Dow Futures And China Economy: Market Reaction To Tariff Conflicts

Table of Contents

The Impact of Tariff Conflicts on the Chinese Economy

The US-China trade war has had a profound and multifaceted impact on the Chinese economy. Understanding this impact is key to interpreting the movements in Dow Futures, a critical barometer of global market sentiment.

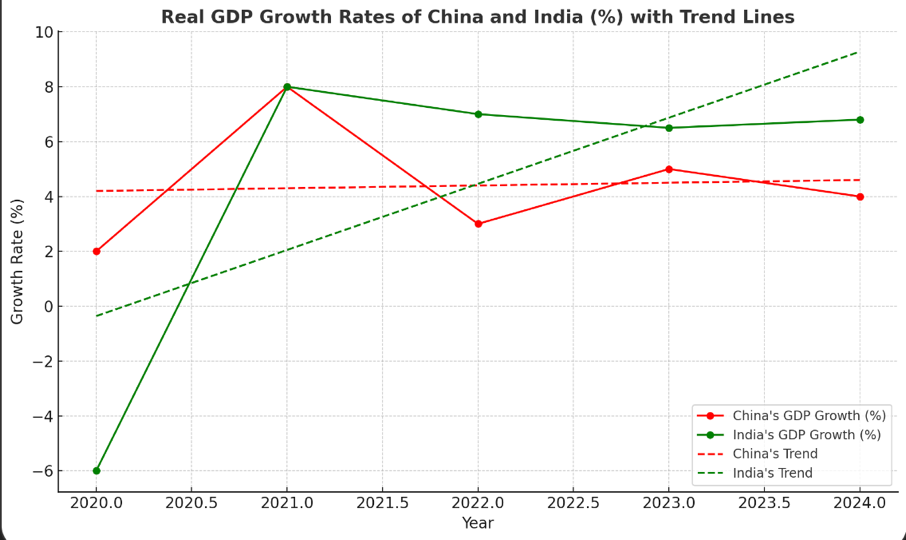

Slowdown in Chinese Economic Growth

Tariffs imposed by the US have undeniably slowed Chinese economic growth. These tariffs have directly affected Chinese exports, leading to decreased revenue and impacting various sectors.

- Manufacturing: The manufacturing sector, a cornerstone of the Chinese economy, has been significantly impacted, with reduced orders from US buyers and increased production costs.

- Agriculture: Agricultural exports, including soybeans and pork, have suffered substantial losses due to retaliatory tariffs.

- Technology: The tech sector has faced challenges due to restrictions on the sale of certain technologies and components.

The impact on China's GDP growth has been noticeable, with figures showing a decline in the annual growth rate compared to pre-trade war projections. Keywords: China GDP, Chinese Exports, Economic Slowdown, Trade War Impact.

Shifting Global Supply Chains

To mitigate the impact of tariffs, many multinational companies have begun shifting their supply chains away from China. This relocation of production to other countries, such as Vietnam, Mexico, and India, has significant implications.

- Reduced Foreign Investment: Uncertainty surrounding the trade war has deterred foreign investment in China.

- Job Losses: The shift in production has led to job losses in some sectors within China.

- Increased Production Costs: Relocating production often involves higher initial investment and operational costs.

Keywords: Global Supply Chains, Relocation, Foreign Investment in China, Manufacturing Shifts.

Increased Domestic Consumption Focus

In response to external pressures, China has increasingly focused on stimulating its domestic economy. This involves a strategic shift towards boosting domestic consumption.

- Government Stimulus Packages: The government has implemented various stimulus packages aimed at boosting consumer spending and infrastructure development.

- Development of Domestic Brands: There's a push to strengthen domestic brands and reduce reliance on foreign goods.

- Improved Infrastructure: Investments in infrastructure projects aim to support economic growth and create jobs.

Keywords: Domestic Consumption, China's Domestic Market, Stimulus Packages.

Market Reaction: Dow Futures and the Trade War

Dow Futures, contracts representing the future value of the Dow Jones Industrial Average, are highly sensitive to global economic events. The US-China trade war has created significant volatility in these futures contracts.

Correlation Between Dow Futures and Tariff Announcements

Announcements and escalations of tariff conflicts often result in immediate and significant reactions in Dow Futures. Charts clearly show a negative correlation – when tariff tensions rise, Dow Futures tend to fall, reflecting investor anxiety. These price fluctuations reflect shifting investor sentiment, with uncertainty driving market volatility. Keywords: Dow Futures Volatility, Market Sentiment, Tariff Announcement Impact, Stock Market Reaction.

