Details Emerge: House GOP's Unveiling Of Trump Tax Proposals

Table of Contents

Key Provisions of the House GOP's Trump Tax Proposals

The proposed Trump tax plan includes sweeping changes to both individual and corporate taxation. Understanding these changes is crucial for individuals and businesses alike.

Individual Income Tax Changes

The House GOP's plan significantly alters the individual income tax system. While specific rates may change during the legislative process, the core principles involve substantial reductions in tax rates across multiple brackets.

-

Significant reduction in individual income tax rates: The proposed plan aims to simplify the tax code by reducing the number of tax brackets and lowering the rates within them. For example, previous proposals suggested collapsing the current seven brackets into three or four, with significantly lower rates for each. (Note: Consult official government sources for the most up-to-date proposed rates as they can change rapidly).

-

Changes to standard deduction and personal exemptions: The plan likely includes increases to the standard deduction, potentially eliminating or significantly altering personal exemptions. This change would simplify the tax filing process for many, but its impact on different income groups would require careful analysis.

-

Impact on different income brackets: While proponents argue the plan benefits all income levels, the actual impact varies considerably. Lower and middle-income families could see some benefit from the increased standard deduction and simplified filing. Higher-income individuals might experience greater tax savings due to the lower marginal rates on higher incomes.

-

Potential implications for families and dependents: The changes to personal exemptions and the child tax credit would significantly affect families with children and dependents. The proposed expansion of the child tax credit could offset some of the losses from eliminated exemptions, but this effect needs detailed examination based on individual circumstances.

-

Specific changes to tax credits:

- Child Tax Credit: Potential expansion of the Child Tax Credit, potentially increasing its value and making it fully refundable.

- Other Credits: Potential changes to other tax credits like the Earned Income Tax Credit (EITC) would need to be carefully assessed for their impact on low- and moderate-income families.

Corporate Tax Rate Reduction

A central element of the Trump tax proposals is a dramatic reduction in the corporate tax rate.

-

Proposed reduction in the corporate tax rate: The plan proposes slashing the corporate tax rate from its current level (e.g., 21%) to a significantly lower rate, potentially boosting business investment. (Again, refer to official sources for the most current proposed rate.)

-

Potential effects on business investment and job creation: Proponents argue that the lower corporate tax rate would incentivize businesses to invest more in their operations, leading to job creation and economic growth. Critics, however, express concerns that these benefits might not fully materialize.

-

Analysis of the competitiveness of US corporations globally: A lower corporate tax rate aims to make American companies more competitive on the global stage, attracting investment and encouraging businesses to remain in or relocate to the US.

-

Discussion of potential revenue implications for the government: Lowering the corporate tax rate would decrease the amount of tax revenue collected by the government. The long-term effects on the national debt and government spending are subjects of ongoing debate.

-

Proposed changes to corporate tax deductions or loopholes: The plan may include revisions to various corporate tax deductions and loopholes. The net impact of these changes on corporate tax liability needs further clarification.

Changes to Capital Gains and Estate Taxes

The proposed tax plan also includes potential alterations to capital gains and estate taxes.

-

Proposed alterations to capital gains tax rates: The plan might involve adjustments to capital gains tax rates, potentially lowering them to stimulate investment and economic activity.

-

Impact on investment strategies and wealth accumulation: Changes to capital gains taxes could significantly impact investment decisions. Lower rates might encourage more investment, while higher rates might discourage it.

-

Analysis of the potential effect on the stock market: Alterations to capital gains taxes could affect stock market valuations and investor behavior, creating both opportunities and risks.

-

Proposed changes to estate taxes and their implications for inheritance: The plan might include modifications to the estate tax, potentially raising or lowering the exemption threshold and altering the tax rates. This would have significant consequences for wealth transfer across generations.

-

Proposed limitations or exemptions: Specific limitations or exemptions related to capital gains and estate taxes would need to be analyzed to fully understand the plan's impact on different groups of taxpayers.

Projected Economic Impacts of the Trump Tax Proposals

The economic consequences of the Trump tax proposals are a subject of intense debate.

Positive Economic Projections

Proponents of the plan predict a range of positive economic effects.

-

Arguments for increased economic growth fueled by tax cuts: The "supply-side economics" argument suggests that lower taxes would stimulate investment, boost productivity, and ultimately lead to higher economic growth.

-

Potential for job creation and increased investment: Lower corporate taxes and individual tax cuts could encourage businesses to expand and hire more workers, leading to a rise in employment.

-

Increased consumer spending as a result of tax relief: Tax cuts could lead to increased disposable income for consumers, resulting in higher consumer spending and further stimulating economic activity.

-

Positive economic forecasts from proponents: Proponents often cite economic models and forecasts predicting significant economic growth, job creation, and increased wages as a result of the tax cuts.

Concerns and Potential Negative Impacts

Critics express several concerns regarding the potential negative impacts of the proposed tax plan.

-

Potential increase in the national debt: The substantial tax cuts could lead to a significant increase in the national debt, especially if they are not offset by spending cuts elsewhere.

-

Concerns about the distribution of tax benefits: Critics argue that the benefits of the tax cuts would be disproportionately concentrated among high-income earners and corporations, exacerbating income inequality.

-

Potential inflationary pressures due to increased spending: The increase in consumer spending and business investment fueled by tax cuts might lead to inflationary pressures if the economy operates near its full capacity.

-

Negative economic forecasts from critics: Critics point to economic models and forecasts that suggest the tax cuts could lead to increased inequality, higher national debt, and minimal impact on economic growth.

Political Ramifications and Future of the Trump Tax Proposals

The success of the Trump tax proposals hinges on various political factors.

-

Analysis of the political landscape and potential for legislative success: The plan’s passage through Congress will depend on securing enough votes from both parties, a challenging prospect given the partisan divisions in American politics.

