resilience, while others experienced substantial losses, highlighting the diverse nature of the AEX's composition.

Impact of Geopolitical Events

Geopolitical events played a significant role in the market's instability. The ongoing war in Ukraine, for instance, continues to disrupt global supply chains, fueling inflation and creating uncertainty about future energy supplies. These geopolitical risks directly impact investor confidence and market stability.

- Supply Chain Disruptions: The ongoing global supply chain crisis, exacerbated by geopolitical tensions, has led to shortages and price increases for various goods, impacting businesses and consumer sentiment.

- Energy Crisis: The war in Ukraine has significantly impacted global energy markets, leading to soaring energy prices and increased volatility in the energy sector. This has created additional uncertainty and negatively impacted investor sentiment.

- Market Instability: The confluence of geopolitical risks, combined with economic uncertainty, has created a highly volatile market environment, making it challenging for investors to predict future trends.

Analysis of the Three-Day Slump and its Short-Term Implications

The AEX's 11% decline wasn't a sudden collapse but rather a three-day downward trajectory. Understanding this day-by-day breakdown provides a more nuanced understanding of the market's reaction.

Day-by-Day Breakdown of the Decline

- Day 1: A moderate decline of X%, setting the stage for further selling pressure.

- Day 2: An accelerated drop of Y%, reflecting growing investor concerns and panic selling.

- Day 3: The most significant drop of Z%, culminating in the 11% overall loss. (Replace X, Y, Z with actual percentage figures for a more impactful analysis, and include a relevant chart or graph here).

Short-Term Outlook for the Amsterdam Stock Exchange

The short-term outlook for the AEX remains uncertain. While some analysts predict a potential rebound, others warn of further declines depending on the resolution of underlying economic and geopolitical factors. Market predictions vary widely, highlighting the inherent uncertainty in the current climate.

Long-Term Effects and Investor Strategies

The consequences of this three-day slump extend beyond the short term, potentially impacting the Dutch economy and investor strategies for years to come.

Potential Long-Term Impacts on the Dutch Economy

A prolonged period of low investor confidence and reduced market activity could negatively impact overall economic growth in the Netherlands. Reduced business investment and consumer spending could follow, impacting various sectors of the Dutch economy. The ripple effect could be substantial.

Strategies for Investors During Market Volatility

Navigating market volatility requires a robust investment strategy. Investors should consider:

- Diversification: Spreading investments across different asset classes to reduce risk exposure.

- Risk Management: Understanding your risk tolerance and adjusting your portfolio accordingly.

- Long-Term Investing: Maintaining a long-term perspective and avoiding impulsive decisions based on short-term market fluctuations.

- Professional Advice: Seeking guidance from qualified financial advisors to make informed investment decisions.

Conclusion: Navigating the Aftermath of the Amsterdam Stock Exchange's Three-Day Slump

The 11% decline in the Amsterdam Stock Exchange over three days represents a significant market event driven by a complex interplay of global economic uncertainty, sector-specific weaknesses, and geopolitical risks. The short-term outlook remains uncertain, while the long-term impacts on the Dutch economy could be substantial. Investors must adopt robust strategies focusing on diversification, risk management, and a long-term investment horizon to navigate this volatility. Stay updated on the latest developments affecting the Amsterdam Stock Exchange and learn how to effectively navigate future market fluctuations. Follow our blog for continued analysis of the Three-Day Slump and its ongoing repercussions.

Featured Posts

-

Porsche 956 Nin Ters Yuez Edilerek Sergilenmesinin Anlami

May 24, 2025

Porsche 956 Nin Ters Yuez Edilerek Sergilenmesinin Anlami

May 24, 2025 -

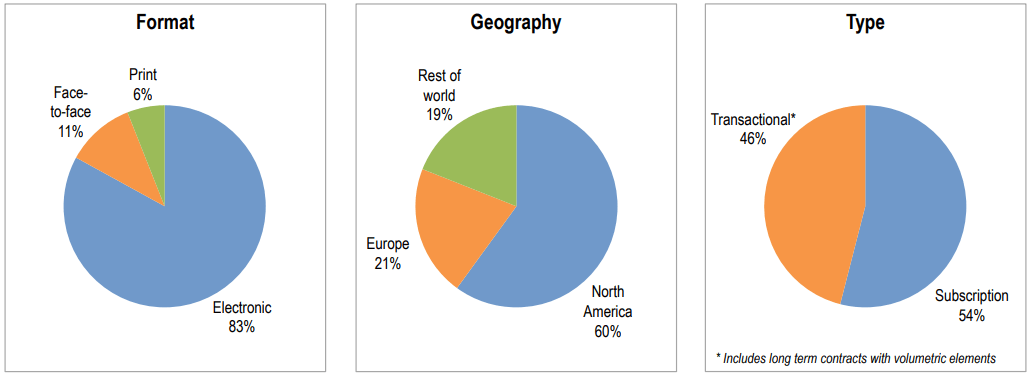

Sterke Prestaties Relx Ai Als Drijfveer Voor Groei Tot 2025

May 24, 2025

Sterke Prestaties Relx Ai Als Drijfveer Voor Groei Tot 2025

May 24, 2025 -

Free Transfer Target Crystal Palace And Kyle Walker Peters

May 24, 2025

Free Transfer Target Crystal Palace And Kyle Walker Peters

May 24, 2025 -

Tracking The Net Asset Value Nav Of The Amundi Msci World Ex Us Ucits Etf

May 24, 2025

Tracking The Net Asset Value Nav Of The Amundi Msci World Ex Us Ucits Etf

May 24, 2025 -

La Chine En France Une Repression Impitoyable Des Dissidents

May 24, 2025

La Chine En France Une Repression Impitoyable Des Dissidents

May 24, 2025

Latest Posts

-

Actress Mia Farrow Demands Trumps Imprisonment Regarding Venezuelan Deportations

May 24, 2025

Actress Mia Farrow Demands Trumps Imprisonment Regarding Venezuelan Deportations

May 24, 2025 -

Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025