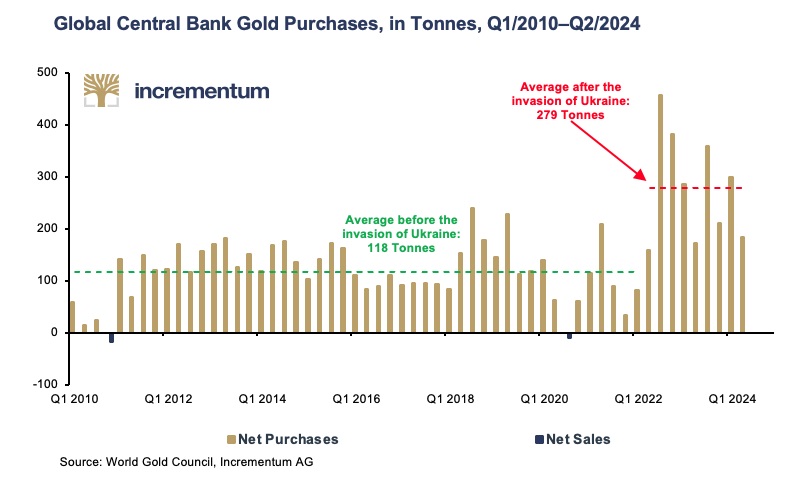

Safe-Haven Assets and Flight to Quality

During periods of heightened trade uncertainty, investors often seek refuge in safe-haven assets. This "flight to quality" involves a shift towards assets perceived as less risky.

- Gold Prices: Gold prices often rise during trade wars as investors seek a hedge against uncertainty.

- US Treasury Bonds: US Treasury bonds, considered low-risk investments, see increased demand.

- US Dollar Strength: The US dollar often strengthens as investors seek a safe haven currency.

Keywords: Safe Haven Assets, Gold Prices, US Treasury Bonds, Flight to Quality.

Uncertainty and Market Volatility

The inherent uncertainty surrounding the trade war is a major driver of market volatility. Predicting market movements during such periods is exceptionally challenging. Investor behavior shifts from risk-seeking to risk-aversion, leading to unpredictable price swings in Dow Futures and other assets. Keywords: Market Uncertainty, Volatility, Investor Behavior, Risk Aversion.

Long-Term Implications and Outlook

The US-China trade conflict has far-reaching implications that extend beyond immediate market reactions.

Potential for De-globalization

The trade war raises concerns about a potential shift away from globalized trade towards more regionalized economies. This could lead to:

- Regional Trade Agreements: A rise in regional trade agreements as countries seek to reduce reliance on global supply chains.

- Slower Global Economic Growth: Disruptions to global trade could negatively impact overall economic growth.

Keywords: De-globalization, Regional Trade Agreements, Global Economic Growth.

Geopolitical Risks and Strategic Competition

The US-China trade conflict is deeply intertwined with broader geopolitical considerations. The competition between these two global powers has significant implications for the global political landscape and future conflicts. Further escalation could create significant instability and uncertainty. Keywords: Geopolitical Risks, US-China Relations, Global Power Dynamics.

Conclusion: Navigating the Complex Relationship Between Dow Futures and the China Economy

The US-China trade war and its associated tariff conflicts have significantly impacted the Chinese economy and, consequently, influenced Dow Futures and broader market sentiment. Understanding the complex interplay between these factors is crucial for making informed investment decisions. Monitoring US-China trade relations is essential for navigating the volatile market conditions. Stay informed about Dow Futures, the China economy, and tariff conflicts to make better investment decisions. For further insights, consult reputable financial news sources and economic analysis reports. Keywords: Dow Futures Trading, China Economic Outlook, Tariff Conflict Analysis, Informed Investment.