-

Discussion of potential bipartisan support or opposition: While some level of bipartisan support might be possible, the likelihood of significant changes and compromises during the legislative process is high.

-

Potential for amendments and revisions during the legislative process: The proposals are likely to undergo substantial changes during the legislative process as lawmakers from both parties negotiate and propose amendments.

-

Key political figures and their stances on the proposals: The stances of key political figures, including influential members of Congress and the President, will greatly influence the final form and fate of the proposals.

-

Discussion of the timeline for implementation: The timeline for the implementation of the tax plan, if passed, would depend on the legislative process and the administrative capacity to put the changes into effect.

Conclusion

The House GOP's unveiling of the Trump tax proposals marks a significant potential shift in US tax policy. This article has explored the key provisions, highlighting both the potential upsides and significant risks. The ultimate impact will depend on many factors including the legislative process, prevailing economic conditions, and how effectively the changes are implemented. Understanding these potential changes is vital for individuals and businesses to prepare and adapt to the shifting landscape of taxation.

Call to Action: Stay informed about the ongoing developments regarding the Trump tax proposals and their potential implications. Continue to follow reliable news sources and official government channels for updates and detailed analyses of the House GOP tax plan and its effect on tax reform in the United States. Learn more about how these Republican tax plan changes could impact your tax brackets and capital gains tax liability. Proactive planning is crucial in navigating these potential shifts in tax policy.

Featured Posts

-

Hudson Bay Receives Court Approval To Extend Financial Restructuring

May 16, 2025

Hudson Bay Receives Court Approval To Extend Financial Restructuring

May 16, 2025 -

Is Tom Cruise Ever Going To Pay Tom Hanks That Dollar

May 16, 2025

Is Tom Cruise Ever Going To Pay Tom Hanks That Dollar

May 16, 2025 -

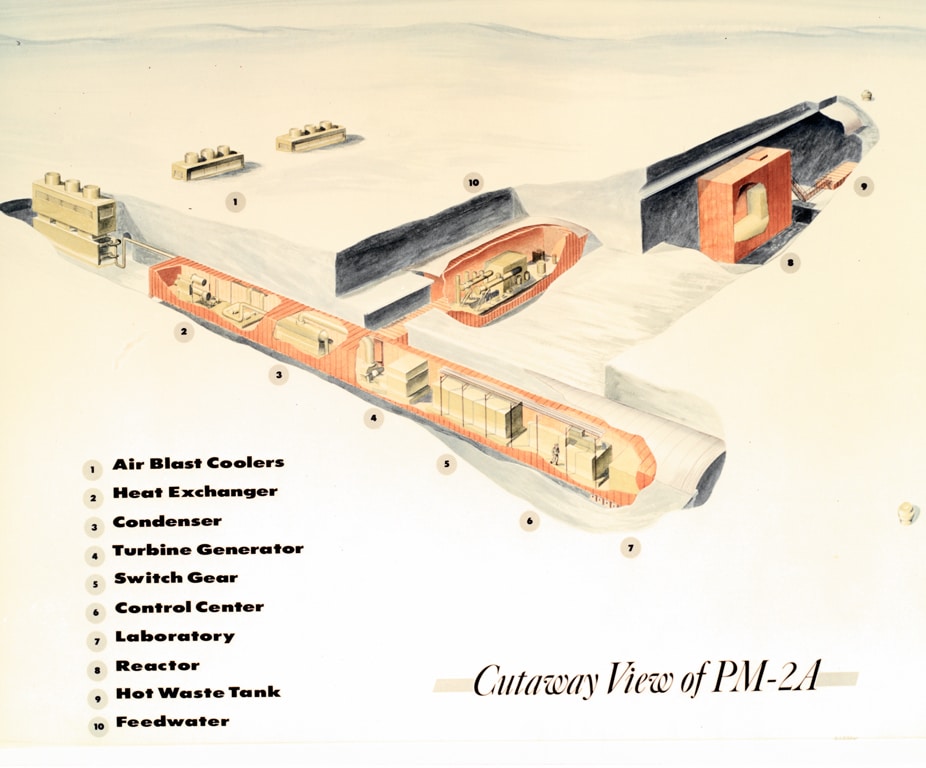

The U S Nuclear Base Beneath Greenlands Ice A Decades Long Secret

May 16, 2025

The U S Nuclear Base Beneath Greenlands Ice A Decades Long Secret

May 16, 2025 -

3 Kissfm Vont Weekend A Photo Journey April 4 6 2025

May 16, 2025

3 Kissfm Vont Weekend A Photo Journey April 4 6 2025

May 16, 2025 -

Cybercriminal Nets Millions Through Executive Office365 Account Breaches

May 16, 2025

Cybercriminal Nets Millions Through Executive Office365 Account Breaches

May 16, 2025

Latest Posts

-

Lafcs Return To Mls Focus The San Jose Test

May 16, 2025

Lafcs Return To Mls Focus The San Jose Test

May 16, 2025 -

Analyzing The Earthquakes Defeat Steffens Performance And Team Strategy

May 16, 2025

Analyzing The Earthquakes Defeat Steffens Performance And Team Strategy

May 16, 2025 -

Lafc Vs San Jose All Eyes On The Mls

May 16, 2025

Lafc Vs San Jose All Eyes On The Mls

May 16, 2025 -

Earthquakes Vs Rapids A Post Match Analysis Of Steffens Performance

May 16, 2025

Earthquakes Vs Rapids A Post Match Analysis Of Steffens Performance

May 16, 2025 -

Reviewing The Earthquakes Loss Zach Steffens Performance And The Road Ahead

May 16, 2025

Reviewing The Earthquakes Loss Zach Steffens Performance And The Road Ahead

May 16, 2025