Featured Posts

-

Chinas Auto Industry Disruptor Or Mainstream Player

Apr 26, 2025

Chinas Auto Industry Disruptor Or Mainstream Player

Apr 26, 2025 -

California Climbs To Fourth Outpacing Japans Economy

Apr 26, 2025

California Climbs To Fourth Outpacing Japans Economy

Apr 26, 2025 -

Economic Shift California Overtakes Japan Securing Fourth Place Globally

Apr 26, 2025

Economic Shift California Overtakes Japan Securing Fourth Place Globally

Apr 26, 2025 -

Is Gold A Safe Haven During Trade Wars Record Rally Explained

Apr 26, 2025

Is Gold A Safe Haven During Trade Wars Record Rally Explained

Apr 26, 2025 -

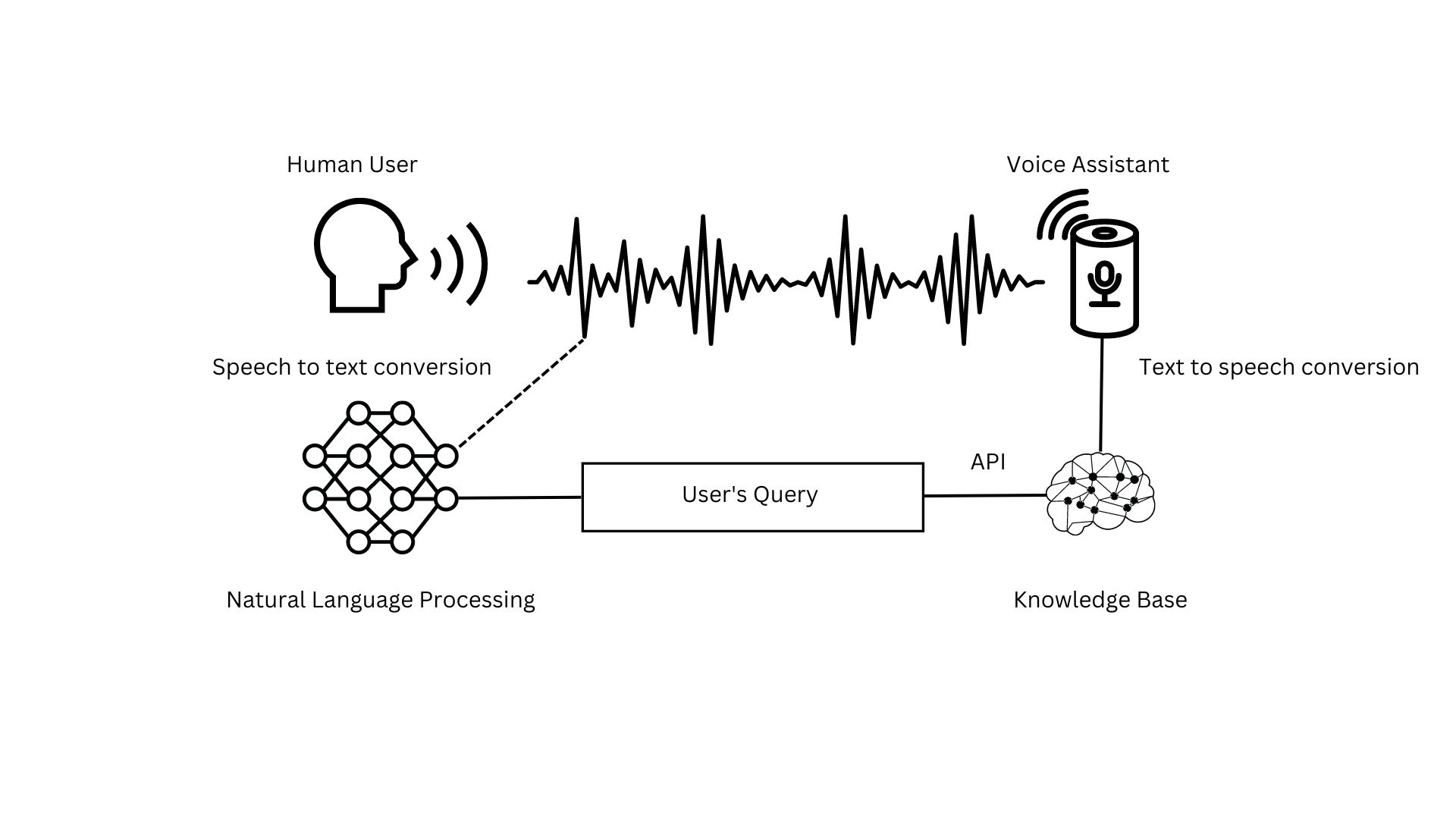

Building Voice Assistants Made Easy Open Ais 2024 Announcement

Apr 26, 2025

Building Voice Assistants Made Easy Open Ais 2024 Announcement

Apr 26, 2025

Latest Posts

-

Charleston Open Pegula Upsets Collins In Thrilling Match

Apr 27, 2025

Charleston Open Pegula Upsets Collins In Thrilling Match

Apr 27, 2025 -

Pegula Rallies Past Collins To Win Charleston Title

Apr 27, 2025

Pegula Rallies Past Collins To Win Charleston Title

Apr 27, 2025 -

Top Seed Pegula Defeats Defending Champion Collins In Charleston

Apr 27, 2025

Top Seed Pegula Defeats Defending Champion Collins In Charleston

Apr 27, 2025 -

Charleston Open Pegula Upsets Defending Champion Collins

Apr 27, 2025

Charleston Open Pegula Upsets Defending Champion Collins

Apr 27, 2025 -

Jannik Sinners Doping Case A Timeline And Analysis

Apr 27, 2025

Jannik Sinners Doping Case A Timeline And Analysis

Apr 27, 2025